German patients get the latest drugs for just $11. Can such a model work in the U.S.?

- Share via

Reporting from Berlin — Patients who come to the Havelhöhe cancer clinic in the leafy outskirts of Germany’s capital are often very sick.

Struggling with advanced-stage cancers, many need strong doses of expensive, cutting-edge chemotherapy that can run into the hundreds of thousands of dollars.

For the record:

4:25 a.m. June 20, 2019An earlier version of this article incorrectly identified Dr. Wolf-Dieter Ludwig. He is chairman of the drug commission of the German Medical Assn., not chairman of the entire association.

But like all Germans, none of the patients sitting quietly in the infusion ward here pay more than 10 euros a prescription, or about $11. “We never talk about costs,” said Dr. Burkhard Matthes, a senior oncologist at the clinic.

Germany’s ability to provide citizens access to the latest drugs while keeping patients’ costs so low is made possible by a novel strategy launched in 2011 to rein in exploding prices that were threatening to bankrupt the nation’s healthcare system.

Mixing free-market incentives to encourage innovation with regulation and lots of transparency, Germany’s drug review process gives manufacturers the chance to bring new products to market and charge higher prices — but only if they can show the new medications are better than existing ones.

Nearly the entire process is open to the public, giving doctors, hospitals and patients access to not only new drugs, but also independent evaluations of how well they work.

And it’s kept drugs accessible. Just 7% of Germans reported cost-related problems getting medical care in the last year, compared to a third of Americans, an international survey found.

“There is a lot we could learn,” said Leigh Purvis, who oversees prescription drug policy for the AARP and has urged U.S. policymakers to more closely study the German model.

Germany, like the U.S., relies on private health insurers and private doctors. The German government doesn’t set drug prices, as some European nations do. And the country — home to some of the world’s largest drug makers — has a robust pharmaceutical market.

“Germans don’t believe the government should run the healthcare system,” said Franz Knieps, a former senior government health official who now heads an association of large German insurers. “But they wanted a system that’s affordable.”

Building that wasn’t easy, but politicians, healthcare leaders and industry officials settled on a compromise that has saved billions of dollars and won the acceptance of even many drug makers.

“We had a lot of doubts about the system when it first started,” said Dr. Markus Frick, a senior official at Germany’s leading pharmaceutical industry group, the VfA. “Now we see it works for many, though not all, cases.”

Germany’s drug pricing initiative was born of widespread fears — not unlike those driving today’s U.S. debate — that the rising cost of new specialty drugs would make health coverage unaffordable.

With roots that date to the 19th century when industrial employers offered health protections to head off a threat of socialism, the German healthcare system is built on a tightly regulated market of private, nonprofit insurers, known as sickness funds.

Germans are required to enroll in one of these funds, which are similar to U.S. health insurers.

There are strict limits on how much patients must pay for their medical care — a major difference from the U.S., where patients’ deductibles have been soaring. Co-pays, for example, are limited to 10 euros per prescription. There are no deductibles.

Sickness funds must cover new drugs as soon as they become available.

Importantly, the funds also must collect enough in premiums to cover the costs of their members’ medical care.

That meant that when drug prices started shooting up in the 2000s, sickness funds began running deficits and faced pressure to hike premiums.

“It was a situation we couldn’t accept,” said Daniel Bahr, a former minister of health. “We needed change.”

On the left, politicians clamored for government price controls. Germany’s powerful pharmaceutical industry, in an echo of arguments made in the U.S, warned that would choke off innovation.

Chancellor Angela Merkel’s right-of-center government chose a middle path.

New drugs would have to go through a system of rigorous evaluation. Using the evaluations, sickness funds — not the government — would then negotiate prices with drug makers.

Under this new system — known by its German acronym AMNOG — sickness funds must pay drug companies the list price for new drugs for one year after they are introduced, an important feature of the system designed to ensure patient access to new therapies.

But the foundation of the system is an independent, transparent assessment of new drugs that is undertaken when the drug enters the market.

Manufacturers must submit information about new drugs to a non-governmental agency that compares them to existing therapies.

The system “asks a very basic question: Is there an added benefit from a new drug? And it’s on drug makers to prove their case,” said Dr. Jürgen Windeler, head of the Institute for Quality and Efficiency in Health Care, or IQWiG, the agency that conducts the analysis.

In a futuristic office park just outside the historic center of Cologne in Germany’s Rhineland, teams pore over thick dossiers of clinical trial data and other information submitted by drug companies.

The teams want to see not just that a drug works, a standard applied in the U.S. The agency demands evidence that companies have tested their therapies against alternatives. And it wants proof a drug improves long-term outcomes, such as helping patients live longer.

At the end of a three-month evaluation, the agency issues a report with a formal determination of whether a drug works better than available treatments, whether it offers no new benefit or whether there is not enough evidence to quantify the benefit.

Each report and all the evidence, neatly bound in a white spiral and kept on file at the agency, is public.

After the findings are published, drug companies, physician groups, patient advocates and other stakeholders can offer public comments on the report.

If a company can’t show its drug is better than existing therapies, it can only charge as much as the comparable existing drugs in the same category.

If, on the other hand, the new drug is shown to be better, the manufacturer can negotiate a price with the sickness funds.

In another important feature of the German system, the sickness funds maximize their leverage by negotiating collectively and settling on a maximum price that all funds will pay.

That is a major difference from the U.S., where insurers and pharmacy benefit companies negotiate their own prices with drug makers, based on their own evaluations, all of which are generally secret.

“The transparency is excellent,” said Dr. Wolf-Dieter Ludwig, chairman of the German Medical Assn.’s drug commission. “We get more information about new drugs and we get comprehensive, independent assessments.”

