- Share via

Elizabeth Woodruff drained her retirement account and took on three jobs after she and her husband were sued for nearly $10,000 by the New York hospital where his infected leg was amputated.

Ariane Buck, a young father in Arizona who sells health insurance, couldn’t make an appointment with his doctor for a dangerous intestinal infection because the office said he had outstanding bills.

Allyson Ward and her husband loaded up credit cards, borrowed from relatives and delayed repaying student loans after the premature birth of their twins left them with $80,000 in debt. Ward, a nurse practitioner, took on extra nursing shifts, working days and nights.

“I wanted to be a mom,” she said. “But we had to have the money.”

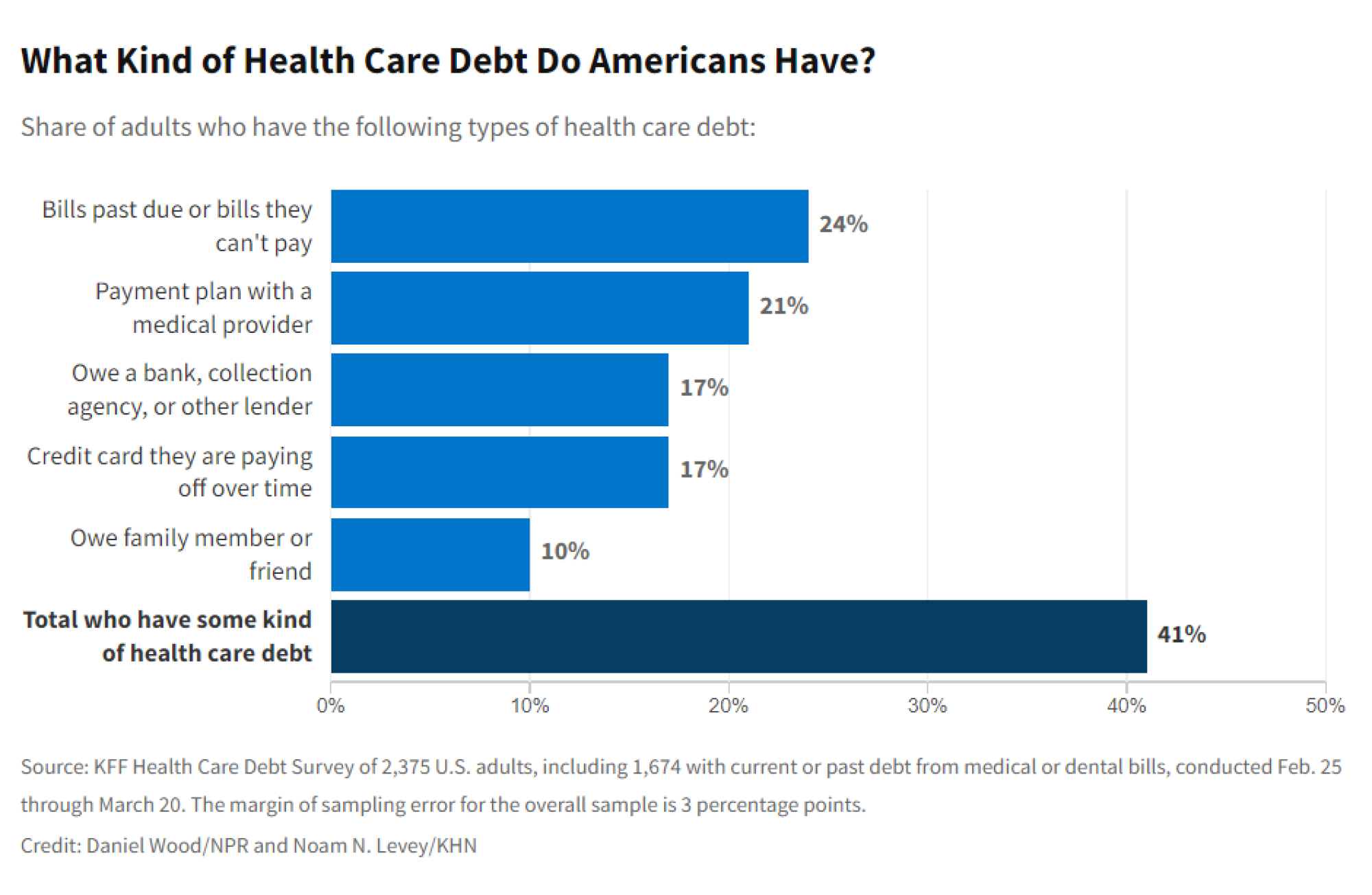

The three are among more than 100 million people in the U.S. ― including 41% of adults ― beset by a healthcare system that is systematically pushing patients into debt on a mass scale, an investigation by KHN and NPR shows.

The investigation reveals a problem that, despite new attention from the White House and Congress, is far more pervasive than previously reported. That is because much of the debt that patients accrue is hidden as credit card balances, loans from family or payment plans to hospitals and other medical providers.

To calculate the true extent of this debt, the KHN-NPR investigation draws on a nationwide poll conducted by the nonprofit Kaiser Family Foundation for this project. The poll was designed to capture bills patients couldn’t afford, as well as other borrowing used to pay for healthcare. New analyses by the Urban Institute and other research partners also inform the project.

The picture is bleak.

People talk about the sacrifices they made when healthcare forced them into debt.

More than half of U.S. adults report that in the last five years they’ve gone into debt because of medical or dental bills, the KFF poll found.

A quarter of adults with healthcare debt owe more than $5,000. And about 1 in 5 with any amount of debt said they don’t expect to ever pay it off.

“Debt is no longer just a bug in our system. It is one of the main products,” said Dr. Rishi Manchanda, who has worked with low-income patients in California for more than a decade and served on the board of the nonprofit RIP Medical Debt. “We have a healthcare system almost perfectly designed to create debt.”

