L.A. arts endowments fell in 2011-12, but things are looking up

MORE: Oscars 2014: Idina Menzel sings Oscar-winning âLet It Goâ from âFrozenâ

Idina Menzel replaced by âAdele Dazeemâ in âIf/Thenâ playbill joke

Adele Dazeem (Idina Menzel) saluted at âThe Book of Mormonâ (Robert Gauthier / Los Angeles Times)

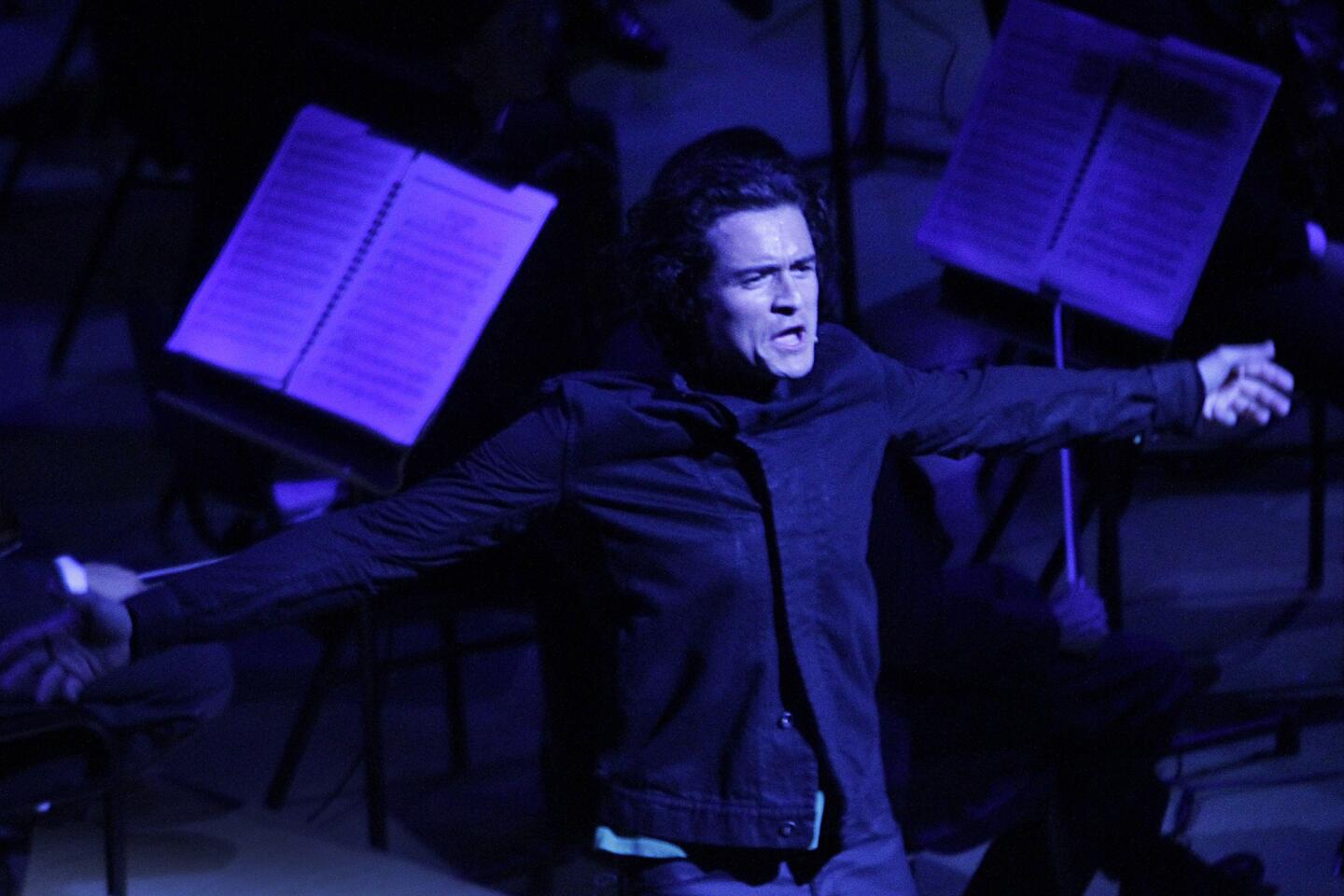

MORE: Orlando Bloom, Joe Morton brighten TchaikovskyFest at Disney Hall

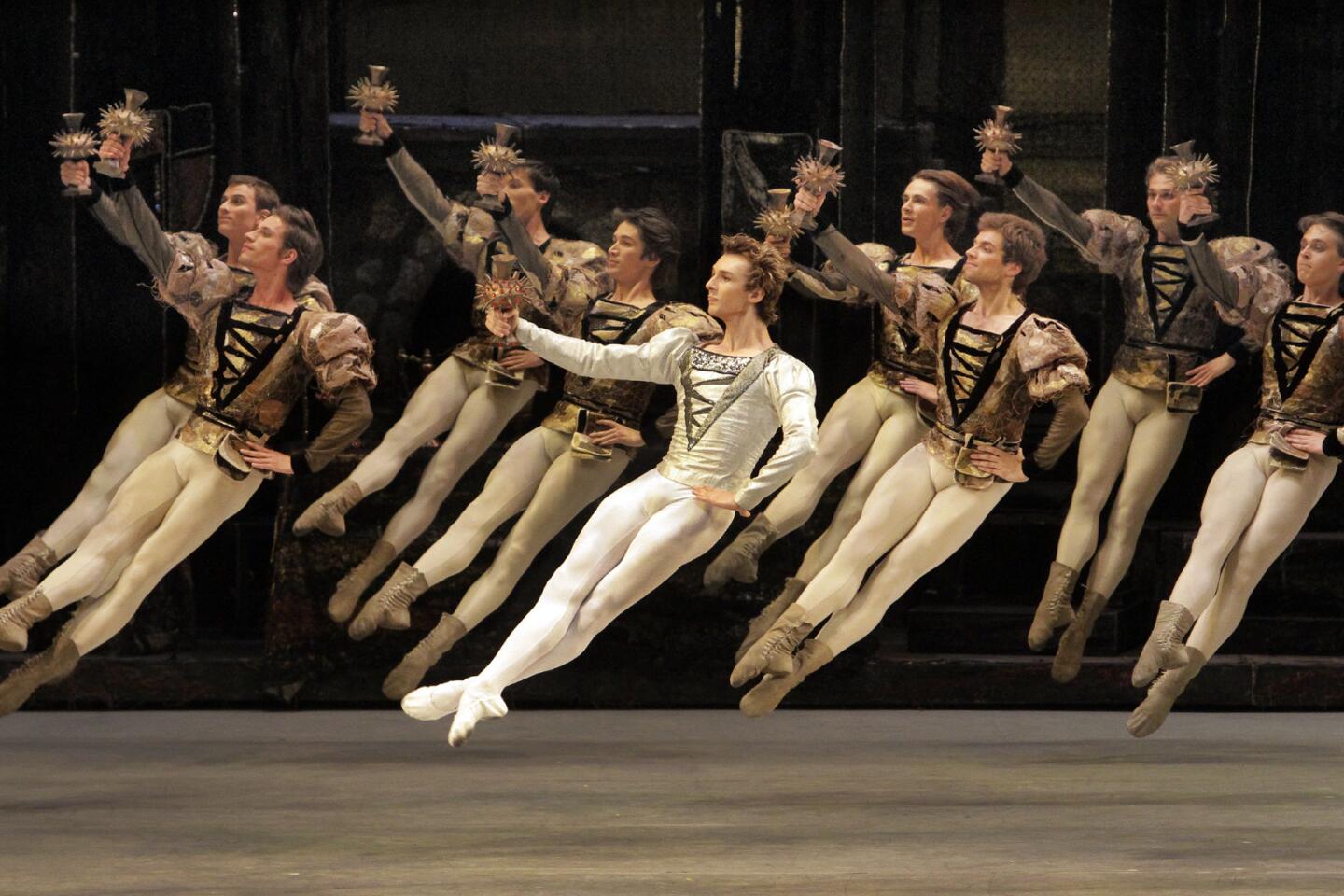

REVIEW: Tchaikovsky on a grand scale (Lawrence K. Ho / Los Angeles Times)

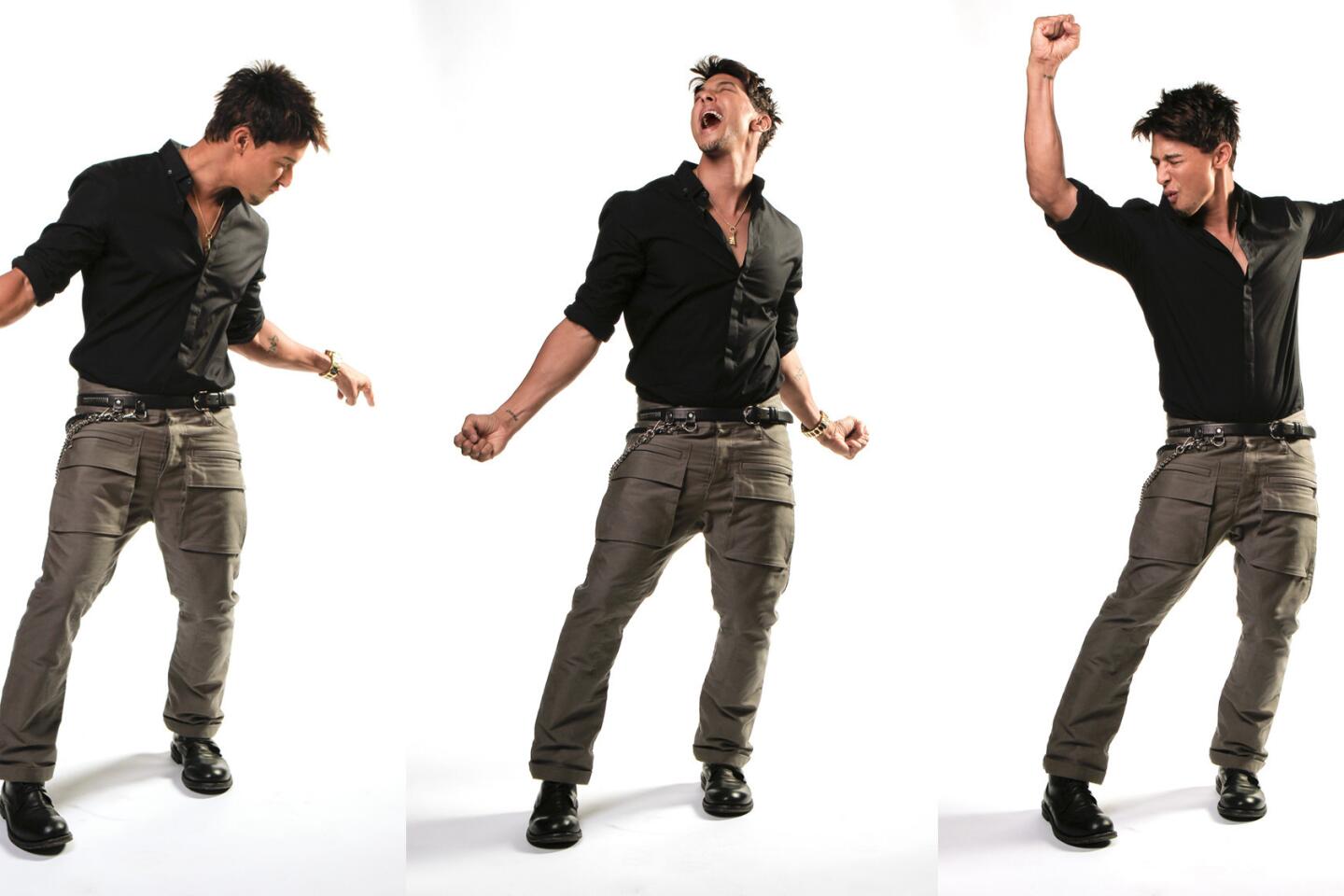

REVIEW: Barry Manilowâs âHarmonyâ musical can sing but needs work (Luis Sinco / Los Angeles Times)

