Disney to pour $60 billion into parks over the next decade

- Share via

Walt Disney Co. plans to nearly double investment in its parks and resorts segment to $60 billion over the next 10 years.

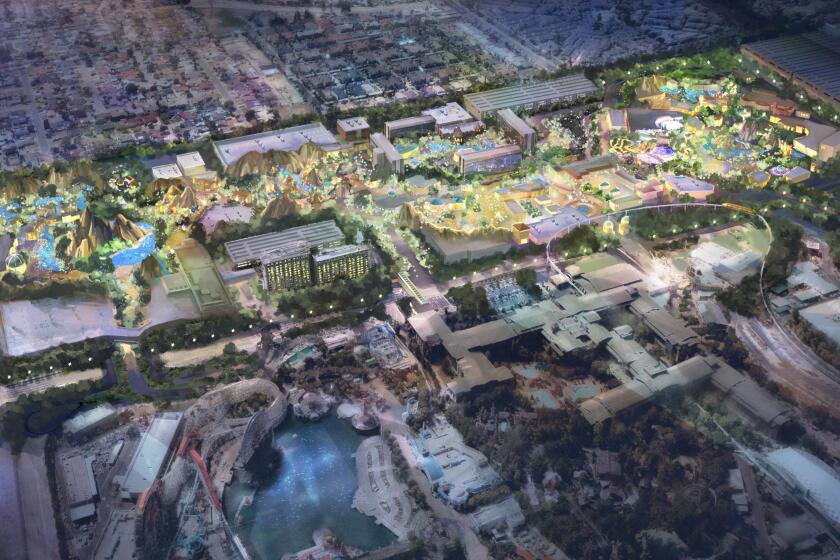

The world’s largest theme-park operator said it has more than 1,000 acres of land it could develop and cited the increased profits it has seen over previous years from investing in rides, cruise ships and other attractions tied to its movies and characters, according to a filing Tuesday.

Disney said it has seen record growth in customer spending at the parks over the last two years, and a significant decrease in the number of tickets it sells at a discount, compared with before the COVID-19 pandemic.

The market reacted negatively to the news, however, with Disney falling 3.6% to close at $81.94.

“I think investors over-reacted to the [capital expenditure] spending,” Lightshed Partners analyst Rich Greenfield said in an email. “It will grow gradually. No big step up anytime soon.”

The company is hosting a three-day series of events for Wall Street analysts at its Walt Disney World resort. The program, which began Monday, includes tours of the theme parks as well as of its newest cruise ship, the Disney Wish. Also scheduled were presentations from Chief Executive Bob Iger, ESPN Chairman Jimmy Pitaro and theme parks chief Josh D’Amaro.

Walt Disney Co.’s plan to squeeze more into its Anaheim resort passed another milepost in the long pitch process to win rezoning approval from the city.

Rival Comcast Corp. has also been investing in its Universal Studios theme-park business with smaller attractions planned in Texas and Nevada and a giant new resort under construction in Orlando.

Parks chief D’Amaro suggested in his remarks that characters from “Frozen,” the hit animated film, could become an attraction at California’s Disneyland. He also said the company could do more with its “Black Panther” and “Coco” film characters.

In a fireside chat with analysts Tuesday, Pitaro said the company has been doing a lot of research on a direct-to-consumer version of its flagship ESPN sports channel.

Disney has been wrestling with seismic changes in the TV and film business as consumers watch more programming on streaming services, rather than on traditional TV and in movie theaters. Iger has said the company may sell traditional channels such as ABC, and that it’s looking for a strategic partner at ESPN.

Iger returned to run the company in November after the board fired CEO Bob Chapek. Disney shares have recently traded at nine-year lows.

Separately, Warner Music Group said it had hired longtime Disney financial executive Bryan Castellani to be its new chief financial officer.

Have a strange yearning to inhale the damp, musty air of Pirates of the Caribbean or walk along charming Main Street U.S.A.? This may be why.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.