Oil for China

China, no longer content to merely hoard U.S. Treasury bonds with its new wealth, is embarking on a global buying spree. Chinese companies have acquired IBM’s personal computer business and made bids for Maytag and, most spectacularly, Unocal, the El Segundo-based oil company. Unocal’s board of directors, which had earlier agreed to sell the company to Chevron, is now reviewing an $18.5-billion offer from CNOOC Ltd., China’s third-largest oil company.

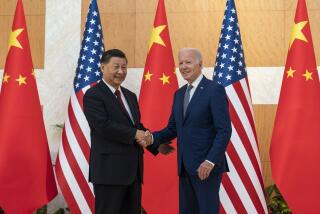

Washington will closely review the offer as well, at a time when China-bashing on Capitol Hill is reaching alarming proportions. On Thursday, Federal Reserve Chairman Alan Greenspan warned members of Congress that their China-focused protectionist instincts pose a threat to the U.S. economy.

The United States has legitimate grievances in its dealings with Beijing -- piracy of intellectual property chief among them -- but overheated talk of slapping high tariffs on Chinese goods if that country doesn’t alter how it manages its currency amounts to self-defeating hysteria.

Lost in all the rhetoric is the fact that most of America’s bilateral trade deficit with China is not attributable to some communist plot, but to U.S. manufacturers that own factories in China and ship their products home.

As a lender and as a supplier of low-cost goods, China has proved a reliable business partner.

Not long ago, China was a net exporter of oil, but its growing need for imported oil is one reason crude is trading at $60 a barrel. As the nation emerges from poverty into the global middle class, it is natural that China’s consumption of global resources starts mirroring its one-fifth share of global population.

For well over half a century, ensuring sufficient reserves and a steady flow of oil has been a cornerstone of U.S. foreign policy. China now has to think in similar ways. Rather than leading to a zero-sum showdown, this affinity of interests between the two nations, if handled properly, could strengthen the relationship.

For decades, U.S. investment has poured into oil exploration and distribution around the world, and it would be rather cheeky and colonialist of Washington to decree that Chinese capital is not welcome to the game. CNOOC is especially interested in Unocal because of the company’s reserves in Asia. The fact that CNOOC is backed by the Chinese government is hardly novel in the global oil industry -- the state oil enterprises of Venezuela and Saudi Arabia have long backed overseas ventures that do business in this country.

If Unocal’s board decides the offer is desirable to its shareholders and the deal proceeds, the interagency Committee for Foreign Investment in the U.S. will review whether it compromises national security by transferring militarily sensitive technology to the Chinese. But overwrought claims that Beijing is out to gain control of “our” oil must be dismissed as more groundless China-bashing.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.