Hollywood keeps its tax break in âfiscal cliffâ deal

Middle-class taxpayers arenât the only ones who stand to benefit from the last-ditch deal to avert the so-called fiscal cliff.

The agreement in Congress also includes something for Hollywood -- the extension of a tax break for movies and TV shows that shoot mainly in the U.S.

The provision, Section 181 of the federal tax code, allows qualifying productions to write down the first $15 million of expenses from their corporate tax bill.

The program will cost an estimated $430 million in deductions in fiscal years 2013 and 2014, according to estimates by the Joint Committee on Taxation.

Congress implemented the federal tax incentive in 2004 to encourage productions to stay home rather than flee to Canada, Britain and other foreign countries.

Itâs not clear how effective the incentive has been. Film and television production continues to migrate to foreign cities, including Vancouver, Canada, and London, because of the stronger film tax breaks available there. And while production in the U.S. has increased dramatically in the last decade, most of that has been attributed to various state tax incentive programs.

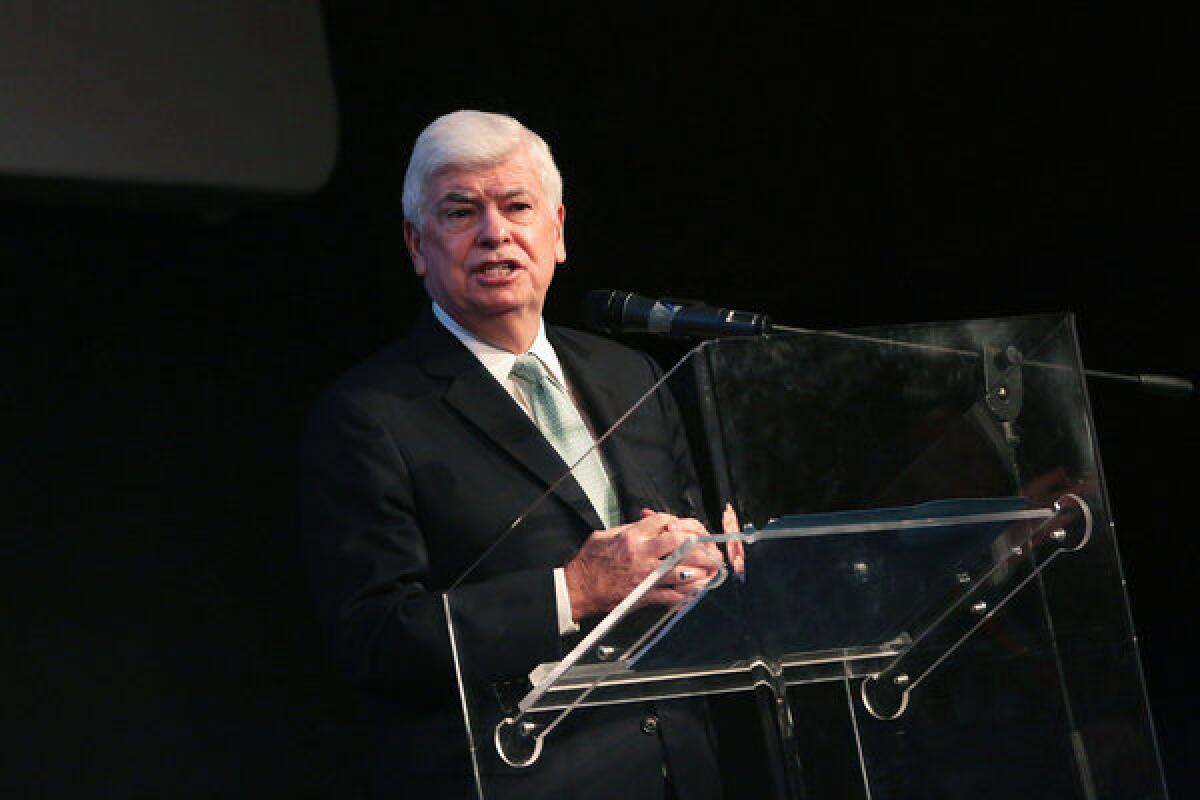

Nonetheless, the federal credit extension was strongly backed by the Motion Picture Assn of America, the chief lobbying arm for the studios. MPAA Chief Executive Chris Dodd has been a strong proponent of tax breaks for the industry.

âThe combination of the state production incentives and the federal incentive over the past decade have been a successful counter to very aggressive incentives in foreign countries,â said Kate Bedingfield, a spokeswoman for the MPAA. âThe accompanying growth of production in the United States over that same time is great evidence of that.â

The film and television industry employs 2.1 million people and is responsible for $137 billion in total wages to American workers, according to the MPAA.

âThe film and television industry is a vital component of the nationâs overall economy, has a positive balance of trade with virtually every country in the world, and has been a significant contributor to growth in our economy,â Bedingfield added.

ALSO:

MPAA website tells stories behind the story

MPAAâs president praises GOPâs anti-piracy stand

Websites go dark to signal opposition to anti-piracy bills

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whippâs must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.