Column: Something for Biden to brag about — his IRS funding more than pays for itself

- Share via

It goes without saying that President Biden will take the podium for Thursday’s State of the Union address armed with facts and figures of all that he’s accomplished for the American people during his term. All presidents do.

Here’s one item we hope he doesn’t fail to mention: By arming the Internal Revenue Service with billions of dollars in new resources, he has generated many more billions of dollars in tax revenues. And without raising tax rates.

That’s the outcome of a provision of the Inflation Reduction Act of 2022, which endowed the IRS with $80 billion in new funding over 10 years. About $20 billion of that is being rescinded as the GOP’s price for an agreement to raise the federal debt ceiling, but what’s left is still enough to start restoring the agency’s tax collection efforts.

A taxpayer who is audited in 2024 and found to have underreported tax will voluntarily pay more tax in 2025, 2026, and beyond.

— Internal Revenue Service

The Treasury Department recently reported that it’s money well spent, in spades. The full $80-billion appropriation would produce $561 billion in increased revenues; the $20-billion give-back would reduce that by $100 billion. If the higher level of funding were renewed after it expires, Treasury says, the new revenues could reach $851 billion.

That includes not only direct recovery of unpaid taxes but what the IRS calls “specific deterrence.” As the agency explains, “a taxpayer who is audited in 2024 and found to have underreported tax will voluntarily pay more tax in 2025, 2026, and beyond.”

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Do the math, and it turns out that every dollar spent on shoring up the enforcement and efficiency capabilities of the IRS produces about $6 in gains.

To a great extent, that return comes from enforcement efforts aimed at the richest Americans, who have consistently reigned as our leading tax cheats. Millionaires and billionaires have been evading about $150 billion a year, IRS Commissioner Danny Werfel told CNBC last month.

