Gov. Jerry Brown’s state budget is set to include a revised healthcare tax

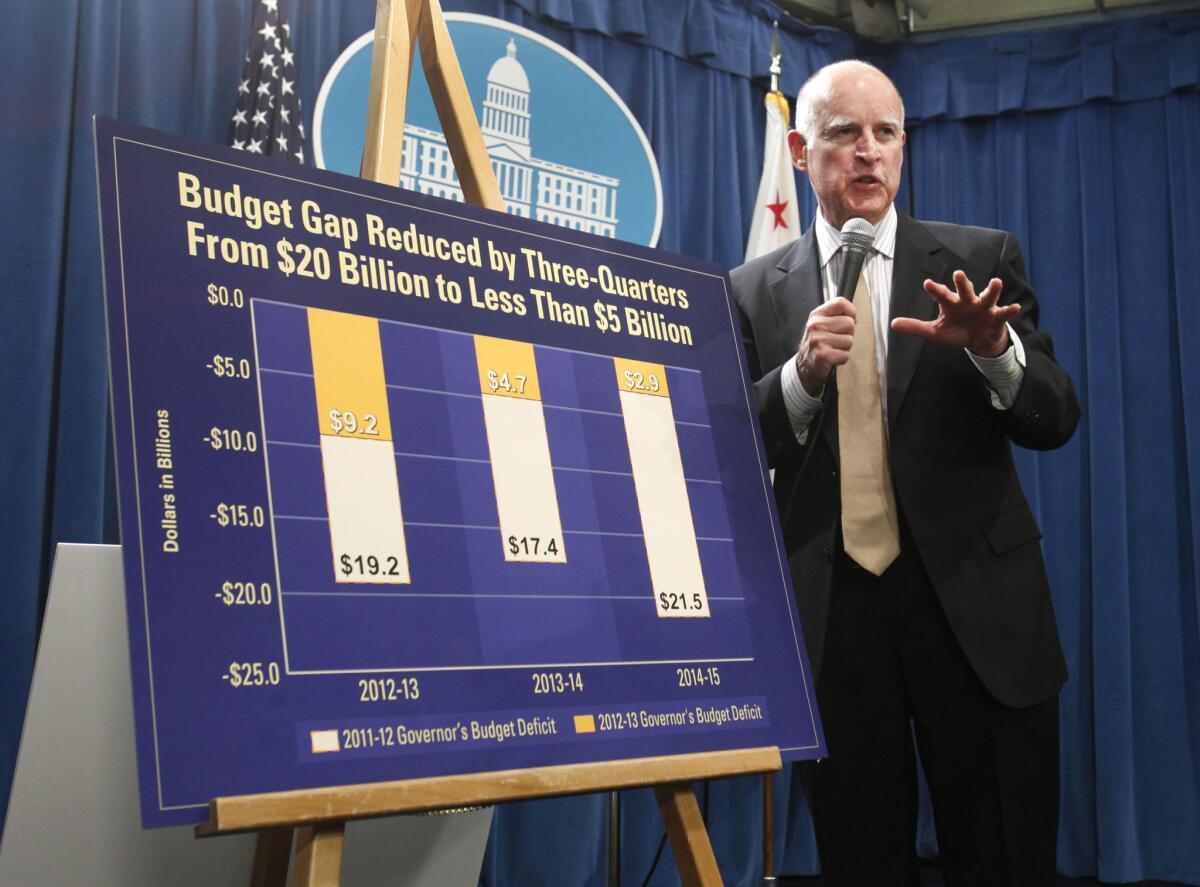

Gov. Jerry Brown discusses the 2012-13 budget in 2012.

- Share via

Reporting From Sacramento — In an effort to break a political and policy logjam, Gov. Jerry Brown will unveil a state budget that revamps a controversial tax on health plans to avoid jeopardizing federal healthcare dollars.

Sources who spoke on the condition that they not be identified prior to Brown’s scheduled Thursday announcement said the reworked tax plan reflects intense behind-the-scenes negotiations with California’s biggest insurance companies.

And to help force agreement in the Legislature, the governor’s budget reportedly links the $1.1 billion in revenues from the tax to specific healthcare programs which otherwise would be left scrambling for funds.

See more of our top stories on Facebook >>

A spokesman for Brown declined to comment before the governor’s news conference, scheduled for 10 a.m. Thursday.

The tax would replace California’s current tax on health plans that participate in Medi-Cal, which provides state subsidized healthcare to the poor. The Obama administration has said the tax must be overhauled to include all health plans — including those without Medi-Cal patients — or the state risks losing federal funding when the existing managed care tax expires June 30.

Negotiations reached a crescendo last fall, when the administration unveiled a proposal to tax plans at different rates based on enrollment. It also would have offset some of the costs to insurance companies with tax breaks.

The new proposal includes a reworking of the tax impact to appeal to a wider array of health plans, according to sources familiar with the negotiations who requested anonymity so not to preempt the governor’s announcement.

The debate over the managed care tax has been a noticeable flash point, in part because it relies on support from both health insurance companies and legislative Republicans. The extension of the tax will require a supermajority vote in both houses of the Legislature, and Republicans so far have shown no appetite for going along.

The governor’s budget for the fiscal year that begins July 1 is widely expected to project another dose of growth in tax revenues, as recent estimates show the California economy still growing and personal income taxes -- the main source of state spending -- at better than expected levels.

A November report from the Legislature’s fiscal analysts projected another strong year of tax revenues, and the potential of a $7.2 billion rainy-day budget reserve by 2017. Brown has consistently demanded a more fiscally cautious plan than Democratic legislative leaders, who have urged more spending on health and human services programs that were cut back during the depth of the recession.

This year’s debate over healthcare funding also will include whether to boost spending on services for the developmentally disabled. A bipartisan group of legislators has endorsed a restoration of some, or all, of the cuts made during California’s recession. But that funding became ensnared in 2015 negotiations over the healthcare tax. On Tuesday, a Republican group of legislators delivered petitions to Brown’s Capitol office urging new developmental disability funding.

“Services for people with developmental disabilities have been taken political hostage in Sacramento,” said Roxanne Sanchez, president of SEIU Local 1021, a Northern California chapter representing local government and healthcare workers.

Sign up for our daily Essential Politics newsletter

ALSO:

Brown releases $170B spending plan

Follow along with live updates from Sacramento

By 2017, California could have $7.2 billion socked away in rainy-day fund

Clinton to court Asian voters, a growing force in California and beyond

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.