Who wins and who loses with California property tax measure Proposition 19

One of the most complicated measures on Californiaâs ballot this November is Proposition 19, which gives new property tax breaks to older homeowners, increases property taxes for those inheriting their parentsâ properties and tacks on some tax relief for those affected by wildfires.

The measure is the product of more than two years of work by the California Assn. of Realtors to give a larger tax incentive to homeowners 55 and older to move into new homes. The Realtors also were behind Proposition 5, a failed 2018 initiative that would have done the same thing. But Proposition 19 adds many other elements â notably a tax increase for the heirs of some homeowners â in an effort to make it more fiscally sound and palatable to voters.

Hereâs a breakdown of how Proposition 19 works, including who benefits from the measure and who doesnât.

The winners

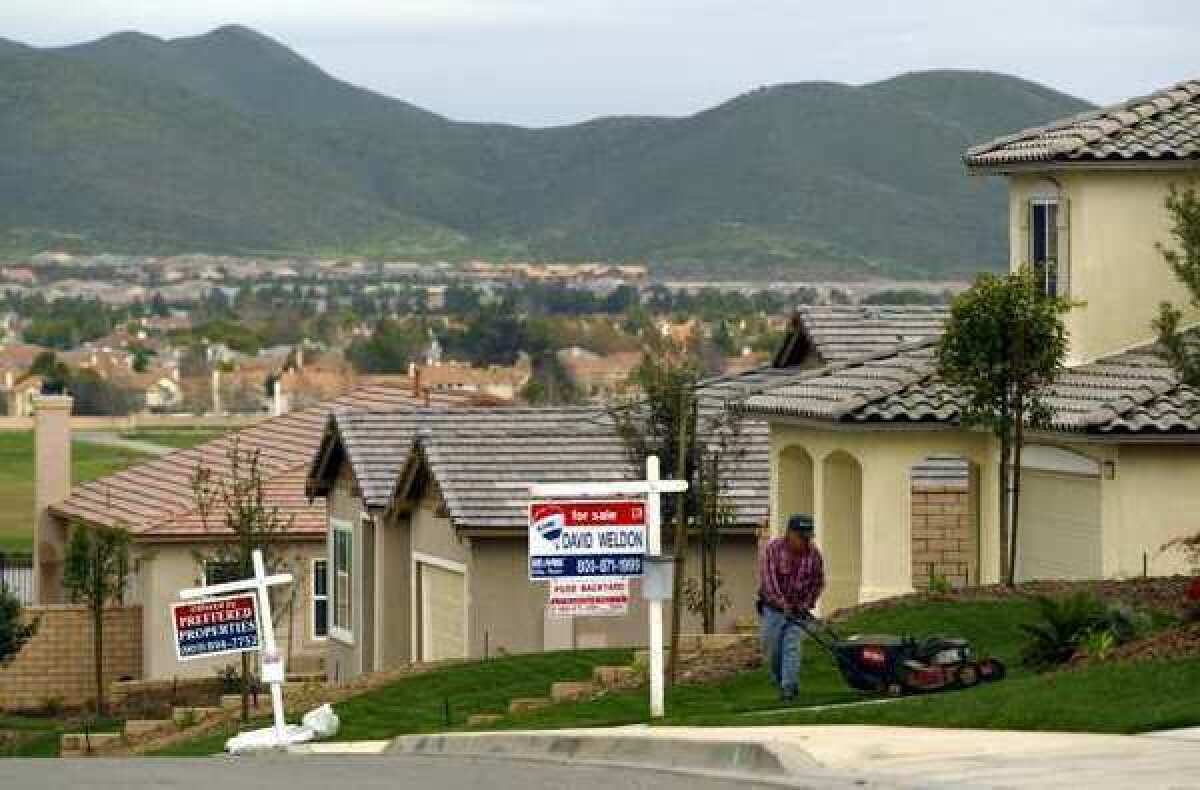

The biggest winners under Proposition 19 would be homeowners 55 and older who would pay lower property taxes when moving to a new, more expensive residence.

Proposition 19 builds off the property tax system inaugurated more than four decades ago when Californians passed Proposition 13, which limits property taxes to 1% of a homeâs taxable value, based on the year the house was purchased. The 1978 ballot measure also restricts how much that taxable value can go up every year, even if a homeâs market value increases much more.

Homeowners receive more benefits the longer they remain in their homes because their tax bills stay restricted even as their homeâs market value goes up. So residents could face a surge in tax payments if they move to a new home â this is the issue that Proposition 19 seeks to address.

Currently, homeowners who are 55 or older have a one-time opportunity to retain their existing tax benefits if they move to a home of equal or lesser value within the same county. They can do the same when moving between Los Angeles and nine other counties.

Proposition 19 would further ease the tax burden by allowing the same group of senior homeowners to blend the taxable value of their old house with the purchase price of a new, more expensive home, reducing the property tax payment theyâd otherwise face. Disabled homeowners would receive the benefit as well. The rules under Proposition 19 would extend to every county in the state, and homeowners could take advantage of the break as many as three times when they decide to move.

