Covered California health insurance premiums will jump next year

SACRAMENTO â Monthly health insurance premiums for roughly 1.7 million people in California will go up an average of 9.6% next year â the largest increase in five years â but state officials said many consumers wonât feel those hikes because taxpayers will pay for them.

The federal Affordable Care Act lets people who donât get health insurance from their jobs buy coverage from a marketplace. Most states let the federal government run their marketplaces for them. But California runs its own marketplace called Covered California.

Monthly premiums on plans purchased through Covered California were stable throughout the pandemic, increasing an average of just over 1% per year from 2020 through 2022 as many people delayed routine healthcare. But this year, rates jumped 5.6% in California as people started returning to doctorâs offices.

The Los Angeles City Council voted Wednesday to put the proposed measure to clamp down on pay for hospital executives on the March 2024 ballot.

State officials blamed next yearâs increase on a variety of factors, including inflation, higher pharmacy costs and labor shortages. Covered California Executive Director Jessica Altman called it âa challenging year for healthcare costs.â

But this weekâs announcement of higher premiums was not met by hand-wringing from consumer advocates, who said many people wonât end up paying more because of a number of government assistance programs. Congress passed a law last year that says when a person buys a Silver-level plan â the most commonly purchased coverage â the premium cannot exceed 8.5% of that personâs income. If it does, the federal government will pay the difference. The law is to be in place through the end of 2025.

State officials say that means more than one-third of people who buy coverage through Covered California would see no change in their monthly premiums as long as they stay with the same insurance company and donât move to another part of the state. Covered California says 20% of consumers wonât pay any premiums at all.

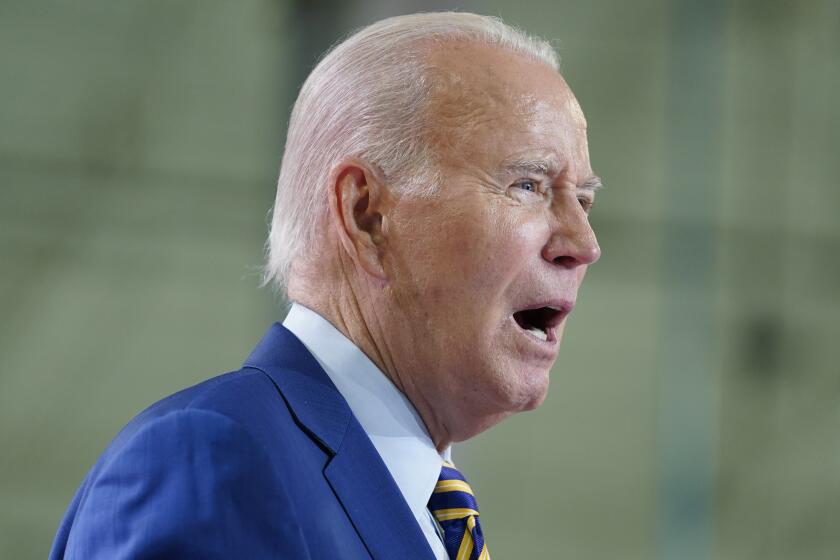

Gearing up for a 2024 reelection campaign as inflation remains a voter concern, the president has emphasized his policies to help families with expenses.

In addition, Californiaâs state budget this year included new spending to eliminate hospital deductibles for about 650,000 people who purchase Silver plans through Covered California. The money comes from a tax on people who refuse to buy health insurance. The new spending means individuals who make up to $34,000 per year and families of four with incomes of up to $70,000 per year will save up to $5,400, according to Health Access California, a consumer advocacy group.

âConsumers should be alarmed by rising health costs but also be comforted that Covered California is offering direct and meaningful relief that should shield them from premium hikes,â Health Access California Executive Director Anthony Wright said.

Still, some consumers could see increases next year, depending on where they live and which company they use. The biggest average increases will be in rural parts of the state with small populations and fewer coverage options.

Of the 11 companies that sell plans on the state exchange, Blue Shield of California had the biggest average increase at 15%. The company reported more than $24 billion of revenue last year but said most of it went to paying claims, resulting in a loss of $910 million for the year. Aetna CVS Health had the smallest average increase of 0.2%.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.