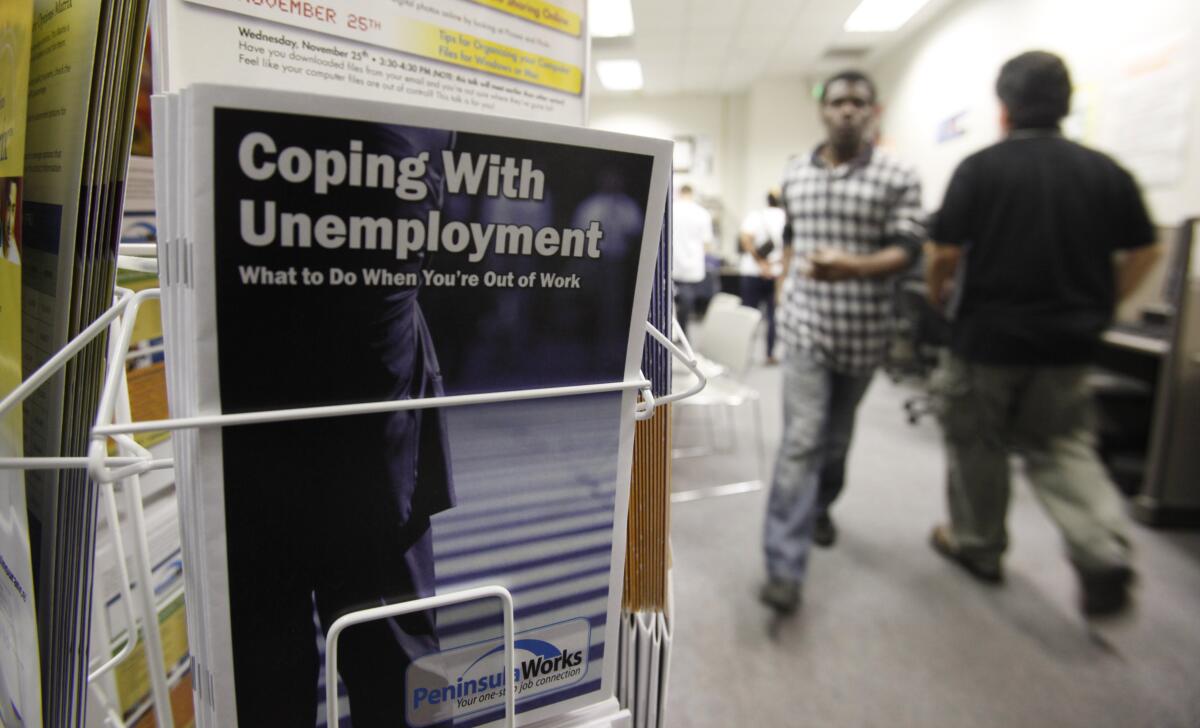

With a recession looming, here’s what you need to know about unemployment insurance

- Share via

The U.S. economy contracted by 1.6% in the first quarter of this year, setting the stage for a recession if economic output declines again in the second quarter, said economist Anil K. Puri, director of the Woods Center for Economic Analysis and Forecasting at Cal State Fullerton.

It may be a bit too early to tell whether we’ll get there, Puri said. But the higher interest rates, supply shortages and high inflation that have flared up in the last two years are good indicators that a recession may be on the horizon.

But there’s no one formula for triggering a recession. Puri said that each of the previous U.S. recessions — which have struck every 6½ years or so since 1945, according to reporting from The Times — has been preceded by its own unique circumstances, which have also affected the duration and severity of the downturns.

Nevertheless, Puri predicted that if the GDP doesn’t improve by next quarter, you can expect to see a decline in employment, income and spending.

The California economy is reasonably strong at the moment. Its unemployment rate stood at 4.3% in May, close to its pre-pandemic low (although higher than the ultra-low national average of 3.6%).

Puri said that people should be concerned mainly about the rising cost of borrowing and prices in general. The job market is likely to shrink as well, meaning those who are unemployed will probably have a more difficult time securing another job.

Those who are laid off can usually count on unemployment insurance checks to help them make ends meet. Here’s what you need to know about receiving those benefits.

Who is eligible for unemployment benefits?

