Keeping your money safe amid bank failures

- Share via

The recent failures of Silicon Valley Bank and Signature Bank, which catered mostly to the tech industry, may have you worried about your money. They were the second- and third-biggest bank failures in U.S. history.

After too many depositors tried to withdraw their money from Silicon Valley Bank in Santa Clara, Calif. — that’s known as a bank run — regulators took over the bank on March 10.

Regulators took control of New York-based Signature Bank soon after, saying it was necessary to protect depositors after too many people withdrew money.

Regulators also guaranteed all deposits at the two banks and created a program to help shield other banks from a run on deposits.

Here’s what you need to know:

Silicon Valley Bank failed late last week, prompting fears of wider upheaval. Here’s what you should know about the collapse and what comes next.

Is my money safe?

Yes, if your money is in a bank insured by the Federal Deposit Insurance Corp. and you have less than $250,000 there. If the bank fails, you’ll get your money back.

Nearly all banks are FDIC insured. You can look for the FDIC logo at bank teller windows or on the entrance to your bank branch.

Credit unions are insured by the National Credit Union Administration.

If you have more than $250,000 in individual accounts at one bank, which most people don’t, the amount over $250,000 is uninsured and experts recommend that you move the remainder of your money to a different financial institution, said Caleb Silver, editor in chief of Investopedia, a financial media website.

If you have multiple individual accounts at the same bank, for example a savings account and certificate of deposit, those are added together and the total is insured up to $250,000.

Federal officials have been taking steps to make sure other banks aren’t affected.

“You shouldn’t be too concerned about your money if it’s in one of the bigger banks, and even in some of the regional banks and the credit unions,” Silver said.

The Silicon Valley Bank failure is the old story of what happens when short-term depositors want their money back from a bank with only long-term assets.

Can I tell if my bank will fail?

If you are worried about your bank closing in the near future, there are some things you can watch out for, Silver said:

- Watch the stock price of your bank.

- Keep an eye on the quarterly and annual reports from your bank.

- Start a Google alert for your bank in case there are news stories about it.

You want to make sure you pay close attention to the way your bank is behaving, Silver said.

“If they’re trying to raise money through a share offering or if they’re trying to sell more stock, they might have trouble on their balance sheet,” he said.

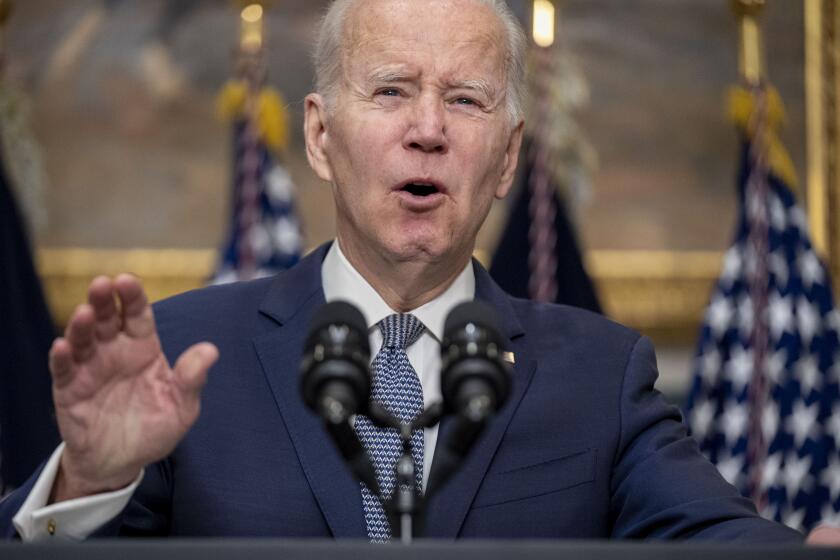

Assuring the public a crisis in the banking system was under control, President Biden blamed his predecessor for creating the conditions for the collapse of Silicon Valley Bank and Signature Bank.

Should I look for alternatives?

If you have more than $250,000 in your bank, there are a few things you can do:

- Open a joint account.

You can protect up to $500,000 by opening a joint account with someone else, such as your spouse, said Greg McBride, chief financial analyst at Bankrate, a financial services company.

“A married couple can easily protect a million dollars at the same bank by each having an individual account and together having a joint account,” McBride said.

If a couple each has individual accounts and a joint account where they have equal withdrawal rights, they can each have up to $250,000 insured in their single accounts and up to $250,000 in their joint accounts. That means each of them will have up to $500,000 insured.

- Move to another financial institution.

Moving your money to other financial institutions and having up to $250,000 in each account will ensure that your money is insured by the FDIC, McBride said.

- Do not withdraw cash.

Despite the recent uncertainty, experts don’t recommend withdrawing cash from your account. Keeping your money in financial institutions rather than in your home is safer, especially when the amount is insured.

“It’s not a time to pull your money out of the bank,” Silver said.

Even people with uninsured deposits usually get nearly all of their money back.

“It takes time, but generally all depositors — both insured and uninsured — get their money back,” said Todd Phillips, a consultant and former attorney at the FDIC. “Uninsured depositors may have to wait some time, and may have to take a haircut where they lose 10% to 15% of their savings, but it’s never zero.”

Historically, the FDIC says it has returned insured deposits within a few days of a bank closing. The FDIC will either provide that amount in a new account at another insured bank or issue a check.

The Silicon Valley Bank collapse sent some business owners and individual account holders scrambling for safe places to put their money.

What about other investments?

The FDIC offers an Electronic Deposit Insurance Estimator, a tool to know how much of your money is insured per financial institution.

FDIC deposit insurance covers:

- checking accounts, negotiable order of withdrawal (NOW) accounts, savings accounts, money market deposit accounts (MMDAs), certificates of deposit (CDs), cashier’s checks, money orders and other official items issued by an insured bank.

FDIC deposit insurance doesn’t cover:

- stock investments, bond investments, mutual funds, life insurance policies, annuities, municipal securities, crypto assets, safe deposit boxes or their contents, U.S. Treasury bills, bonds or notes.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.