Healthcare taxes may fall unevenly

WASHINGTON — When Congress decides how to pay for President Obama’s signature healthcare initiative, some of his strongest political bastions may be footing a heavy bill.

And in a political irony, states that went for Obama’s Republican rival, Sen. John McCain of Arizona, in 2008 are among those likely to benefit most from Democratic healthcare policies.

Some of the “bluest” states that propelled Obama into the White House are among those most likely to pay more in taxes to fund expanded health insurance coverage and make other changes to the system, analysts say. People in states such as Illinois, New Hampshire, Massachusetts, Connecticut and New York have a higher share of wealthier taxpayers and residents who get generous healthcare plans through work -- and both sets of people may be tapped to raise money for the healthcare overhaul.

Moreover, those states have less to gain from a national effort to expand health insurance coverage because their residents already are more likely to have insurance than are Americans as a whole.

Those conclusions by a range of policy analysts may point to future tension in the healthcare debate: Though battle lines so far have been drawn largely in partisan terms, lurking regional divisions could fracture Congress even further.

“New York is going to be asked to pay a lot more taxes, and people in Iowa and Montana will not,” said Robert Blendon, a professor of health policy at the Harvard School of Public Health.

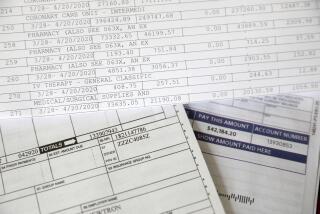

Obama has proposed raising money for a healthcare overhaul by reducing the tax breaks available to high-wage earners, such as those for charitable giving and home mortgage interest. Another idea backed by some Democrats would tax the most generous health insurance policies provided by employers, which some have called Cadillac healthcare plans.

Regional differences may help explain why Senate leaders such as Max Baucus (D-Mont.) and Charles E. Grassley (R-Iowa), who are, respectively, the chairman and ranking minority member of the Finance Committee, are more enthusiastic about taxing employer-provided benefits, while House Ways and Means Chairman Charles B. Rangel (D-N.Y.) is cooler to the idea.

California ranks among the states whose residents would be most likely to pay higher taxes if Obama successfully limited tax breaks for high-wage earners. About 1.4% of taxpayers would face potential increases, according to a study cited by the group Citizens for Tax Justice. That places California among the top 15 most vulnerable states.

But employers in California as a whole do not offer particularly generous healthcare plans, according to data compiled by the Economic Policy Institute, so the state would not be among the hardest-hit if employer health plans were taxed.

When the policy institute assessed one proposal for taxing the most expensive health plans, which had been developed by a tax reform panel under President George W. Bush, it found that 36% of people with family plans in California would be taxed, compared with 41% for the nation overall.

In addition, California has a higher than average share of residents lacking health insurance, and so it might be among those to gain the most by expanding access to insurance. About 18.5% of state residents lack insurance, compared with 15.3% nationally, according to 2006 and 2007 data compiled by the Henry J. Kaiser Family Foundation, which studies health insurance trends.

To be sure, the precise effect of any healthcare bill is hard to assess before the details are known. And all states could benefit if the legislation succeeds in its goal of driving down healthcare costs.

Moreover, many people see improving access to health insurance as a broad national goal. “Everybody will benefit from universal coverage -- in red states and blue states,” said Judith Feder, a professor of public policy at Georgetown University and senior fellow at the liberal Center for American Progress.

Still, the basic concepts Congress is considering could affect some regions more than others. So far, regional fault lines in Congress have been more pronounced in the debate over other issues, such as Obama’s efforts to crack down on greenhouse gas emissions to slow climate change. But that may soon change as the debate gets more specific.

“Now the debate is mostly in the abstract,” Blendon said. “But people soon will start saying: ‘What will this mean for New York, L.A. and Philadelphia?’ ”

Critics of taxing higher-cost employer health plans say that it would hit many people who happen to live where costs are higher than average, not necessarily those whose packages are overly generous.

That is why the idea of taxing the priciest health benefits could run into resistance from lawmakers representing high-cost cities such as Chicago and New York.

“It doesn’t have to do with Cadillac benefits; it has to do with geography,” said Brian Biles, a professor at George Washington University and a former aide to the House Ways and Means Committee. “A package with this in it would attract strong opposition from members of Congress in the high-cost areas.”

--

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.