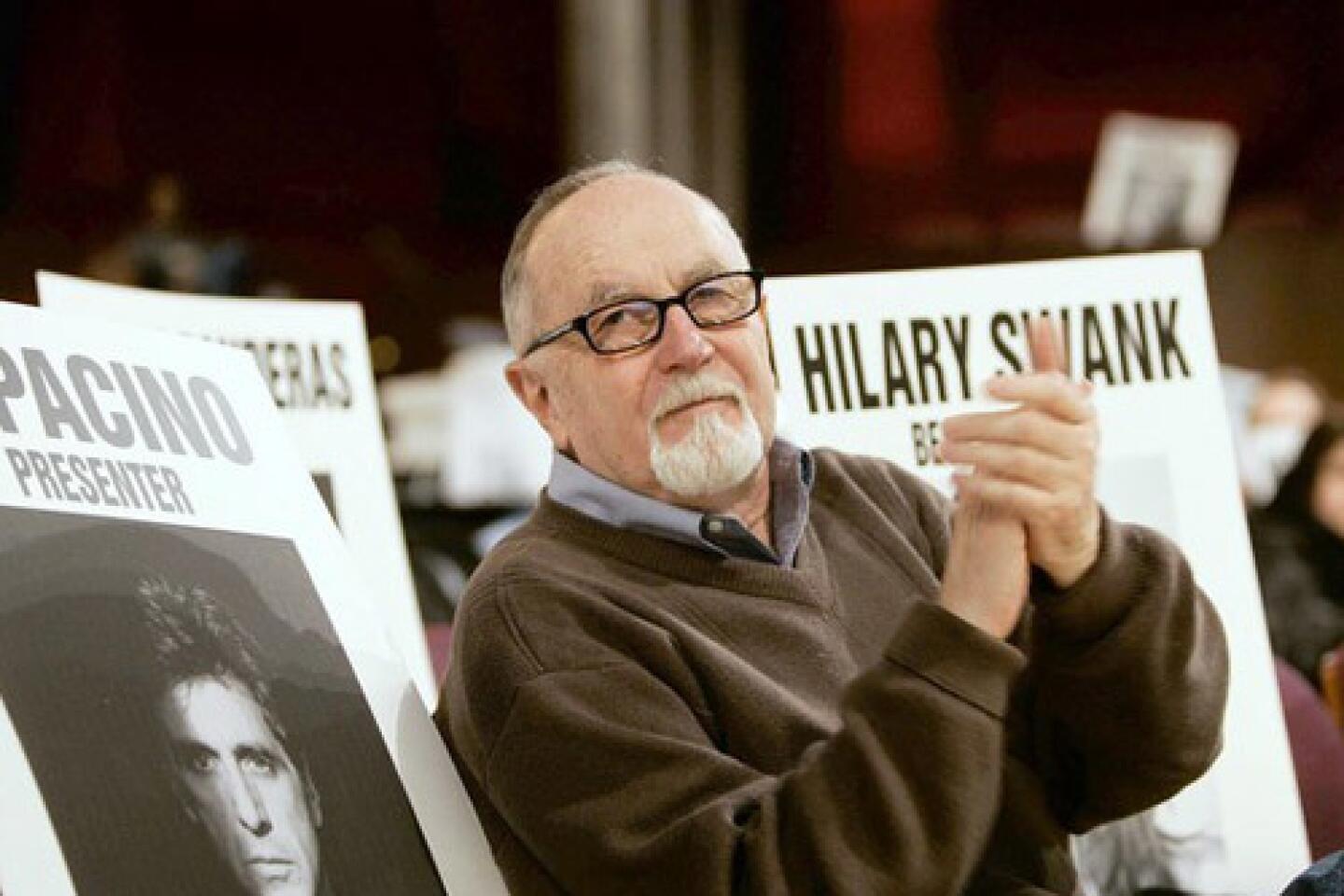

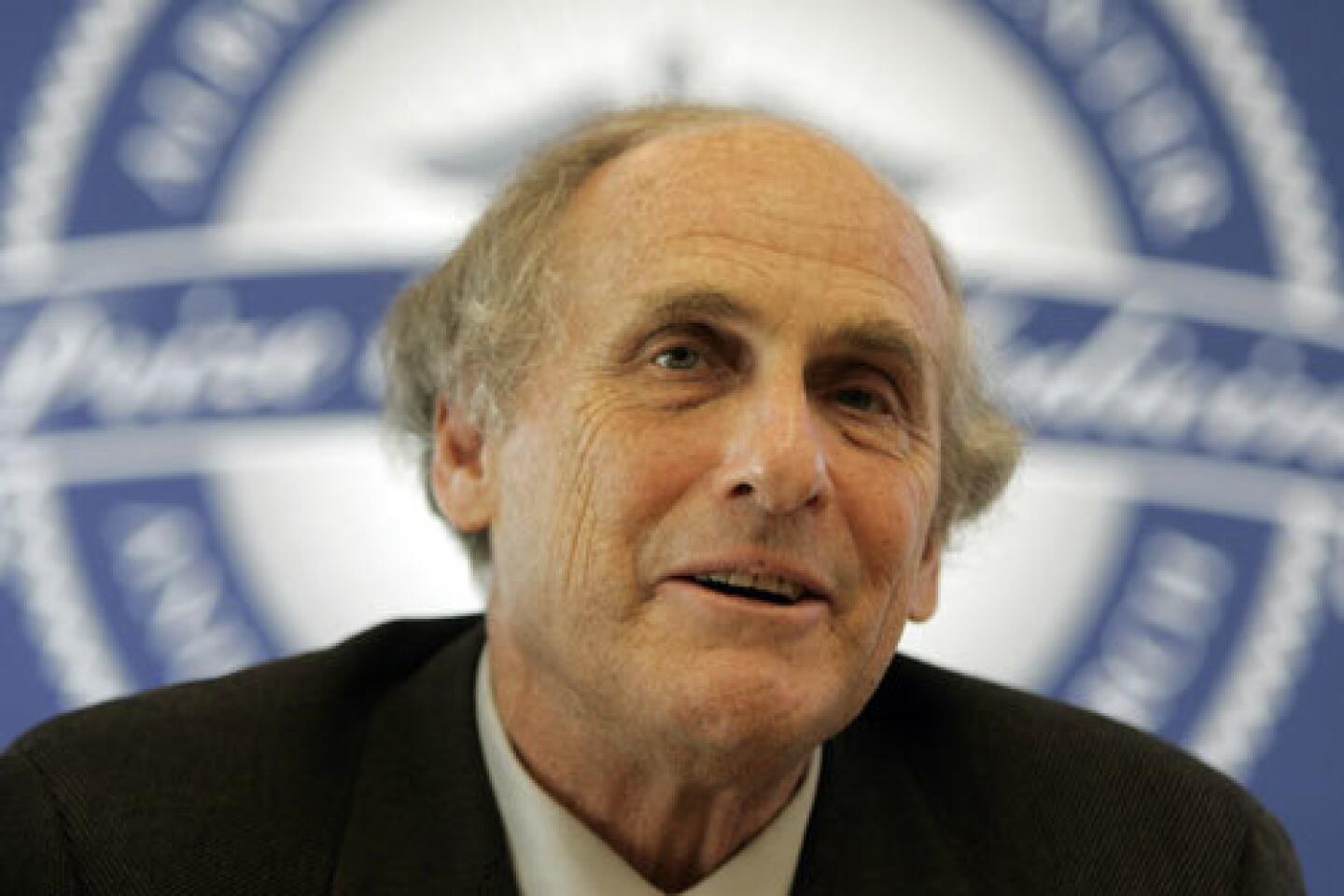

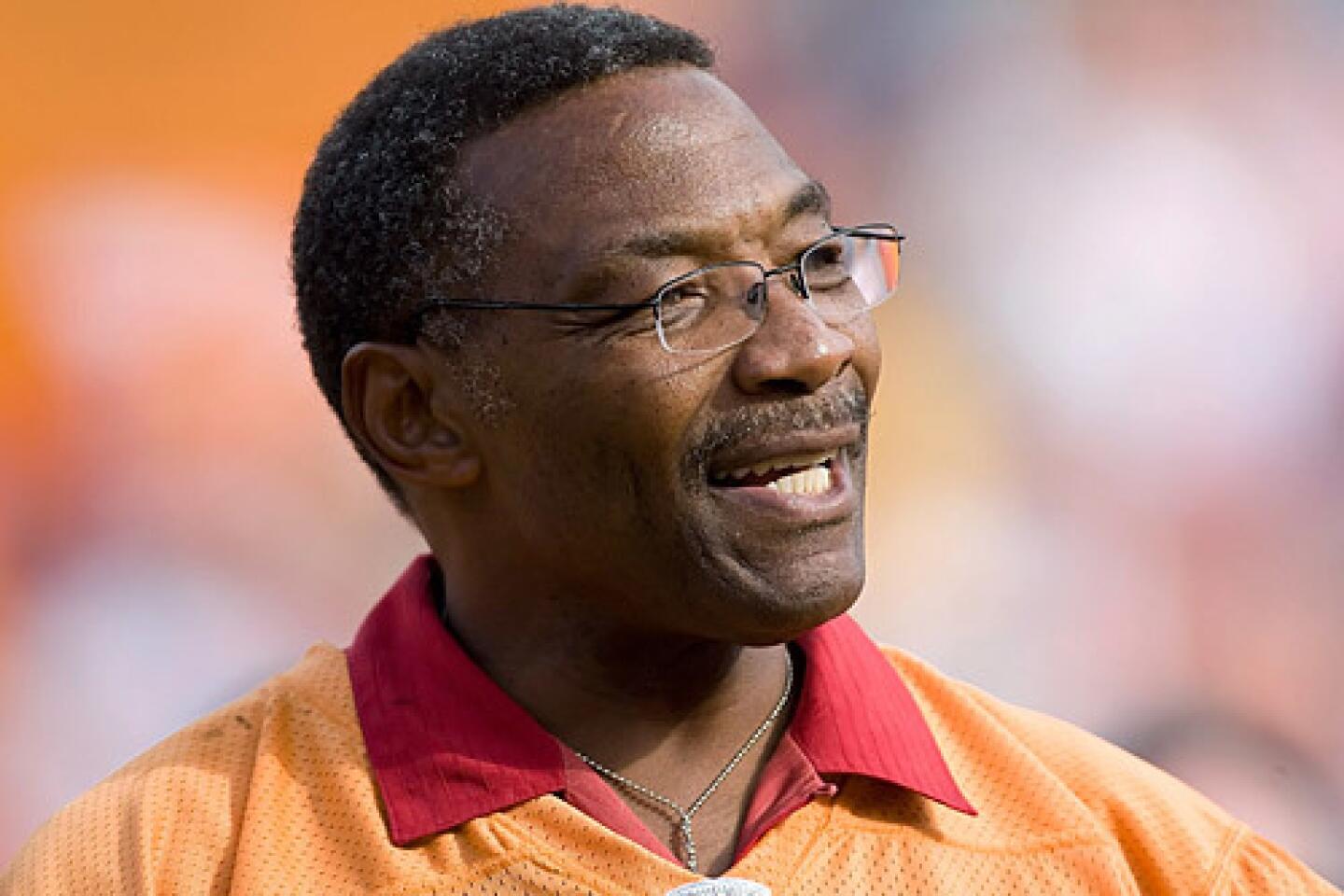

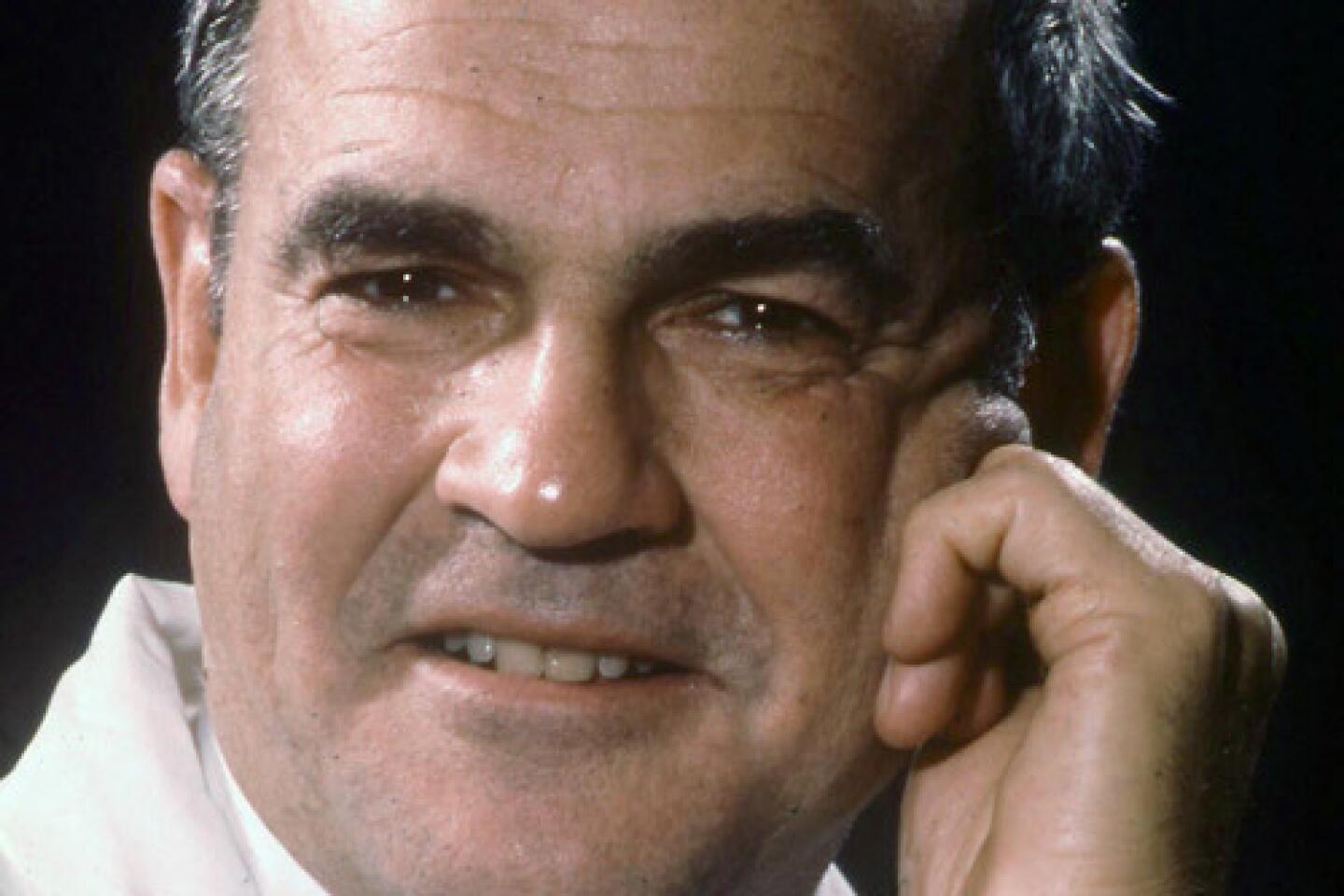

Ted Forstmann dies at 71; Wall Street financier, philanthropist

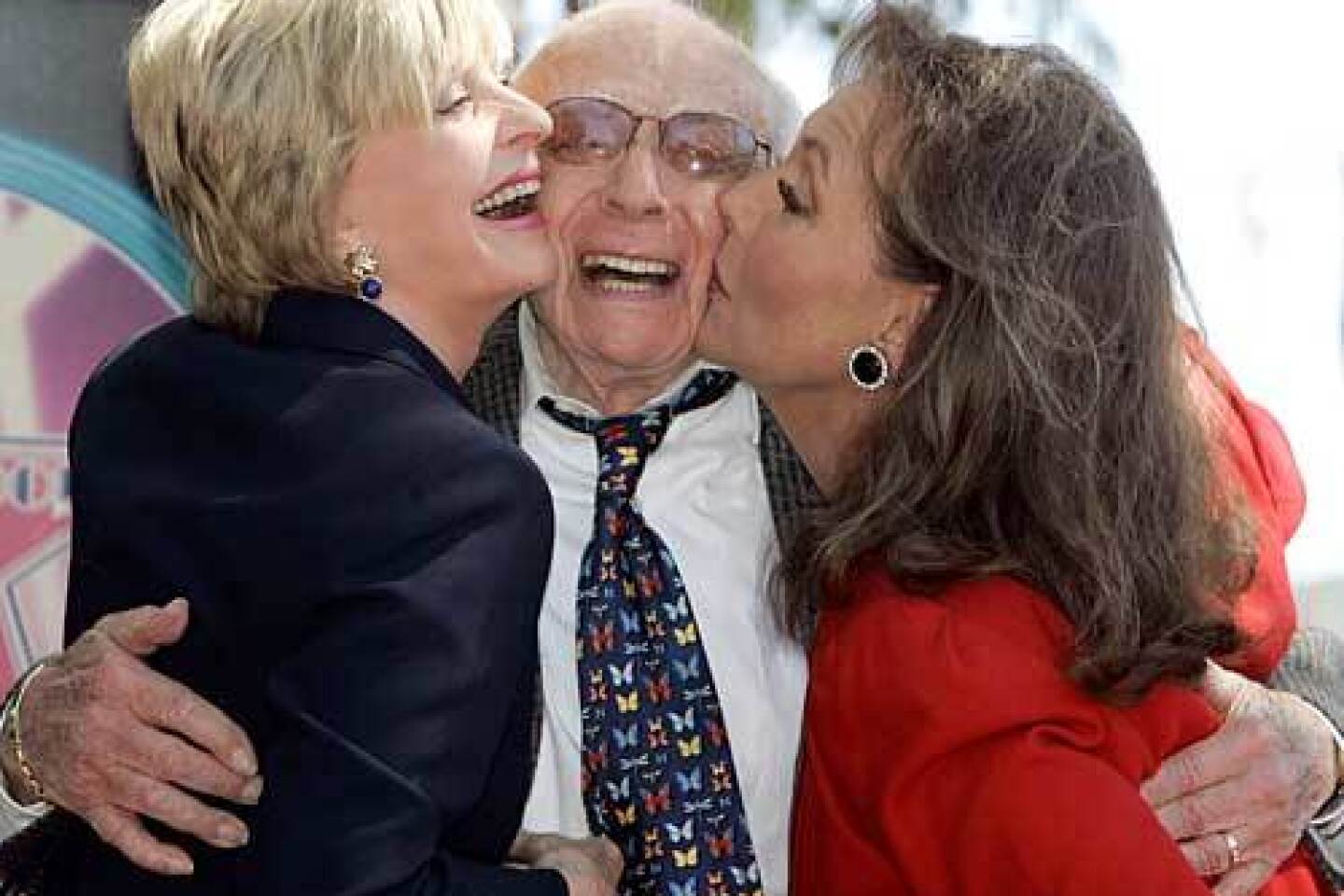

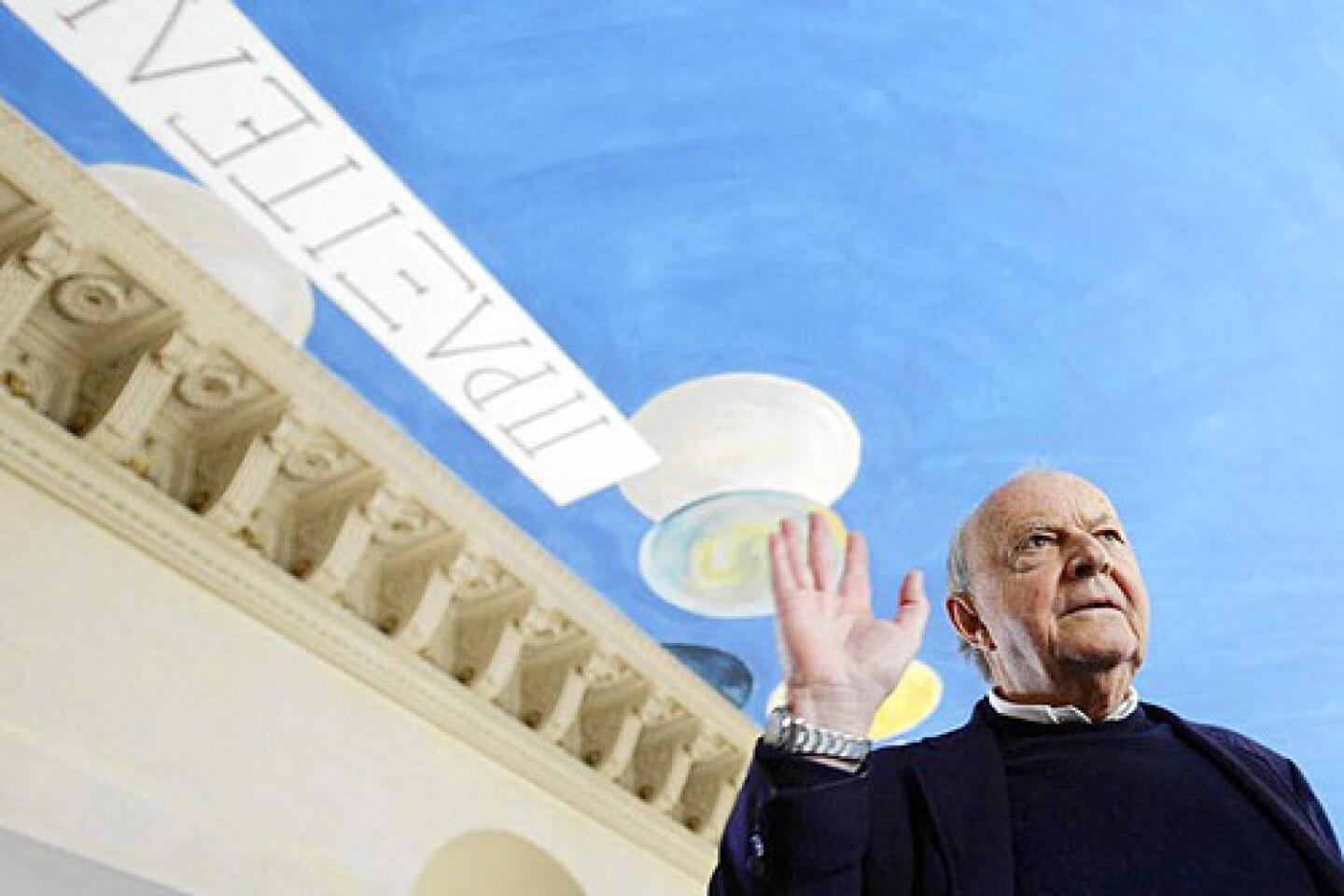

Ted Forstmann, a longtime Wall Street financier and philanthropist who was a major player during the wave of corporate takeovers in the 1980s, including the battle for RJR Nabisco in 1988, died Sunday. He was 71.

