Capitol Journal: A tax hike that no one could quibble about

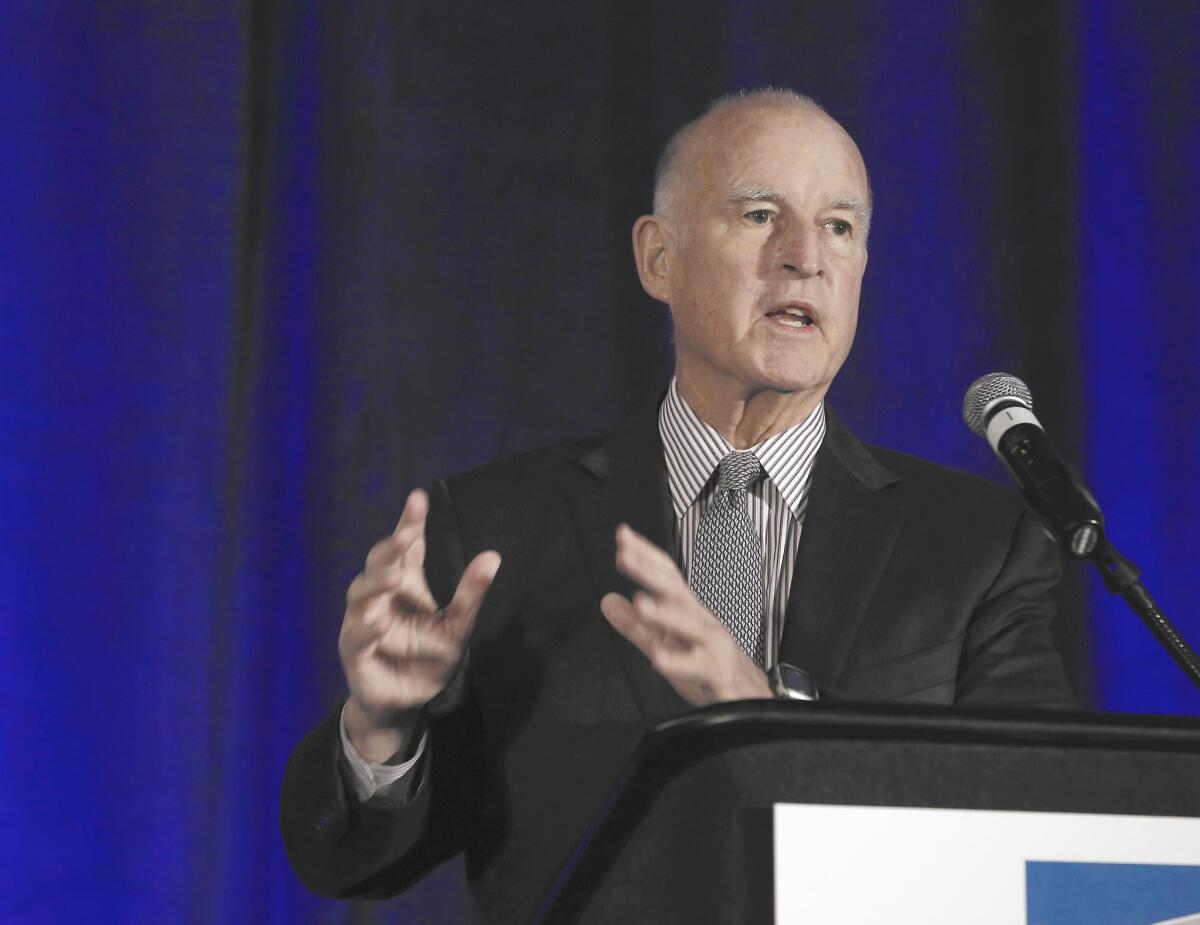

Gov. Jerry Brown is expected to quickly sign the tax on healthcare insurance plans when the Legislature sends him the measure.

in sacramento â Holy Howard Jarvis! California legislators are close to passing a tax increase.

But not even Jarvis, the iconic anti-tax rebel, is rolling over in his grave about this levy boost.

Itâs a good government version of âgive me your money and no one gets hurt.â

The taxpayers in this instance make out like bandits.

Yes, really.

Gov. Jerry Brown has been advocating the tax on healthcare insurance plans for months. Heâll quickly sign it once the Legislature sends him the measure. That should be in a few days.

Itâs a tax to keep afloat Medi-Cal â Californiaâs healthcare program for the poor â as itâs being loaded up with Obamacare beneficiaries.