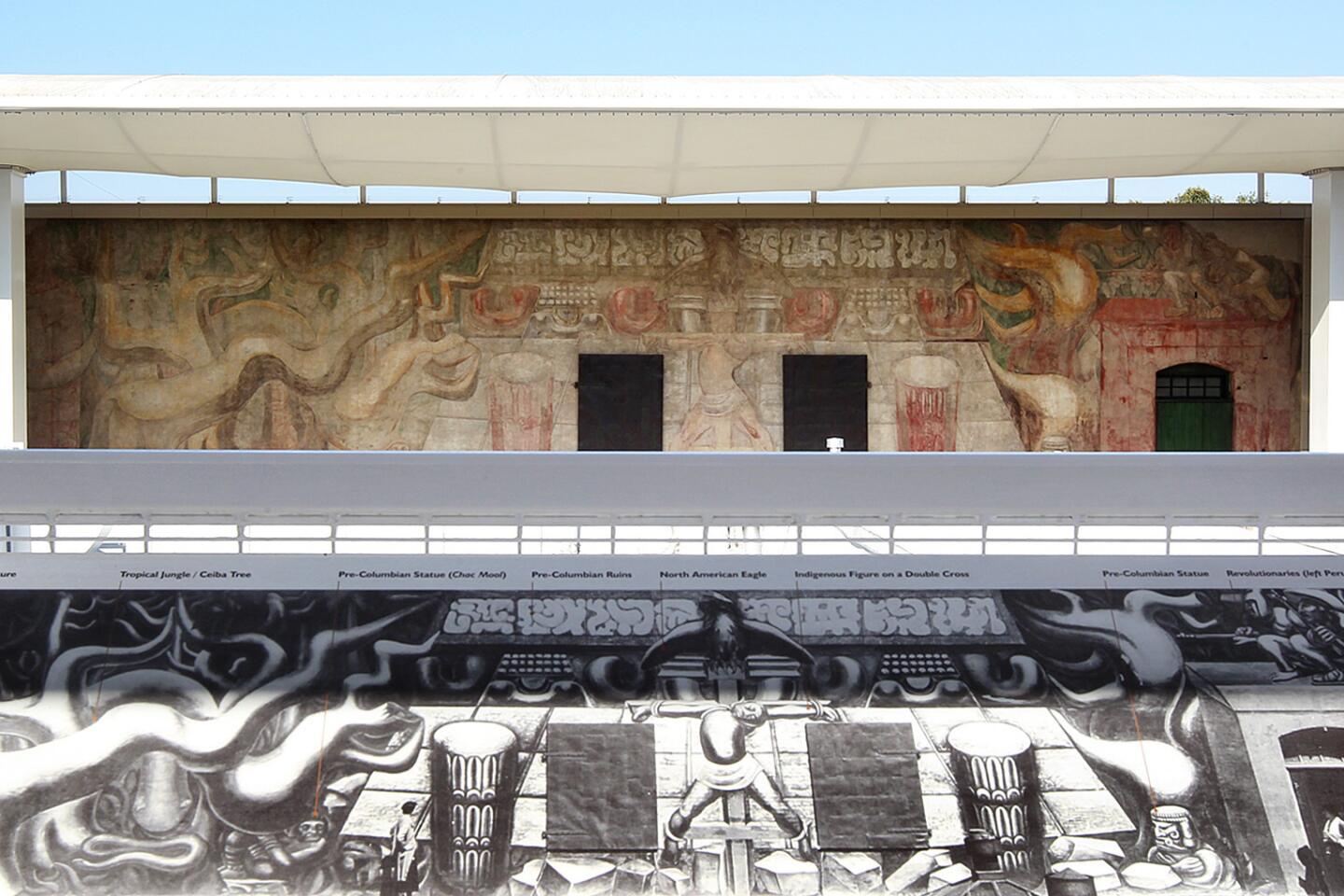

MORE: Carlos Almarazâs time is coming, nearly 30 years after death (Kirk McKoy / Los Angeles Times)

MORE: Hollywoodâs Theatre Row sees exits stage right, left as scene changes

INTERACTIVE: Hollywoodâs Theatre Row (Genaro Molina / Los Angeles Times)

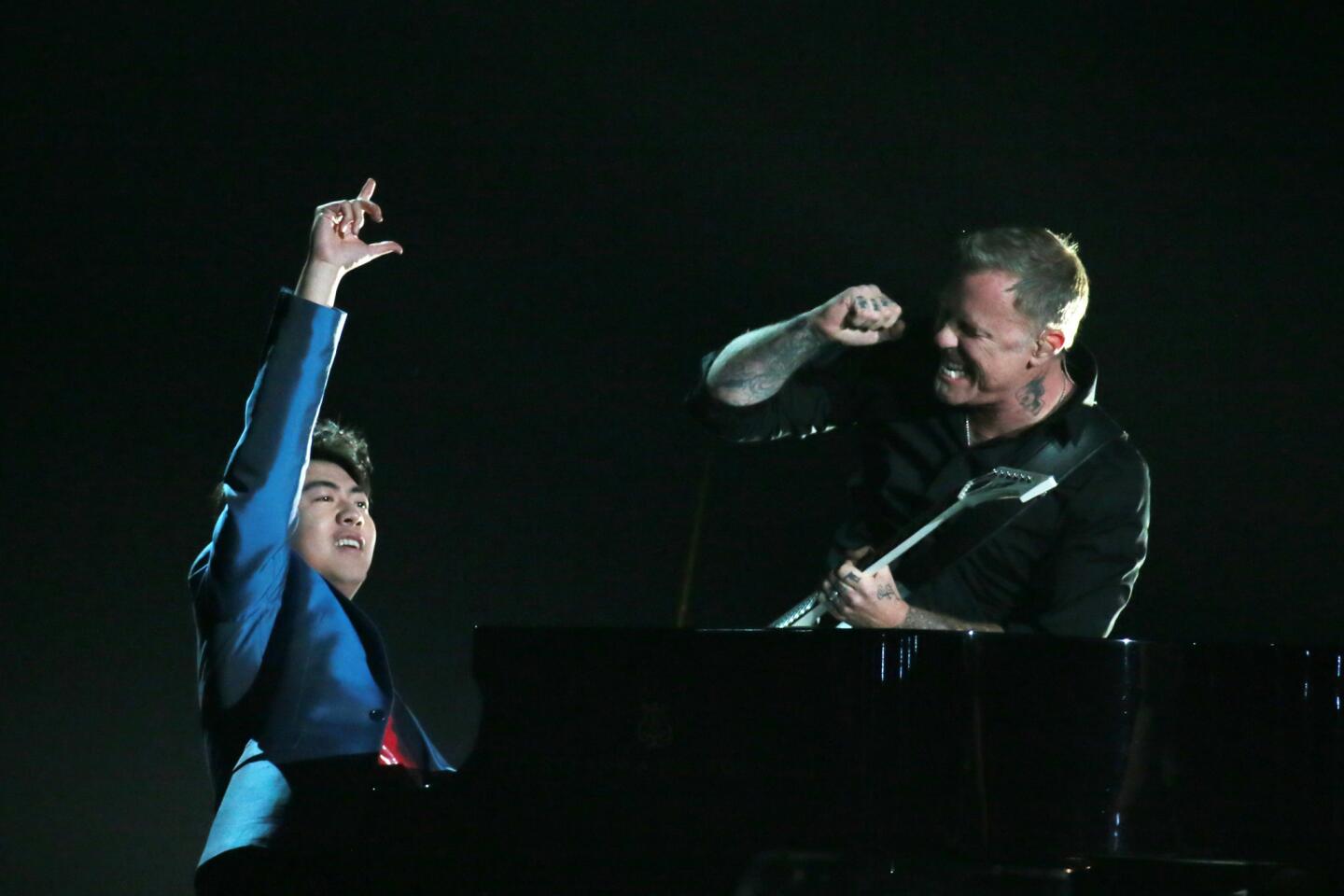

More: Grammys 2014: Lang Lang performs âOneâ with Metallica (Robert Gauthier / Los Angeles Times)

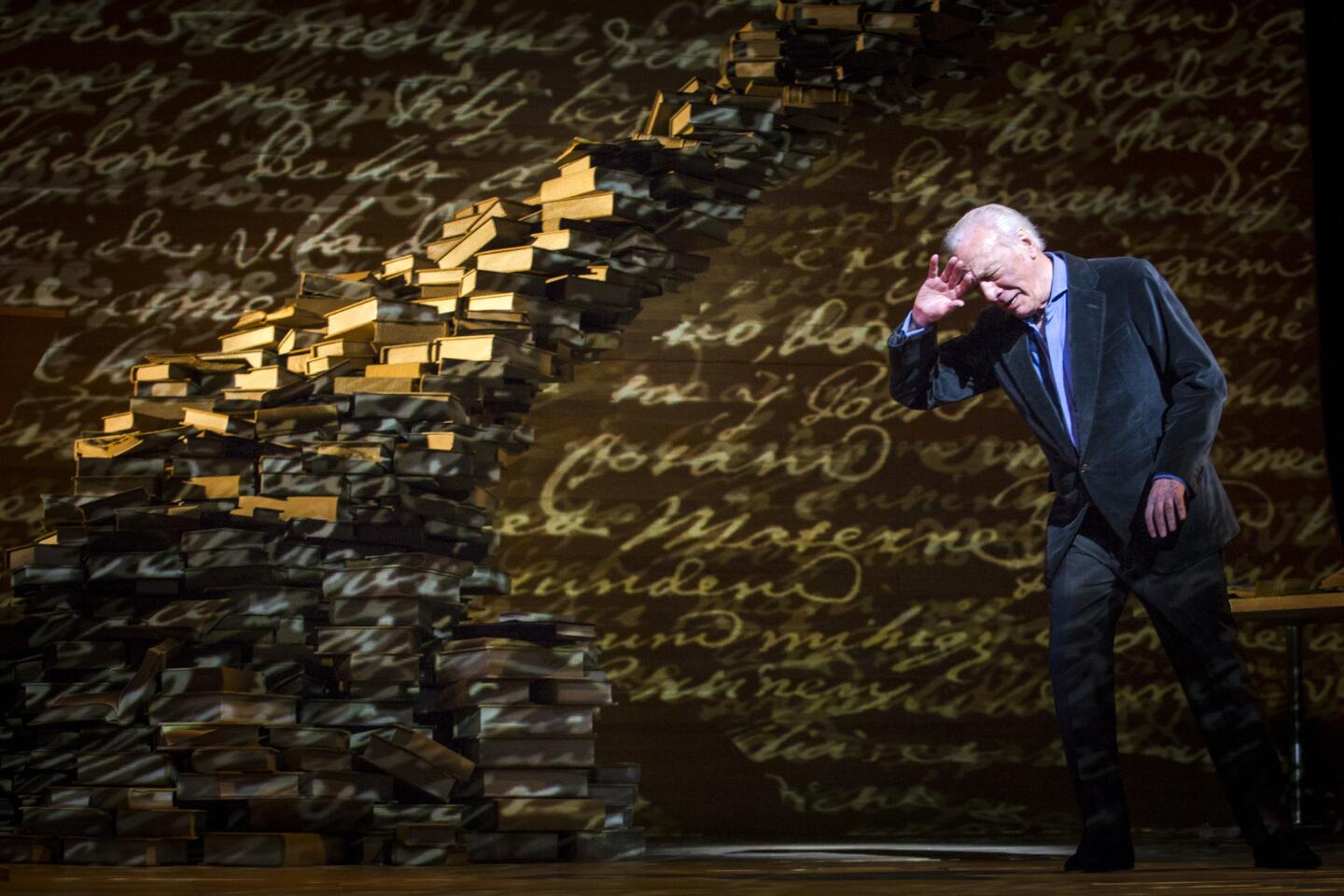

Review: Christopher Plummer, a man of letters, says âA Word or Twoâ (Doriane Raiman / Los Angeles Times)

