Column: PG&E’s bankruptcy offers a chance to clean a very dirty house

- Share via

Customers, regulators, suppliers and employees are justifiably nervous about Tuesday’s bankruptcy filing by Pacific Gas & Electric, California’s biggest utility.

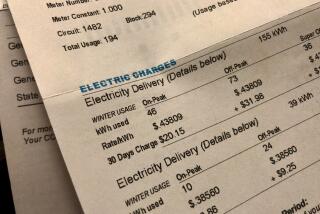

Lucrative energy contracts may be canceled, layoffs may occur, and higher electric and gas bills may well be in the offing. Then there’s the possible loss of regulatory control by the state as a federal bankruptcy judge becomes the No. 1 guy dictating the company’s future.

But the bankruptcy presents at least one golden opportunity to come to grips with this perennially lousy company: Fire the board of directors. And by that we mean every last one of them.

After the resignations of Geisha Williams as PG&E chief executive and Roger Kimmel as a director, the board has 10 members. It wins slightly better marks than the average board of a big corporation in that all the directors first took office in this century, but once you’ve said that you’ve said everything. One has been serving for 14 years, another for 13 years.

That’s long enough to have overseen the company during what may be the lowest points in its history, including the San Bruno pipeline explosion of 2010, which took eight lives and leveled a residential community. San Bruno led to PG&E’s conviction on six felony counts in 2016. It’s a measure of the company’s scorn for the criminal process that not a single director resigned because of the conviction. (Two retired the following year, but only because they had reached the mandatory retirement age of 72.)

Since San Bruno, the performance of PG&E has only gotten worse. It now stands accused of having falsified gas pipeline records after the explosion. Its equipment sparked more than 1,500 fires from 2014 through 2017, according to the Public Utilities Commission, as my colleague Taryn Luna reported this week. A few weeks ago, when I asked state Sen. Jerry Hill (D-San Mateo), whose district includes San Bruno, if there were any signs that the company had instilled a culture of safety in its workforce — Job One after the explosion — his curt answer was “no.”

Last week the company avoided blame for the 2017 Tubbs fire in wine country, which killed 22 people, when fire officials concluded the blaze began on private property. But it still faces possible liability for the Camp fire of 2018, which killed 86. State fire authorities haven’t yet determined the cause of the fire, but potential liability for that blaze and others is what prompted PG&E to file for bankruptcy.

Most of the board has been in place, holding on to their seats with what George Orwell compared to prehensile bottoms, during this entire period. But directors are the Teflon saucepans of corporate governance: Nothing ever seems to stick.

The current PG&E crew is a good example, since the company it oversees has the worst service record this side of Wells Fargo. The 11 who were in place as of the end of 2017 earned an average stipend of $271,873. They cost shareholders a total of $3.1 million.

The company’s profiles of its board membership and the individual directors show how negligible a role they’ve played in its management. My favorite page in its 2018 proxy statement is the one with charts attesting to the board’s “ethnic diversity” (9.1% African American) and “gender diversity” (27.3% female). Since the board then had 11 members, those percentages translate into one black director and three women — including CEO Williams, who is now gone.

For reference, here’s the membership, including their year of appointment and current or former day job:

Barbara Rambo, 2005, management consultant, ex-BofA executive.

Rosendo Parra, 2009, ex-Dell executive.

Eric D. Mullins, 2016, investment executive.

Forrest Miller, 2009, chair of PGE’s utility subsidiary.

Benito Minicucci, 2018, COO, Alaska Airlines.

Richard Kelly, 2013, energy executive.

Richard Meserve, 2006, ex-chair, Nuclear Regulatory Commission.

Fred J. Fowler, 2012, retired natural gas executive.

Lewis Chew, 2009, CFO, Dolby Laboratories.

Anne Shen Smith, 2015, ex-CEO, Southern California Gas.

What do these people bring to the table that justifies their appointments? According to their PG&E bios, mostly boilerplate. Two bring the company “leadership and business skills” (Rambo and Miller), one offers “leadership and problem-solving skills” (Parra), one offers “strategic leadership, management and business skills” (Fowler), and one offers “energy experience and leadership” (Kelly). Chew is said to represent the customer perspective, but he’s a commercial customer, not a residential homeowner in, say, San Bruno. Meserve, 73, is being kept around despite passing the retirement age of 72 to help the company decommission its Diablo Canyon nuclear plant.

None of them seems to have had a clue about how to get the company to perform its duties safely and operate honestly.

It’s true that Mullins and Minicucci, elected in 2016 and 2018, are directors of comparatively recent vintage, but since they were brought on by the previous management, they can’t claim to be entirely new brooms.

The board, then, is a $3.1-million asset of supposed gilt-edged management ability that has helped to run PG&E into bankruptcy. Why keep them around? Many ideas for reconstructing PG&E have been swirling about, including breaking it up, selling it to someone else, or even taking it over as a ward of the state. There are pros and cons attached to each of these ideas, but only one that looks to be all pluses: Fire the board.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik’s blog.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.