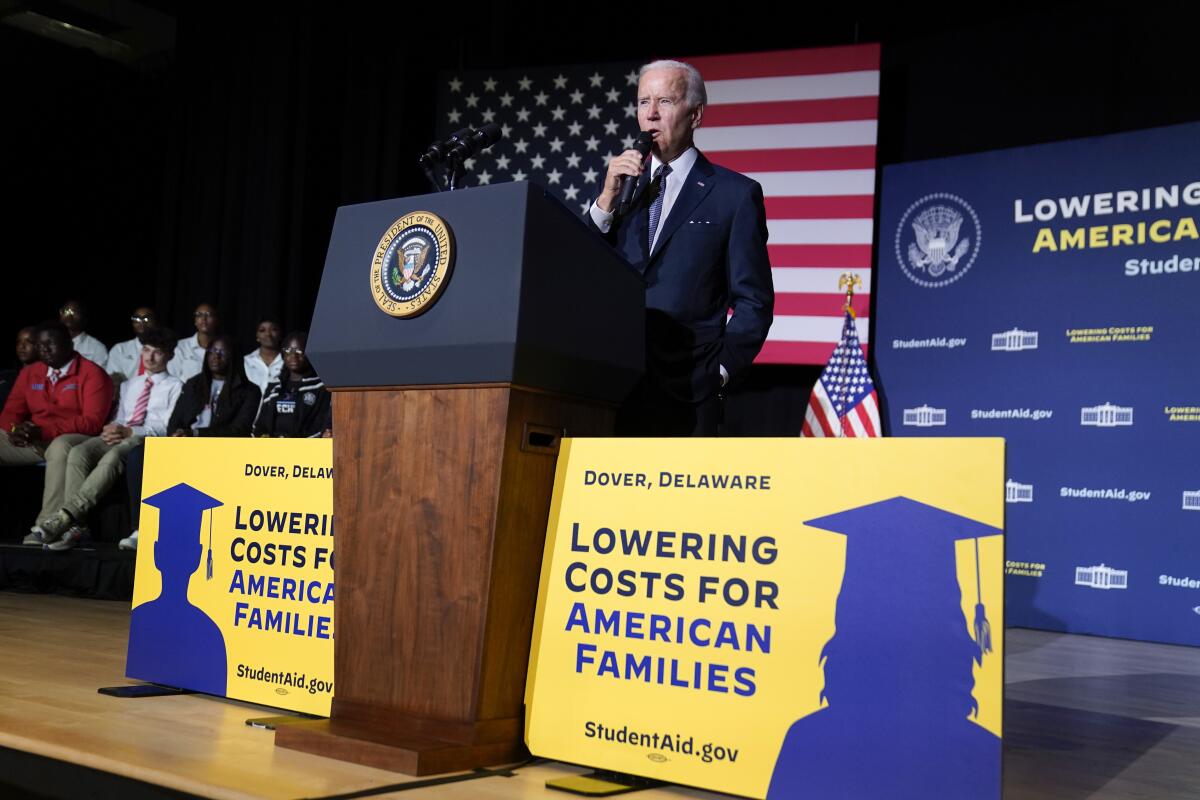

Appeals court allows part of Biden student loan repayment plan to go forward

WASHINGTON â A federal appeals court has allowed the U.S. Education Department to move ahead with a plan to lower monthly payments for millions of student loan borrowers, putting on hold a ruling last week by a lower court.

The ruling from the 10th U.S. Circuit Court of Appeals puts back on track a central part of President Bidenâs efforts to address student debt â a rule that lowers from 10% of discretionary income to 5% the amount that some borrowers qualifying for a repayment plan need to pay.

The reduced payment threshold was set to take effect Monday, but federal judges in Kansas and Missouri last week blocked much of the administrationâs student loan repayment plan in two separate rulings. The appeals court ruling on Sunday means the department can move ahead with the reduced payments already calculated.

The rulings have created a difficult environment for borrowers to navigate, said Persis Yu, deputy executive director of the Student Borrower Protection Center, which advocates for eliminating student debt. The stay granted by the 10th Circuit is temporary and subject to appeal, Yu said, leaving many borrowers in the dark about future financial obligations.

After months of negotiations, the administration is proposing a rule to reduce the debts of millions of borrowers. But the plan will likely face legal challenges.

âBorrowers are having to make decisions right now about their financial lives, and they donât know the very basic information that they need in order to make informed decisions,â Yu said.

The Biden administration created the SAVE plan last year to replace other existing income-based repayment plans offered by the federal government. It allowed many to qualify for lower payments, and forgiveness was granted to borrowers who had made payments for at least 10 years and originally borrowed $12,000 or less.

The appeals court ruling does not affect the injunction issued by a federal judge in Missouri, which prevents the Education Department from forgiving loan balances going forward.

The injunctions are the result of lawsuits from Republican-led states seeking to invalidate the Biden administrationâs entire loan forgiveness program, which was first available to borrowers in the summer of 2023, and at least 150,000 have had their loans canceled. The suing states argued that the administrationâs plan was a workaround after the Supreme Court struck down the original plan for student loan forgiveness earlier that year.

Ma writes for the Associated Press.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.