The cause was brain cancer, according to a statement from sports marketing giant IMG, where Forstmann served as chairman and chief executive. He was the senior founding partner of the investment firm Forstmann Little & Co.

Forstmann Little, which was founded in 1978, completed leveraged buyouts of companies including Dr. Pepper, Yankee Candle, Community Health Systems and the cable TV technology company General Instrument.

In the 1980s, the firm had become one of Wall Street’s most successful specialists in leveraged buyouts. The firm’s deals generated lofty returns for its partners and outside investors, which included many corporate pension funds.

Forstmann Little used bank loans and its own funds to finance acquisitions. The firm was known for competing with rivals who financed their bids with high-yield, high-risk “junk” bonds rated below investment grade. It was Forstmann who called such investors “barbarians at the gate,” coining a new Wall Street term.

In a leveraged buyout, a company is purchased with mostly borrowed money, with the remaining cost representing the equity contributed by the buyers. The debt is then repaid with funds generated from the company’s cash flow or sales of assets.

Once the debt is reduced, the value of the investors’ equity can soar. And the investors can realize that gain if the company is resold or sells new stock to the public.

In 1988, Forstmann made clear his distaste for deal-making greased by junk bonds, which he considered to be too risky. The Associated Press quoted him as saying, “Today’s financial age has become a period of unbridled excess with accepted risk soaring out of proportion to possible reward.”

“Every week, with ever-increasing levels of irresponsibility, many billions of dollars in American assets are being saddled with debt that has virtually no chance of being repaid,” he said.

Theodore Joseph Forstmann was born Feb. 13, 1940, and raised in affluence in Greenwich, Conn. His father, Julius, had inherited Forstmann Woolen Co., a fabric company that made him one of the world’s richest men.

Forstmann was a highly ranked junior amateur tennis player and played goalie for Yale University’s hockey team while earning a bachelor’s degree in English literature. He attended Columbia University Law School.

He worked for a few years at a Manhattan law firm and a few more at small investment firms on Wall Street before opening Forstmann Little in 1978 with his younger brother, Nick, and a former investment banker, Brian Little. It became one of the first buyout firms to raise money for acquisitions directly from pension funds.

Forbes magazine estimated Forstmann’s net worth to be $1.6 billion in March. He promised to give the majority of his wealth to charitable causes, including the Children’s Scholarship Fund.

Never married, he became the legal guardian of two boys in the 1990s after meeting them at an orphanage in South Africa.

More to Read

Start your day right

Sign up for Essential California for the L.A. Times biggest news, features and recommendations in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.