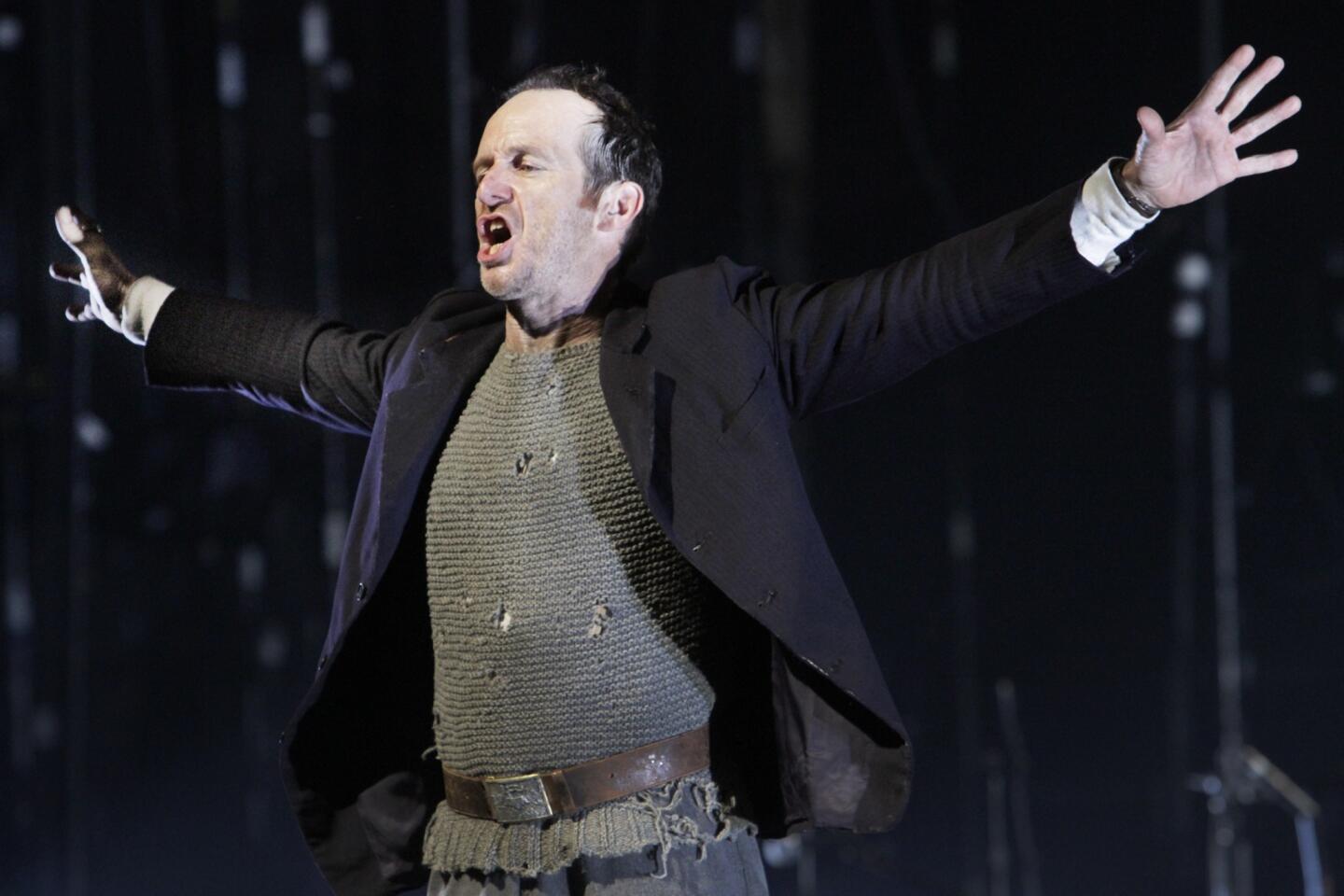

REVIEW: A poet embedded among troops lives to tell âAn Iliadâ (Lawrence K. Ho / Los Angeles Times)

MORE: New MOCA director Philippe Vergne is a museum veteran

New MOCA director Philippe Vergne plans an artist-enabling museum (Carolyn Cole / Los Angeles Times)

MORE: A âBeautifulâ tapestry of Carole Kingâs life (Carolyn Cole / Los Angeles Times)

REVIEW: L.A. Phil, Dudamel reinvigorate Tchaikovskyâs âNutcrackerâ (Lawrence K. Ho / Los Angeles Times)

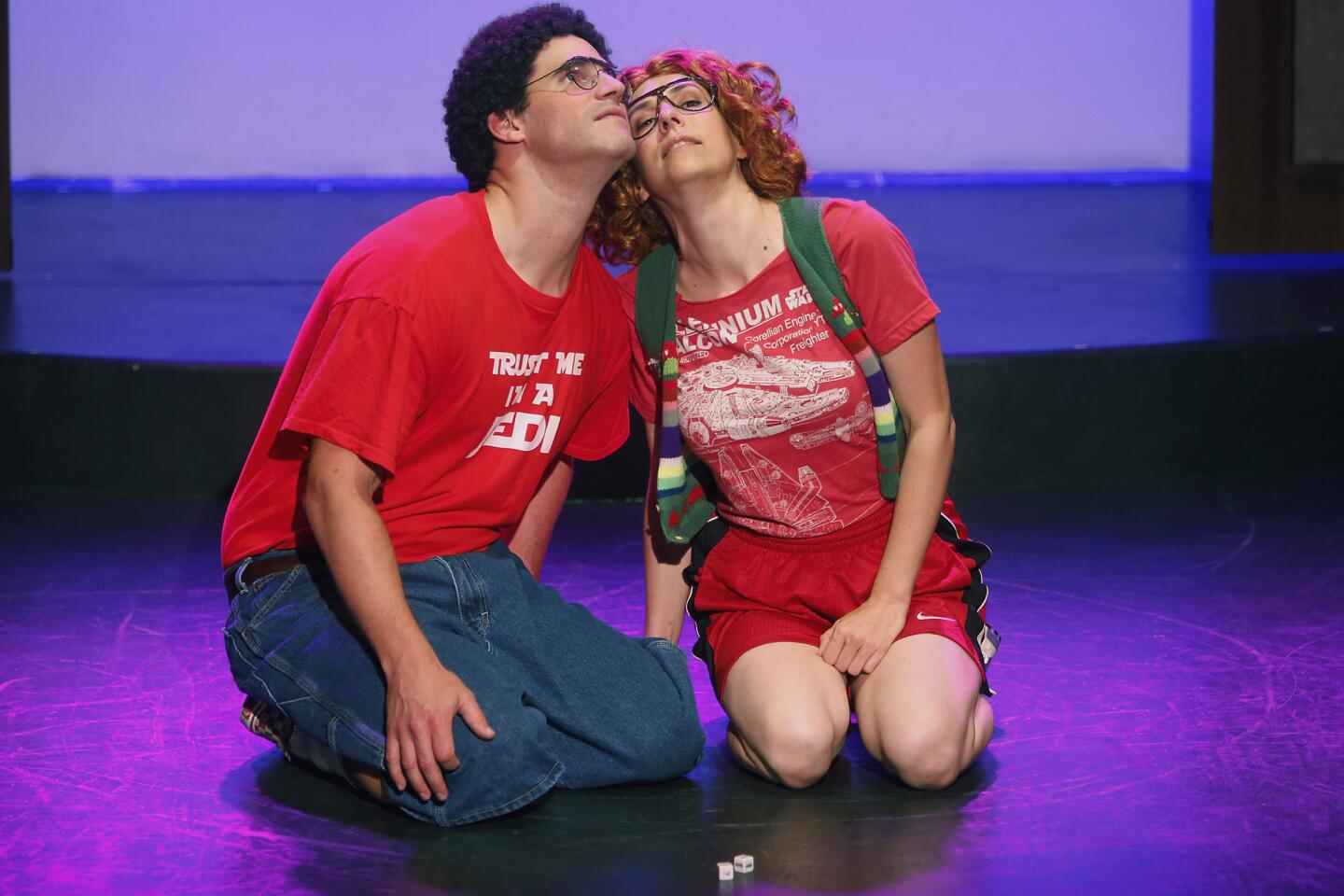

REVIEW: Lively âPeter and the Starcatcherâ make us believers again

MORE: Baddie role in âPeter and the Starcatcherâ hooked John Sanders (Jay L. Clendenin / Los Angeles Times)

REVIEW: Cirque du Soleilâs âTotemâ a thrilling salute to human growth (Christina House / For the Times)

REVIEW: Time has overtaken âThe Sunshine Boysâ (Lawrence K. Ho / Los Angeles Times)

REVIEW: âChicagoâ storms into the Hollywood Bowl (Jay L. Clendenin / Los Angeles Times)

REVIEW: âMarriage of Figaroâ a wedding of many talents (Lawrence K. Ho / Los Angeles Times)

REVIEW: With âTosca,â Los Angeles Opera goes for grand (Lawrence K. Ho / Los Angeles Times)

