Hollywood’s cable struggles become clearer as write-downs add ‘nails to linear TV’s coffin’

- Share via

Warner Bros. Discovery ripped off a Band-Aid this week, giving investors an alarming look at the plummeting value of the cable television business.

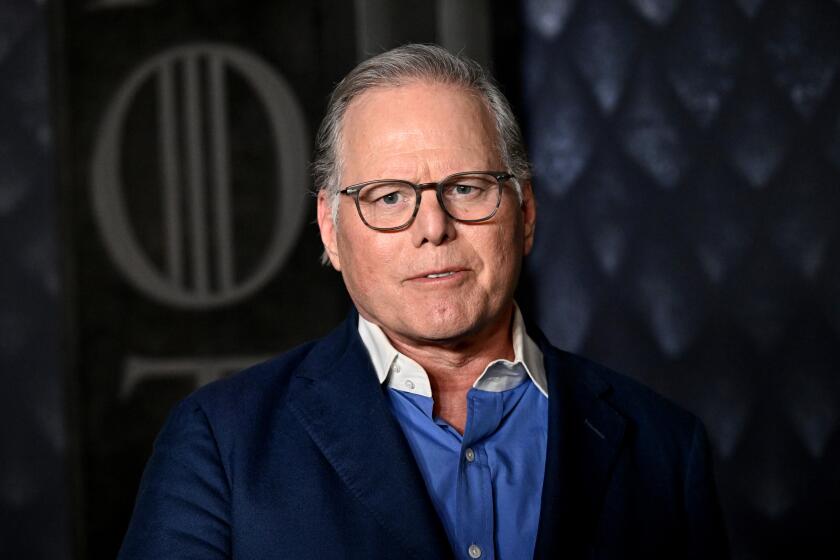

During its second-quarter earnings report, the company said that its networks, including CNN, TNT, HGTV, Food Network and Animal Planet — were worth $9 billion less than they were just two years ago. The new valuation comes as the company prepares to lose its key NBA contract after next season — a change that has shaken the David Zaslav-led company.

The massive write-down brought into sharp focus the collateral damage of the entertainment industry’s shift to streaming. Warner Bros. Discovery’s channels have long been popular destinations for viewers, particularly during an earlier era of channel surfing. But no more.

“It’s fair to say that even two years ago, market valuations and prevailing conditions for legacy media companies were quite different than they are today,” Zaslav, the company’s chief executive, said during a Wednesday call with analysts.

On Thursday, the company’s shares fell 9% to $7.02.

Zaslav and his lieutenants painted the problems as part of an industrywide reckoning. Walt Disney Co., NBCUniversal and Paramount Global also are struggling to manage the decline of their cable channels, which have historically produced high profit margins. The companies have lost billions of dollars building streaming services to compete with Netflix.

Paramount on Thursday told investors that it was taking a $6-billion impairment charge to account for the steep decline of its cable channel portfolio, which includes MTV, BET, Nickelodeon, VH1 and Comedy Central. It also will lay off 15% of its staff, or about 2,000 people.

David Zaslav’s success or failure turning around Warner Bros. Discovery could dictate the future of the film studio and storied television brands.

A dozen years ago, channels including ESPN, Nickelodeon and HGTV were available in more than 100 million U.S. homes. That number has dropped to about 65 million homes, as viewers turn to streaming options.

“Paramount’s and Warner Bros Discovery’s writedowns this week add nails to linear TV’s coffin,” Ross Benes, Emarketer’s principal analyst, said in an emailed statement.

Paramount’s struggles recently prompted controlling shareholder Shari Redstone to orchestrate a sale of the company her family has controlled for 35 years to technology scion David Ellison.

The pending sale to Ellison’s Santa Monica-based Skydance Media, which should be completed next year, is a stark admission that medium-sized media companies may be too small to compete against deep-pocketed tech giants. Ellison’s father, tech entrepreneur Larry Ellison, is helping back his son’s deal.

Analysts have said some of Warner Bros. Discovery’s setbacks, including the expected loss of the NBA deal, have been self-inflicted.