The Trump administration and many in Congress are increasingly calling for more transparency in the U.S. drug market as well. And congressional Democrats want Medicare to use its leverage to negotiate lower drug prices for seniors. But thus far, there has been little progress on Capitol Hill, where drug companies continue to wield influence.

Germany also ran up against industry. Pharmaceutical companies initially chafed at providing data, Windeler said.

The assessments have also been tough. Nearly half of the 338 evaluations conducted since the system debuted have found no clear advantage over existing therapies.

Nor are sickness funds always able to settle on a price with drug companies; in about a fifth of the cases, negotiations have gone to arbitration, a legal process for setting prices.

In a few cases, companies unhappy with how their drug was graded or dissatisfied with the price have pulled out of the German market.

In 2011, for example, Boehringer Ingelheim, a leading German manufacturer, and American drug giant Eli Lilly stopped marketing the diabetes drug Trajenta in Germany.

Most companies, however, have been reluctant to abandon Europe’s largest market.

At the same time, the review process has helped restrain prices, while still getting new drugs into the market, evidence shows.

When, for example, Pfizer in 2016 introduced a new breast cancer treatment called Palbociclib, the U.S. drug maker charged 66,000 euros, or about $74,000, for an annual course of the therapy.

That was far more than existing breast cancer drugs such as Tamoxifen, which cost just 71 euros, or $79, a year in Germany, or Anastrozol, whose annual cost was 303 euros, or $339, according to the assessment.

German evaluators didn’t give Pfizer’s drug a strong recommendation, concluding that while Palbociclib appeared to slow tumor growth, the drug didn’t appear to measurably prolong patients’ lives.

Physician and patient groups nevertheless argued strongly for access to Palbociclib. And the sickness funds agreed to negotiate with Pfizer. They ultimately settled on a price of 35,000 euros a year, or $39,000, an almost 50% discount off the original price.

Although many in Germany wish the system was saving more, it is generally credited with lowering overall drug spending by about 2 billion euros a year, or about 5%. In the U.S., that would translate into more than $18 billion in annual savings.

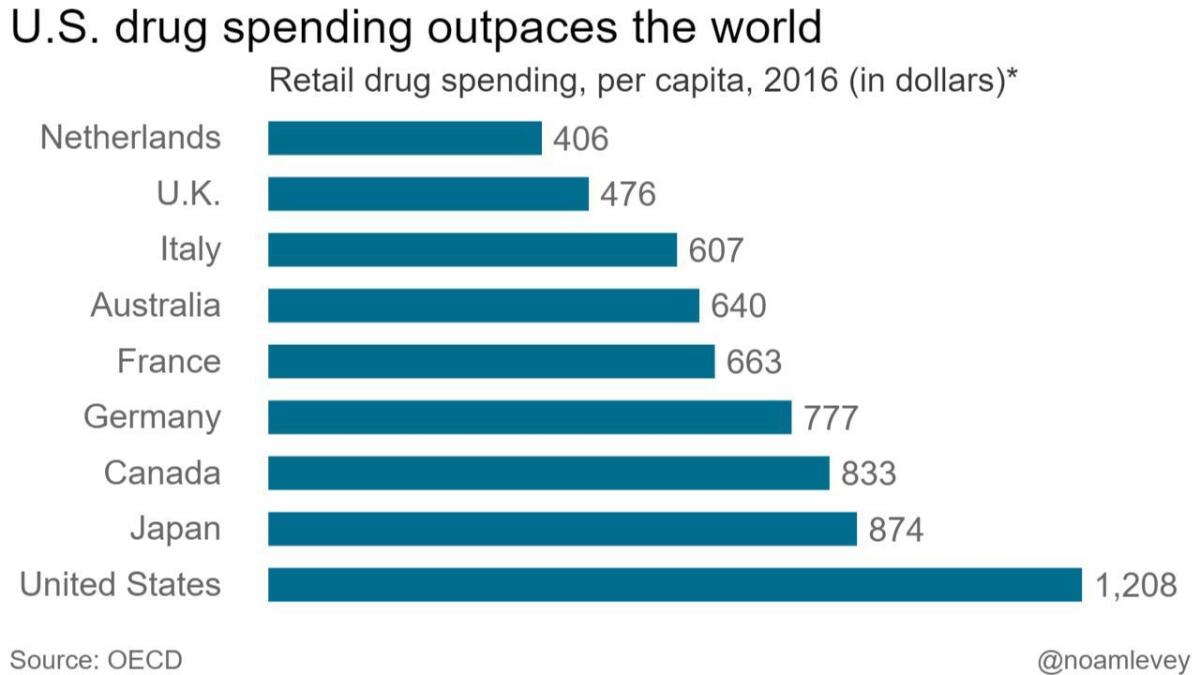

Total German spending on retail drugs — including what sickness funds and patients pay — is still among the highest in Europe, topping $775 per person annually, according to the Organization for Economic Cooperation and Development. But that is still considerably lower than in the U.S., where per-person spending exceeds $1,200, the highest in the world.

Equally important, the system has opened the drug market to public scrutiny, a marked contrast to the secrecy that cloaks the U.S. market.

Dr. Antje Haas, who oversees price negotiations with drug makers for the national association of sickness funds, known as the GKV-Spitzenverband, called the transparency “the real jackpot.”

At the AARP, Purvis noted that it wouldn’t be necessary to replicate all of Germany’s drug pricing system to help American patients.

If Congress and the White House only devised a more uniform system for assessing the value of drugs and making that information publicly available, as it is in Germany, that would be a major step forward, she said.

Support for this story came from the Assn. of Health Care Journalists’ International Health Study Fellowship, funded by the Commonwealth Fund.

More stories from Noam N. Levey »

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.