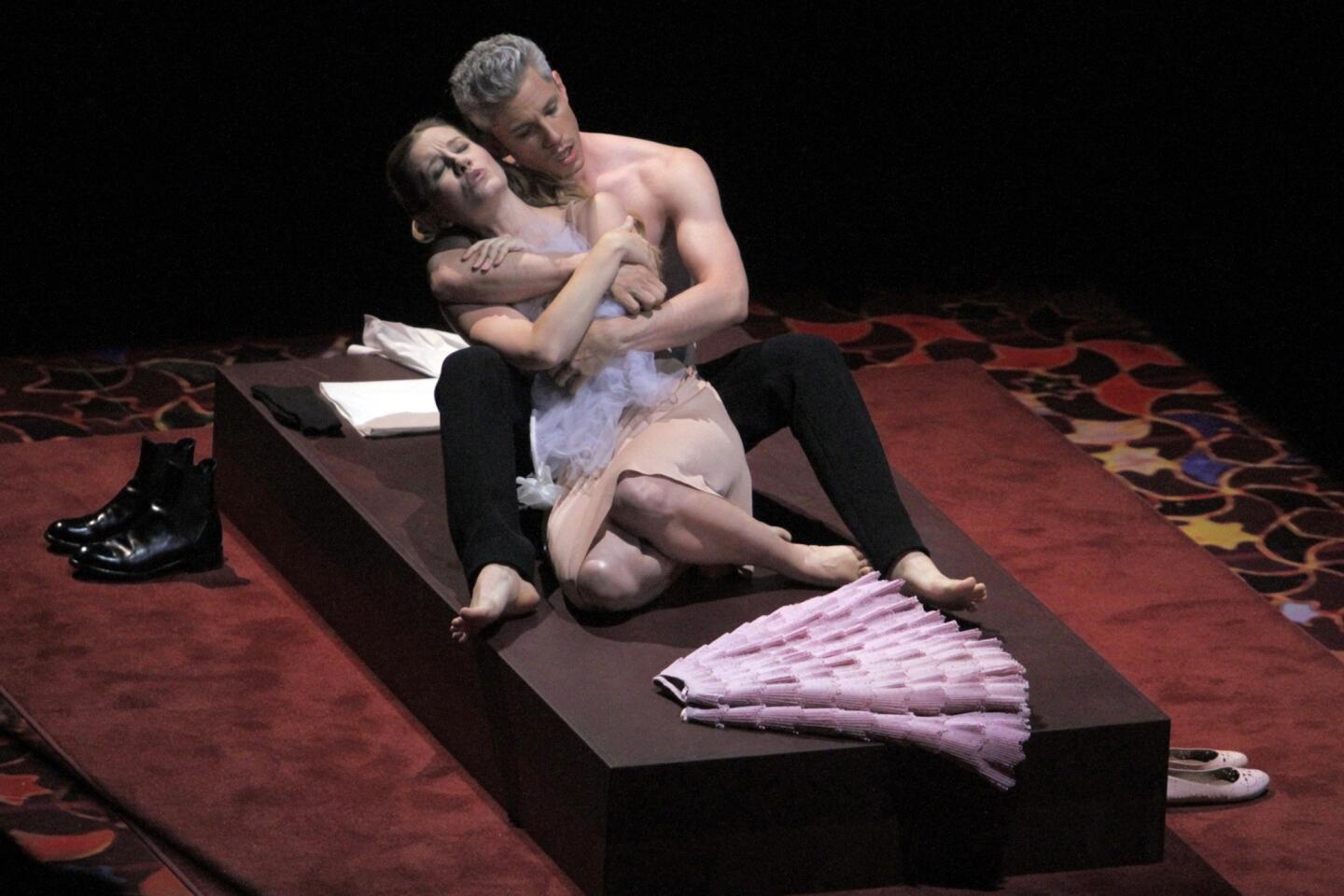

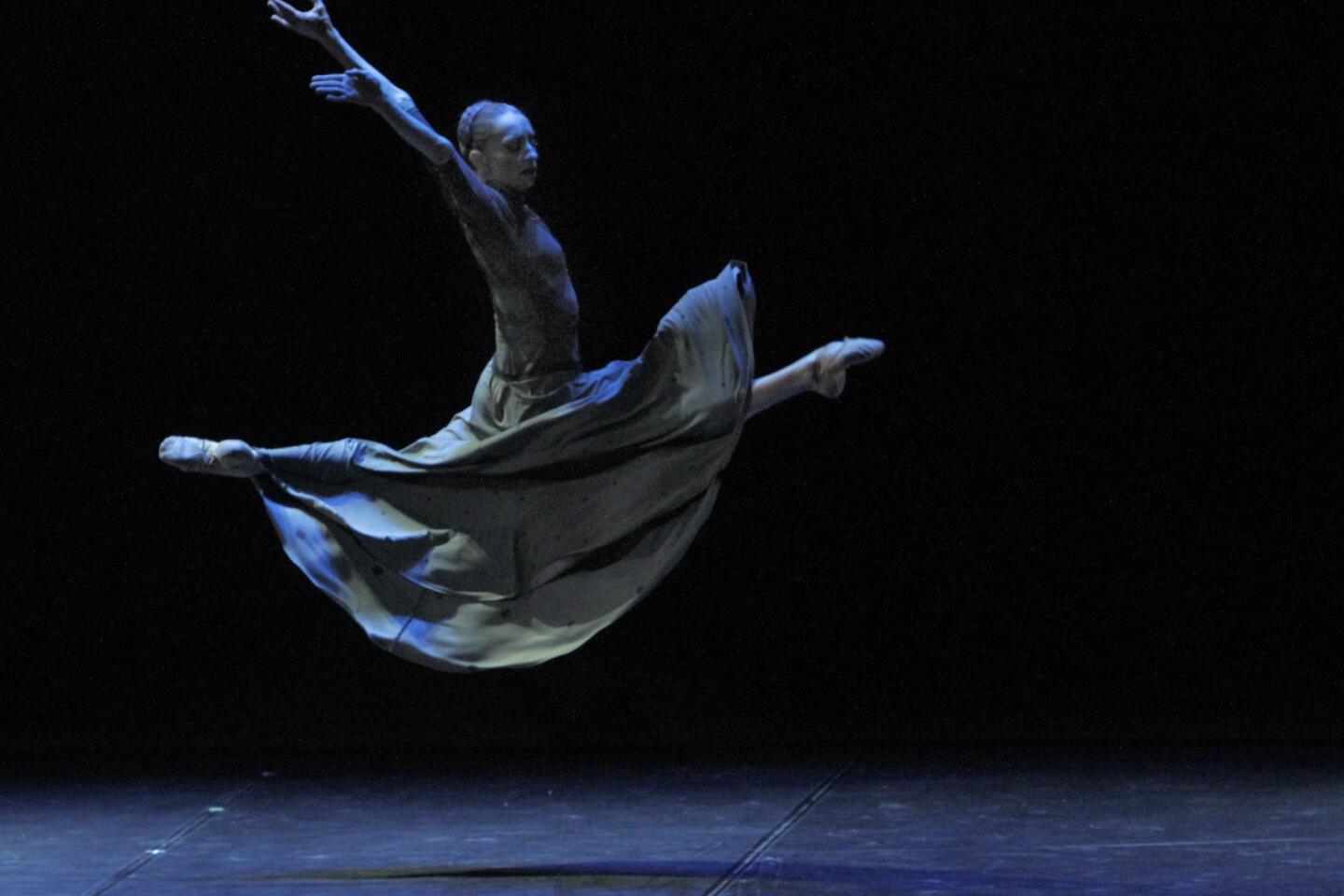

REVIEW: The collateral damage of genius in Boris Eifmanâs âRodinâ (Lawrence K. Ho / Los Angeles Times)

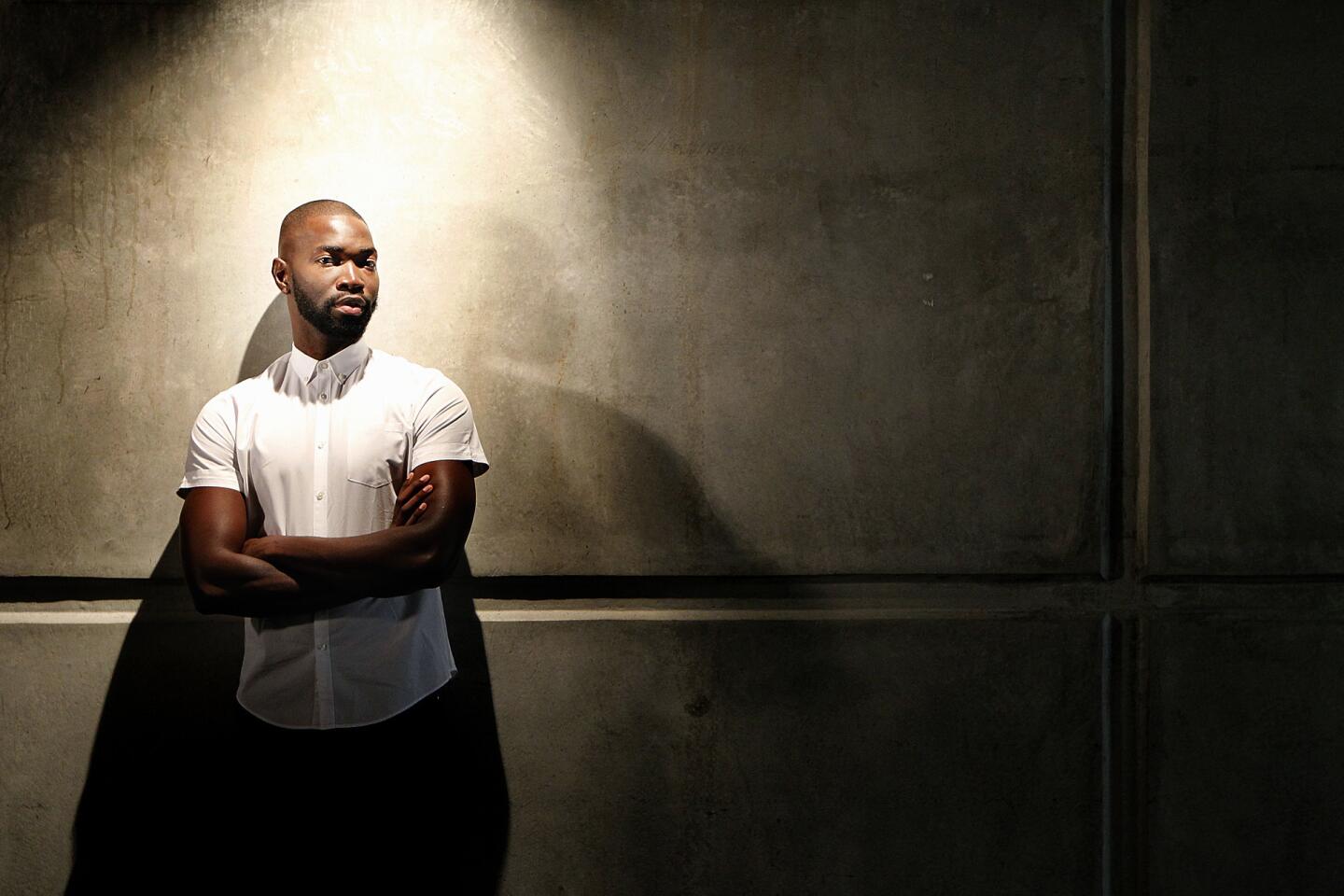

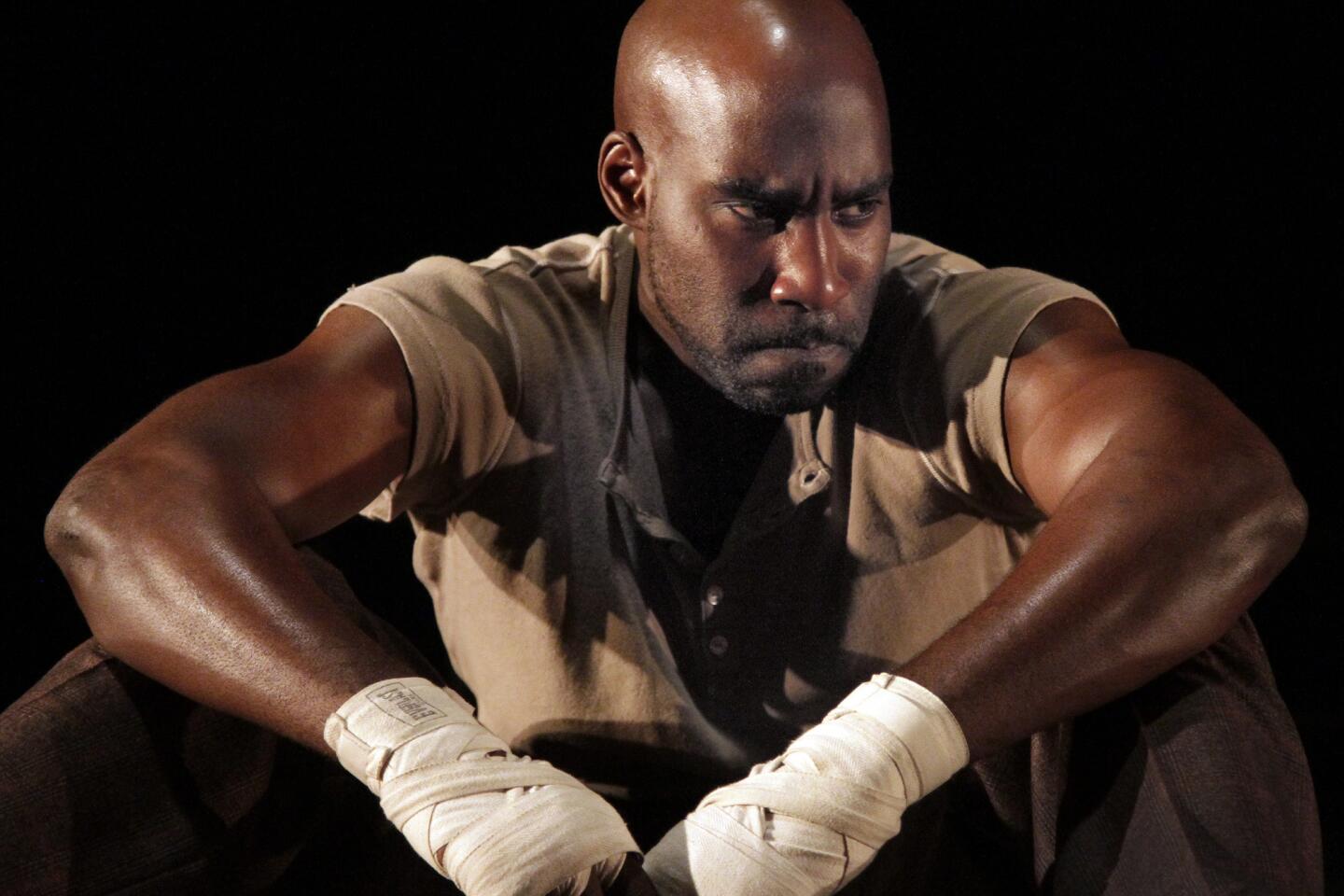

REVIEW: âThe Royaleâ punches well but has character issues (Lawrence K. Ho / Los Angeles Times)

