Judge approves Fisker bankruptcy plan favored by car owners

- Share via

Fisker Inc. will wind down operations under a bankruptcy plan approved Friday that should allow car owners to drive their cars for years — while not paying anything to shareholders who were wiped out investing in the defunct Southern California electric-vehicle maker.

The plan approved by U.S. Bankruptcy Court Judge Thomas Horan in Delaware comes as Fisker is grappling with a Securities and Exchange Commission investigation into possible securities violations at the company before its June bankruptcy filing.

Fisker disclosed in August that it had been subpoenaed by the SEC, which recently confirmed that it was investigating the company and demanded that the bankruptcy plan preserve records.

“The SEC has been much more aggressive in pursuing its claims and remedies, even if the focus of its investigation has filed for bankruptcy,” said Jennifer Lee, a former assistant director at the SEC Division of Enforcement now in private practice.

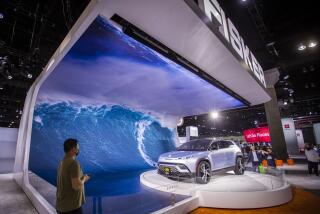

Manhattan Beach EV maker Fisker Inc. said it was halting production of its snazzy Ocean SUV, seeking financing and a strategic partner in a further setback for car designer Henrik Fisker.

The agency has declined to comment on its investigation.

Co-founders Henrik Fisker, the company’s chairman and chief executive, and his wife, Geeta Gupta-Fisker, the chief financial and operating officer, and other officials are facing multiple shareholder lawsuits.

Plaintiffs allege violations of fiduciary duties and securities laws, including media appearances by Henrik Fisker touting the company’s prospects even as its fortunes declined.

Horan issued his ruling after a flurry of filings, hearings and closed-door meetings this week as Fisker, its creditors and owners worked out an agreement.

Leadership of the Fisker Owners Assn. came out last week in favor of the proposed plan, stating the vehicle maker had made progress in addressing open recalls Fisker had issued for its Ocean SUV and had engaged in “constructive dialogue” over maintenance issues.

The approved plan also resolved concerns by the National Highway Transportation Safety Board over how to pay for the costs of recalls, including one for malfunctioning brakes and another for a defective water pump. Under the approved plan, Fisker’s estate will cover those costs.

Another issue that was resolved was access to Fisker’s cloud server for over-the-air software updates the Ocean must receive to operate. Access to those updates will be provided by American Lease, a Bronx, N.Y., business that leases Uber and Lyft cars. It bid $46.25 million for Fisker’s unsold inventory of more than 3,000 cars.

American Lease agreed late this week to pay $2.5 million for access to the cloud for five years and will share that access with Fisker’s more than 6,000 car owners for an undetermined price.

“We’re happy with the outcome today, and we’re optimistic about the future,” said Brandon Jones, president of owners association. “There’s still some discussion and negotiation needed, but we’ll have the services we need to maintain our cars.”

Founded in 2016, Fisker went public in 2020 via a special purpose acquisition company backed by private equity firm Apollo Global Management. The company raised $1 billion in equity capital and borrowed even more, but ran out of money.

Headquartered in Manhattan Beach, Fisker moved to La Palma in Orange County earlier this year.

Henrik Fisker, a noted automotive designer, envisioned the company’s debut model, the Ocean, as a competitor to Tesla’s Model Y, but the company had trouble making and delivering the high-tech SUV. The Ocean was plagued by software glitches, though its ride and build were praised.

Several thousand car owners were eligible to vote on the plan, because they had filed claims against Fisker making them unsecured creditors.

Evan Scott, 39, filed two claims, one for nearly $28,000 based on the loss of value of his Ocean after price cuts, and a second for $1,000 after his car was delivered with faulty tires that had to be replaced after four months. He said he voted for the plan but feels he was misled by the company after purchasing some $50,000 in stock, which is now worthless.

“Everything they said was a lie for the last six months, and they knew they were going to file for bankruptcy,” said the Portland, Ore., resident.

Fisker’s stock reached a high of $28.50 in March 2021 amid peak interest in electric vehicles and a stock bubble that was popped after a rise in interest rates the following year. By the time of Fisker’s bankruptcy, its shares were trading for a nickel.

The Ocean’s base model retailed for $38,999 with the highest trim version going for more than $60,000, until a series of sharp price cuts. American Lease purchased its fleet of Oceans for about $13,900 per vehicle.

Fisker filed for bankruptcy after it was unable to secure a strategic investment from an auto manufacturer that Reuters identified as Nissan. It also failed in efforts to sell the company to other buyers. It estimated liabilities of up to $500 million and assets at between $500 million and $1 billion at the time of the filing.

It is being liquidated under Chapter 11 of the bankruptcy code typically used by companies seeking to restructure and remain in business. The process, however, has allowed management to remain in control of day to day operations of the company as it works through recalls and other issues.

Manhattan Beach EV-maker Fisker went bankrupt last month after several thousand buyers acquired the premium electric SUV that debuted only last year. Now the owners have banded together to make sure they can get parts and service and operate vehicles some bought for as much as $60,000.

By the time the bankruptcy plan was approved there were more than 4,000 claims filed against Fisker, including two that totaled more than $1 billion — one for $694 million for debt held by U.S. Bank, and a second for $475 million by Magna International, which manufactured the Ocean for Fisker at an Austrian plant.

Fisker has yet to sell the assets it owns in Austria as well as its intellectual property, which includes the vehicles designs and software code — which theoretically could be purchased by another auto maker to produce the Ocean and other vehicles Fisker had planned. Proceeds from those sales will go into a trust, with the majority received by the company’s secured creditor.

That creditor is CVI Investments and its investment manager, Heights Capital Management Inc., affiliates of Susquehanna International Group, a large Pennsylvania trading firm founded by billionaire Jeff Yass. It has a secured claim of more than $180 million stemming from debt it is owed by Fisker.

A number of shareholders sent letters to the court asking for an SEC inquiry into Fisker’s dealings with the creditor, whose position as a secured lender had been opposed by unsecured creditors earlier in the bankruptcy process. Attorneys for CVI have not responded to requests for comment.

Car owners seeking compensation may have other avenues to recover funds from the loss of warranty protection, software and mechanical problems and other issues.

The law firm Hagens Berman is filing arbitration cases against J.P. Morgan Chase Bank, a leading Fisker auto loan maker. Partner Steve Berman said his firm is proceeding with some 1,300 individual arbitration demands. Chase declined to comment.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.