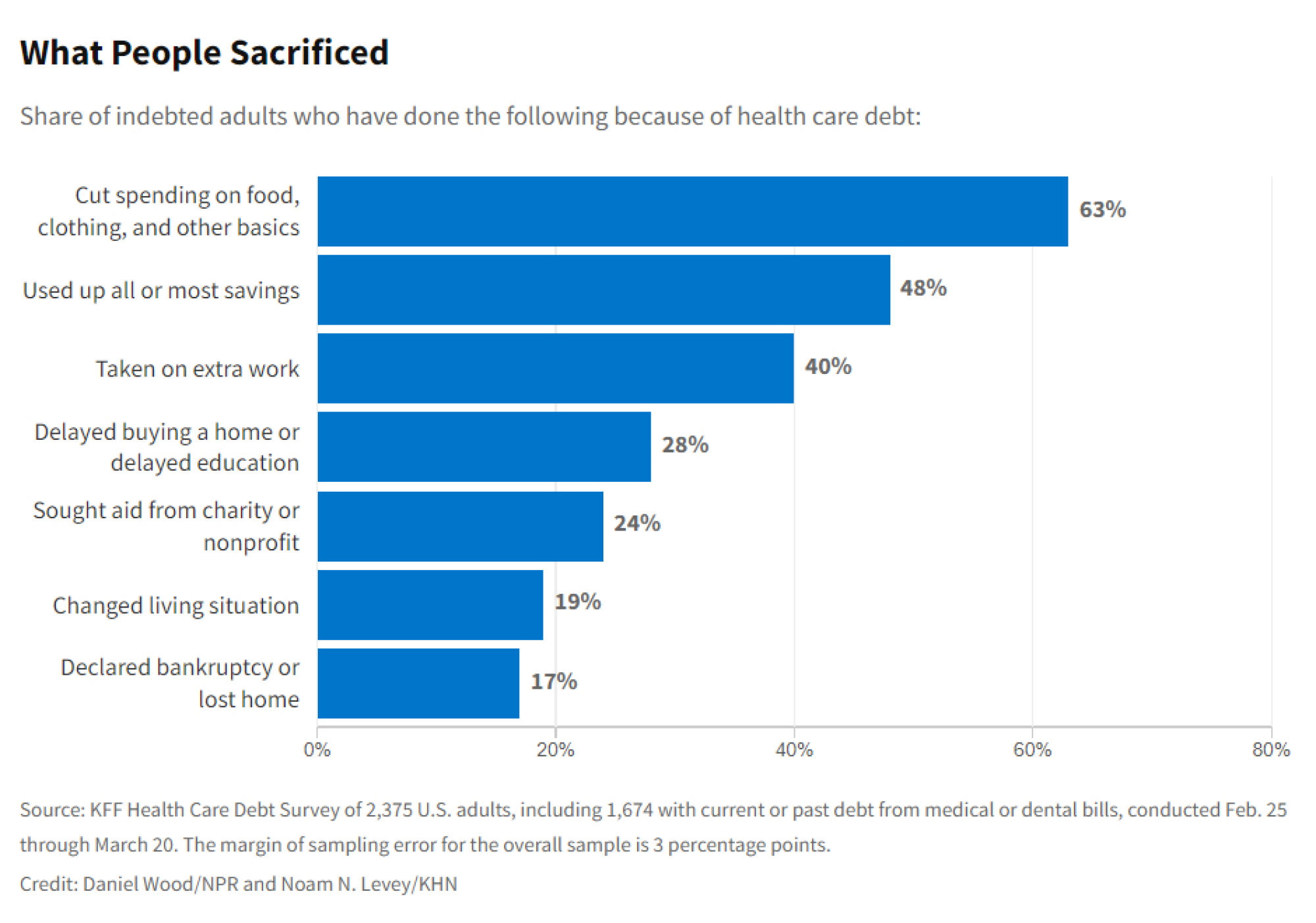

The burden is forcing families to cut spending on food and other essentials. Millions are being driven from their homes or into bankruptcy, the poll found.

Medical debt is piling hardships on people with cancer and other chronic illnesses. Debt levels in U.S. counties with the highest rates of disease can be three or four times what they are in the healthiest counties, according to an Urban Institute analysis.

The debt is deepening racial disparities.

And it is preventing Americans from saving for retirement, investing in their children’s educations or buying a home.

Perhaps most perversely, medical debt is blocking patients from care.

About 1 in 7 people with debt said they’ve been denied access to a hospital, doctor or other provider because of unpaid bills, according to the poll. An even greater share ― about two-thirds ― have put off care because of the cost.

“It’s barbaric,” said Dr. Miriam Atkins, a Georgia oncologist who, like many physicians, said she’s had patients give up treatment for fear of debt.

The No Surprises Act, which took effect this month, makes it illegal for hospitals to slap patients with sky-high charges for out-of-network care.

Patient debt is piling up despite the landmark 2010 Affordable Care Act, which expanded coverage to tens of millions of Americans but did not slow the rise of high-deductible health plans that leave patients with thousands of dollars in bills.

Now hospitals and other medical providers are pushing millions into credit cards and other loans.