REVIEW: L.A. Dance Festival returns to boost homegrown dance (Lawrence K. Ho / Los Angeles Times)

REVIEW: Sensual energy crackles in Alvin Ailey dance program (Luis Sinco / Los Angeles Times)

REVIEW: Aaron Copland as a hinge (Lawrence K. Ho / Los Angeles Times)

REVIEW: âAmerican Buffaloâ at Geffen a refreshing dose of Mamet (Gary Friedman / Los Angeles Times)

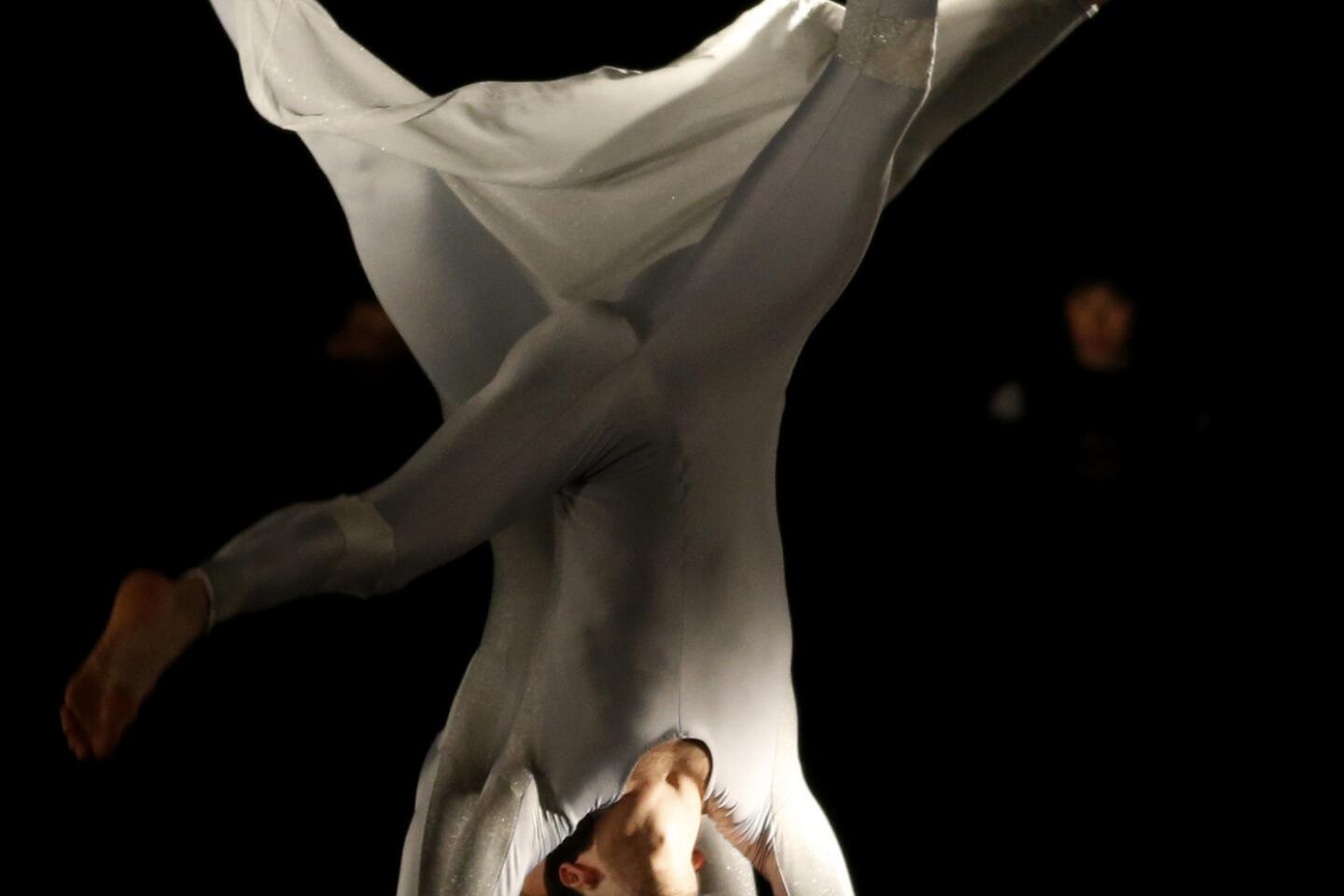

REVIEW: Flashes of lightning in Trisha Brownâs âAstral Convertedâ (Luis Sinco / Los Angeles Times)

REVIEW: A new Cinderella at Los Angeles Opera makes an impression (Lawrence K. Ho / Los Angeles Times)

REVIEW: Ethical quandaries buzz in âThe Netherâ (Lawrence K. Ho / Los Angeles Times)

REVIEW: L.A. Operaâs âFlying Dutchmanâ back in action (Lawrence K. Ho / Los Angeles Times)

MORE: For David Henry Hwangâs âChinglish,â a case of bad timing in China (Rick Loomis / Los Angeles Times)

MORE: Clive Davisâ next role: Broadway producer of a new âMy Fair Ladyâ (Gina Ferazzi / Los Angeles Times)

REVIEW: The usually inventive BBC Concert Orchestra goes retro (Lawrence K. Ho / Los Angeles Times)

MORE: Los Angeles Chamber Orchestra violinist has a date with a Stradivarius (Francine Orr / Los Angeles Times)

REVIEW: Elevator Repair Serviceâs âGatzâ a rewarding marathon | Elevator Repair Service takes on the great âGatzâ | Marathon plays stand the test of time (Michael Robinson Chavez / Los Angeles Times)

REVIEW: Trey McIntyre Project dances are both slight and potent | Trey McIntyre Project brings âWays of Seeingâ to Segerstrom (Luis Cinco / Los Angeles Times)

REVIEW: Esa-Pekka Salonen and an electrifying L.A. Philharmonic | Esa-Pekka Salonen returns to L.A. with murder in mind (Matthew Lloyd / For The Times)

REVIEW: Esa-Pekka Salonen and an electrifying L.A. Philharmonic | Esa-Pekka Salonen returns to L.A. with murder in mind (Michael Robinson Chavez / Los Angeles Times)

REVIEW: How David Langâs âlove failâ succeeds sublimely (Michael Robinson Chavez / Los Angeles Times)

REVIEW: Bolshoiâs âLakeâ is sometimes choppy, sometimes smooth | Photos (Lawrence K. Ho / Los Angeles Times)

MORE: Glorya Kaufman gives USC millions to build a dance school (Al Seib / Los Angeles Times)

MORE: Benjamin Millepied gets moving in Los Angeles | Photos | Review (Ricardo DeAratanha / Los Angeles Times)

REVIEW: Barbra Streisand puts the Hollywood Bowl under her spell (Michael Robinson Chavez / Los Angeles Times)

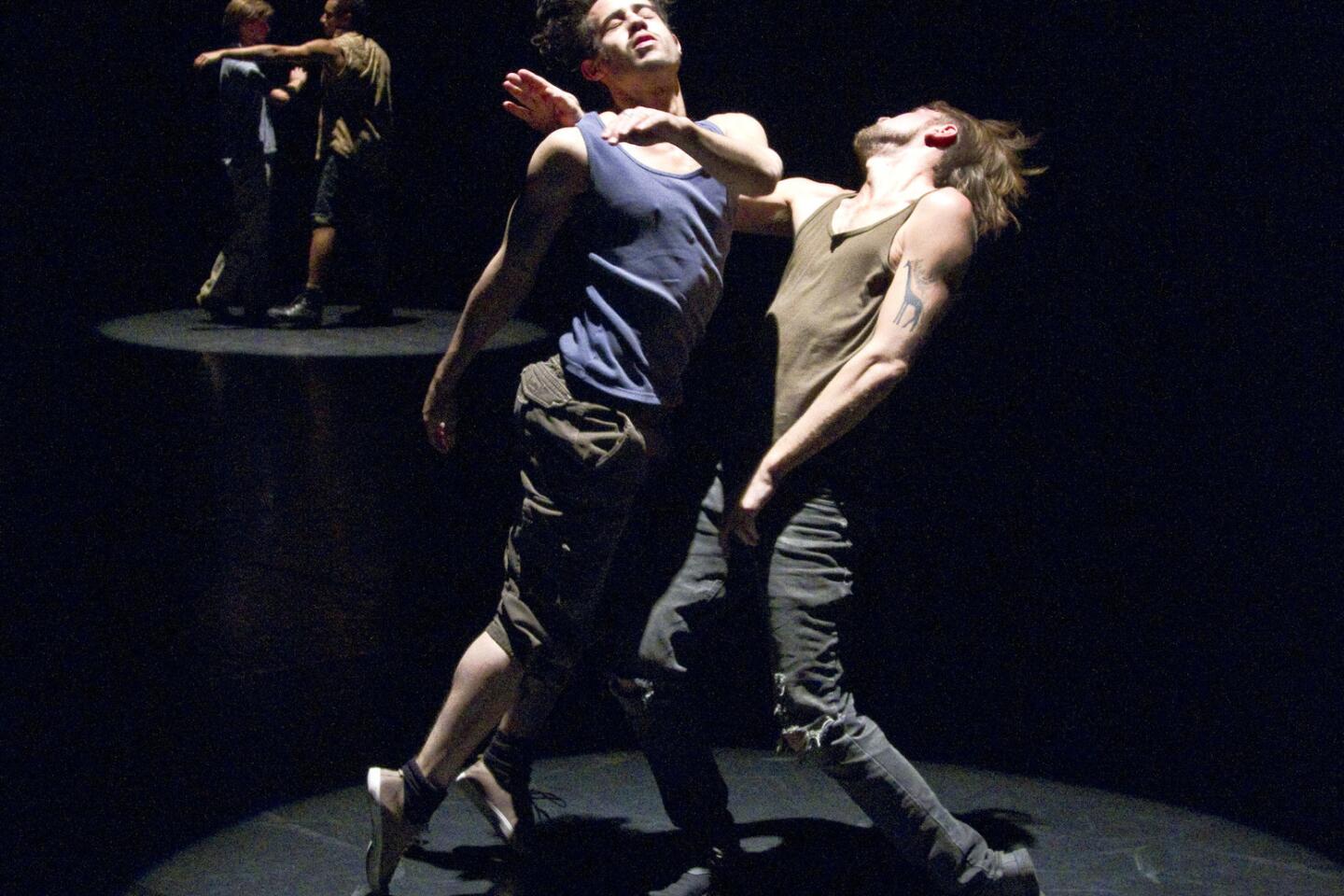

REVIEW: Desire and sexual politics whirl among âThemâ (Ricardo DeAratanha / Los Angeles Times)

