- Share via

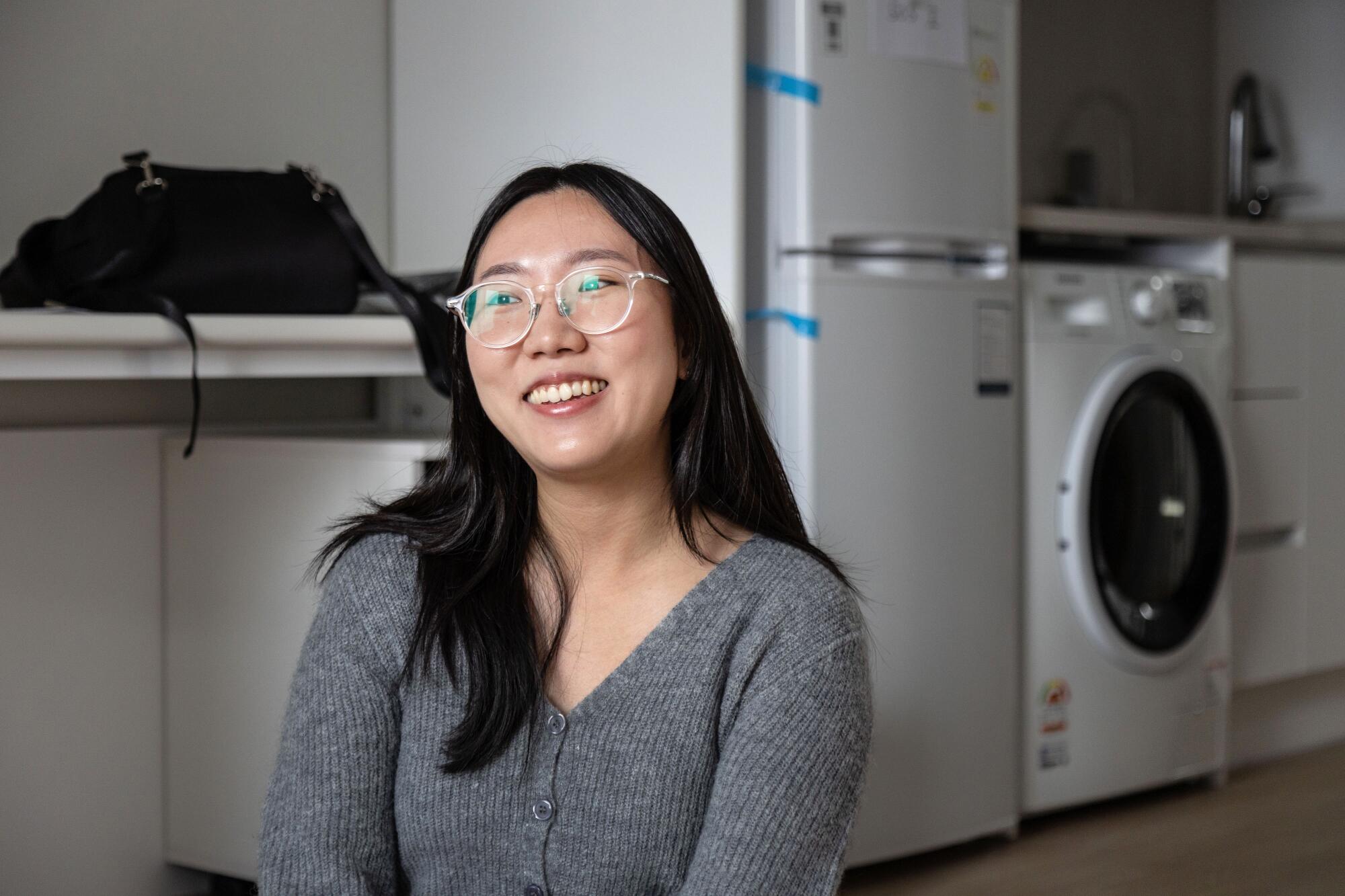

SEOUL — The studio apartment Choi Soul recently scored might have the cheapest monthly rent in Seoul: 10,000 won, or about $7.

“After I got the text message informing me I got it, I stared at it over and over again for a week straight,” said the 24-year-old college student. “I felt like I could finally start saving for my future.”