Managed by the California Employment Development Department, the UI program is a form of insurance that almost all employers pay into on behalf of their workers. The employers’ payments collectively cover the cost of the benefits paid to all employees laid off or furloughed, or whose hours are sharply reduced.

In California, if you lose your job or have your hours reduced through no fault of your own, you may be eligible for weekly UI benefits. Remember, though, that these benefits are available only to employees — that is, people whose income is reported on a W-2 form.

If you’re self-employed or an independent contractor, you are not automatically eligible because your employer — you — didn’t pay the taxes that fund the UI program. You’ll be eligible only if you worked as an employee within the previous 18 months for a company that paid into the system on your behalf.

(In response to the COVID-19 shutdowns, the federal government created Pandemic Unemployment Assistance to aid self-employed workers and contractors, but that program has expired.)

If you believe that you meet the definition of an employee but were misclassified as a contractor, you can file a claim for benefits and let the department determine your eligibility.

Other eligibility requirements besides losing your job or having your hours cut include:

- Being physically able to work

- Being available for work

- Being ready and willing to accept work immediately

- Being more than minimally attached to the workforce

To calculate whether you are “more than minimally attached,” the state looks at your earnings over a 12-month period within the previous year and a half. To be eligible, you need to have earned at least $1,300 in one of those prior quarters or at least $900 in your highest-paid quarter (your “base period”), plus at least 25% of that amount in the other three quarters combined.

In addition, UI benefits are available only to people permitted to work in the United States. That rules out many noncitizens; according to the Public Policy Institute of California, immigrants living in California without authorization make up 9% of the state’s workforce. If your work permit lapses before your UI benefits run out, the EDD may continue your benefits if you can prove that you logged at least one year of work prior to filing your claim, according to the EDD.

If you quit your job, you are not immediately eligible for UI, nor are you necessarily ineligible. According to the EDD, you’ll have to file a claim and prove that you quit for a good reason.

Your employer may be able to stand in the way of you getting benefits as well. If it can show you were fired for misconduct, you would not be eligible.

For the record:

1:24 p.m. July 5, 2022A previous version of this story said that appeals were heard by administrative law judges and appeals panels at the Employment Development Department. Appeals are heard by the California Unemployment Insurance Appeals Board, an independent state agency.

Any EDD decision on benefits can be appealed to an administrative law judge at the California Unemployment Insurance Appeals Board. The administrative law judge’s ruling may also be appealed, first to the appeals board and then to the state courts system.

How do you apply for UI benefits?

The quickest way, the department says, is to apply online at www.edd.ca.gov/UI_Online.

You’ll need to provide proof that you’re eligible, including proving that you are who you claim to be. The state uses ID.me to verify your identity; you’ll need to upload a selfie and copies of either two official picture IDs, such as a driver’s license and a passport, or one official picture ID and two other official records without pictures, such as a Social Security card and a birth certificate.

After establishing your identity, you’ll need to provide information about your last employer, including its name, address and phone number, your supervisor’s name, the last day you worked, the reason you no longer have that job and the total gross pay you received in your last week of work (from Sunday through your final day).

You’ll also need to document your work history over the last 18 months, providing similar information for your employers and your earnings in that period.

Oddly enough, the EDD’s online application process is not open around the clock. Instead, you can file your claim with UI Online only during the following times:

- Monday from 4 a.m. to 10 p.m.

- Tuesday through Friday from 2 a.m. to 10 p.m.

- Saturday from 2 a.m. to 8 p.m.

- Sunday from 5 a.m. to 8:30 p.m.

If you can’t use ID.me, you’ll need to apply for benefits by phone, fax or mail.

To apply by phone: Representatives are available Monday through Friday, 8 a.m. to 5 p.m., except on holidays. The state has set up different phone lines to offer service in multiple languages.

- English or Spanish, (800) 300-5616 or (800) 326-8937

- Cantonese (800) 547-3506

- Vietnamese (800) 547-2058

- Mandarin (866) 303-0706

- TTY (800) 815-9387

To apply by fax or mail: You’ll still need to go online to download a printable application in English or in Spanish from the EDD’s website. Help is available from a federally subsidized jobs center; consult the American Job Center site for a list of the centers near you.

