Op-Ed: Free market ideology won’t help us during the COVID-19 crisis. Here’s what would

- Share via

As the COVID-19 crisis unfolds across the globe, one lesson is emerging: markets are extremely fragile, and critically needed help will come not from business but from governments.

Neoliberal pundits and conservative economists have insisted in the past several decades that markets can be the solution to nearly every problem societies face. As Ronald Reagan, echoing Margaret Thatcher’s sentiments, famously said in his January 1981 inauguration address, “government is not the solution to our problem, government is the problem.” That principle has been a driving force in national politics in the U.S. as well as in Europe and much of the developing world ever since. We have lived in a neoliberal world for more than a generation now.

In fact, the current health crisis is demonstrating the opposite. Major industries — from airlines to energy — are turning to governments for financial support. Small-business owners are clamoring for no-interest loans, tax cuts and outright free money. Worries of a credit crunch have banks benefiting from cheaper interest rates — courtesy of central banks.

It is hard to imagine where heavily indebted European countries and companies would be without the recent massive intervention of the European Central Bank in sovereign and corporate bonds. Huge declines in stock markets have everyone looking to governments and the E.U. — not businesses — for life-saving responses. And, of course, governments — not businesses — are the ones coordinating national and local responses to the crisis in terms of health services.

In the U.S., the spotlight is on state and federal authorities. In Europe, it is on regional, national and E.U. authorities. In China, South Korea, Japan, Singapore and other Asian countries, it has been governments, not industry, which have mobilized to address the problem. States, and not markets, have been the sources of the solution. This is not to say that pharmaceutical companies and other economic actors will not eventually prove valuable, too, especially when it comes to vaccines and antiviral drugs.

Help the Los Angeles Times reimagine what California should look like after the COVID-19 pandemic ends.

The point is rather that anyone believing that the economy and society more generally need very little help from government is wrong. The current crisis is making it very clear that even the most powerful industries are vulnerable. It is also making clear that, by definition, markets lack the type of coordination needed to address crises. We are turning first to public officials, not CEOs or CFOs.

Past crises, such as the financial one of 2007-08, showed us something similar. Then, too, the immediate solutions came from government. Let’s hope that once the world gets over this latest crisis the lessons will not be forgotten. But memories are short, and many will be tempted to go back to the established paradigm. It happened in the aftermath of 2008: Several key government initiatives, such as the establishment of the Consumer Financial Protection Bureau, were eventually undermined, while banks were allowed to get bigger, not smaller and better regulated.

This time it must be different. We must all assume, even in good times, the fragility of markets. This means that we must invest, ahead of time, in government structures, programs and funding for challenges that will inevitably arise. And we must commit to them for the long term.

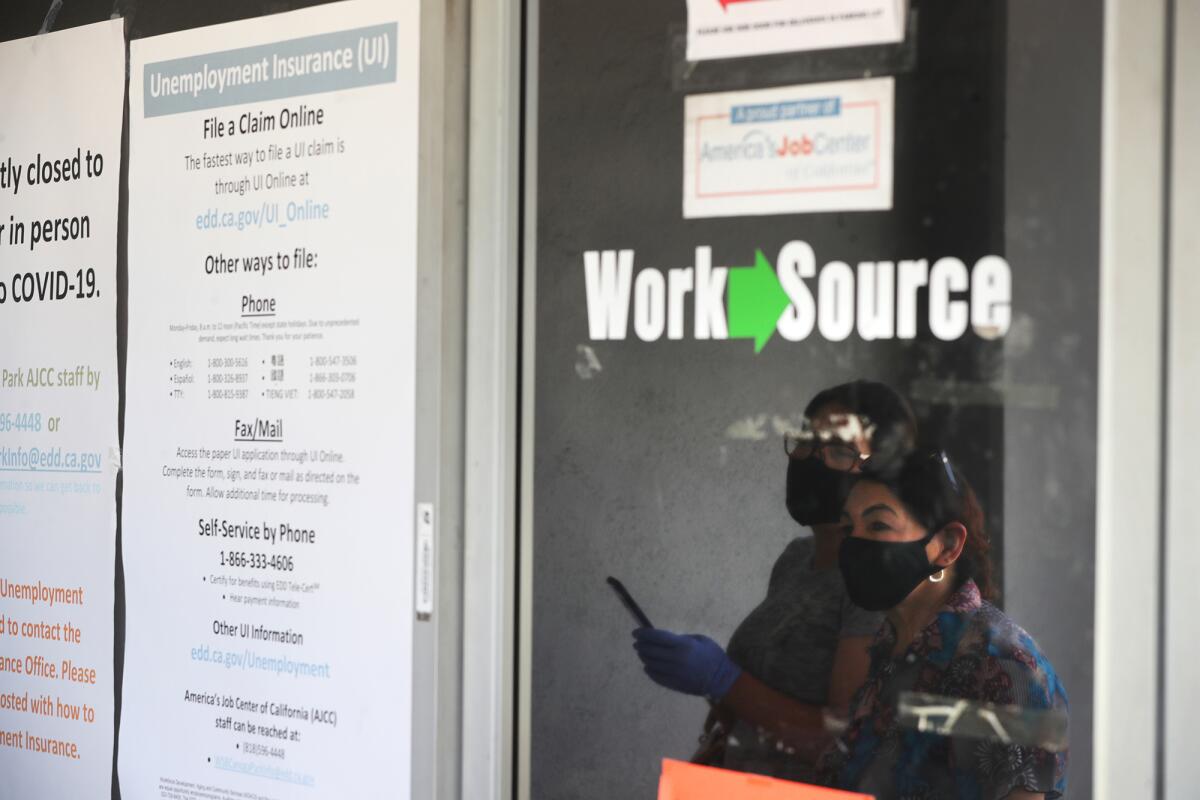

Unemployment benefits, for instance, should be designed to support major crises that last not months but a year or more, and with payments that come close to full, or at least livable, wages. Robust sick leave policies should be introduced.

Government agencies should establish strong partnerships with private sector companies in good times, so that they are prepared for coordinated action when the bad times arrive. These could include retraining programs that provide direct state incentives to employers to hire unemployed workers (such as six months’ worth of wages), as well as placement programs for college students in state-sponsored job training. Other countries, such as Denmark and France, do this successfully.

The capacity of critical government websites and offices — such as those linked to unemployment claims — should be greatly expanded to operate properly when demand surges, and not just under normal conditions. Protocols for local, state and federal coordination should be augmented and refined, so that critical supplies are produced, tracked and easily and fairly distributed in times of need.

Regulatory reform should encourage companies and nonprofit organizations to have resources for rainy days that can last months. For instance, nursing home providers or fast-food chains could be required to contribute to shared insurance pools so that their abilities to function could be sustained for more than a month or two, even during severe downturns. And policies for better international cooperation should be devised.

One of the big lessons emerging from the COVID-19 pandemic is that collective action is the only thing that will revive economies and contain a virus. Neither can be accomplished by markets alone.

Francesco Duina is a professor of sociology and European studies at Bates College. He is the author, most recently, of “Broke and Patriotic: Why Poor Americans Love Their Country.”

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.