Opinion: Are baby boomers ruining the housing market for everybody else?

- Share via

If you follow the real estate pages, you have probably seen stories claiming that baby boomers are creating havoc in the housing markets — pushing up prices, staying in their homes too long and overtaxing rental markets. Some stories even predict that boomers will cause regional market crashes in coming decades.

But are the actions of baby boomers really so problematic? And are the homeownership decisions of aging boomers key to understanding the future of home-price dynamics?

According to Freddie Mac, more than 67 million U.S. homeowners are over the age of 55. Collectively, they own about two-thirds of all U.S. home equity. About 63% of these homeowners plan to age in place while the rest plan at least one more move. Among the movers, 71% say they plan to rent rather than buy their next homes.

The stories identifying baby boomers as a key reason housing is unaffordable for younger buyers tend to make the same points. They argue that baby boomers have not been selling the way they used to, and that the average duration of staying in a home has risen from six years before the 2008 crisis, to nearly 10 years today. Moreover, if survey responses of older homeowners prove accurate, this trend will continue, limiting the supply of resale listings, and potentially pushing up home prices in markets with limited new construction and strong demand.

Another repeated concern is that the boomers who do plan to sell their homes and rent thereafter could strain the availability of affordable rental housing. The size of the baby-boomer generation could create an influx of older renters that will make rental prices unaffordable for younger households.

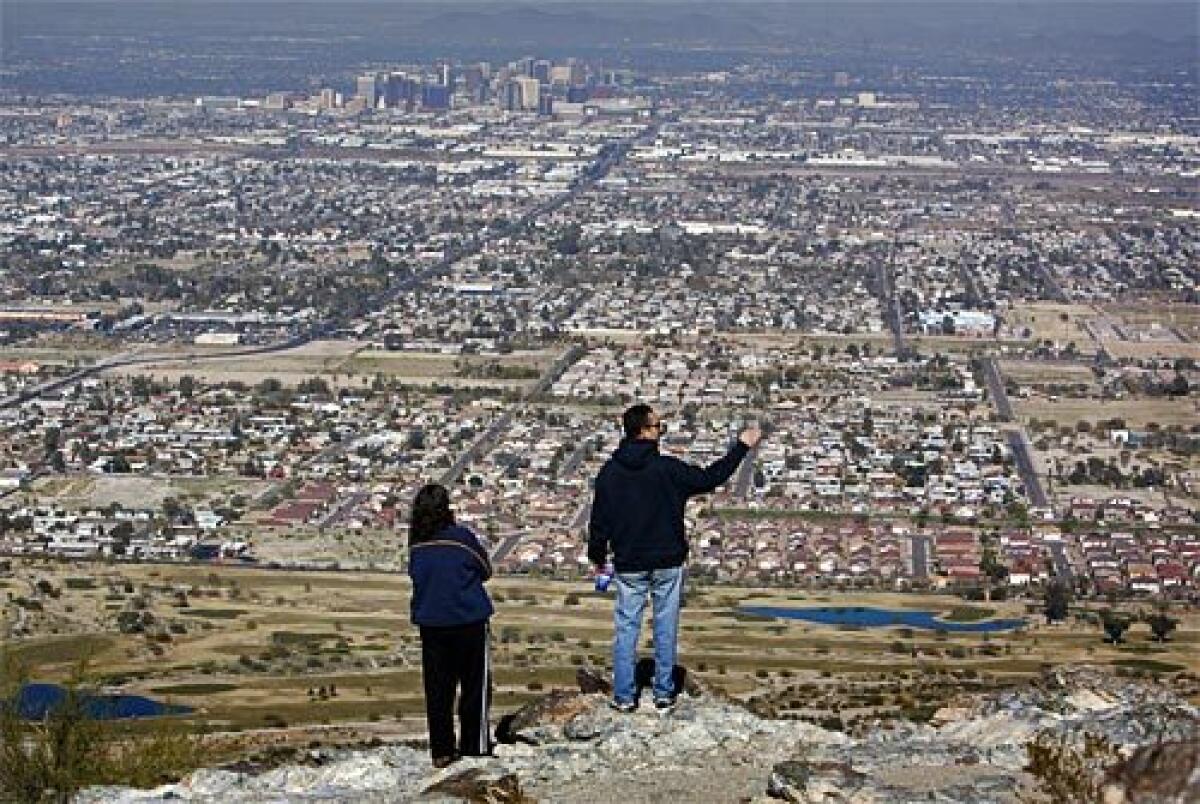

And then there are predictions of boomer bubbles — large price corrections in boomer enclaves once aging homeowners die or are unable to live independently. Younger households, we are told, prefer “happening” urban environs, so there is little chance they will be willing purchasers of aging boomer properties, meaning it is just a matter of time before home prices deflate in places like Phoenix, Las Vegas or the Villages in Florida.

One thing these boomer-shaming stories fail to appreciate, however, is that housing supply adjusts to changes in demand. Although a lack of adequate supply is always a big concern, today the metro areas with the greatest job growth are also leading the way in entry-level construction. And when supply is scarce, areas previously not used for residential housing often are repurposed, as with L.A.’s Arts District or the massive rail-yard conversions that took place in Jersey City.

And before you panic and abandon plans to buy a retirement home in Sun City or Delray Beach, consider a different perspective about the predictions of massive deflation in such communities. Numerous academic studies have found that differences in house prices across cities are more closely related to variability in employment rates, to growth in real incomes and to construction costs than to demographic shifts. If regions are economically viable, with productive commerce and job opportunities, chances are good that the young will come, and housing markets will be sustained.

The predicted “inevitable crash” in retirement-community prices focuses on demographic shifts that will play out over the next 20 years. That’s a long time when compound interest is at work. If the Federal Reserve hits its 2% inflation target, the price level will increase by almost 50% over the next 20 years. If retirement-community sales prices hold firm — not falling a dime in the next 20 years — prices still will have fallen 50% in real terms, creating plenty of room to attract younger generations to retirement communities without any drop in current home prices.

Moreover, the basic premise that younger generations will eschew suburban-style living is subject to challenge. New Census Bureau data show millennials are increasingly trading in urban life for the suburbs. It is not hard to imagine this shift intensifying in the future as an estimated $8 trillion in baby-boomer home equity is passed on to the next generation.

How seriously should we take predictions of boomer-induced home price concerns? When it comes to predictions of future real estate prices, caution is warranted. Consider two famous examples.

A 1989 study published by two well-respected Harvard economists predicted that the aging of the baby-boomer generation would reduce the demand for housing and cause a significant decline in real home prices. The professors concluded, “If the historical pattern [between births and housing demand] continues over the next twenty years, housing prices will fall to levels lower than observed at any time in recent history.” Of course, the opposite has happened.

And then there’s this. In 1971, the economy of Seattle was suffering. Boeing had cut more than 60,000 jobs and the outlook for Seattle’s future was reflected in the words of a famous billboard from the time: “Will the last person leaving Seattle turn out the lights.” Today the city has some of the most expensive real estate in the nation.

Our recommendation: Beware of predictions, especially about the future.

Paul Kupiec and Ed Pinto are baby boomers and resident scholars at the American Enterprise Institute.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.