Why outsiders like AT&T keep stumbling in Hollywood

- Share via

This is the May 25, 2021, edition of The Wide Shot, a weekly newsletter about everything happening in the business of entertainment. Sign up here to get it in your inbox.

It didn’t take long after last week’s $43-billion WarnerMedia-Discovery deal announcement for AT&T to be inducted into the unofficial Hollywood merger Hall of Shame.

Jim Cramer railed against AT&T on CNBC, calling the soon-to-be cleaved $85-billion combination of the Dallas phone company and Time Warner (now WarnerMedia) “one of the dumbest mergers in recent history.” On the same network, media mogul Barry Diller referred to AT&T’s decision to spin off its media assets as “the great escape.”

The Ankler, in a blistering take, added AT&T to the long list of Hollywood outsiders that have bought their way into show business only to leave bruised — a litany that includes Seagram, Coca-Cola and General Electric. I’d add Verizon, which recently decided to hive off its digital media assets, AOL and Yahoo.

What is it about the media and entertainment business that has proved so hazardous to corporate interlopers?

It would be an oversimplification to blame the cultural mismatch of the buttoned-up business school bean counters believing they know how to run a media company better than the profligate studio heads. Sure, that’s a factor, as are the often misguided ideas about what synergies may come. In 1984, Coca-Cola CEO Roberto C. Goizueta in the New York Times compared the audience’s “thirst for entertainment” to their desire for Diet Coke.

It’s about more than that disconnect, though. For one thing, movies are an especially tricky business for industrial types because they’re unpredictable and require intensive upfront capital spending long before there’s any hope of revenue.

“The industry would love to tell stories about how it’s a culture mismatch, but mainly, it’s a product mismatch,” said J.D. Connor, a professor at USC’s School of Cinematic Arts. “It’s not that they want [studios] to be corporate, it’s that they want them to be corporate in ways that are incompatible with the way movies have been made since WWII.”

Even that dynamic doesn’t tell the whole story. Take the example of GE and NBCUniversal, a relationship lampooned in “30 Rock” with Alec Baldwin trying to impose Six Sigma management techniques onto freewheeling “TGS.”

It’s true that the movie and TV companies never quite jelled with the maker of turbines and washing machines. Still, the end of the GE-NBCUniversal tie-up was spurred by more fundamental business problems.

As my colleague Meg James wrote with Ben Fritz in 2009, Vivendi — the French utilities owner that also misfired in its Hollywood ambitions — owned 20% of NBCUniversal and had to decide whether it wanted to sell its stake for $4 billion or hold on to its interest. With Vivendi on the way out, GE had to come up with the cash or find a new investor, and GE’s financial services businesses had been hit hard in the collapse of the capital and real estate markets. Enter Comcast Corp., which was looking to become a bigger player.

Similarly, one knock against AT&T’s purchase of Time Warner was that the phone company didn’t understand entertainment and that the corporate overlords were too quick to toss out people who knew what they were doing. The more complicated reality: After building a mountain of debt, it couldn’t spend what it would take to turn HBO Max into a formidable competitor while facing massive competition in the 5G space, analysts said.

While entertainment has proved to be a landmine for many, not every newcomer leaves with its tail between its legs. Sony Corp. is an interesting example. In the first two decades after the Japanese electronics company took over Columbia Pictures in the early-1980s, it sure looked like another instance of a foreign buyer overpaying for a legacy studio and getting burned, as detailed in the 1996 book “Hit & Run” by Nancy Griffin and Kim Masters.

In 2013, activist shareholder Daniel Loeb waged an unsuccessful campaign to get Sony management to partially spin off its entertainment arms in order to funnel more cash into its struggling electronics units, which were facing competitive pressures. A little more than a year later, the studio was rattled by a devastating cyberattack. If anyone could have succumbed to buyer’s remorse, it was Sony.

But now Sony Corp. is doing gangbusters business with PlayStation 5, and the studio itself, while smaller than Disney and Warner Bros., is making money. The pictures division, including film and TV, generated $762 million in operating income in the latest fiscal year, up from $628 million a year earlier. While Sony certainly could still sell, it doesn’t have to.

We could also look at Philadelphia’s Comcast as a Hollywood outsider that has stuck with its bet, though it already owned some channels such as E! and the Golf Channel before buying NBCUniversal.

The combination of making movies, running TV networks and operating theme parks hasn’t evidently distracted from the larger mandate of laying cable.

One company that might take note of the history of disastrous Hollywood marriages is Amazon. The Seattle e-commerce giant is close to a deal to buy MGM, home of “Rocky” and “007,” for $9 billion, a price that many industry types think is too high, though the $1.64-trillion company can afford it. The Wall Street Journal signals a deal could come as soon as this week.

Buying MGM’s 4,000-film library and TV operations could make sense for a company trying to bulk up in entertainment after succeeding with acquired movies like “Coming 2 America.”

