Biden proposes new taxes on the rich to keep Medicare solvent

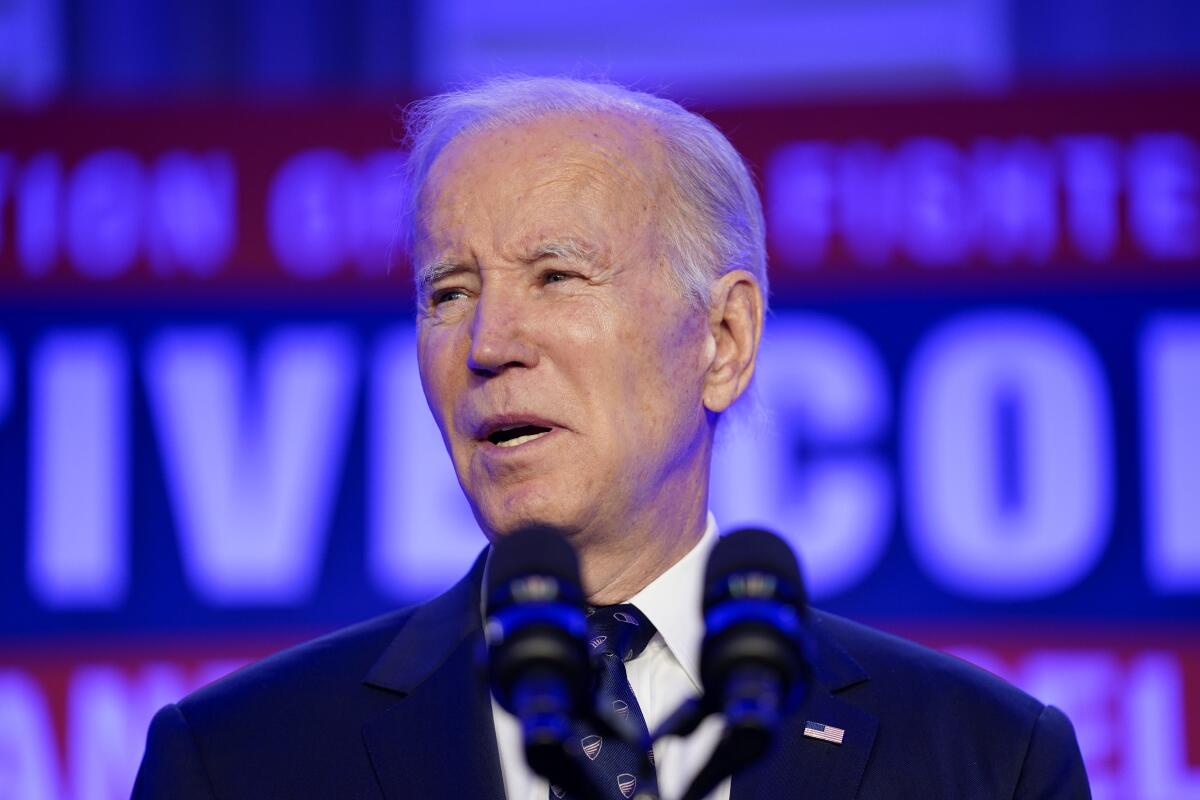

WASHINGTON â President Biden on Tuesday proposed new taxes on the rich to help fund Medicare, saying the plan would help to extend the insurance programâs solvency by 25 years and provide a degree of middle-class stability to millions of older adults.

In his plan, Biden is overtly declaring that the wealthy ought to shoulder a heavier tax burden. His budget would draw a direct line between those new taxes and the popular health insurance program for people 65 and older, essentially asking those whoâve fared best in the economy to subsidize the rest of the population.

Biden wants to increase the Medicare tax rate from 3.8% to 5% on income exceeding $400,000 per year, including salaries and capital gains. The move would likely increase tax revenue by more than $117 billion over 10 years, according to estimates in February by the Tax Policy Center.

âThis modest increase in Medicare contributions from those with the highest incomes will help keep the Medicare program strong for decades to come,â Biden wrote in a Tuesday essay in the New York Times. He called Medicare a ârock-solid guarantee that Americans have counted on to be there for them when they retire.â

Senate Minority Leader Mitch McConnell (R-Ky.) was quick to dismiss the plan, telling reporters on Tuesday that Bidenâs budget agenda âwill not see the light of day.â

More than 65 million people rely on the program, which costs taxpayers roughly $900 billion every year. The number of Medicare enrollees is expected to continue growing as the U.S. population ages. But funding for the program is a problem: Federal officials warn that without cuts or tax increases, the Medicare fund might only be able to pay for 90% of benefits by 2028.