Faxing your application to (866) 215-9159 may result in a faster turnaround.

Applications that are mailed in may take longer to process. Send yours to P.O. Box 989738, West Sacramento, CA 95798-9738.

How long do you have to wait for benefits?

The department says it tries to make a decision on claims within three weeks, and once a claim is accepted, there is an additional wait of one week. Currently, only a fraction of the claims filed have been awaiting action for more than three weeks.

But when claims skyrocketed at the start of the pandemic, so did the waiting times for new applicants. Some laid-off Californians waited months for help; at one point in 2020, more than 1.5 million people were stuck in the backlog.

The EDD struggled to implement the new benefits launched by the federal government, including aid for gig workers and other contractors, and looser eligibility requirements contributed to an epic amount of unemployment fraud. The state is trying to avoid another pileup of claims — real and fraudulent — by upgrading the antiquated EDD systems that were overwhelmed by claims during the pandemic.

Which employers have to obtain unemployment insurance?

As an employer, you must pay UI taxes for any employee whom you’ve paid more than $100 in a three-month period, according to the EDD. The tax applies to the first $7,000 of each worker’s wages. The rate for new employers is 3.4%, and for others it’s 1.5% to 6.2%, depending on their history of UI claims.

In addition to businesses with one or more employees, the list of employers required to pay into the UI program includes:

- Nonprofit agencies

- Elementary, secondary and vocational schools

- State and local governments and federal agencies

- Agricultural employers

- Families that pay a maid, nanny or other domestic worker $1,000 or more in a single quarter

- Native American tribes recognized by the federal government

How large are the benefits?

Your work-related income during a recent one-year period determines how much UI you will receive per week. The amount is equal to roughly half your weekly wages, bonuses and tips (technically, your highest quarterly income divided by 26), with a minimum weekly benefit of $40 and a maximum of $450.

To find out how much you’re eligible for, visit the EDD’s website and use the UI calculator.

Your benefits will continue for 26 weeks, assuming you don’t find a new permanent job before then that pays more than you receive in UI. After that, if unemployment in the state remains high, you may qualify for up to 13 more weeks, although to be eligible you need to have earned in your “base period” at least 40 times your weekly benefit amount.

During times of sustained high unemployment, Congress has usually extended UI benefits multiple times. So if you still can’t find a job after 39 weeks, if the unemployment rate is high, you may qualify for more help.

The 26 weeks of standard UI benefits are available for 12 months (but not after that), beginning at the start of your claim. That provides some cushion if you miss the biweekly deadline to recertify your eligibility (see below), become temporarily ineligible because of illness, injury or short-term work, or have some other interruption in your benefits.

If you’ve exhausted your benefits and are still looking for a job that can sustain you, you’ll have to open a new claim, but you won’t be eligible unless you’ve met the earnings requirement at some point during the last 18 months ($1,300 in a single quarter, or $900 to $1,299 in a quarter plus 25% of that amount during the rest of that year). Typically, that means you found enough temporary work between the weeks you spent on unemployment to meet the income threshold for a new round of benefits.

Can you work and still collect UI?

In California, you can work part time and still receive benefits. Any income you make will be subtracted from your weekly payment.

For example, if you make $50 at work and are receiving $200 in UI, you’ll receive only $150 in benefits for the week.

You can also pause your benefits while you work a temporary job, then resume them after the job ends — provided that less than a year has passed since the start of your UI claim.

The state also offers a work-sharing program that supports employers wanting to avoid layoffs. Employers who reduce at least two of their employees’ hours by 10% to 60% are eligible for supplemental UI for their workers.

The supplement is equal to the percentage of your income lost times the amount of UI benefits you would have received had you been laid off. For example, if you would have qualified for $300 in UI and your hours were cut by 15%, then you’d receive $45.

Maintaining eligibility for UI benefits

To continue receiving UI, you have to recertify every two weeks that you still meet the requirements for benefits. You can do that through the EDD’s online UI portal or by calling the EDD Tele-Cert at (866) 333-4606. Both are available around the clock.

You’ll be asked six questions to confirm that you are:

- Physically able to work

- Available to work

- Ready to accept work immediately

- Eligible for the same amount of aid

If you don’t recertify on time, your payment could be delayed or denied.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.