Column: California has a new plan to tax the super rich. Will it drive them out?

More than a third of California’s 39 million residents are living at or near the poverty line, many of them lacking food security or decent housing or adequate healthcare. More than 150,000 are homeless. Adjusted for the cost of living, California has the highest poverty rate in the country.

But California also has more people on the Forbes 400 list of richest Americans than any other state. It has 165 billionaires and more than 80,000 tax filers with adjusted gross incomes over $1 million.

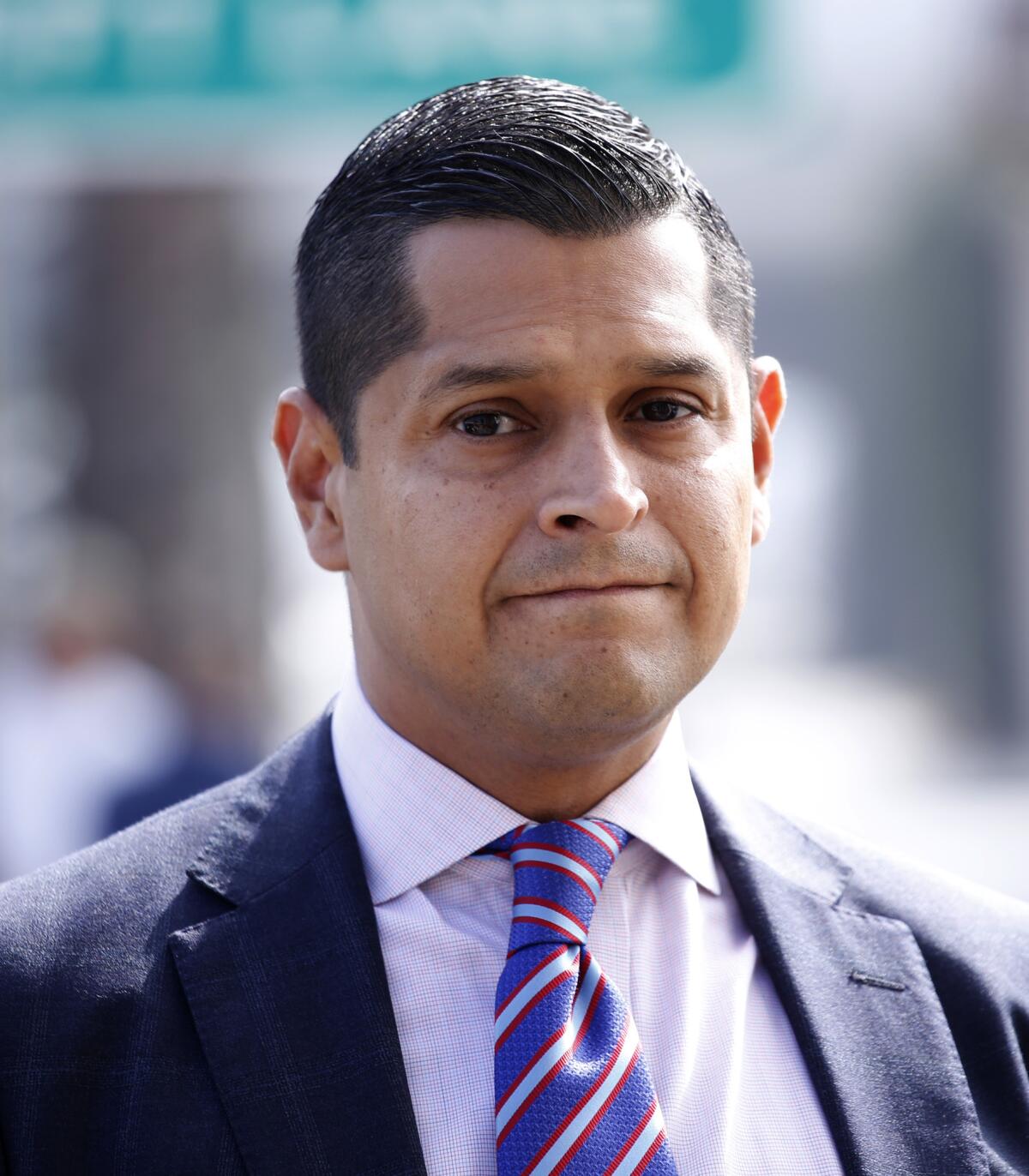

That astounding level of income and wealth inequality is the best, most compelling argument in favor of Assembly Bill 1253, which would raise personal income taxes on the state’s top earners. The bill, written by Assemblyman Miguel Santiago (D-Los Angeles), would have no effect on the 99% of Californians who earn less than $1 million per year, but sets a sliding scale of new income tax surcharges on those who earn more.