The main thing, said NYU Stern professor Paul Hardart, is what happens when the idea presented on a company slide show meets the real world. In Comcast’s case, it appears to be working. With every deal, the result will depend on execution.

“What misses oftentimes is that there’s a strategic thing that makes sense in a conference room and on the whiteboard,” said Hardart, a former executive at Universal. “But it’s the execution that doesn’t work.”

Stuff we wrote

— A streaming service for cord-cutters in Middle America who want TV escapism? Stephen Battaglio discusses FrndlyTV, a Denver-based company with nearly 500,000 subscribers.

— Netflix is diving deeper into the podcast space in a bid to keep audiences invested in its shows and movies. The Los Gatos-based streaming giant is expanding its podcasts, taking pitches from outside producers and is looking to hire an executive to lead its audio push, report Anousha Sakoui and Wendy Lee.

— Producers are looking to unionize as media giants grow. Here’s why: “The rise of streaming has upended the economics of producing, making it harder for producers to earn a sustainable living,” Sakoui writes.

— A big week in CNN controversies shows that Discovery will have its hands full. Battaglio on the network’s decision to not discipline Chris Cuomo for participating in strategy sessions on how his brother Gov. Andrew M. Cuomo should deal with sexual harassment allegations. Also: CNN cuts ties with Rick Santorum.

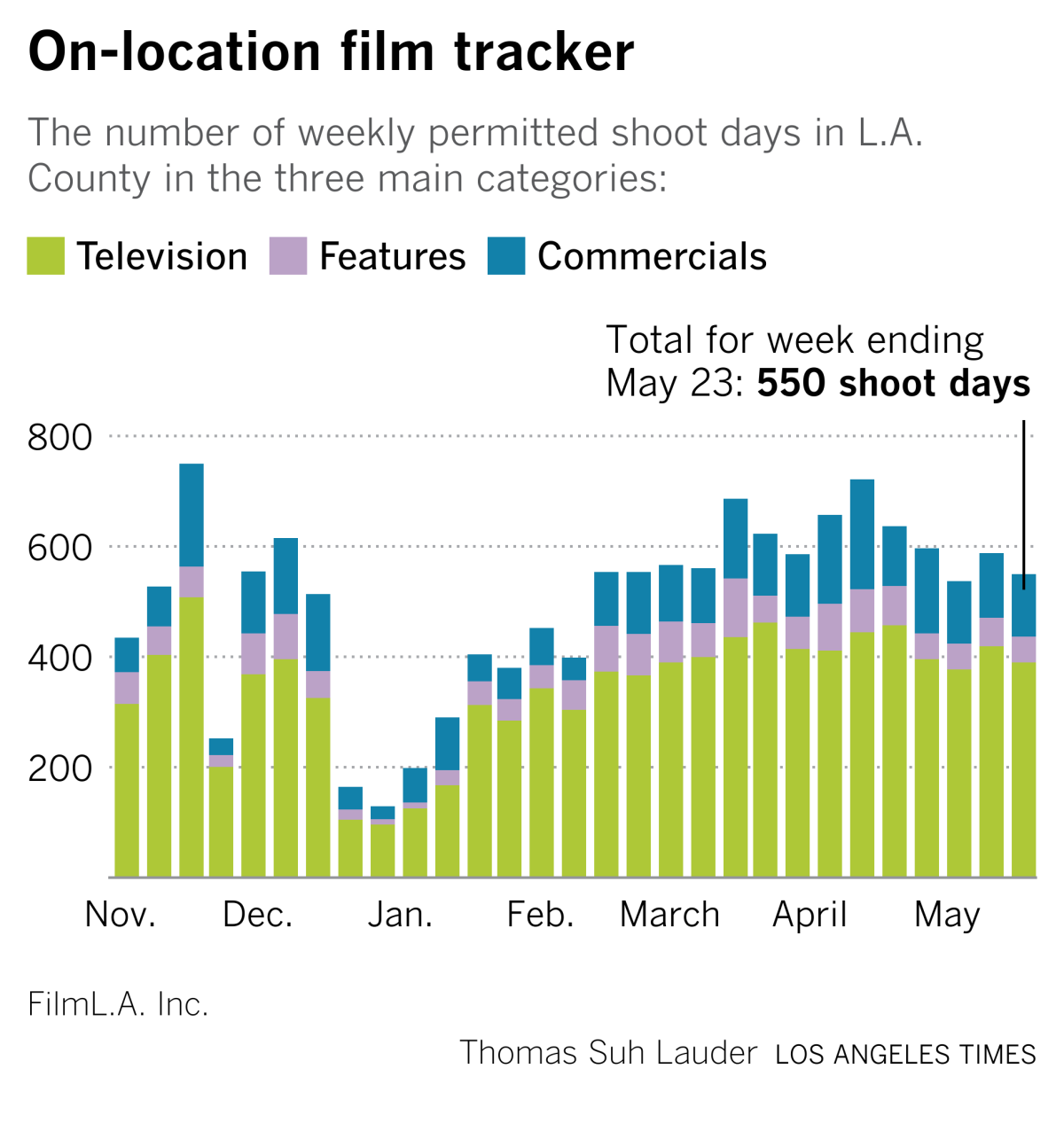

Hollywood production

Since greater Los Angeles’ production lull in January, shoot days in the area have settled into a ballpark of around 550 a week, according to FilmLA data. The vast majority of the recovery has been driven by television.