Patient debt also sustains a shadowy collections business fed by hospitals that sell debt to collection companies.

America’s debt crisis is driven by a simple reality: Half of U.S. adults don’t have the cash to cover an unexpected $500 healthcare bill, the KFF poll showed.

Many simply don’t pay. Medical debt is the most common form of debt on consumer credit records.

As of last year, 58% of debts recorded in collections were for a medical bill, according to the Consumer Financial Protection Bureau. That’s nearly four times the percentage attributable to telecom bills, the next most common form of debt on credit records.

But the medical debt on credit reports represents only a fraction of the money that Americans owe for healthcare, the KHN-NPR investigation shows.

- About 50 million adults ― roughly 1 in 5 ― are paying off bills for their own care or a family member’s through an installment plan with a hospital or other provider, the KFF poll found.

- One in 10 owe money to a friend or family member who covered their medical or dental bills, another form of borrowing not customarily measured.

- Still more debt ends up on credit cards, as patients charge their bills and run up balances. About 1 in 6 adults are paying off a medical or dental bill put on a card.

For many Americans, debt from medical or dental care may be relatively low. About a third owe less than $1,000, the KFF poll found.

But healthcare debt can be catastrophic.

Sherrie Foy, 63, and her husband, Michael, saw their retirement upended when Foy’s colon had to be removed.

