How Newsom plans to fix California’s projected $37.9-billion budget deficit

- Share via

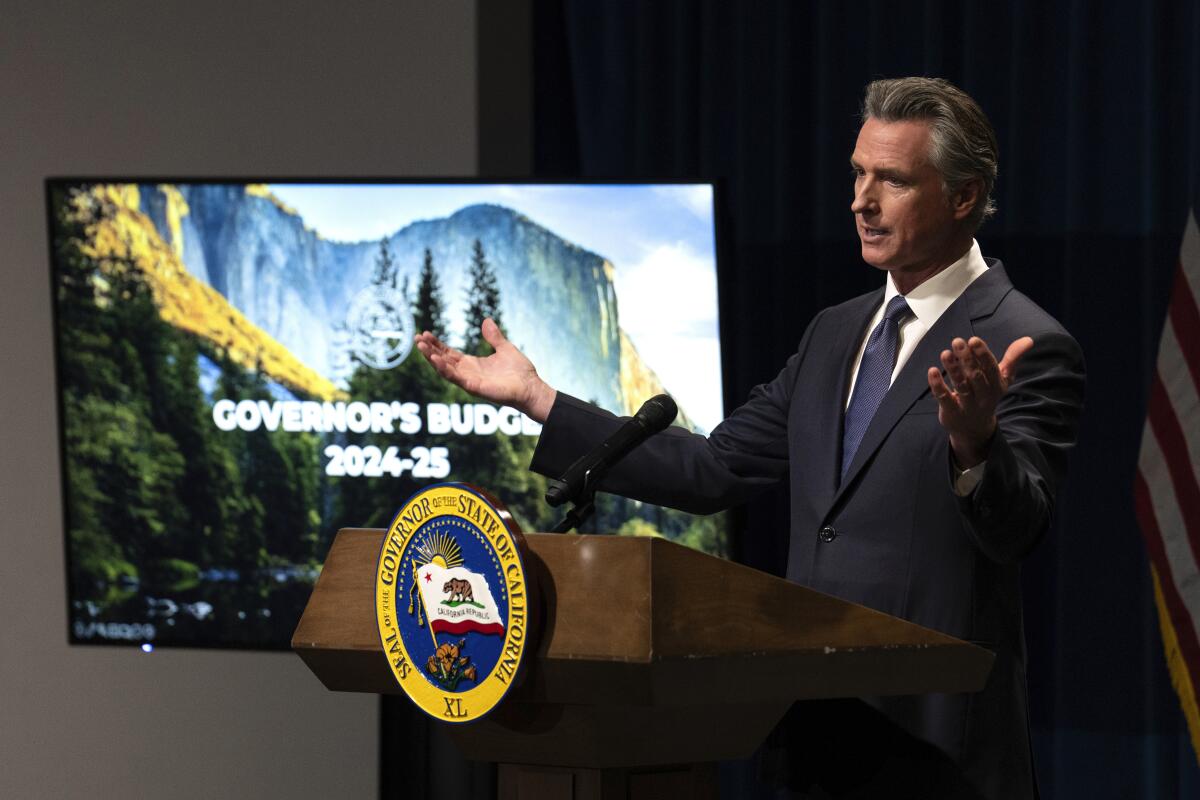

Gov. Gavin Newsom asked California lawmakers on Wednesday to dip into the state’s rainy-day reserves, and signaled his desire to potentially delay a minimum wage increase for healthcare workers as part of his plan to offset an expected $37.9-billion deficit.

A confluence of weaker-than-expected state revenues, delayed tax deadlines and overspending based on inaccurate budget projections created the budget shortfall. Newsom’s new deficit estimate is more than double the shortfall he and lawmakers anticipated last June, a tacit admission of how badly the state underestimated the size and scope of the budget hole, and marks substantial disagreement within California government about the depth of the financial problem.

Newsom described his plan as an example of resilience as he outlined the $291.5-billion budget proposal for fiscal year 2024-25 during a presentation Wednesday in Sacramento. His proposal to offset the shortfall includes declaring a budget emergency in order to dip into reserves; cutting $8.5 billion in spending from programs that support climate change efforts, housing and other services; and reconsidering the healthcare wage increase.

“This is a story of correction and normalcy, and one that we in some respects anticipated — the acuity perhaps not — and one we’re certainly prepared to work through,” Newsom said.