The brand-new unit is compact — 226 square feet — but comes furnished with an air conditioner, induction cooktop, refrigerator, laundry machine and plenty of cabinet space.

Choi, who moved in last week, only had to order herself a bed.

Part of a new public housing complex in Seoul’s Dongjak district called Yangnyeong Youth House, the heavily subsidized studio was built for people like her: young South Koreans struggling to find a place to live.

Home to 10 million people, Seoul has one of the most expensive housing markets in the world. The median price of an apartment has doubled in the last 10 years to around $685,000.

Buying a home here is often referred to as “scraping together your soul.”

“I don’t think anyone my age will be able to buy a home here,” Choi said. “Maybe it’ll be easier for the next generation.”

The rental situation hasn’t been much better.

As of December, the average monthly rent for Seoul apartments smaller than 355 square feet was $457 — a 15% increase since 2021, according to government data analyzed by housing advocacy group Minsnail Union.

In some college neighborhoods, single-person units are now going for as much as $700.

For Choi, who makes the national minimum wage of $7 an hour as a freelance videographer while she pursues a broadcast journalism degree, seeing these prices feels like “getting stuck at the very first gate of adulthood.”

In addition to real estate speculation, recent shifts in rental preferences and the country’s demographics are to blame for the housing crisis.

Until recently, most middle-class South Koreans rented their homes through a unique system called jeonse. Instead of paying monthly rent, a tenant pays the landlord a deposit amounting to up to 70% of the property’s market value.

For a long time, it was a win-win proposition.

Interest payments on jeonse loans are generally lower than what rent would be, allowing tenants to more easily save toward their own homes. For landlords, the lump sum deposits in effect act as interest-free loans, which they can use to invest in stocks or real estate.

But a series of high-profile scams, in which over-leveraged landlords refused to pay back the deposits, has increasingly turned tenants away from jeonse and toward paying rent in cash — an option that used to be mainly for young or poor people.

South Koreans are also taking longer to get married or start families, further pushing up demand in the cash rental market, where the majority of single-person homes can be found.

“Competition is very high at the moment, and it’s probably going to get worse,” said Seo Won-seok, a real estate policy expert at Chung-Ang University. “What this also says is that we need more public housing to ease these trends.”

Seoul is still home to a fifth of the country’s population, but housing issues are the primary reason that 1.7 million South Koreans have left the capital for surrounding provinces in the last decade, swapping out cheaper rents for longer commutes into the city center.

In such a climate, securing a spot in public apartments such as Yangnyeong feels like winning a lottery.

“Everybody around me wants to get into a public apartment,” said Kim Do-yeon, a 25-year-old college senior who works part time as a convenience store clerk. “I applied to five other places before I got this one.”

Kim was among the 700 people who applied for one of the 36 units in Yangnyeong Youth House, which the district built over a public parking lot.

Only those between the ages of 19 and 39, with a monthly income of $1,620 or less were eligible for a spot.

On paper, the monthly rent is $93 — low even by the standards of public housing. But by using profits from its public works corporation, the district is offering $7 rents for the inaugural group of tenants.

“For now, we’ve secured enough funding for the first six months, but we plan to continue offering the same rate even after that,” said Choi Sun-young, a district office spokesperson.

“We’re also currently developing additional $7 public rentals for other young tenants, such as newly married couples.”

Still, it’s not quite as cheap as it seems: Each tenant must come up with a security deposit of about $10,000.

Kim got help from her parents, who were already giving her a hand with basic expenses. The tiny apartment she is leaving, with a single window that faces a concrete wall, was costing her $446 a month.

After signing her contract with an official from the district, Kim headed up to the fifth floor to tour her new place, which had a new house smell and was filled with sunlight.

“Wow, it’s so spacious,” she said.

“You can put blinds or curtains here,” explained the official, standing by the window. “But please don’t put any nails in the walls.”

Kim didn’t mind.

“I can’t even cook in my current place because there isn’t enough room and the ventilation is so bad,” she said. “Now I can finally cook my own meals.”

Tenants have the option to renew their two-year contract four times, meaning this will be the home that will see Kim through until her mid-30s.

By then, she hopes to have settled into a career as an accountant.

But after that, she said, her time in Seoul will be up.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.