Progress in GM Talks Cited by Delphi

- Share via

Delphi Corp., which filed for Bankruptcy Court protection last month, said Monday that it was making progress in restructuring talks with General Motors Corp. and would delay an effort to reject its union contracts.

Delphi, the largest U.S. auto parts supplier, was scheduled to ask a judge Dec. 16 to void its union contracts. The company is pushing that back to Jan. 20. Delphi has almost 34,000 hourly workers represented by the United Auto Workers and other unions.

GM stock rose on hopes the negotiations will avert a strike that could fatally wound the already crippled automaker, which is losing U.S. market share and has lost more than $3 billion in the first nine months of this year.

Shares of GM closed up 36 cents Monday at $23.22.

“The threat of a Delphi strike is somewhat reduced by this action,” said David Healy, an auto analyst with Burnham Securities.

The UAW called the announcement “a positive sign” but said it would not resume stalled discussions with Delphi until the auto supplier retracted a proposal that would cut hourly workers’ wages by nearly 62%, from $27 an hour to $10 to $12.50 an hour.

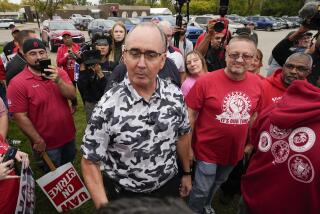

“If Delphi is serious about restarting discussions, taking that insulting proposal off the table would be a good place to start,” UAW President Ron Gettelfinger and Vice President Richard Shoemaker said in a joint statement.

Delphi spokeswoman Claudia Piccinin wouldn’t elaborate on the company’s union discussions but said Delphi had made recent progress with GM. Delphi is the automaker’s former parts division and the company’s largest supplier.

Delphi said GM has agreed to temporarily forgo price cuts on some Delphi parts in order to help the struggling supplier. GM bought $14 billion in parts from Delphi last year, or around 16% of its total parts spending.

GM spokesman Jerry Dubrowski said GM was working toward an outcome that would satisfy its shareholders and ensure Delphi’s survival. GM spun off Delphi in 1999, and the two companies share common labor agreements.

In a note to investors, Goldman Sachs analyst Robert Barry said GM wanted to avert a Delphi strike and win UAW approval for its own restructuring. Last week, GM announced a plan to cut 30,000 hourly jobs and close all or part of 12 facilities in North America.

In exchange, GM may provide cash for Delphi employee buyouts or may agree to allow Delphi workers to flow back to GM, Barry said.

Healy said negotiating with Delphi was the lesser of evils for GM. In addition to avoiding a strike, GM doesn’t want the Bankruptcy Court to transfer pension liabilities to GM, Healy said.