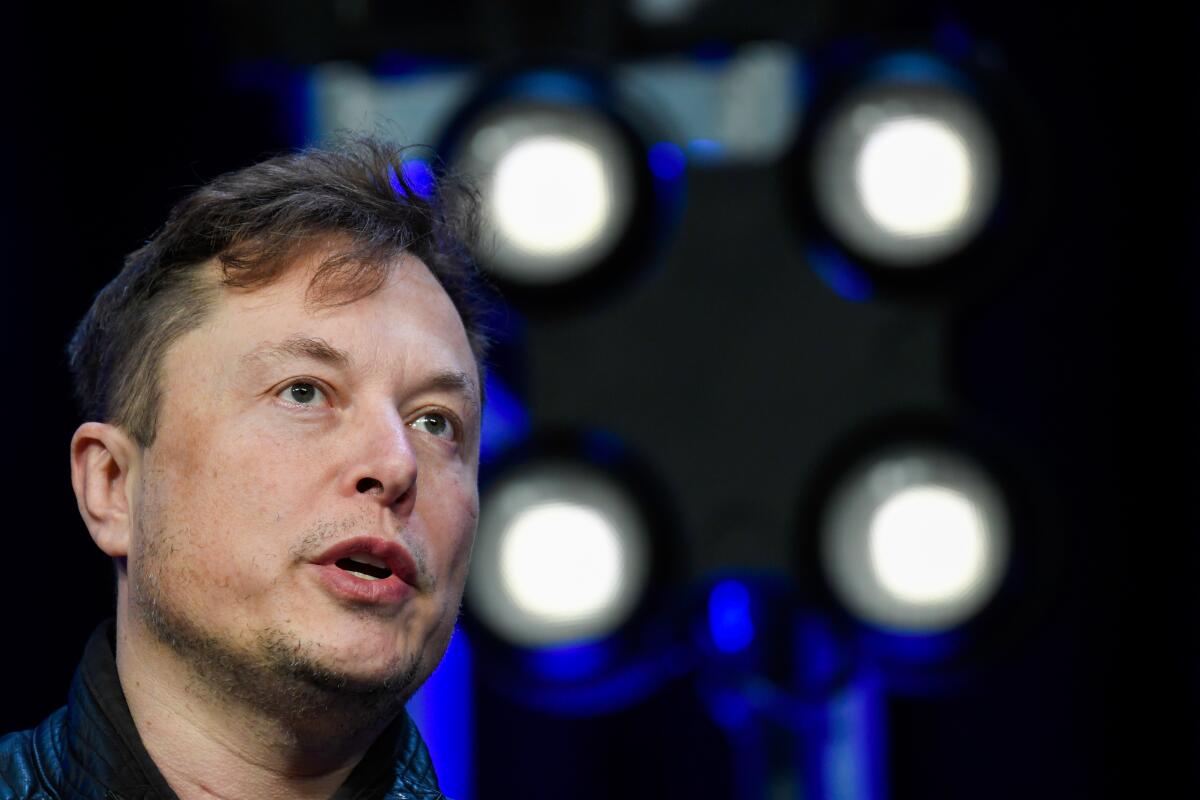

Elon Musk’s multibillion-dollar pay package is rejected for a second time. What to know

A Delaware judge rejected Tesla Chief Executive Elon Musk’s multibillion-dollar pay package for a second time, writing in her opinion this week that the company’s approval process for the package was “deeply flawed.”

Tesla shareholders approved the compensation plan in 2018, which was once valued at $56 billion but fluctuates dramatically with Tesla’s stock price. Chancellor Kathaleen McCormick first rejected the plan earlier this year on the grounds that Musk had unfair influence over shareholders and that negotiations over his pay plan were not legitimate.

McCormick rejected the plan again this week, citing similar reasons, although attorneys for Musk have argued that the outsized compensation plan is justified because it’s directly tied to Tesla’s valuation, which currently sits at more than $1 trillion.

A dominant player in the electric vehicle market, Tesla has faced setbacks this year amid increased competition and safety concerns surrounding its Full Self-Driving mode. The company slashed more than 10% of its global workforce in April, citing a need to cut costs.

Musk was tapped last month to lead President-elect Donald Trump’s new Department of Government Efficiency, a role that could bolster his influence and Tesla’s standing.

Tesla shareholders have voted to restore CEO Elon Musk’s record $44.9-billion pay package that was thrown out by a Delaware judge earlier this year.

How did we get here?

Tesla shareholder Richard Tornetta filed a lawsuit against Musk and the company in 2018 after the majority of shareholders approved a 10-year performance-based pay package for Musk.

Tornetta alleged that Musk misled investors who approved the plan and exercised inappropriate influence over negotiations. Musk denied the allegations at trial, saying he did not control the terms of the pay package or attend meetings where it was discussed.

McCormick sided with Tornetta in January and blocked the plan. After the ruling, Tesla shareholders voted again to approve the pay package, with more than 70% in favor, but it was not enough to change McCormick’s mind.

Why did the judge rule twice?

After McCormick’s first ruling, Musk’s attorneys argued that the shareholders’ overwhelming support of his compensation plan should override the court’s decision. Tesla shareholders voted twice to approve the plan, but McCormick maintained that they were not acting independently.

“There were undoubtedly a range of healthy amounts that the board could have decided to pay Musk,” McCormick wrote in her second opinion. Instead, the board “capitulated to Musk’s terms and then failed to prove that those terms were entirely fair,” she said.

McCormick said that it was not standard for a judge to change a ruling based on the vote of shareholders. There was “no procedural ground” to reverse the decision, she wrote.

Elon Musk’s ties to the Trump administration pose potential conflicts of interest for his various businesses that have extensive contracts with the federal government.

How does Musk’s pay compare?

If approved, Musk’s compensation plan would be the largest in U.S. history for a public company executive, according to CNBC. The pay plan includes a series of 12 milestones and would award Musk additional Tesla shares as the company grows.

In order for Musk to reach each milestone, Tesla’s market capitalization must increase in $50-billion increments. For Musk to fully vest in the award, the company’s market cap must reach $650 billion, the company said.

Musk’s attorneys argue that the pay plan is a reflection of what the executive is worth, but McCormick disagrees. In her second ruling, the judge also awarded the plaintiffs $345 million in legal fees, although plaintiff attorneys had asked for a whopping $5.6 billion.

Who’s right?

Corporate governance expert Charles Elson said the Delaware court’s ruling was sound and in line with the law because Musk had violated conflict of interest regulations. Tesla also created improper new evidence after McCormick’s first decision by calling for a second shareholder vote, he said.

“The judge found that the board was not independent of Musk and there was no negotiation between him and the board that produced this package, which makes it suspect,” Elson said. “The standard rules have to apply.”

Elon Musk’s good standing with Donald Trump may be good news for Tesla, but not necessarily for EV makers in general.

What will Musk do now?

Musk criticized McCormick’s ruling on X, the social media platform he owns, writing that “shareholders should control company votes, not judges.”

Tesla also posted on X that the court’s decision was wrong and the company plans to appeal. The appeal would be filed with the Delaware Supreme Court.

“This ruling, if not overturned, means that judges and plaintiffs’ lawyers run Delaware companies rather than their rightful owners,” the company wrote.

Attorneys for Tornetta and the other shareholders who oppose Musk’s pay plan said they would defend the court’s ruling if the decision is appealed.

The Associated Press contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.