Investors appear to share that view. As Warner Bros. Discovery’s stock slid Wednesday, other media companies largely maintained their value. Disney, which suffered a tough Wednesday after acknowledging softness within its theme parks, held steady. Comcast closed up 2%. And Netflix, the biggest winner of the streaming wars, was up 3% to $630.35.

Warner Bros. Discovery’s stock is down 40% this year. Much of the fall coincided with the company’s inability to negotiate a renewal of the NBA rights deal for TNT. The NBA last month announced that it was instead striking agreements with Disney’s ESPN, NBCUniversal and Amazon’s Prime Video.

TNT has broadcast pro basketball since 1989, a vestige of its Ted Turner days.

Warner Bros. Discovery sued the NBA, asking a judge to force the NBA to accept a deal that Warner Bros. Discovery offered as a match to the Amazon deal. The league, which has said the lawsuit has no merit, is expected to respond later this month.

The David Zaslav-led media company posted disappointing second-quarter earnings Wednesday, sending its shares tumbling in after-hours on Wall Street.

The company’s stock is down 70% since the Zaslav-orchestrated 2022 takeover of WarnerMedia from AT&T.

In that deal, Zaslav’s Discovery swallowed the larger media company. That merger left the company saddled with more than $50 billion in debt.

The company has since laid off thousands of workers. It has slashed program spending, tightened budgets and shelved projects, including such movies as “Batgirl” and “Coyote vs. Acme.”

Bank of America analyst Jessica Reif Ehrlich, once bullish on the company’s potential, wrote that the firm is not on a sustainable path.

The stock slide “comes on the heels of significant under-performance over the last two years,” Reif Ehrlich wrote in a report Thursday.

“Unfortunately, the stock performance is a clear indication that investors see little optimism that the tides may soon start to turn,” MoffettNathanson media analyst Robert Fishman wrote in a separate report Thursday.

Investors are worried that, without basketball, Warner Bros. Discovery will not be able to maintain its distribution fees during upcoming contract negotiations with pay-TV providers such as Comcast and DirecTV.

Reif Ehrlich asked on Warner Bros. Discovery’s earnings call whether moves the company has made to cobble together additional sports rights, including NASCAR, Big East college basketball and the French Open of tennis, were “enough to close the gap.”

Chief Financial Officer Gunnar Wiedenfels said the company has confidence that its strategy would eventually pay off but didn’t know when.

“There’s been talk about recovery a year, a year and a half ago,” he said. “It hasn’t really happened. It is what it is.”

Zaslav sought to assuage investors, saying he and other key executives “have an attack plan meeting every week, all hands on.”

The executives pointed to growth in their streaming division, which includes premium channel HBO. The division added nearly 4 million subscribers during the quarter. The company’s streaming chief said his team was excited by its upcoming programming slate.

Zaslav also pointed to the Warner Bros. film studio, suggesting that projects in development would help spark the company’s turnaround. The company has had success with “Dune: Part Two” and “Godzilla x Kong: The New Empire,” but other movies, including “Furiosa: A Mad Max Saga,” have flopped.

During the call, Zaslav and Wiedenfels touted the company’s progress in paying down its debt, which is now $38 billion.

“We did an awful lot of work to get our balance sheet in good shape,” Zaslav said. “We view our debt as an asset.”

But Lightshed Partners analyst Richard Greenfield responded in a note to investors: “Debt is a liability, not an asset. And if WBD had less debt, they could invest far more heavily in content creation.”

Reif Ehrlich and other analysts have suggested that the company look at asset sales, such as cleaving off its video game unit, which suffered a tough quarter as its “Suicide Squad” game underperformed.

While company executives have hinted they are open to looking at sales, they also underscored the importance of keeping the company whole.

“Look, we have been operating under the one Warner Bros. Discovery strategy for the past 2½ years,” Wiedenfels said. “Every day, I’m seeing evidence everywhere in the business of the benefits of those strategies.”

“They can’t go on like this,” Bank of America analyst Jessica Reif Ehrlich said, referring to the lagging stock and string of missteps by Warner Bros. Discovery boss David Zaslav.

But the second-quarter numbers did not contain such evidence. The company reported a net loss of $10 billion compared with a loss of $1.24 billion for the same period a year earlier. Warner Bros. Discovery generated revenue of $9.7 billion, a 6% decline from the same quarter a year earlier.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.