Rapidly growing Medi-Cal covers more than one-third of the stateâs residents. The federal Affordable Care Act has added 5 million people alone. Sacramento also has made Medi-Cal available to immigrant children who are in the country illegally.

But even without Obamacare and the immigrant kids, the tax might be necessary. Thatâs because the state has been taxing Medi-Cal managed care plans, but the feds say the levy canât be limited just to Medi-Cal. And unless that changes by July 1, Washington will cut off $1 billion in funding.

So Brown proposes taxing non-Medi-Cal health plans too.

Naturally, there were objections, largely because Medi-Cal plans get reimbursed for the taxes with the help of matching federal money. But the non-Medi-Cal plans would not be.

Confused so far? So is practically everyone in Sacramento, at least those not fluent in government-ese.

Brown came up with a creative solution last month, but begged off trying to explain it to reporters. âItâs extremely complex,â he said. âVery few people understand it.... I couldnât explain it to you if I wanted to.â

OK, hereâs the simple version: All plans â Medi-Cal or not â would be taxed. Medi-Cal plans would pay at a higher rate. But theyâd continue to be reimbursed.

This is the sweet spot: The non-Medi-Cal plans would benefit from having other state taxes â corporation and insurance â reduced or eliminated. So these plans would wind up $105 million ahead.

The state would pocket nearly $1.3 billion, thanks to the feds. That would fill the budget hole, plus leave $250 million for other health-related spending.

Where the surplus will go is still being negotiated. But a program sure to benefit is one that serves people with developmental disabilities. It has been starved since the recession.

This is a tax hike in name only.

Not even Californiaâs most aggressive anti-tax lobby, the Howard Jarvis Taxpayers Assn. â named after the man who pushed the ballot measure that dramatically cut property taxes in 1978 â is fighting Brownâs proposal. Itâs neutral.

âWe donât have a compelling reason to oppose this,â says Jon Coupal, the organizationâs president. âIf taxes are being offset by other tax reductions, thereâs nothing to pass along to consumers.

âFrankly, weâve got bigger fish to fry. Like the transportation tax. Weâre going to plant our flag there.â

Heâs referring to another Brown proposal â to increase fuel taxes to pay for repair of crumbling highways. Thatâs stalled in legislative gridlock.

The state Chamber of Commerce, Californiaâs most powerful business lobby, supports the tax on health plans.

âItâs the right thing to do and makes sense,â says chamber President Allan Zaremberg. âHowever, on a pure political scale, there are people who are appropriately prudent â and should be.â

Thatâs because there are political consultants who make a good living by taking someoneâs vote for an innocuous tax hike and turning it into an intolerable evil.

A Democratic legislator in a competitive district could be challenged for reelection by a Republican. Or, more likely, a Republican legislator in a strong GOP district could be attacked by a wannabe of the same party.

Because itâs a tax increase, this legislation will require a two-thirds vote. That means at least one Republican vote in the Senate and two in the Assembly.

Assembly Republicans seem to be mustering the nerve.

âI donât think you should get scared by a phraseâ like tax increase, says Assembly GOP leader Chad Mayes of Yucca Valley. âI think thereâll be a lot of support. Weâre different than the Senate. Weâve delved in a little deeper.â

Sen. Joel Anderson (R-Alpine) has been leading the Senate GOP resistance.

âI believe the risk is way too greatâ that some insurers will pass on their tax hikes to premium payers, Anderson says. âUnless all the parts fall just right, this could be devastating to the state and to consumers. And I want is to be sure that this doesnât lead to collapsing some insurance companies.â

Most insurance companies, however, seem to be OK with the tax.

Senate Health Committee Chairman Ed Hernandez (D-West Covina) says he expects voting this week. âI think the votes are there.â

Eagerly awaiting passage are supporters of last yearâs bill that will allow terminally ill patients to swallow a lethal pill.

Both the âright-to-dieâ act and the healthcare tax were part of the same special legislative session. The law inspired by Brittany Maynard â a young woman with brain cancer â was signed by Brown but canât take effect until 90 days after the special session ends. It will immediately after the healthcare tax is enacted.

Itâs long past time to pass the tax, adjourn the session, permit the dying to end their suffering and move on to other issues. Like fixing the highways.

Twitter: @LATimesSkelton

ALSO:

Brownâs budget to include healthcare tax

Hereâs what the Assembly GOP wants from healthcare tax negotiations

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.