At SXSW, an unexpected banking crisis disrupts a tech-world tradition

- Share via

AUSTIN, Texas — Walking through Roku City on Sunday afternoon, you’d hardly know the namesake company was having an unusually stressful weekend.

Sure, the faux metropolis — a several-story re-creation of Roku’s beloved screensaver, set up in the heart of downtown Austin for the city’s tech and culture extravaganza South by Southwest — had its share of problems. A massive robot rampaged through one part of the installation; a kraken’s tentacles rose menacingly from the sea in another.

But nothing served to suggest that Roku, a San Jose-based streaming and hardware giant, had just watched millions of dollars potentially disappear into thin air. According to a regulatory filing, the company had $487 million, or about a quarter of its cash, saved in Silicon Valley Bank — the tech-world lending mainstay that failed, spectacularly and unexpectedly, late last week.

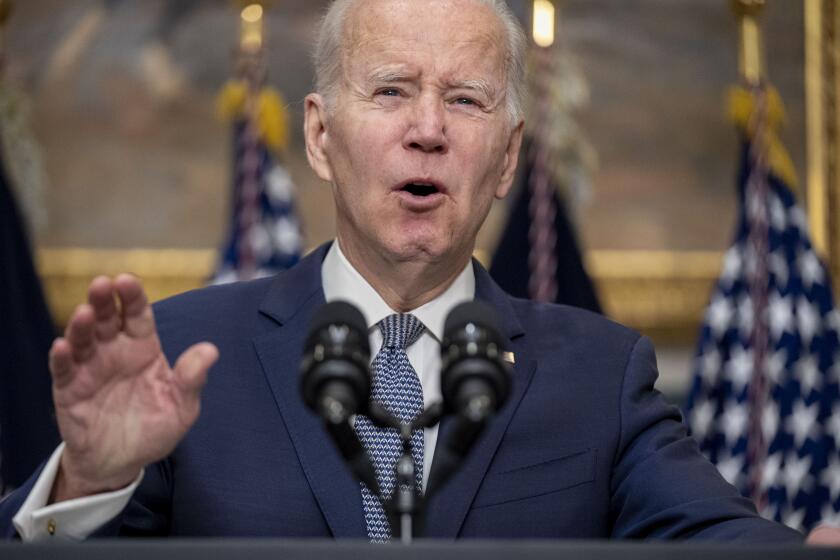

Assuring the public a crisis in the banking system was under control, President Biden blamed his predecessor for creating the conditions for the collapse of Silicon Valley Bank and Signature Bank.

Amid fears that a bank run could spread to other financial institutions, federal agencies — including the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corp. — now say that all of the bank’s clients will be able to get their money back. Still, given that Silicon Valley Bank did lots of business in the tech and media ecosystem — the lifeblood of South by Southwest, or SXSW, a combination film festival, tech expo and cultural summit — the crisis cast a pall over the first few days of the conference.

Attendees shared rumors of startup founders crying in the street after news of the bank’s collapse broke. Even among more put-together attendees, private Slack channels were reportedly awash in commiseration.

A spokesperson for Roku declined to comment.

At a small mixer Sunday afternoon for people working in the “conversational AI” field — that is, artificially intelligent programs mimicking human speech, including chatbots and synthetic voices — some said the bank’s collapse has dampened spirits at the annual conference.

The news has been “shocking” to attendees, said Ciro Sobral, 32, a product manager at the Singapore-based e-commerce company Shopee. Given that the Silicon Valley Bank had been a fixture of the tech world for decades, he added, people have been drawing parallels between its collapse and the 2008 financial meltdown.

“Everybody was caught off guard,” he said.

The failure of Silicon Valley Bank demonstrates the risk in showering unproven companies with cash and in handing so much power to venture capitalists to manage the process.

Although his employer was not directly affected, he added, the resulting chaos could lead to more centralization in the AI field.

“When something like this happens, it’s a big opportunity for the Big Tech” mainstays such as Microsoft and Google, Sobral said. “I don’t know what will happen next, because a lot of small businesses were using” the bank.

Shannon Brownlee, another attendee at the AI meet up, said that although her communication tech company Valence Vibrations didn’t keep its own money in Silicon Valley Bank, outside investors who had previously expressed interest in her startup have now said they need more time to figure out their finances.

“Our lead investor from the last [funding] round had $30 million in Silicon Valley Bank,” she said. “He’s just scrambling right now trying to figure it out.”

Upon her arrival at the conference Friday morning — she lives in Los Angeles — Brownlee, 22, almost immediately heard about the crash.

“We arrived, we went to go sit down at a coffee shop, do some work,” Brownlee said. “And as soon as we sat down, it was just like: ‘Oh my God, everyone is freaking out.’”

She’s heard of other conference attendees who have it far worse, though. Some tech workers arrived in Austin only to discover that they didn’t have access to company assets anymore, she said; now they’re “just kind of stuck here.”

“People are definitely nervous,” the startup co-founder added, and although the panel lineup seems to have been relatively unaffected, the general tone is decidedly more somber.

Other media interests that have been affected by the bank’s failure include the video platform Vimeo and the video game platform Roblox. Wrapbook, an entertainment industry payroll platform, said on Friday that the bank collapse meant its payroll processing would be delayed.

“A bank failing is an extreme external event,” Wrapbook tweeted. “We apologize, on behalf of all of us at Wrapbook, for any challenge this puts on you.”

Demands by the tech industry’s most vocal libertarians for a government bailout of Silicon Valley call to mind the old saw: The goal in business to privatize profits and socialize losses.

Reign Ventures, an early-stage investment fund, tweeted on Saturday that they’d had to shut down events they’d planned on hosting at SXSW because of the bank’s collapse.

“We are so sorry to miss you and we are sending our support to all the startups and VCs being impacted during this challenging time,” the firm wrote.

Dan Solomon, senior editor at Texas Monthly, said in his own tweet Friday that at one panel he attended, a startup founder spent the whole time “trying to get a wire transfer to go through before 5pm so she could make payroll.”

There were, indeed, a few oblique references to the news of the week during the convention’s education-oriented panels. During a talk on the future of AI, BuzzFeed Chief Executive Jonah Peretti quipped that everything these days is driven by virality — even bank runs.

Silicon Valley Bank failed late last week, prompting fears of wider upheaval. Here’s what you should know about the collapse and what comes next.

And during a Monday morning chat titled “How D.C. Wants to Mess With Your Startup,” U.S. Chamber of Commerce President Suzanne Clark framed federal regulators’ latest actions to protect depositors as an example of when government can be helpful to tech companies — even as she pushed back in the rest of her talk on what she characterized as federal overreach in the economy.

“It’s an important morning for a lot of us to be quiet,” Clark said. “It’s an important morning to get smarter and to do the homework of really understanding what happened.”

But for the most parts, many tech-themed panels at SXSW didn’t acknowledge the crisis that was surely affecting many in the audience, if not those on stage themselves.

Ironically, it was the festival’s cultural side that seemed most eager to engage with the crisis.

At a live Sunday evening episode of comedian Matt Besser’s popular comedy podcast “improv4humans,” Silicon Valley Bank received multiple mentions. At one point, during a scene about Jesus struggling with money problems, someone from the audience yelled out “SVB!” unprompted.

At another point, guest star James Adomian riffed in character as a SXSW panelist having a horrible shrooms trip: “I just lost all my seed money at the SVB blowup!”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.