For example, a qualifying homeowner who owns a home with a taxable value of $200,000 that is worth $600,000 on the market would pay roughly $2,200 in property taxes now. If the homeowner moves to a $700,000 house, the homeowner would pay $3,300 a year in property taxes under Proposition 19. Without the initiative, the same homeowner would pay $7,700 annually at the new home.

Jeanne Radsick, president of the Realtors group, said itâs vital for homeowners who may be empty nesters or who are looking to move for health reasons to have more options.

âIf they can maintain a stable tax basis, they can live a similar life,â Radsick said. âThereâs not enough senior housing to accommodate them otherwise.â

Still, the beneficiaries of Proposition 19 are those who already benefit the most under the stateâs existing property tax rules. Homeowners 55 and older in California are much more likely to be white and wealthy than younger renters, according to an analysis of Proposition 19 by the California Budget and Policy Center, a nonprofit that advocates for working low-income Californians.

âBy expanding tax breaks for this economically advantaged group, Prop. 19 would make Californiaâs tax system less progressive and more inequitable,â the analysis said.

Also, the real estate industry stands to benefit from the increase in home sales that is expected as a result of the measure. State and national Realtor groups are funding the Proposition 19 campaign, contributing more than $37 million so far to secure its passage.

Radsick said that protecting Realtorsâ interests was not a driving force behind the push for Proposition 19.

âIt is not about making money for the Realtors, for crying out loud,â she said. âItâs about tax fairness for people who need help.â

The losers

Those who stand to lose the most under Proposition 19 would be children who inherit their parentsâ home and intend to keep it as a second home or rent it out. Their property taxes would go up a lot.

About 650,000 California homeowners over the last decade received a tax break that allows them to maintain their parentsâ low property tax payments when they inherit their homes, according to the stateâs nonpartisan Legislative Analystâs Office. As detailed in a 2018 Times investigation, a large number of those inherited homes along the coast are probably used as investment properties.

The provision has since been dubbed âthe Lebowski loopholeâ after The Times found that âThe Big Lebowskiâ actor Jeff Bridges and his siblings had advertised a beachfront home in Malibu inherited from their parents for nearly $16,000 a month in rent despite an annual property tax bill thatâs a fraction of that amount.

Proposition 19 would eliminate this property tax break for investment homes and commercial properties, meaning that heirs who inherit their parentsâ properties would pay taxes based on market value. With some limitations, children who move into homes inherited from their parents would be able to retain the tax break.

Curtailing the inheritance property tax break would generate more than enough revenue to make up for the loss in tax dollars from the new tax relief offered to older homeowners in Proposition 19, the legislative analyst found.

Radsick said itâs reasonable to cap heirsâ tax benefits, especially when children are using their parentsâ homes as vacation or investment properties.

Opposition to this portion of Proposition 19 comes from the Howard Jarvis Taxpayers Assn., the anti-tax organization founded by the driving force behind Proposition 13. The group supports further tax breaks for older homeowners but does not believe they should be funded by raising property taxes on heirs.

âItâs a billion-dollar tax increase on California families,â said Susan Shelley, the groupâs spokeswoman.

What about wildfire victims and wildfire funding?

Many of the advertisements for Proposition 19 say the measure will benefit wildfire victims and create new funding to fight wildfires.

Thatâs true, but wildfire victims are not the primary beneficiaries of Proposition 19, and the money may not materialize as backers have touted.

For those whoâve lost their homes in wildfires or other natural disasters, the measure would give them the same benefits as people 55 and older. But disaster-affected homeowners comprise well under 1% of those eligible for tax relief under Proposition 19, according to the California Budget and Policy Center analysis.

Proposition 19 requires the state to put increased tax revenues that may be generated from the measure into wildfire response. But most of that cash is allocated only when the state does not have to put additional tax dollars into public schools to meet existing constitutional guarantees for education funding. Though the COVID-19 pandemic has created significant uncertainty for the state budget, the legislative analyst believes that the vast majority of the wildfire funding will not start flowing until 2025 at the earliest.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.

![[20060326 (LA/A20) -- STATING THE CASE: Marchers organized by unions, religious organizations and immigrants rights groups carry signs and chant in downtown L.A. "People are really upset that all the work they do, everything that they give to this nation, is ignored," said Angelica Salas of the Coalition of Humane Immigrant Rights. -- PHOTOGRAPHER: Photographs by Gina Ferazzi The Los Angeles Times] *** [Ferazzi, Gina -- - 109170.ME.0325.rights.12.GMF- Gina Ferazzi/Los Angeles Times - Thousands of protesters march to city hall in downtown Los Angeles Saturday, March 25, 2006. They are protesting against House-passed HR 4437, an anti-immigration bill that opponents say will criminalize millions of immigrant families and anyone who comes into contact with them.]](https://ca-times.brightspotcdn.com/dims4/default/34f403d/2147483647/strip/true/crop/1983x1322+109+0/resize/840x560!/quality/75/?url=https%3A%2F%2Fcalifornia-times-brightspot.s3.amazonaws.com%2Fzbk%2Fdamlat_images%2FLA%2FLA_PHOTO_ARCHIVE%2FSDOCS%2854%29%2Fkx3lslnc.JPG)