Donât let the bear market keep you from retiring. But there are a bunch of other financial and emotional factors to consider before taking the leap.

Bidenâs suggested Medicare changes are part of a fuller budget proposal that he plans to release on Thursday in Philadelphia. Pushing the proposal through Congress will likely be difficult, with Republicans in control of the House and Democrats holding only a slim majority in the Senate.

The proposal is a direct challenge to GOP lawmakers, who argue that economic growth comes from tax cuts like those pushed through by former President Trump in 2017. Those cuts disproportionately favored wealthier households and companies. They contributed to higher budget deficits, when growth failed to boom as Trump had promised and the economy was then derailed in 2020 by the COVID-19 pandemic.

The conflicting worldviews on how raising taxes affects the economy is part of a broader showdown. Biden and Congress are already under pressure to reach a deal to raise the governmentâs borrowing authority at some point this summer, or else the government could default and plunge the U.S. into a debilitating recession.

Grover Norquist, president of Americans for Tax Reform and an advocate for the kinds of tax cuts generally favored by Republicans, said the economy would suffer under the presidentâs plan.

âThe Biden tax hikes will raise the cost of goods and services for everyone, and make American workers and businesses less competitive internationally and versus China,â Norquist said.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, had some reservations about the proposal, but still applauded it.

âThe presidentâs plan would generate hundreds of billions of dollars â perhaps even approaching a trillion dollars â to strengthen Medicare,â said MacGuineas, a fiscal watchdog focused on deficit reduction.

White House Press Secretary Karine Jean-Pierre declined to discuss the numbers behind the budget plan on Tuesday, telling reporters in a briefing that she would not âdive into the math,â but that Bidenâs proposal on Thursday would be âvery detailed and transparent.â

The independent, nonpartisan Congressional Budget Office will analyze the proposal later this year.

William Arnone, chief executive of the National Academy of Social Insurance â an advocacy organization for Medicare and other entitlement programs â says thereâs some risk in taxing wealthier Americans more for the program, given that they already pay more in premiums for Medicare coverage.

âAt some point higher-income Medicare enrollees may say: âThis isnât a good deal for me anymore,ââ Arnone said. âThe genius of social insurance is that we all pay in, and we all get something out in return. If higher-income people start to question the equity, that could lead to a loss [of] confidence in the program.â

What will the Inflation Reduction Act do for you?

Ahead of an expected budget feud and the 2024 campaign season, Democrats have ramped up talk around Medicare, vowing to fend off any Republican attempts to cut the program. GOP lawmakers have reached little consensus on how to fulfill their promise to put the government on a path toward balancing the federal budget in the next 10 years.

Last year, members of the House Republican Study Committee proposed raising the eligibility age for Medicare to 67, which would match the age for full Social Security benefits. But that idea hasnât moved forward in a split Congress.

Republicans have denied that they plan to cut Medicare. A proposal from Sen. Rick Scott (R-Fla.) that would require Congress to reconsider all federal laws every five years, including Medicare, has gotten little traction.

Raising taxes on Americans who make more than $250,000 in order to pay for Medicare has broad support among older Americans, according to surveys conducted in recent years by the nonpartisan Senior Citizens League. Raising the eligibility age for Medicare is widely unpopular, said Mary Johnson, a policy analyst for the organization who has researched the issue.

Politicians who try that route might âlose supporters, and it can backfire. You can wind up losing your office, too,â Johnson warned. âA very high percentage of seniors are voting in elections.â

Bidenâs plan is also intended to close what the White House describes as loopholes that allow people to avoid Medicare taxes on some income. Besides the taxes, Biden wants to expand Medicareâs ability to negotiate drug costs, which began with the Inflation Reduction Act. He signed the sweeping legislation last year.

The White House said its budget plan would expand the pharmaceutical drug provisions of the Inflation Reduction Act. More drugs would be subject to price negotiations, other drugs would be brought into the negotiation process sooner and the scope of rebates would be expanded.

Taken together, Bidenâs new proposals would help shore up a key trust fund that pays for Medicare, which provides healthcare for older adults. According to the White House, the changes would keep the fund solvent until the 2050s, about 25 years longer than currently expected.

Changes would also be made to Medicare benefits. Biden wants to limit cost sharing for some generic drugs to only $2 to lower out-of-pocket costs for treating conditions such as hypertension and high cholesterol.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.