Federal Reserve officials sound warnings about higher rates

- Share via

A run of strong economic data and signs that inflation remains stubbornly high could lead the Federal Reserve to raise its benchmark rate higher in the coming months than it has previously forecast, several Fed officials say.

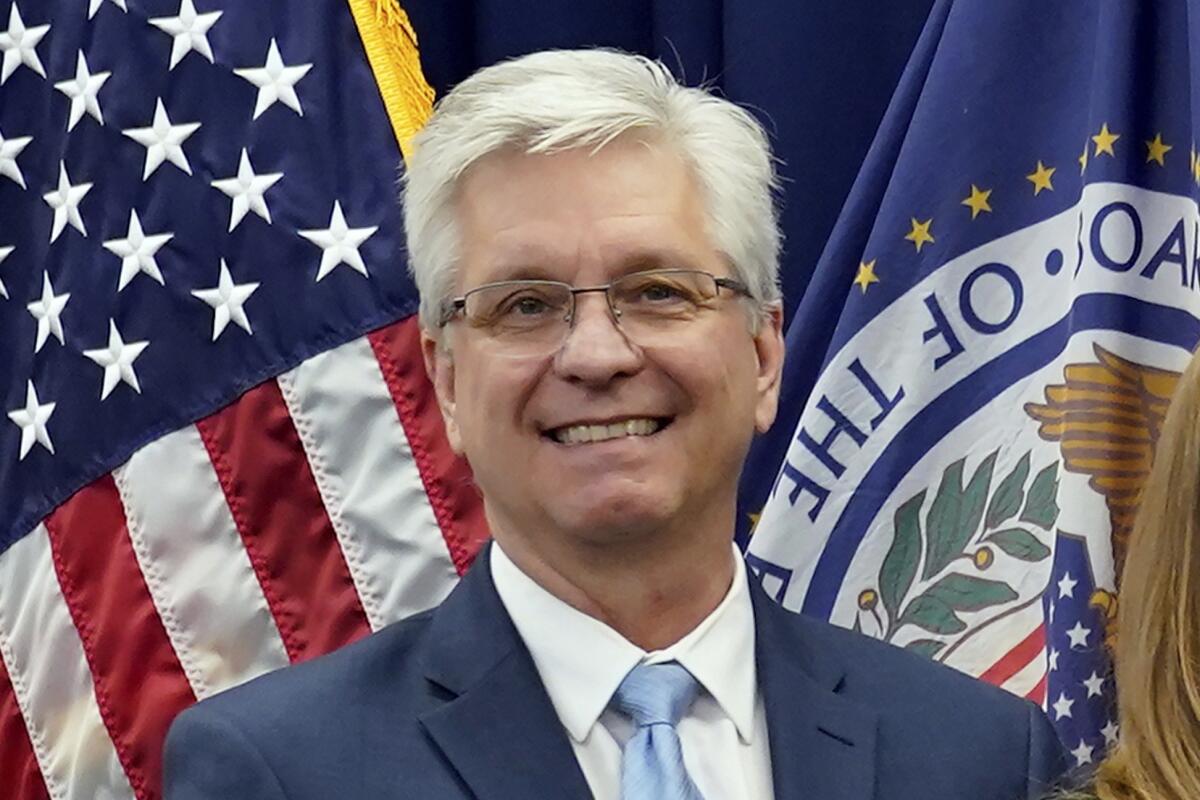

On Thursday, Christopher Waller, a member of the Fed’s influential Board of Governors, said that if the economy continued to show strength and inflation remained elevated, the central bank would have to lift its key rate above 5.4%. That would be higher than Fed officials had signaled in December, when they projected it would peak at roughly 5.1% this year.

“Recent data suggest that consumer spending isn’t slowing that much, that the labor market continues to run unsustainably hot and that inflation is not coming down as fast as I had thought,” Waller said in prepared remarks for a business conference in Los Angeles.

His suggestion was in contrast to a speech he gave in January, titled “A Case for Cautious Optimism,” that captured a prevailing sentiment at the time that inflation had peaked and was steadily declining.

Even if data to be released later this month were to show hiring and inflation cooling again, Waller said, he would still favor raising the Fed’s rate to a range between 5% to 5.5%, up from about 4.6% now. And if the economic figures were to “continue to come in too hot,” he said, the Fed’s key rate “will have to be raised this year even more to ensure that we do not lose the momentum that was in place” before the robust January economic reports.

America’s consumers rebounded last month from a weak holiday shopping season by boosting their spending at stores and restaurants at the fastest pace in almost two years.

Over the last year, the Fed has raised short-term rates at the fastest pace in four decades to try to curb the worst inflation since the early 1980s. Those hikes have led to higher rates across the economy: Mortgage rates have nearly doubled, to 6.7%, and auto loans, credit card borrowing and business loans have become more expensive.

The Fed’s goal is to cool the economy by raising the cost of borrowing and slowing business and consumer spending. More modest growth probably would help slow inflation to the Fed’s 2% target. Fed officials next meet March 21-22, when they are expected to raise their key rate by a quarter-point to about 4.9%.

In recent weeks, several reports suggested that the economy was stronger and inflation more persistent than previous data had indicated. The economy gained a total of more than half a million jobs in January, and the unemployment rate reached a 53-year low of 3.4%.

Inflation data was also revised higher and came in hotter than expected in January. Waller noted that for the final three months of last year, core inflation — which excludes the volatile food and energy categories — was revised up to an annual rate of 4.3% from 3.1%. It then rose to 4.6% in January.

“Although inflation has been coming down since the middle of last year,” Waller said, “the recent data indicate that we haven’t made as much progress as we thought.”

America’s employers added a stunning 517,000 jobs in January, a surprisingly strong gain in the face of the Federal Reserve’s higher interest rates.

Other Fed officials have also expressed unease about the reports showing higher inflation and hotter growth. On Wednesday, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, said, “I lean towards continuing to raise further.”

“These are concerning data points, suggesting that we’re not making progress as quickly as we would like,” Kashkari said.

And on Thursday, Raphael Bostic, president of the Atlanta Fed, said he supports pushing rates to about 5.1% in coming months, the same as projected in December. He added that the Fed’s rate hikes may not start to bite until this summer, so the Fed needs to be cautious about tightening credit too far and causing a recession.

Yet Bostic also added, “There is a case to be made that we need to go higher.”

“Jobs have come in stronger than we expected,” Bostic said. “Inflation is remaining stubborn at elevated levels. Consumer spending is strong. Labor markets remain quite tight.”

And on Friday, Loretta Mester, president of the Cleveland Fed, told Bloomberg News that the Fed “needs to do a little more” to raise rates and to keep them elevated for an extended period.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.