Number of the week

This week’s jaw-dropper comes from Discovery CEO David Zaslav, already one of the highest-paid people in America, who earned 14.8 million stock options (valued at $190 million) the day before the merger announcement.

The disclosure comes amid news that the combination of WarnerMedia and Discovery is expected to result in at least $3 billion in annual cost synergies, which usually translates into layoffs. That’s not encouraging for a company that just went through three years of upheaval after almost two prior years of regulatory battles.

Having a boatload of stock options isn’t the same as a straight payday. The exercise price — or the price at which Zaslav has the option to purchase the shares — ranges from $35.65 to $43.33 a share. From WSJ: “The value of the company’s shares would have to rise by about 7% from Wednesday’s close for some of the options to be worth exercising, and by about 24% for all of them to be in the money.” Discovery’s stock price was $31.28 on Monday.

Still, it’s a monster reward and incentive for an executive whose preview just expanded from “90 Day Fiancé” and “Diners, Drive-Ins and Dives” to include a 100-year-old movie studio, HBO and a cable news network.

‘Social cinema’ startup launches

Breaking: Kinema, a new company that aims to help people put on virtual and in-person film screenings, has raised $2 million in funding to grow what it calls a “social cinema platform.” Kindred Ventures, Lupa Systems and Galaxy Interactive participated in the seed round.

The New York-based startup, founded earlier this year, arrives on the scene after the virtual cinema concept took hold during the pandemic as a way for theaters and audiences to adapt to closures. Kinema’s technology allows people and institutions to host screenings virtually, or turn their local community centers, yoga studios, libraries and houses of worship into screening rooms.

As audiences inch their way from their homes, Kinema is betting there will be a growing hunger to watch movies as a group in-person, online and through hybrid systems. “We’re already seeing demand,” Kinema founder Christie Marchese said in an interview. “Not everybody’s ready for a giant space, so they’re more likely to come together with a community they trust.”

The company this month used its platform to put on a virtual Asian American and Pacific Islander film festival. “I feel the festival of the future could be made on Kinema,” said Steve Jang of Kindred Ventures.

Big screen boosters

Hollywood’s “The Big Screen is Back” confab at AMC Century City 15 was meant to serve as the studios’ belated show of support for movie theaters. They could have called it “Disney+? What Disney+?” The three-hour event didn’t produce much news, with the distributors deciding to save their powder for CinemaCon in August.

In a moment of ultimate irony, Arnold Schwarzenegger declared he wouldn’t “be here if it weren’t for the theaters” and made fun of the experience of watching movies on a “little iPhone.” While the event was still going on, Netflix announced a spy thriller series starring the former California governor.

The theatrical market is still very much in flux. Universal’s “F9” made $160 million overseas this weekend, mostly from China. That may or may not translate to U.S. box office. “Cruella” and “A Quiet Place Part II” will further test the American appetite for moviegoing over the Memorial Day holiday. Universal Pictures on Monday said it would release its “Boss Baby” sequel simultaneously to theaters and Peacock.

Top stories from the web

— It’s the media’s “mean-too” moment. In public radio, there is either an epidemic of bullying or an epidemic of whining, depending on whom you ask, writes Ben Smith.

— “Is the China-Hollywood romance officially over?” asks THR. “Five years after an unprecedented era of frenzied East-West deal-making, cash flow has stopped, Donald Trump’s trade war lingers, censorship is on the rise and human rights abuses in the Middle Kingdom have upended business prospects for the U.S. film industry.”

— How a review changed both Sarah Silverman and a New York Times critic. A.O. Scott critiqued her approach to comedy in a 2005 movie. Now they sit down to talk about what he got right and wrong, and why owning up to mistakes is freeing.

— Fox CEO Lachlan Murdoch talks about his dad, Tucker Carlson, Trump and why he plans to stick around. (Insider)

Finally ... a ‘spectacle’

Hosted by Mariah Smith, the podcast “Spectacle” takes reality television seriously as a cultural force by examining one franchise per episode, from PBS’ “An American Family” to the sweet dystopia of Netflix’s “The Circle.”

I’ve also been enjoying the stadium rock of Italy’s Måneskin, winners of the Eurovision Song Contest. To me, they sound like a Queens of the Stone Age or Black Keys rap-rock revival act. Here’s the winning song.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.