After Michael retired from Consolidated Edison in New York, the couple moved to rural Virginia. Sherrie had the space to care for rescued horses.

The couple had diligently saved and had retiree health insurance. But Sherrie’s surgery led to medical bills that passed the $1-million cap on their health plan.

When Foy couldn’t pay the more than $775,000 she owed the University of Virginia Health System, the couple declared bankruptcy.

The Foys cashed in a life insurance policy and liquidated savings accounts they had created for their grandchildren.

“They took everything we had,” Foy said. “Now we have nothing.”

Nearly 150,000 Californians would see their health insurance premiums rise significantly if Congress doesn’t extend subsidies set to expire this year.

Debt from medical and dental bills touches nearly every corner of U.S. society, burdening even those with insurance coverage through work or government programs such as Medicare.

About 1 in 8 medically indebted Americans owe $10,000 or more, the KFF poll said.

Americans have been hit particularly hard by the rise of high-deductible health plans, which force people to pay thousands of dollars out of their own pockets before coverage kicks in.

About a third of seniors have owed money for care, the poll found. And 37% of these said they or someone in their household have been forced to cut spending on food, clothing or other essentials.

Nearly half of Americans in households making more than $90,000 a year have incurred healthcare debt in the last five years, the KFF poll found.

Women are more likely than men to be in debt. And parents more commonly have healthcare debt than people without children.

Nationwide, according to the poll, Black adults are 50% more likely and Latino adults 35% more likely than whites to owe money for care.

The growing toll of the debt has sparked new interest from elected officials, including the White House, which in April announced new initiatives to crack down on debt collectors and track hospital financial aid.

Federal regulators are increasingly approving medicines before studies have shown they work, leaving patients at risk of taking prescriptions that could harm but not help them.

The changes probably won’t address the root causes of this national crisis. “The No. 1 reason, and the No. 2, 3 and 4 reasons, that people go into medical debt is they don’t have the money,” said Alan Cohen, a co-founder of insurer Centivo who has worked in health benefits for decades.

Buck, the Arizona father who was denied care, has seen this firsthand while selling Medicare plans to seniors. “I’ve had old people crying on the phone with me,” he said. “It’s horrifying.”

Buck, now 30, recovered from the intestinal infection, but after being forced to go to a hospital emergency room, he was hit with thousands of dollars in medical bills.

Today the Bucks, who have three children, estimate they owe more than $50,000.

“We’ve all had to cut back on everything,” Buck said. The kids wear hand-me-downs. They scrimp on school supplies and rely on family for Christmas gifts. “I feel as if I’ve failed as a parent.”

The couple are preparing to file for bankruptcy.

ABOUT THIS PROJECT

“Diagnosis: Debt” is a reporting partnership between Kaiser Health News and NPR exploring the scale, effects and causes of medical debt in America.

The stories draw on the KFF Healthcare Debt Survey, a poll designed and analyzed by public opinion researchers at Kaiser Family Foundation in collaboration with KHN journalists and editors. The survey was conducted Feb. 25 through March 20, 2022, online and via telephone, in English and Spanish, among a nationally representative sample of 2,375 U.S. adults, including 1,292 adults with current healthcare debt and 382 adults who had healthcare debt in the last five years. The margin of sampling error is plus or minus 3 percentage points for the full sample and 3 percentage points for those with current debt. For results based on subgroups, the margin of sampling error may be higher.

Additional research was conducted by the Urban Institute, which analyzed credit bureau and other demographic data on poverty, race and health status to explore where medical debt is concentrated in the U.S. and what factors are associated with high debt levels.

The JPMorgan Chase Institute analyzed records from a sampling of Chase credit card holders to look at how customers’ balances may be affected by major medical expenses.

Reporters from KHN and NPR also conducted hundreds of interviews with patients across the country; spoke with physicians, health industry leaders, consumer advocates, debt lawyers and researchers; and reviewed scores of studies and surveys about medical debt.

Levey writes for Kaiser Health News, an editorially independent publication of the Kaiser Family Foundation. Kaiser Health News is not affiliated with Kaiser Permanente.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.