Column: The GOP shutdown drama in Washington costs us plenty, even when Congress averts a stoppage

Tired of Congressâ repeated partisan standoffs every time a big fiscal deadline approaches, like this weekâs? Weary of the breathless cable coverage of looming government shutdowns or debt defaults, knowing the partisans (almost) always come to some 11th-hour compromise, as they did Tuesday?

Or have you tuned out by now?

Opinion Columnist

Jackie Calmes

Jackie Calmes brings a critical eye to the national political scene. She has decades of experience covering the White House and Congress.

Hereâs why you should pay attention: These senseless, self-induced crises have cost us taxpayers big bucks in higher interest on U.S debt, even when Congress manages to avert a government stoppage or a default. On top of that, theyâve taken an incalculable toll on the publicâs faith in governance.

And know that this irresponsibility is not a both-sides issue. Democrats and Republicans are not equally culpable. Going back more than a quarter century, it has been Republicans who have provoked the showdowns, setting conditions that couldnât become law on their own both for funding the government and raising the nationâs debt limit, so the Treasury can keep borrowing to pay the bills.

In fact, Republicans have made budget brinkmanship routine â when a Democrat is in the White House, that is. They were quietly complicit as the federal debt grew by nearly $8 trillion during the Trump administration.

This weekâs scary 2024 polls only get scarier when you contemplate what the former president and his allies have in mind for a Trump presidency 2.0.

The serial fiscal dramas have real consequences. The latest came Friday, when Moodyâs Investors Service announced that it had changed its outlook for U.S. government debt to ânegativeâ from âstable,â partly because of âcontinued political polarization.â

The firmâs statement did not single out Republicans explicitly; private-sector analysts stick to politically neutral prose, not least to avoid alienating clients. Yet in expanding on the âcongressional dysfunctionâ it sees as an economic as well as political problem, Moodyâs gave four examples: âRenewed debt limit brinkmanship, the first ouster of a House Speaker in U.S. history, prolonged inability of Congress to select a new House Speaker, and increased threats of another partial government shutdown.â

Those examples only describe the House Republican majority.

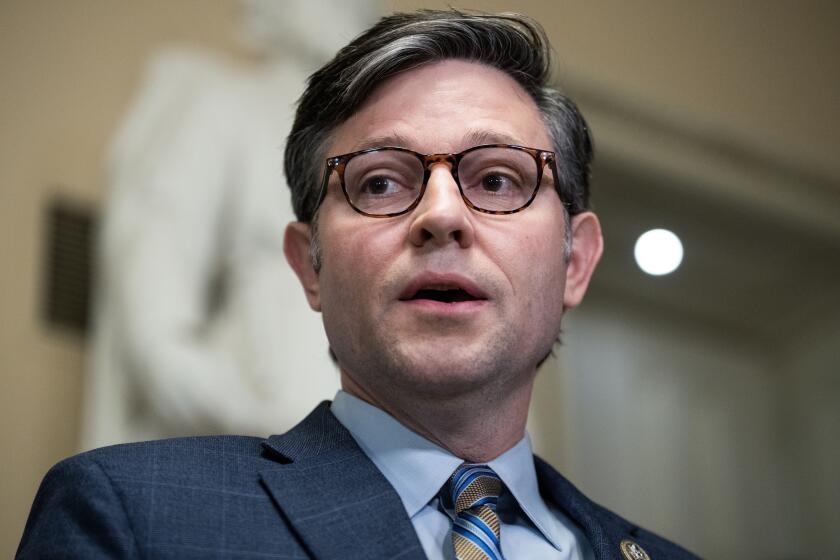

The new House Speaker Mike Johnson is little different from Matt Gaetz and the rest of the âCrazy 8sâ who ousted Kevin McCarthy three weeks ago.

On Tuesday the latest shutdown threat was lifted â for now. The Houseâs novice speaker, Mike Johnson of Louisiana, could not resolve Republicansâ infighting over how much to slash spending and other nonstarter demands, including anti-abortion add-ons. He turned to Democrats for enough votes to pass a stopgap funding bill that simply extends the current spending levels, keeping government open and buying Congress time â to February â to finally reach an agreement for this fiscal year.

So the saga isnât over yet. Though Moodyâs lowered its outlook for U.S. debt, it did maintain the nationâs triple-A credit rating, the highest possible. If Congress makes a hash of the funding process yet again in the new year, Moodyâs is poised to knock that down as well.

That, in turn, could provoke the countryâs creditors, who buy Treasury bills and notes, to demand that the government pay them higher interest, which only adds to the annual deficit, the tab we taxpayers are ultimately responsible for.

New House Speaker Mike Johnson just relied on Democratic votes to fund the government. Will it come back to haunt him?

Two ratings firms have already downgraded U.S. credit from AAA to AA+. Fitch Ratings did it in August, soon after House Republicans refused to raise the debt limit without unrealistically deep spending cuts. The last-minute debt deal that since-ousted Speaker Kevin McCarthy negotiated with President Biden enraged far-right Republicans and was the beginning of his end.

Fitchâs reasoning previewed Moodyâs. Its analysis pointed to a âsteady deterioration in standards of governanceâ over the past two decades. In other words, dysfunction is nothing new, it has just gotten worse in the MAGA era. Again, Fitch didnât cite âRepublicansâ specifically, but the timeline makes clear who it faulted.

Fitch had warned months earlier that âdebt ceiling brinkmanshipâ and the continued questioning of the 2020 presidential election were worrisome signs. When it finally lowered the credit rating, Fitch reportedly told Biden administration officials that the Jan. 6, 2021, insurrection was a factor. According to the Associated Press, Fitch had concluded that the governmentâs stability deteriorated from 2018 to 2021, then increased once Biden succeeded Trump. But then Republicans took over the House this year.

He has devoted his career to demeaning, endangering and imprisoning LGBTQ+ people. Thatâs the rĂŠsumĂŠ House Republicans were looking for.

Fitchâs downgrade was only the second time in the nationâs history that the U.S. credit rating has been cut. The first was after a 2011 debt-limit crisis, when Standard & Poorâs took the AAA rating down a peg. It has never restored the top rating.

There is a parallel between Congressâ fiscal mayhem in 2011 and 2023: Those years followed Republicansâ winning a House majority in midterm elections, and resolving to shake things up under a Democratic president. In 2011, it was the tea party takeover. Now we have the MAGA House.

Republicans once claimed the descriptor âfiscal conservatives.â But over decades of covering budget policy, Iâve watched them squander that brand. Insisting on excessive spending cuts to reduce deficits while opposing any tax increases, threatening shutdowns and near-defaults â those arenât the tactics of fiscal conservatives.

By now weâre sick and tired of the brinksmanship. If only Republicans were too.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.