FTX founder Sam Bankman-Fried is charged with criminal fraud and money laundering

- Share via

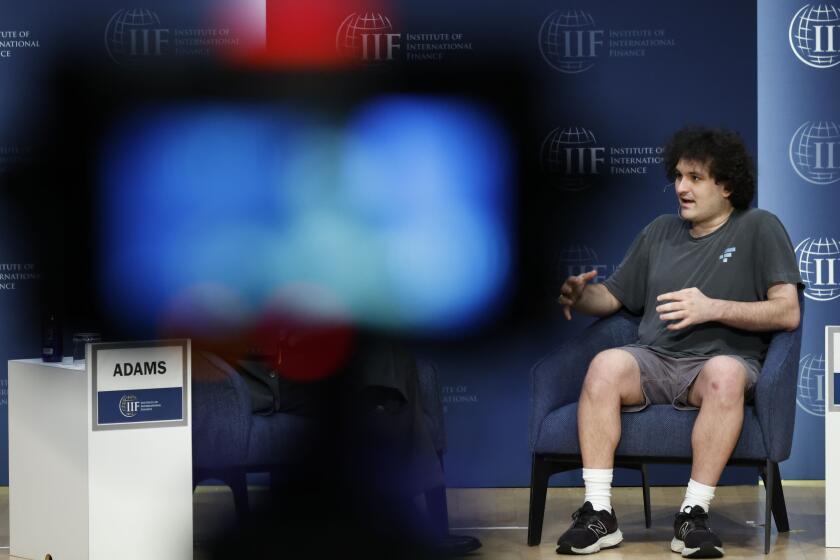

NEW YORK — U.S. prosecutors charged Sam Bankman-Fried, the founder and former chief executive of cryptocurrency exchange FTX, with a host of financial crimes and campaign finance violations Tuesday, alleging that he played a central role in the collapse of FTX and hid its problems from the public and investors.

The indictment says that, beginning in 2019, Bankman-Fried intentionally devised “a scheme and artifice to defraud” FTX’s customers and investors, diverting their money to pay expenses and debts at his crypto hedge fund, Alameda Research, and to make lavish real estate purchases and large political donations.

Bankman-Fried was arrested Monday by Bahamian authorities at the request of the U.S. government, which charged him with eight criminal violations, including wire fraud, money laundering and conspiracy to commit fraud on the United States. He was also charged with making more than $25,000 in illegal campaign contributions — a notable charge as Bankman-Fried was one of the largest political donors this year.

The criminal charges are on top of civil charges announced earlier Tuesday by the Securities and Exchange Commission, which also alleged that Bankman-Fried defrauded investors and used their proceeds to buy real estate on behalf of himself and his family.

The maximum potential prison exposure from these charges is 115 years, according to Nicholas Biase, a spokesperson for the prosecutors.

U.S. authorities will also seek to have Bankman-Fried forfeit all financial gains he might have received as part of the scheme. They are expected to request his extradition to the United States, although the timing of that request is unclear.

Facing a complex web of lawsuits and regulatory investigations into alleged wrongdoing by his companies, the fallen crypto billionaire denied knowledge of misusing customer funds.

A lawyer for Bankman-Fried, Mark S. Cohen, said Tuesday that his client was “reviewing the charges with his legal team and considering all of his legal options.

FTX filed for bankruptcy Nov. 11, when it ran out of money after the cryptocurrency equivalent of a bank run.

Since FTX collapsed, Bankman-Fried has been holed up in his Bahamian luxury compound in Nassau. He has a right to contest his extradition, which could delay but probably not stop his transfer to the United States.

Bankman-Fried was one of the world’s wealthiest people on paper; at one point his net worth reached $26.5 billion, according to Forbes. He was a prominent personality in Washington, donating millions of dollars to mostly left-leaning political causes and Democratic political campaigns. FTX grew to become the second-largest cryptocurrency exchange in the world.

Sam Bankman-Fried’s $16-billion fortune was always a myth. The mystery is why venture firms and the financial press thought it existed.

That all unraveled quickly last month, when reports called into question the strength of FTX’s balance sheet. Customers moved to withdraw billions of dollars, but FTX could not meet all the requests because it apparently used its customers’ deposits to cover bad bets at Bankman-Fried’s investment arm, Alameda Research.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” said SEC Chair Gary Gensler.

The SEC complaint alleges that Bankman-Fried raised more than $1.8 billion from equity investors since May 2019 by promoting FTX as a safe, responsible platform for trading crypto assets.

Instead, the complaint says, Bankman-Fried diverted customers’ funds to Alameda Research without telling them.

Sam Bankman-Fried’s bankrupt digital-asset exchange FTX was hit by a mysterious outflow of about $662 million in tokens in the past 24 hours, the latest twist in one of the darkest periods for the crypto industry.

“He then used Alameda as his personal piggy bank to buy luxury condominiums, support political campaigns, and make private investments, among other uses,” the complaint reads. “None of this was disclosed to FTX equity investors or to the platform’s trading customers.”

Alameda did not segregate FTX investor funds and Alameda investments, the SEC said, using that money to “indiscriminately fund its trading operations,” as well as other ventures of Bankman-Fried.

Bankman-Fried’s arrest came just a day before he was due to testify in front of the House Financial Services Committee. Rep. Maxine Waters (D-Los Angeles), the chairwoman of the committee, said she was “disappointed” that the American public, and FTX’s customers, would not get to see Bankman-Fried testify under oath.

The hearing will still be held Tuesday despite his arrest, with the new chief executive of FTX, John Ray III, giving testimony.

Breaking News

Get breaking news, investigations, analysis and more signature journalism from the Los Angeles Times in your inbox.

You may occasionally receive promotional content from the Los Angeles Times.

Bankman-Fried said recently that he did not “knowingly” misuse customers’ funds, and said he believes his millions of angry customers will eventually be made whole.

The SEC challenged that assertion Tuesday in its complaint.

“FTX operated behind a veneer of legitimacy Mr. Bankman-Fried created by, among other things, touting its best-in-class controls, including a proprietary ‘risk engine,’ and FTX’s adherence to specific investor protection principles and detailed terms of service. But as we allege in our complaint, that veneer wasn’t just thin, it was fraudulent,” said Gurbir Grewal, director of the SEC’s Division of Enforcement.

“FTX’s collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike.”