The deficit deepens state government’s economic challenges and could pose political problems for Newsom this year as he grapples with lawmakers and interest groups about his proposed cuts.

His budget proposal indicates that he wants to work with lawmakers to add funding restrictions to a law he signed last year that increases the minimum wage for healthcare workers to $25 per hour. Such changes could delay the pay hike from taking effect if state revenues drop below a certain level.

The governor’s plan seeks to maintain funding for many of his expensive policy promises, including the expansion of Medi-Cal eligibility to all immigrants regardless of legal status.

But his decision to dip into the budgetary reserves sounds a new alarm for the Golden State. Until now, Newsom has rebuffed calls from Democratic lawmakers to tap into the state’s rainy-day fund and other reserves, which act as a piggy bank that can be cracked open during a financial crisis to avoid sweeping cuts to critical services and social safety net programs.

The governor is proposing that he declare a budget emergency this summer, which is required by law to draw down the reserve accounts. His plan to spend $13.1 billion of the reserves means less funding will be available to backfill spending if revenues continue to decrease, possibly forcing more painful and drastic cuts in the years ahead.

Newsom is also looking to dip into the reserves at a time when he’s proposing decreased annual spending. The 2024-25 budget marks a decline of nearly $20 billion in spending from the budget lawmakers passed last June for the current fiscal year.

California’s budget difficulties were compounded last year when the state and federal government delayed the deadline to file 2022 income tax returns from April to November due to winter storms that pummeled coastal California and flooded parts of the state. The extended deadline affected more than 99% of California taxpayers in 55 of the state’s 58 counties, according to the state Department of Finance.

In a typical budget year, state government has tax receipts in hand before the governor unveils a revised budget proposal in mid-May and before reaching a final spending agreement with lawmakers in June. The tax delay forced lawmakers and the governor to enact the current budget in July based on estimates of how much money the state would collect in tax revenues by the November deadline.

“If you recall, this time last year we were dealing with unprecedented flooding,” Newsom said. “Little did we know that those extreme weather patterns would lead to this extreme volatility in financial projections.”

The Department of Finance anticipated last year that there would be a nearly $32-billion shortfall in the current fiscal year, which ends on June 30. That forced lawmakers and the governor to trim their spending plans.

The state budget is highly dependent on income taxes paid by California’s highest earners. Revenues are prone to volatility, hinging on capital gains from investments, bonuses to executives and windfalls from new stock offerings.

Newsom and lawmakers anticipated additional revenue declines driven by a declining stock market, high interest rates and increased inflation. But Newsom’s new estimate indicates the deficit is much worse than lawmakers and the governor planned for in June.

Now state leaders must cut spending further in the upcoming fiscal year to make up for last year’s actual revenue shortfall and an anticipated deficit in the coming year.

“The timing challenge related to this deficit estimate is definitely unique,” said Gabriel Petek of the Legislative Analyst’s Office.

In December, the office projected the budget deficit would be $68 billion — much higher than Newsom’s estimate. The governor chalked up the difference to the Department of Finance anticipating greater revenues than the Legislative Analyst’s Office, among other accounting discrepancies.

“We just are a little less pessimistic than they are about the next year,” Newsom said.

Despite the budget challenges, there’s no indication of a larger economic crisis in California.

“Until now, California has been growing faster than the U.S., on a per capita basis, and has been one of the fastest-growing states in the U.S.,” said Jerry Nickelsburg, an economics professor and director of the UCLA Anderson Forecast. “And now it’s growing at about the rate of the U.S., as really everyone sort of slows down a bit.”

He noted that there’s more geopolitical risk worldwide and that the presidential election could affect U.S. economic policy in the near future.

But Nickelsburg added that the slow growth is expected to be short-lived, with economic growth accelerating later this year and into 2025.

Newsom’s January budget proposal begins a six-month process of hearings and negotiations with the California Assembly and Senate, both of which will have new leaders by the time the budget talks intensify.

He promised to provide a more complete fiscal plan in May when the state has a more accurate understanding of 2023 income tax collections.

Newsom shot down the idea of California enacting a wealth tax to address the shortfall.

