Does your student loan qualify for forgiveness? The short and long answers

- Share via

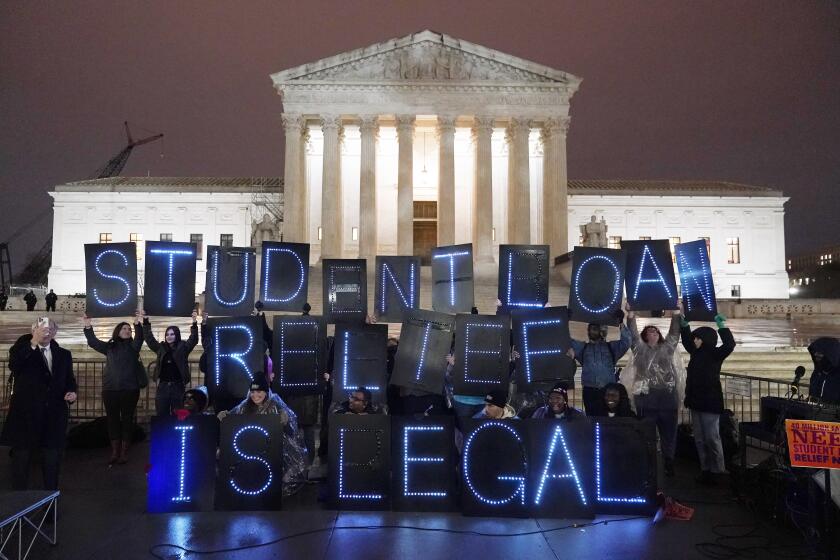

Headlines about student loan debt forgiveness have sent many borrowers scrambling to figure out whether they would be eligible for the aid.

Under the administration’s plan, anyone earning less than $125,000 (or married couples earning less than $250,000) will qualify for up to $10,000 in federal student loan forgiveness. Up to $20,000 in loan forgiveness will be available to borrowers who meet the income limits and obtained Pell Grants, which are awarded to students from families with extremely limited means.

But there are many types of federal loans, and the administration hasn’t offered guidelines specifying which can be forgiven. Instead, it has said that any loan taken out directly from the federal government would be included in the debt-relief program. Those loans — the main form of federal financing since 2010 — make up most student debt.

What about FFEL, Perkins and HEAL loans?

Here’s where things get murkier. The Federal Family Education Loan, Federal Perkins Loan and Health Education Assistance Loan programs offered loans guaranteed by the U.S. government but issued by schools or private lenders. The Department of Education holds some FFEL and Perkins loans, but some of those (and all HEALs) are held by third parties.

When the federal government suspended loan payments and interest charges during the pandemic, the relief applied only to direct loans, FFEL and Perkins loans held by the government and direct FFEL, Perkins and HEALs in default. Any loan whose payments and interest have been suspended will be eligible for the $10,000 to $20,000 in forgiveness, said Abby Shafroth, director of the student loan borrower assistance project at the National Consumer Law Center.

The Biden administration’s student loan relief plan is expected to wipe out the debt of 1 million or more Californians. Here’s who is eligible and for how much forgiveness.

To find out whether your FFEL or Perkins loans could qualify, go to your account at the Federal Student Aid site (studentaid.gov) and call up the “My Loan Servicers” list. If the servicer’s name is preceded by “DEPT OF ED,” that loan is held by the federal government.

Many people may not know whether their older loans are federally held as they weren’t given a choice when they took them out, Shafroth said. The loans they received depended on the financial aid programs their school was participating in while they were enrolled.

So will people with privately held but federally guaranteed loans be included in the new forgiveness effort? The Biden administration initially said yes, but on Sept. 29 reversed course and said no, not at this point.

Anyone who had applied before Sept. 29 to consolidate privately held FFEL or Perkins loans into a federal direct loan will be eligible for the blanket forgiveness, the department said. Otherwise, it said, the Education Department “is assessing whether there are alternative pathways to provide relief to borrowers with federal student loans not held by ED, including FFEL Program loans and Perkins Loans, and is discussing this with private lenders.”

The White House said Pell Grant recipients would receive twice as much loan forgiveness as other low- and moderate-income borrowers. Do you qualify? Check the Federal Student Aid website.

How about consolidation loans?

If you’ve refinanced your private and federal loans into a single one from a private lender, it is private and thus ineligible for forgiveness.

But if you’ve combined your federal loans — direct or guaranteed, such as FFEL or Perkins — into a federal consolidation loan, that will be eligible for forgiveness if each of them disbursed its funds before July 1. In other words, if you took out a federal student loan in July, then consolidated it with your older federal loans, the new, consolidated loan would not be eligible.

On Sept. 29, the department issued new guidance on its website indicating that borrowers could no longer do this sort of consolidation and qualify for the debt relief.

There are other reasons to go ahead and consolidate loans, though.

