How to pay for Ozempic and other promising medications

Steve Haines always loved to go for walks, but exercise had become a nightmare when he was 380 pounds and diabetic. The 49-year-old from Champaign, Ill., said he would get ulcers on his feet after long walks.

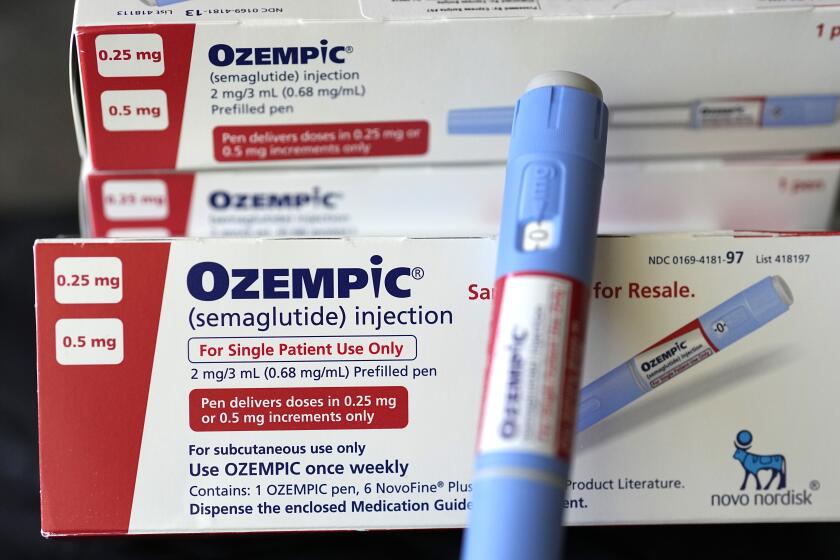

About six years ago, Hainesâ doctor prescribed Ozempic, a medication approved by the Food and Drug Administration to treat diabetes that also helps with weight loss. Haines lost weight and began to feel more active. Now, at 220 pounds and with his diabetes under control, he gets out of the house a lot.

âI sometimes walk 10 to 15 miles in a day,â Haines said.

Haines is one of many Americans who live with diabetes. According to the Centers for Disease Control and Prevention, around 1 in 10 Americans have diabetes, and the vast majority have Type 2, a condition in which the body canât control the amount of sugar in the blood.

Ozempic, generically known as semaglutide, can be a lifeline for many. Semaglutide stimulates insulin secretion and controls blood sugar, which helps manage Type 2 diabetes. The medication also slows digestion and sends signals to the brain that the stomach is full, effects that can lead to weight loss.

Nearly 3,000 reported overdoses of popular weight loss and diabetes drug semaglutide, sold under the brand names Ozempic and Wegovy, were reported in the United States this year.

Prescriptions in the U.S. for semaglutide medications such as Ozempic increased 300% from 2020 to 2022, despite a high price tag. Depending on factors such as the dosage and the pharmacy, Ozempic can cost more than $11,000 a year.

Insurance provides coverage for some patients, but others must find alternative ways to pay, through savings or assistance programs or borrowing.

Understanding insurance coverage

Most health insurance plans, including Medicare and Medicaid, cover at least some of the cost of semaglutide medication when itâs prescribed to treat Type 2 diabetes. However, coverage can vary depending on an individualâs plan and state requirements.

Alvin Carlos, a certified financial planner based in Washington, D.C., suggested calling your insurance provider to ask if your plan covers drugs such as Ozempic and what the out-of-pocket costs may be.

When choosing insurance, a low-deductible plan can be better for expected costs such as ongoing prescriptions, Carlos said. A health savings account or flexible savings account, both of which use pretax income to pay for health expenses, can also mitigate out-of-pocket costs.

Those who donât have insurance that covers Ozempic for diabetes, or are seeking the drug for weight management or other non-diabetic reasons, will likely have to find alternative ways to pay for the medication.

Less than half of large employers currently cover the new generation of obesity drugs, but an additional 18% say theyâre considering adding them amid surging interest.

Exploring payment options

Hillary Filstrup, 37, a customer service manager in Tulsa, Okla., tried to get Ozempic to manage her weight after being diagnosed with polycystic ovary syndrome and developing insulin resistance. However, her insurance wouldnât cover the medication since her condition wasnât diabetes-related. Filstrup opted to pay out of pocket for a semaglutide medication from a compounding pharmacy.

For those like Filstrup with high out-of-pocket costs or no insurance coverage for Ozempic and other medications, there are ways to help pay for them.

- Manufacturers savings programs: Pharmaceutical companies often offer savings cards to reduce out-of-pocket costs for eligible patients. Novo Nordisk, the manufacturer of Ozempic, provides a savings card that can significantly lower the cost for up to three months for qualifying patients with private or commercial insurance.

- Patient assistance programs: Patient assistance programs are designed to help uninsured patients who cannot afford their medications. Qualification criteria may include income limits and lack of insurance coverage.

- Borrowing money for medical bills: A medical credit card such as CareCredit or a personal loan are two ways to finance medical bills, but both come with interest that can increase the total cost. Financial planner Carlos advised that using a loan or credit card is best for one-time urgent medical expenses rather than recurring costs such as semaglutide medications. They can be fast-funding options that help bridge a gap while patients sort out insurance coverage and their longer-term finances.

The diabetes drug has become the latest weight loss craze, and it triggers bigger concerns over the inherited diet obsession within Latinx culture.

Be proactive

Once you decide to start Ozempic, create a plan that factors in the additional costs to your monthly budget and ways to manage the financial impact. Filstrup acknowledged that the medication, despite its benefits, is an expense that many people may not be able to afford.

Both Haines and Filstrup said that semaglutide medication is a tool, along with exercise and nutrition, for a more significant shift in health.

âThe medication is just very helpful,â Haines said. âIt provides you with the opportunity to become healthier.â

Choudhuri-Wade writes for personal finance website NerdWallet. This article was distributed by the Associated Press.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.