And what‚Äôs wrong with that? Sure, we have high taxes on the rich already ‚ÄĒ but California has enormous needs, not to mention an impending budget crisis, and the rich have deep, deep pockets.

In general, raising taxes on the rich is a good idea for the same reason Willie Sutton robbed banks: It’s where the money is. It is also fair up to a point. California’s highest income taxpayers owe a significant debt to the society that made them wealthy, and they should pay that debt graciously. Besides, I’ve yet to see a soak-the-rich proposal in California that actually soaks the rich.

The real question is a pragmatic one: Will they pay it or will they flee the state?

If you listen to anti-tax groups and Republican legislators, you’d think that California is at some delicate tipping point, and that if we ask our wealthiest residents for even a penny more they will pack their belongings and stomp out of California to a state where the taxes are lower.

‚ÄĚI want to be careful about our one-percenters,‚ÄĚ said Sen. John Moorlach (R-Costa Mesa) at a hearing on AB 1253 on Monday.

Republican solicitude for the 1% should hardly come as a surprise. But does Sen. Moorlach really believe this proposal will send taxpayers scurrying out of state? If this bill were to pass, Californians with $1.5 million a year in taxable income would have to pay $5,000 extra. Taxpayers with $5 million would see an increase of $100,000. Those with $20 million would see an increase of more than $600,000. The state’s top marginal tax rate would rise to 16.8%.

That’s not nothing. Especially when you consider that rates here are already high, that the wealthy are also paying federal income taxes (at a top rate of 37%) and that they can no longer deduct their state tax bills from their federal taxes.

But let’s get serious. It won’t drive many people out.

California is home to more than a quarter of the country’s 623 billionaires. Is that happenstance? Coincidence? Of course not. It’s because California is where the jobs and industries are that make people rich. It’s because taxes are not the determining factor for most people about whether to live in California; they’re also likely to consider the state’s climate, ocean, business opportunities, universities and other quality-of-life amenities.

California has imposed taxes on the wealthy before, and every time, anti-tax activists have shrieked that the sky would fall. But there’s no persuasive evidence that rich people have fled in significant numbers. Not after 2004’s Proposition 63, which slapped a 1% tax on incomes over $1 million, or 2012’s Proposition 30, which upped taxes for people earning over $250,000, or Proposition 55, which extended the Proposition 30 tax hikes.

Sure, there are lower-tax states where Californians could go. Nevada, Texas, Florida, Alaska, South Dakota, for example. But do we really think many Silicon Valley billionaires ‚ÄĒ or millionaires ‚ÄĒ are going to pack up for South Dakota to avoid Miguel Santiago‚Äôs income tax surcharge? Do people in Bel-Air or Venice want to move to Dallas?

Of course some will leave. Maybe to Miami, if they can bear the humidity. And over time, we need to keep an eye on whether our taxes are becoming confiscatory or counterproductive. But there’s no reason to think we’re at that point yet.

The research is murky, sometimes even contradictory. But one influential 2016 study concluded that millionaire tax flight occurred only at ‚Äúthe margins of statistical and socio-economic significance.‚ÄĚ

‚ÄúIt‚Äôs simplistic to say that nobody moves in response to taxes,‚ÄĚ said Tracy Gordon, a senior fellow at the Urban-Brookings Tax Policy Center. ‚ÄúBut it‚Äôs a trickle, according to all the research I‚Äôve seen.‚ÄĚ

Today, the top 0.4% of taxpayers account for 40% of the dollars that come in from the state‚Äôs personal income tax. To that I say: Good for us. But the other taxes California imposes ‚ÄĒ the property tax and the sales tax ‚ÄĒ aren‚Äôt nearly as progressive. And don‚Äôt forget the loopholes, shelters and deductions available to those with fancy lawyers.

AB 1253, which would raise an estimated $6.8 billion annually, needs careful vetting; it will no doubt change before it reaches the floor. It comes as voters are considering dramatic changes in the way commercial property is taxed under California’s Proposition 13. If Democrats win nationwide in November, federal tax hikes may be considered as well. Those and other factors should be considered.

Because the incomes of the wealthy fluctuate year to year, state budgeters would also need to be fiscally conservative with the new revenues: Don’t overspend. Put more money in the state’s rainy day fund.

But the Legislature would be remiss if it didn’t work to raise more desperately needed money from those who can best afford to part with it.

@Nick_Goldberg

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.