Op-Ed: Trumpâs tax reform is leaving millions of poor children behind

In 2019, the U.S. spent more than $100 billion on the federal Child Tax Credit. Families that qualify can take up to $2,000 off their taxes for each dependent child, and if the credit is more than the taxes they owe, they get a refund for the balance. The Child Tax Credit is the single largest federal expenditure made to benefit children.

But 23 million children are ineligible for the full Child Tax Credit because their parents earn too little to qualify. In other words, a program meant to aid children is leaving behind those who need it most. Extending the full Child Tax Credit to low-income families would cut the child poverty rate â the percentage of children (up to age 17) living below the poverty line â by a quarter.

The 2018 rewrite of the tax code, President Trumpâs Tax Cuts and Jobs Act, increased the maximum Child Tax Credit from $1,000 to $2,000 per child and extended eligibility for the full credit to families with incomes between $110,000 and $400,000. The rewrite did not replicate this generous expansion for the nationâs lowest income families.

Under the law, the credit âphases inâ with earnings, so parents in two-adult, two-child families now need to earn $36,000 a year to qualify for the full $2,000 Child Tax Credit, and a single parent of two needs to earn $30,000. These earnings requirements exclude 35% of children from the full benefit of the credit. Only 2% are ineligible for the full credit because their families earn too much.

Our research shows that families with young children and families in rural areas are disproportionally excluded from the full credit, as are the majority of black and Latino children. Female-headed families are less likely to receive the full credit, at least in part because women are paid less than men for the same work. In California, 37% of children are left out of the full credit, and there are areas of the state â primarily in metro areas and in the Central Valley â where those who donât get the credit are the majority, not the exception.

The rate of child poverty in the U.S. â 13.7 % â is one of the highest among developed democracies. In countries where child poverty is significantly less common â Canada, Germany and the United Kingdom, for example â child tax credits (also called child allowances), reach nearly all children, no matter their parentsâ earning level.

In Germany, families annually receive at least $2,400 for each child to help cover the basic costs of raising kids. This investment helps cover childcare and after-school activities. Studies show that the future benefits of such child allowances, in terms of positive impacts on childrenâs health and test scores, as well as maternal health, far exceed their immediate dollar value.

In 2016, at the urging of California Reps. Barbara Lee (D-Oakland) and Lucille Roybal-Allard (D-Downey), Congress commissioned the National Academy of Sciences to study evidence-based policies that could cut child poverty in the U.S. Of all the policy proposals considered, an expanded Child Tax Credit for low-income families proved to be the strategy that would result in the most substantial reduction in child poverty.

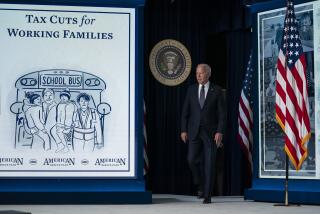

There are efforts underway at the federal level to correct the inequities in the Child Tax Credit. The American Family Act, first introduced in 2017, would extend full eligibility to low-income children, increase the value of the credit for all, and distribute it monthly. We estimate the American Family Act would move 4 million children out of poverty and would cut the number of children in the deepest poverty nearly in half.

Democrats broadly support the American Family Act, and backing is growing among Republicans. Last month, Utah Sen. Mitt Romney came out in favor of a Child Tax Credit that includes all low-income kids. In 2018, then Wisconsin Gov. Scott Walker signed into law what was the first universal Child Tax Credit in the U.S., a one-time credit delivered in time to help families with school supplies.

Like Wisconsin, other states are beginning to fill the gap. In July 2019, Gov. Gavin Newsom established the nationâs first Young Child Tax Credit, providing $1,000 to families with earnings below $25,000 and children under the age of 6. Just last week, New York Gov. Andrew Cuomo proposed an expansion of his stateâs low-income Child Tax Credit to include more low-income families with young children.

We know what is needed to make significant progress in the fight against child poverty. Simple fairness demands that the full Child Tax Credit be available to all children.

Sophie Collyer is a research director at the Center on Poverty and Social Policy at Columbia University. David Harris is president of the Childrenâs Research and Education Institute. The research featured in this piece was produced in partnership with Christopher Wimer and Irwin Garfinkel, co-directors of the Center on Poverty and Social Policy, and Jane Waldfogel, of the Columbia Population Research Center. Garfinkel and Waldfogel are professors at Columbia.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.