K-12 schools somewhat relieved

The budget proposal was something of a relief for schools: no major cuts, no major step back of priorities and expanded efforts such as free school meals for all and gradual expansion of transitional kindergarten that will allow all 4-year-olds to attend public school by the start of the 2025-26 school year.

But funding for facilities to improve early-education classrooms is delayed for a second straight year. The total for public school funding is $109.1 billion, about 40% of the state budget.

Overall, the funding level guaranteed under the state’s complex formula works out to $8 less per student over last year, to a total of $17,653 per student — a small difference but one that adds up with nearly 6 million public school students. The funding level also becomes potentially significant coupled with inflation and employee wage increases. School districts also are anxious over the expiration of COVID-relief funding that had led to record, but temporary, revenues for schools.

“This certainly takes the cake on being the best bad-year budget” for K-12, said Kevin Gordon, president of Capitol Advisors Group, a firm that lobbies on behalf of school districts.

Delaying increases for universities

Newsom proposes deferring a 5% budget increase for the University of California and California State University, and providing two years’ worth of increases next year. In 2022, he pledged five years of 5% annual base funding increases to deliver long-sought financial stability in exchange for gains in access, equitable student achievement, affordability and training for state workforce needs.

A highly anticipated measure to help address the need for new affordable student housing with a zero-interest revolving loan fund would be suspended under the proposed budget.

On financial aid, the proposal forgoes a planned one-time investment of $289 million for the middle-class scholarship program. And a sweeping plan to significantly increase Cal Grants for needy students will not kick in this year due to the budget shortfall.

Sonya Christian, chancellor of California Community Colleges, said Newsom’s proposal maintains key investments, such as the $60-million expansion of nursing programs in community colleges.

Cuts to social services

Newsom’s budget proposal includes backtracking or delaying planned funding for numerous programs serving vulnerable Californians.

Child-welfare advocates were stunned Wednesday by a proposed $30-million reduction in funding for an urgent response program that helps youth in foster care and families in crisis, a move that could eliminate the service entirely.

“While we recognize the large deficit affecting the administration’s budget proposal, we can’t continue down this path of deprioritizing kids that has led to alarmingly poor outcomes,” Ted Lempert, president of the nonprofit group Children Now, said in a statement.

Other funding planned for this year has been delayed to make up for the shortfall.

That includes delaying $80 million for a program meant to reduce the number of families in the child welfare system experiencing homelessness, and $50 million for a program that helps homeless Californians with disabilities. The funds would be delayed to the 2025-26 budget under Newsom’s proposal.

And Behavioral Health Bridge Housing program designed to provide shelter to homeless Californians with serious mental health issues would see $235 million in funding delayed.

Some homeless funding delayed

Newsom proposed more than $1.2 billion in total cuts to a variety of housing programs, including regional planning grants, low-interest development loans and assistance for first-time home buyers, and suggested delaying payments until next year for several programs that address homelessness.

His plan would maintain $3.4 billion for homelessness, including funds to dismantle encampments and provide grants to local governments to prevent people from losing their homes.

Newsom spoke forcefully about the public’s demand to see results from the billions the state spends on homelessness.

“People have just had it,” he said. “They want these encampments cleaned up. They’re done. They’re fed up.”

Cuts to environmental programs

Newsom proposed cutting the state’s multiyear climate budget by 11% from the $54 billion approved in 2022, including reductions to clean-transportation programs and others that address forest maintenance, watershed resilience, coastal protection and rising sea levels.

“We would have hoped for a little bit more of a courageous proposal — something that is more creative and solutions-oriented about how to fund the transition that is so desperately needed toward clean energy and resilience,” said Mary Creasman, chief executive of California Environmental Voters.

Newsom acknowledged that 2023 was the planet’s hottest year on record, and vowed to “hold Big Oil accountable” for its role in the climate crisis. That includes a recommendation in the budget to eliminate some subsidies that benefit oil and gas corporations, such as funds geared toward intangible drilling costs and allowances for economic credits.

In a statement, Barry Vesser, chief operating officer with the Santa Rosa-based Climate Center, said that was a wise recommendation, but that the governor should go even further and eliminate all tax breaks and subsidies for fossil fuel corporations.

Times staff writers Mackenzie Mays, Queenie Wong, Hayley Smith, Howard Blume, Jenny Gold, Teresa Watanabe, Debbie Truong, Andrew Khouri and Doug Smith contributed to this report.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.