REVIEW: Two ways to capture magic of âThe Tempestâ | Photos (Lawrence K. Ho / Los Angeles Times)

REVIEW: Barbara Cook rejuvenates song standards (Lawrence K. Ho / Los Angeles Times)

MORE: Rafael Fruhbeck de Burgos, Lynn Harrell at Disney Hall (Lawrence K. Ho / Los Angeles Times)

REVIEW: Some bright spots in a lesser âMadame Butterflyâ | Photos (Lawrence K. Ho / Los Angeles Times)

MORE: Operaâs ever-inquisitive Eric Owens is in high demand (Bob Chamberlin / Los Angeles Times)

Criticâs Notebook: The joys and challenges of the L.A. small-theater scene (Ricardo DeAratanha / Los Angeles Times)

MORE: Christopher Hawthorneâs On the Boulevards Project (Luis Cinco / Los Angeles Times)

MORE: George Takei builds on legacy with âAllegianceâ at the Old Globe (Don Bartletti / Los Angeles Times)

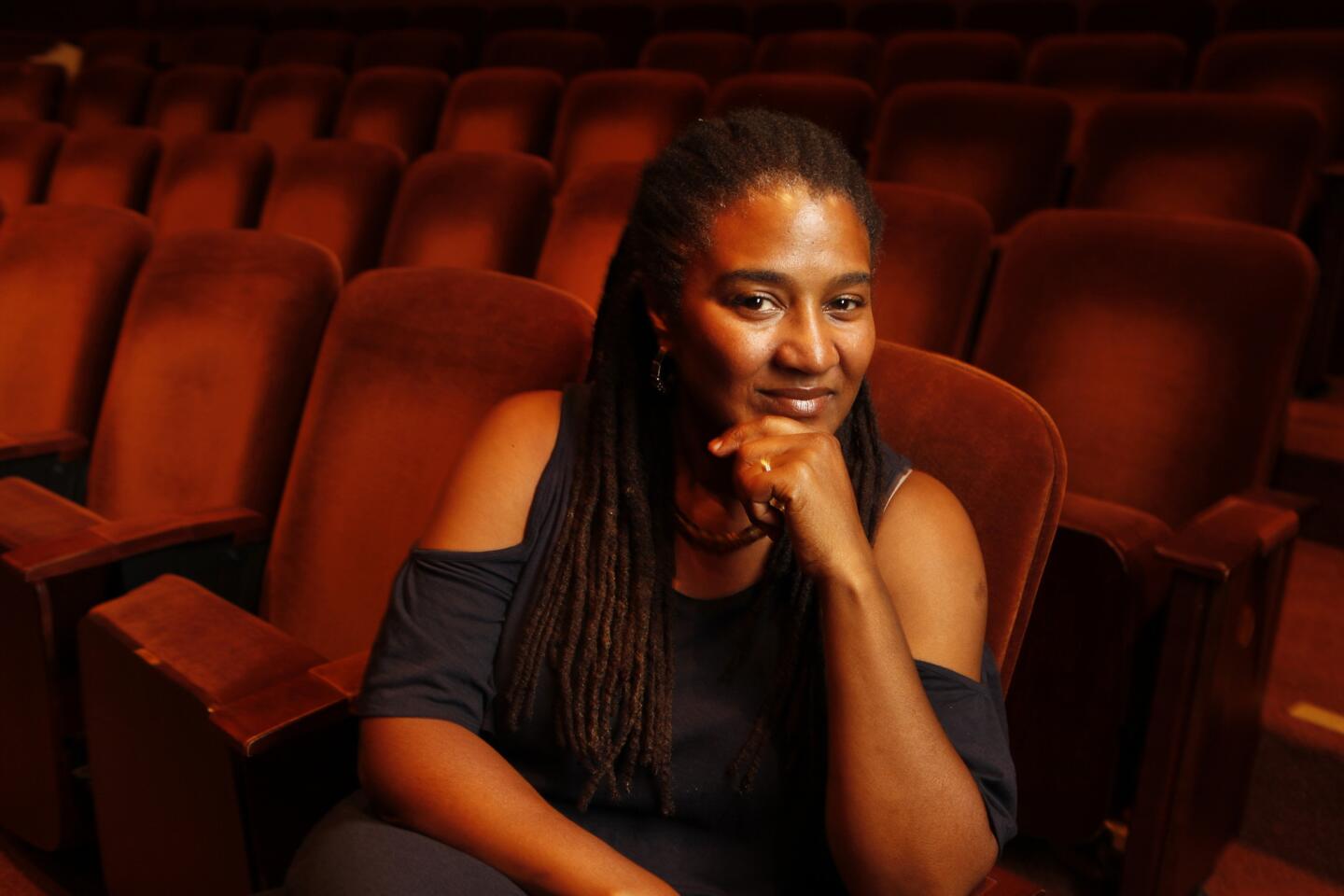

MORE: Emily Mann a natural to direct âStreetcarâ and âThe Convertâ (Carolyn Cole / Los Angeles Times)

REVIEW: Lackluster Expo Line reflects Metroâs weak grasp of design (Mark Boster / Los Angeles Times)

MORE: James Corden, âOne Manâ and a plethora of talent (Carolyn Cole / Los Angeles Times)

MORE: Llyn Foulkesâ art of raw emotion (Genaro Molina / Los Angeles Times)

MORE: Mickalene Thomas, up close and very personal (Al Seib / Los Angeles Times)

REVIEW: âFolliesâ is a source of heartache and razzmatazz (Glenn Koenig / Los Angeles Times)

MORE: Will downtown L.A.âs Grand Park succeed? | Photos (Francine Orr / Los Angeles Times)

MORE: Artist Xavier Veilhan casts Richard Neutraâs VDL House in a new light (Gary Friedman / Los Angeles Times)

REVIEW: A blazing âRedâ with Alfred Molina as Mark Rothko (Gina Ferazzi / Los Angeles Times)

MORE: Lynn Nottage wants âVera Starkâ to be a conversation starter (Al Seib / Los Angeles Times)

MORE: In the Studio: Ben Jackel uses broad ax strokes (Genaro Molina / Los Angeles Times)

Review: âWar Horseâ at Ahmanson Theatre is a marvel of stagecraft | Photos (Kirk McKoy / Los Angeles Times)

More: A pop choreographer with a busy schedule (Ricardo DeAratanha / Los Angeles Times)

More: Hammer biennial lends artists a helping hand (Kirk McKoy / Los Angeles Times)

More: PlĂĄcido Domingo leads an uptempo life (Robert Gauthier / Los Angeles Times)

More: In the moment with Cate Blanchett (Jay L. Clendenin / Los Angeles Times)

More: Yuja Wang turns heads at the Hollywood Bowl with a purple gown Photos (Lawrence K. Ho / Los Angeles Times)

More: Jesse Tyler Ferguson takes on âThe Producersâ at the Bowl | Review | Photos (Lawrence K. Ho / Los Angeles Times)

Review: LACMAâs new hunk âLevitated Massâ has some substance | Criticâs Notebook: Art on an architectural scale at LACMA (Gina Ferazzi / Los Angeles Times)

Review: LACMAâs new hunk âLevitated Massâ has some substance | Criticâs Notebook: Art on an architectural scale at LACMA (Mel Melcon / Los Angeles Times)

Review: Antic âAliceâs Adventures in Wonderlandâ a scenic spectacle | More photos (Brian van der Brug / Los Angeles Times)

More: Q&A: Sanaa Lathan (Allen J. Schaben / Los Angeles Times)

More: Los Angeles Opera takes fresh look at Verdiâs âThe Two Foscariâ | Review (Lawrence K. Ho / Los Angeles Times)

Review: Itzhak Perlman closes Hollywood Bowl classical season (Lawrence K. Ho / Los Angeles Times)

Review: L.A. Operaâs âDon Giovanniâ upholds tradition expertly | Photos (Lawrence K. Ho / Los Angeles Times)

More: Kristin Chenoweth warms up for California concerts (Carolyn Cole / Los Angeles Times)

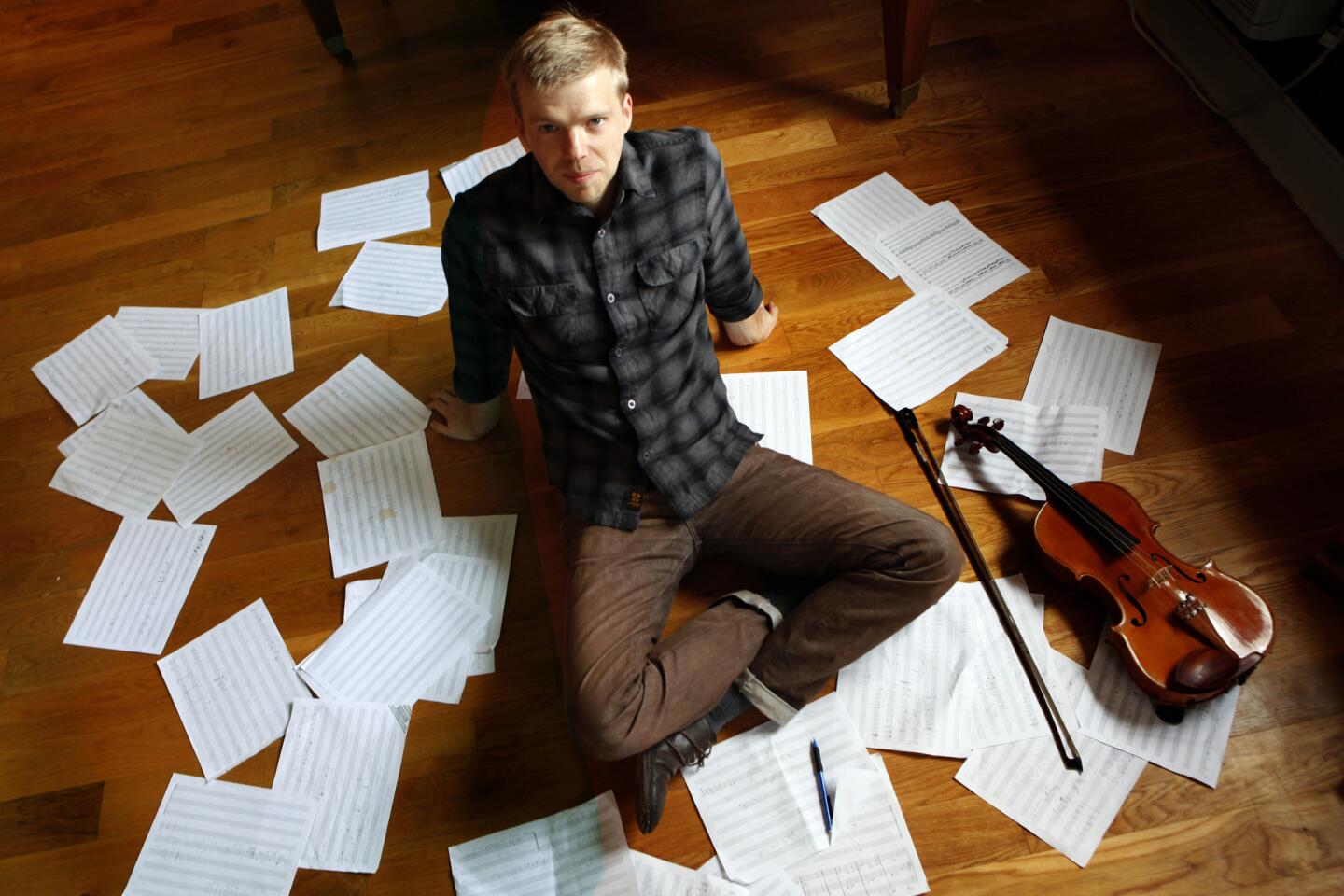

More: Composer Andrew Normanâs imagination has taken residence (Carolyn Cole / Los Angeles Times)