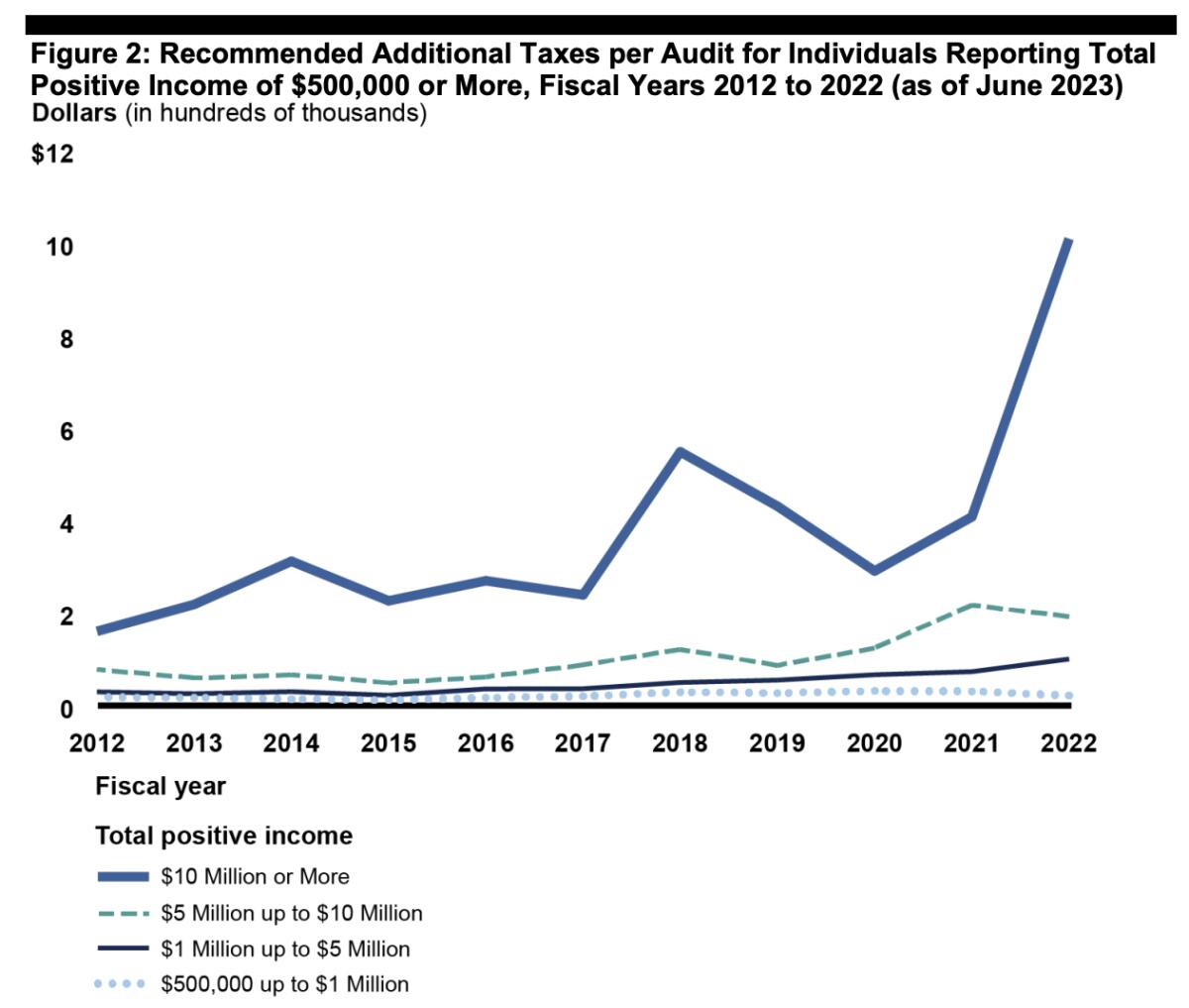

Every hour a government auditor spends scrutinizing a return declaring $5 million of income unearths nearly $3,500 in unpaid taxes, according to the Government Accountability Office; for returns reporting $10 million or more, the yield is more than $13,000 per hour. It’s hard to imagine a better bang for the government buck.

Under Biden, the IRS has been able to start reversing the historical free ride on tax compliance enjoyed by corporations and the rich. “Tax cheating became almost risk-free for the wealthiest Americans during the Trump years,” David Cay Johnson reported recently in the Nation.

The Wall Street Journal says America ‘soaks the affluent.’ Try to hold back your tears.

This is a crime highly corrosive to American society — taxes unpaid by the wealthy only land on the backs of lower-income taxpayers, and the perception of the rich getting away with it even as they increase their share of national income eats away at the public’s respect for government generally.

All this should provide some perspective on the partisan tug of war staged by the Republican Party over IRS funding in recent years. After the Inflation Reduction Act passed Congress without a single Republican vote, GOP lawmakers threw a conniption over the IRS appropriation.

They depicted the 87,000 workers who might be hired with the appropriation as an army of jackbooted thugs poised to knock down the doors of ordinary Americans. “We should stop the weaponization of the tax code, abolish the IRS, and start over,” Sen. Ted Cruz (R-Texas) declared in a typically feverish broadside.

What Cruz and his fellows don’t seem to understand is that raising taxes on the wealthy and cracking down on their tax breaks is overwhelmingly popular among the voters — including Republicans — as Timothy Noah observed in the New Republic.

The truth is that the ability of the IRS to enforce the law against the most determined cheats had been hobbled for decades — by budget cuts enacted by Republicans and Democrats alike. From 2011 to 2019, the audit rate of returns reporting $1 million or more in income fell from 7.2% to 0.7%, according to the IRS. In the same period, the audit rate of large corporation returns fell from 10.5% to 1.7%.

Oversight of the wealthiest Americans had gotten so embarrassingly low that then-Treasury Secretary Steven Mnuchin ordered the IRS in 2020 to audit at least 8% of returns reporting $10 million in income or more every year.

Reviving the enforcement capability at the IRS was no simple matter. Years of attrition had sapped the agency’s expertise at analyzing the complex finances of the 1%.

Training new auditors takes two to three years. High-income and high-wealth individuals and their representatives often “intentionally delay or obstruct the audit,” according to the Government Accountability Office. “For example, ... taxpayers or their representatives might take the maximum amount of time to provide the minimum amount of information to the auditor.”

Still, the IRS has materially stepped up its targeting of millionaires and billionaires. In January, Werfel reported that over the previous year the IRS had collected $520 million in unpaid taxes from some 1,600 rich scofflaws — thus far.

Why does the IRS focus its enforcement capabilities on the poorest families?

Last month, the IRS sent letters to 125,000 high-income households that hadn’t filed tax returns since 2017, advising them to get right with the government “immediately” by paying their delinquent tax, interest and penalties. The mailings went out to more than 25,000 recipients with more than $1 million in income and more than 100,000 of those with incomes between $400,000 and $1 million.

The agency is also taking a closer look at schemes through which corporations and wealthy taxpayers are known to shelter their income illicitly. That includes unwarranted business deductions for corporate jets actually used for personal travel, which should be treated as income.

Meanwhile, Senate Finance Committee Chair Ron Wyden (D-Ore.) has launched a committee investigation of business deductions taken by multimillionaire Harlan Crow on his superyacht Michaela Rose by declaring it a vessel for business charters. Wyden asserted in a letter to Crow’s lawyer that there’s no evidence the yacht has been registered as a charter vessel, but instead has been used for pleasure cruises by Crow, his family and his guests.

Crow has been in the news as a generous benefactor to Supreme Court Justice Clarence Thomas, who reportedly traveled on the yacht to several locations around the world, Wyden observed. By taking deductions for charter losses and maintenance costs, Wyden asserted, “Mr. Crow appears to have claimed to lower his tax liability by millions of dollars.”

The most important outcome of Biden’s approach to tax enforcement is curing corporations and the wealthy of their poor taxpaying hygiene. They’ve gotten away with evading their responsibilities for so long that they came to see the IRS as their own entitlement program. The rest of us have been paying for that. A newly vigilant IRS, in effect, puts our money back in our pockets.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.