For example, Shafroth said, borrowers who won’t have their entire balances forgiven and hold government or nonprofit jobs should consolidate now to take advantage of the temporary expansion in the Public Service Loan Forgiveness program. The program, which wipes out all federal loan debt for people who make 10 years’ worth of payments while in public service, is waiving some of its usual eligibility requirements until Oct. 31.

Another example: Some federally guaranteed loans are not eligible for income-driven repayment plans unless they are part of a consolidation loan. In an income-driven plan, borrowers typically pay 10% of their discretionary income every month for 20 to 25 years, at which point any remaining balance is discharged.

The Education Department is in the process of reviewing payment records for these plans, giving borrowers credit for the months when payments were paused and for months spent in lengthy forbearance periods. That process, which won’t be completed before Jan. 1, Shafroth said, will allow borrowers to have their balances discharged sooner.

You can start the consolidation process on the Education Department’s Federal Student Aid website. Learn more here.

For details of the plan to forgive up to $20,000 in student loan debt, listen to a Twitter Spaces conversation hosted by Times journalists.

What if I’m in default?

Shafroth said federal direct loans in default are expected to be eligible for forgiveness. If collections on your loan have been paused during the pandemic, that’s a good sign that it could be forgiven if your income is below the cap.

About 7.5 million people have student loan debts in default.

How certain are we about these details?

It’s important to remember that the administration’s proposal exists largely in the form of announcements and fact sheets, not yet in something as formal as a law, regulation or executive order. The companies that service student loans, which will be front and center for much of this effort, have yet to see guidelines from the Education Department.

“This was news to everybody,” said Scott Buchanan, executive director of the Student Loan Servicing Alliance. “There’s a lot of regulatory stuff we’ve got to work through and figure out.”

Historically, he said, there have been statutory or regulatory barriers to some of the steps the White House has said it plans to take.

“It’s going to be a collaborative effort between us and the [Education Department] to find a way forward here,” Buchanan said.

There’s also the possibility that critics of the plan will sue to try to block it. Some argue that the department doesn’t have the authority to forgive debt on such a broad scale — an issue President Biden raised last year, although the administration has since released a legal opinion asserting that it does have that power.

Shafroth said she is optimistic the forgiveness plan will survive.

“It is one thing for opponents of debt cancelation to trash-talk it to media and on Twitter,” she said. “It is another thing entirely for them to actively try to claw back billions of dollars of financial relief from 43 million working- and middle-class Americans.”

The federal plan would forgive up to $20,000 in student loans for Pell Grant recipients and $10,000 for other borrowers earning less than $125,000 a year.

Do Parent Plus loans qualify for forgiveness?

The short answer is yes.

The longer answer is that it depends on income. Yes — if the parent’s income is less than $125,000 for someone who files taxes as a single person or $250,000 for a married couple.

Can current or new students have their debt forgiven?

Current students, yes, if their loans are federal direct loans and they meet the income limits. But the relief applies only to loans issued before July 1.

That means students who haven’t started college or taken out loans yet won’t be eligible for loan forgiveness from this program in the future. Nor will current students with eligible loans be able to throw new loans into the forgiveness mix.

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.

Do I qualify automatically for loan forgiveness?

In some cases, yes. If you are on an income-driven repayment plan and have kept your information up to date, the government knows how much money you make and is expected to apply the appropriate amount of loan forgiveness to your account.

But if you are on a standard repayment plan — that is, you pay the same amount every month, regardless of your income — you should fill out the paperwork the Department of Education will provide in coming weeks. To be notified about updates, sign up for emails from the department.

What if I already paid off my loans?

Congratulations! You have no more student debt.

For people who recently paid off their loans, there might be a way to get some money back. The Fresno Bee pointed out that you can get refunds for payments made after March 2020 and the resulting balance forgiven under the program. Be sure to read the fine print if you attempt this.

The federal government plans to forgive up to $20,000 in student loan debt for millions of Americans. Here’s everything you need to know.

Where can I find more information?

The Times has covered several aspects of this issue:

- How can you tell if you received a Pell Grant? (And what is a Pell Grant?)

- Who is eligible for the loan forgiveness? And how much?

- How will this affect borrowers in California?

To dig into these issues and answer your questions, The Times hosted a Twitter Spaces conversation Thursday with staffers Jon Healey, Jessica Roy, Eli Stokols and Debbie Truong. You can listen to a replay here.

About The Times Utility Journalism Team

This article is from The Times’ Utility Journalism Team. Our mission is to be essential to the lives of Southern Californians by publishing information that solves problems, answers questions and helps with decision making. We serve audiences in and around Los Angeles — including current Times subscribers and diverse communities that haven’t historically had their needs met by our coverage.

How can we be useful to you and your community? Email utility (at) latimes.com or one of our journalists: Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

More to Read

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.