More: ItâÂs no easy act for Felicity Huffman (Jay L. Clendenin / Los Angeles Times)

More: Sophie B. Hawkins channels Janis Joplinâs spirit in âRoom 105â (Luis Sinco / Los Angeles Times)

Review: Israel Philharmonic, rising above differences (Lawrence K. Ho / Los Angeles Times)

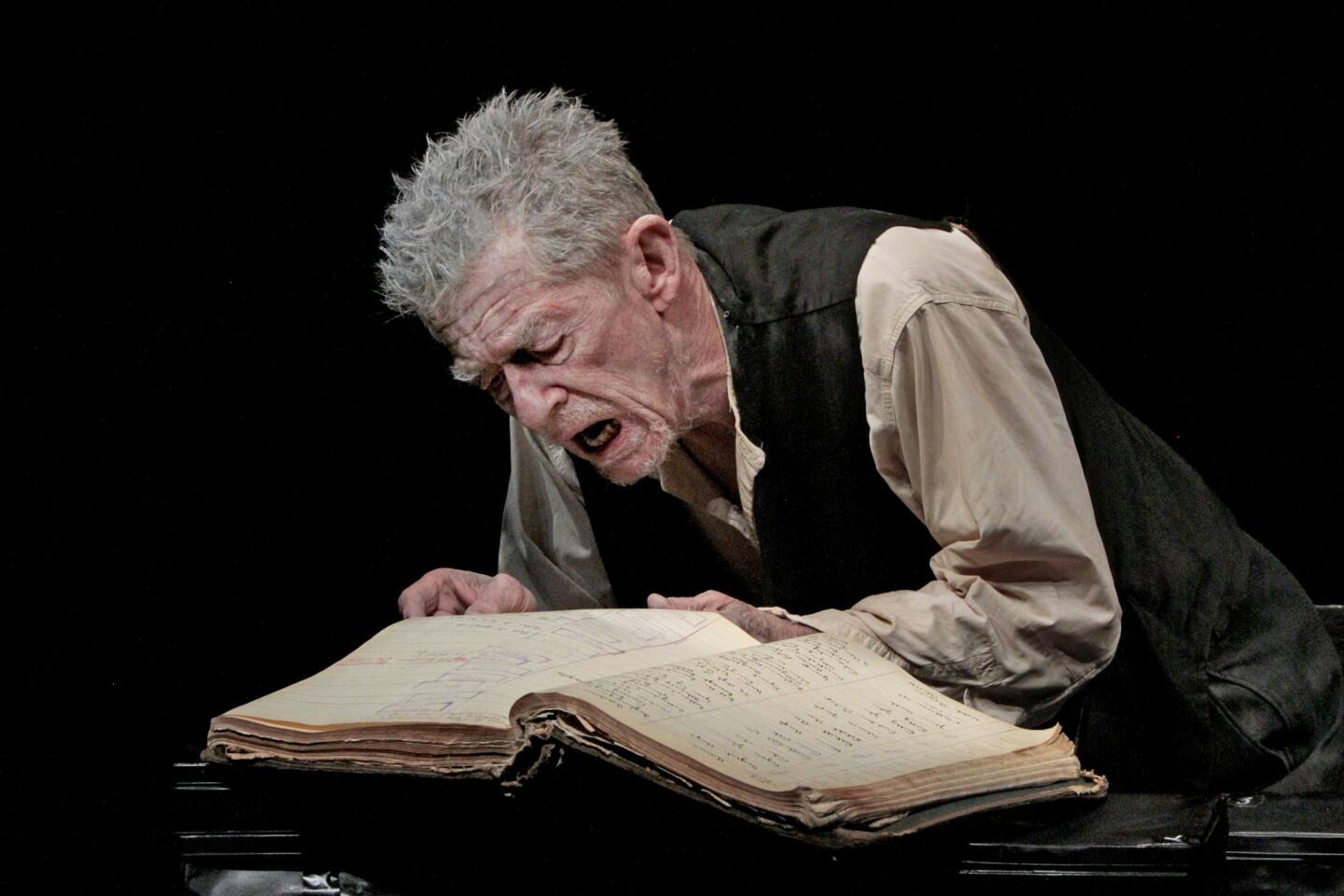

More: John Hurt plays back âinterrupted pauseâ of âKrappâs Last Tapeâ | Review (Anne Cusack / Los Angeles Times)

More: Teatro ZinZanni sets up a tent and fills it with elegant chaos (Lawrence K. Ho / Los Angeles Times)

More: Performance review: A down-to-Earth âDirtday!â (Lawrence K. Ho / Los Angeles Times)

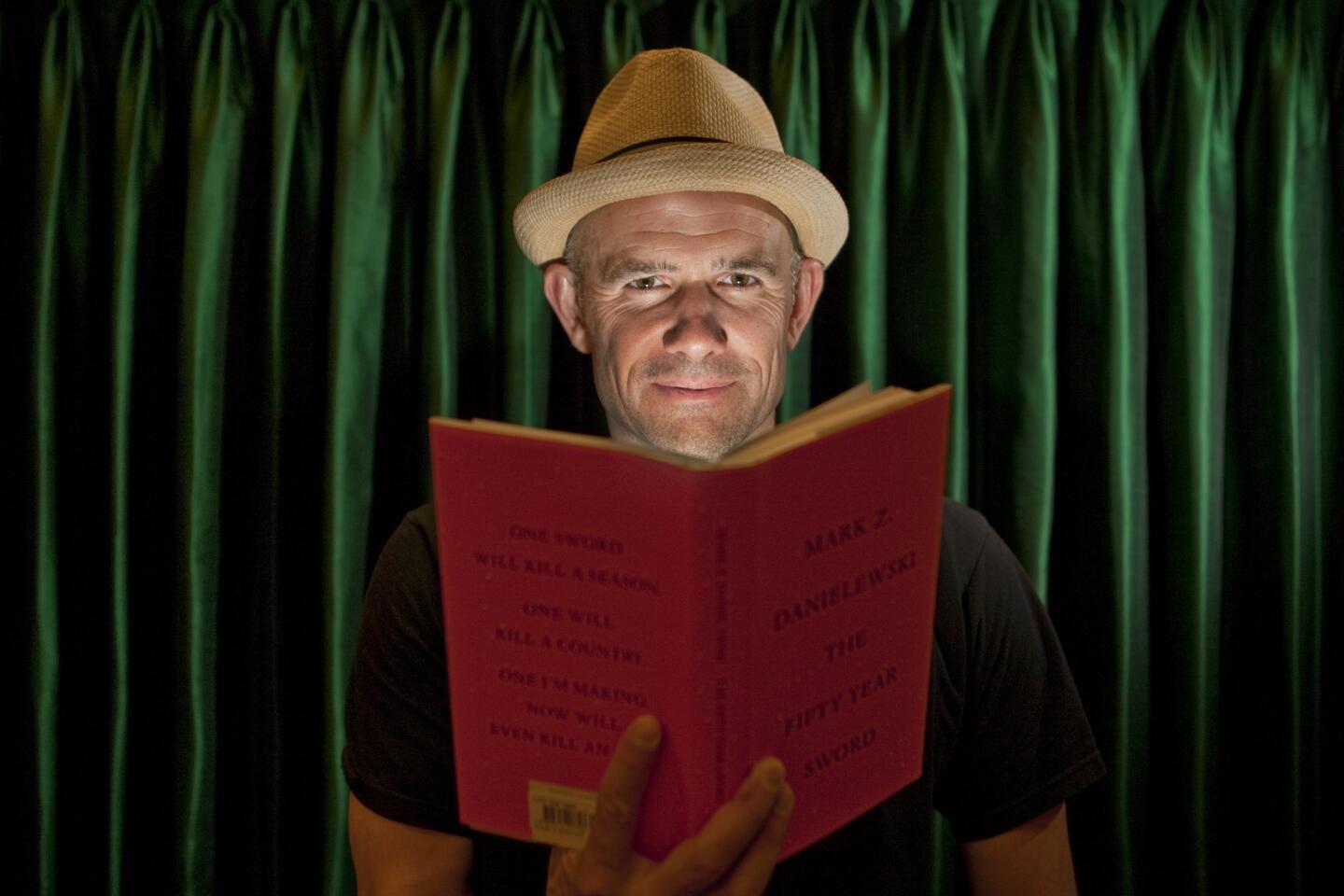

More: Mark Z. Danielewski: The writer as needle and thread (Allen J. Schaben / Los Angeles Times)

More: Gustavo Dudamelâs captivating theatrics serve the music | More photos (Jay L. Clendenin / Los Angeles Times)

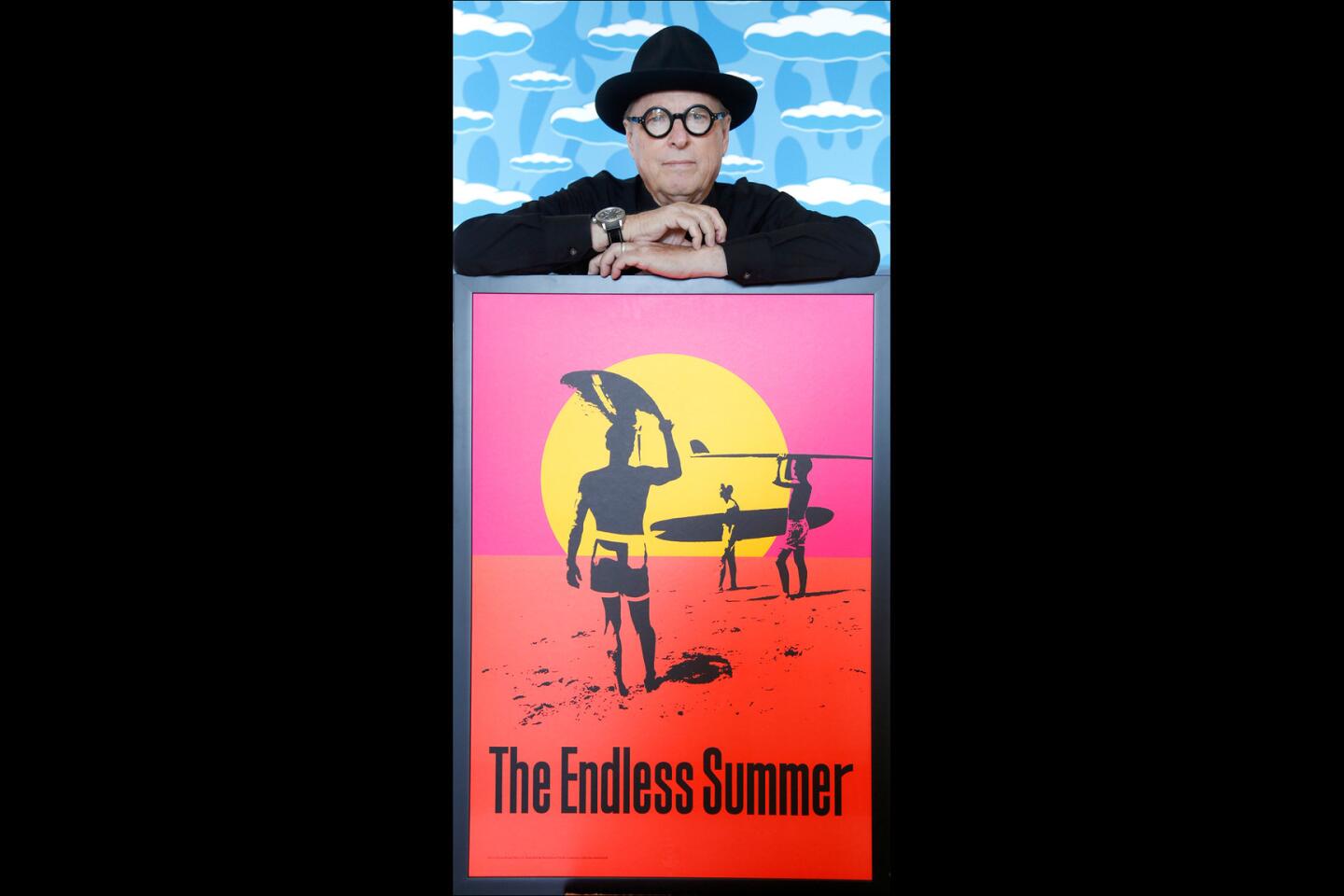

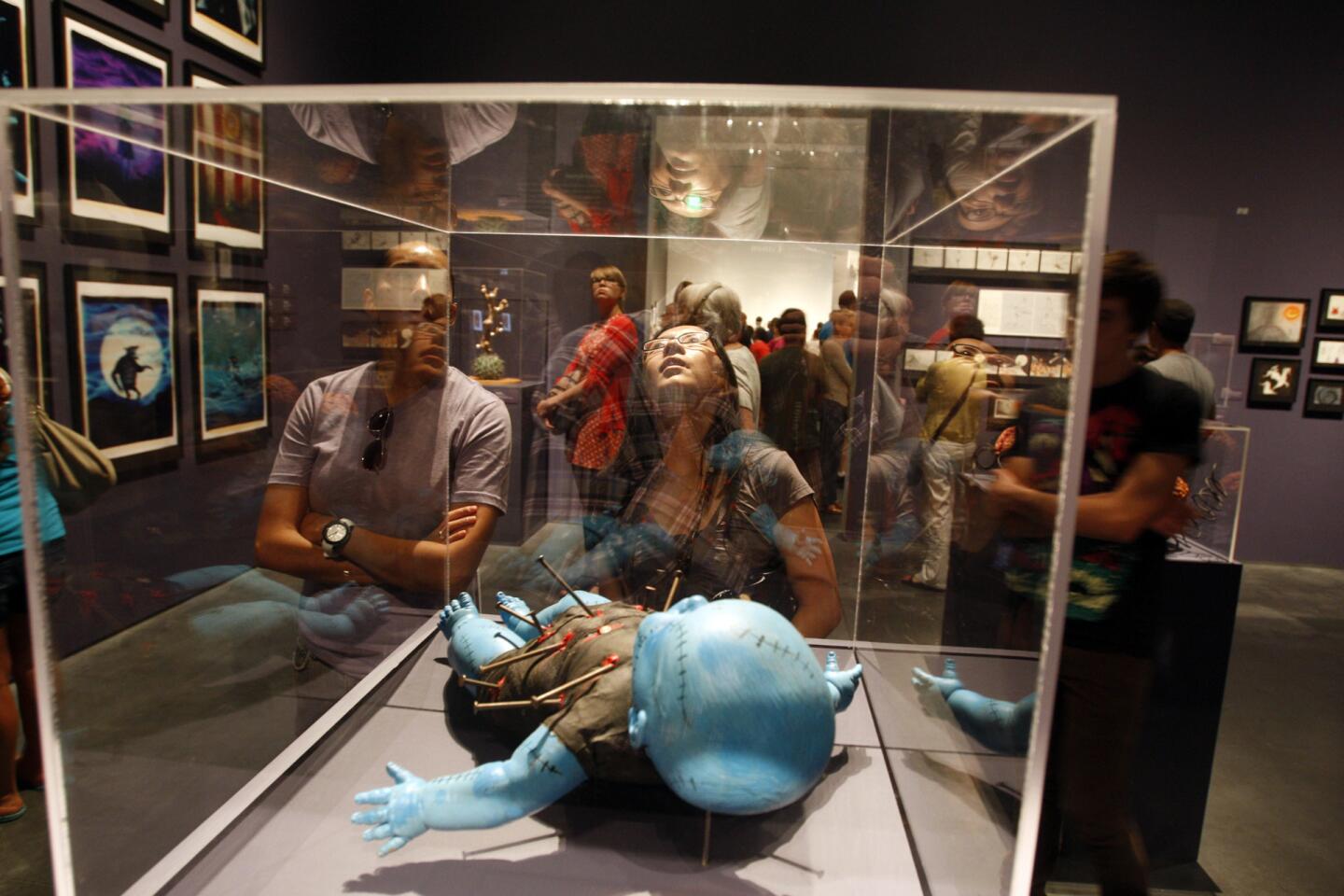

MORE: Doing the numbers on LACMAâs Tim Burton show (Gary Friedman / Los Angeles Times)

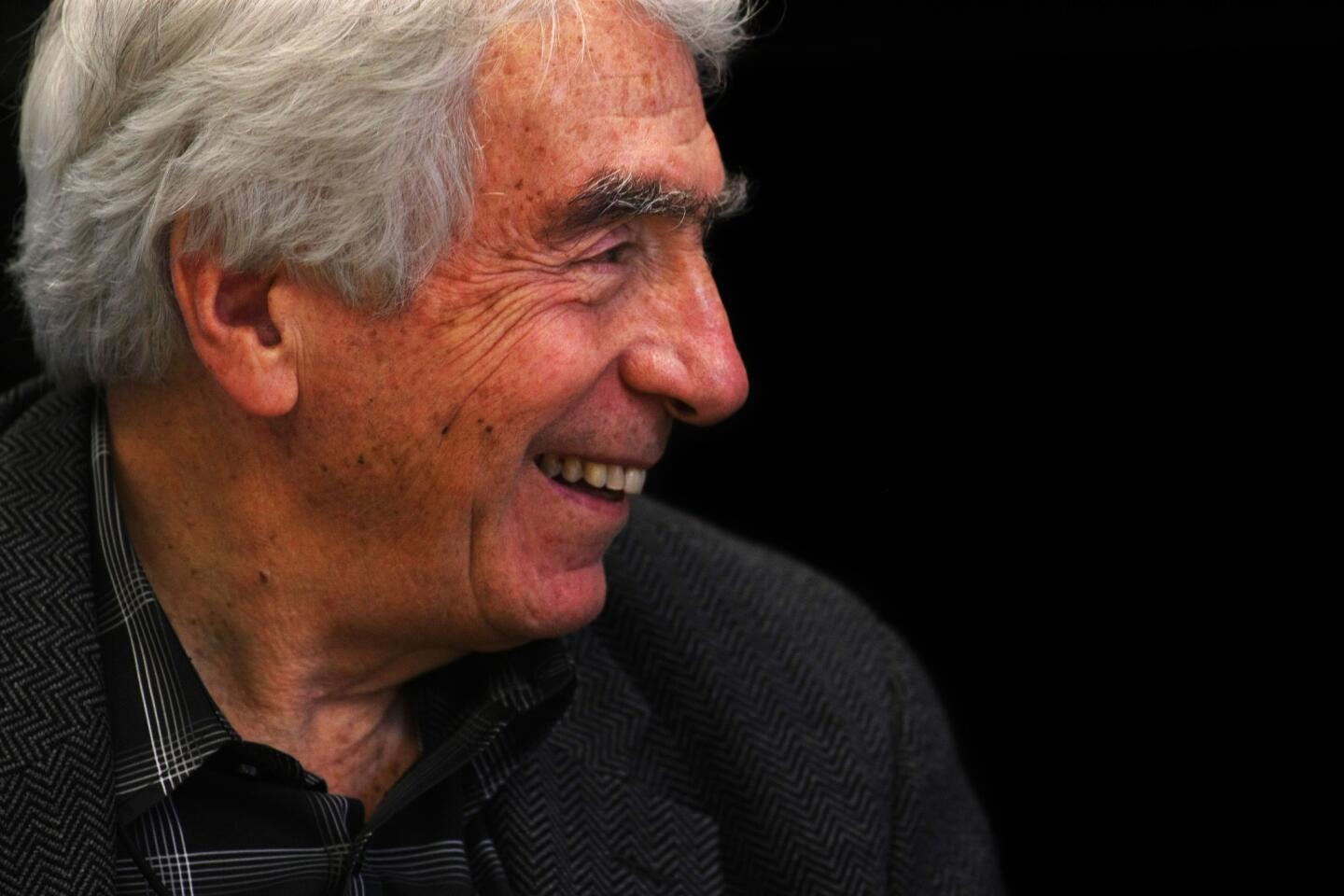

The publicâs window into nonprofit arts groupsâ financial condition is a time-lapse look. The numbers typically donât become available until many months after an organization has closed the books on a fiscal year. Theyâre now in for most groupsâ 2011-12 fiscal year, and for most of the biggest arts and cultural organizations in L.A. it was no bonanza. But better things could be ahead for the current 2012-13 fiscal year because of financial markets that have boomed since the last one.

Charity Navigator, a New Jersey-based nonprofit group that tracks other nonprofitsâ financial performance to help donors decide where to funnel their money effectively, said that the median result nationally for 105 arts groups in its database for the year ending June 30, 2012 was a 2.3 percent decline in net assets. That means half the groups experienced a decline of at least that much.

Net assets include the value of land, buildings and equipment, as well as investments. Another indicator of how organizations fare financially is their endowment â permanently invested funds they rely on to generate returns they can pump into their operations, augmenting what they get from donors, their box offices and concession sales.

FULL COVERAGE: 2013 Spring arts preview

While there are different formulas for deciding how much to tap for operations, typically organizations aim to spend about 5 percent of their endowmentsâ value. Often they calculate the value over three years to level out the effect of a single great or lousy year.

Endowments generally grew in 2009-10 and 2010-11, two years of recovery for investment markets after two years of severe losses.

But eight of the 11 largest Los Angeles groups saw their endowments drop in 2011-12. Another, the Autry National Center of the American West, goes by the calendar year and hasnât yet issued its reports for 2012. Its endowment dropped 1.3 percent in 2011.

Two organizations avoided losses by playing it safe. The Museum of Contemporary Art and California Science Center were considerably more risk-averse with their investments than other groups.

PHOTOS: LA Opera through the years

With 27 percent of its endowment in stocks and mutual funds, far lower than financial analysts would typically recommend for a middle-aged personâs 401k retirement plan, MOCA reaped a 0.3 percent investment return. The Science Center took even less risk and came away with a 1.6 percent gain. Neither made any withdrawals during the year.

The eight endowments taking hits ranged from Center Theatre Groupâs 0.8 percent drop to the Hammer Museumâs 11 percent decline. The J. Paul Getty Trustâs endowment ended the year at $5.3 billion â a decline of $246 million, or 4.4 percent.

Declining endowments donât necessarily mean that the investments themselves lost money, although in most cases they did. Another factor is withdrawals. The Getty withdrew $274.1 million to pay bills, far outweighing investment growth that totaled $28.1 million, for a 0.5 percent rate of return.

The best endowment results were reported by the Los Angeles Philharmonic, which benefitted from having a fiscal year that ended Sept. 30, 2012, three months later than the others. During the three extra months, one common measure of stock market performance, the S&P 500 index, rose by nearly 6 percent. The upswing has continued, and as of May 23, the S&P 500âs gain since June 30, 2012 was 21.5 percent, giving organizations an excellent chance to more than recoup last yearâs endowment declines.

The Philâs endowment grew from $200 million to $214 million â an increase of 6.9 percent, even after withdrawing $7.9 million to help with operating expenses.

Spending $109.6 million, the Phil would have ended the year with a deficit if not for the endowment. Instead, its bottom line was a $7.6 million initial surplus, which dipped to $4.4 million because of subtractions due to an accounting change related to its pension plans.

ALSO:

Getty executives enjoyed big pay hikes in 2012

MOCA hits $75 million mark, nearing endowment goal

Starving artists? Not among the leaders of L.A. arts institutions

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.

Mike Boehm is a former arts reporter and pop music critic for the Los Angeles Times.