Will that love letter help seal the deal — or add to housing discrimination?

- Share via

If you’re like most people, you wouldn’t think of writing a love letter to a person you’ve never met.

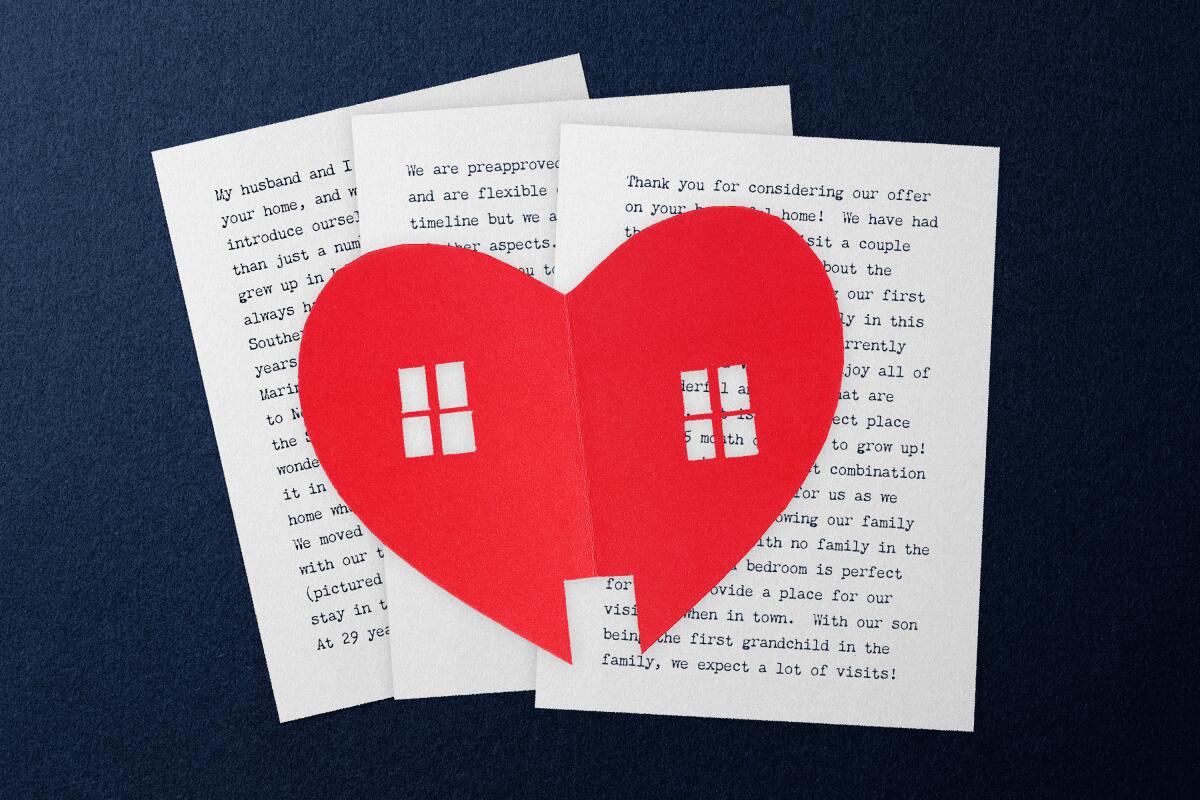

For years, prospective home buyers have been doing just that, professing their adoration to property owners they do not personally know and spilling all sorts of details to win their dream home.

It’s a practice that caught on in competitive housing markets, and in a place such as Los Angeles, where there is no shortage of creative writers, it became nearly engrained in the process of trying to buy a home.

Daniel Blatt’s real estate agent credits Blatt’s letter for helping him secure his four-bedroom home in Wilshire Center.

Blatt, a writer, felt the weight of the pandemic in his small West Hollywood apartment and went searching for more outdoor space. The rent-controlled spot had been his home since he moved to L.A. in 1999. It was time for a change.

When he found the home he wanted, his agent told him he should write a letter to distinguish his application among the others.

Southern California home buyers talk about how they made it through — or around — the flurry of ever-higher bids.

Blatt professed his love for the house, envisioning his “octogenarian mother” eating breakfast on the patio during her visits. He described how he would use the space to make edits to his fantasy epic, born in that West Hollywood apartment, which surely would blossom between refreshing walks in the home’s garden.

He got the home. “I know there were multiple offers on the table,” Blatt said.

The letters used to be more common in higher-end sales, but the ferocity of the current market made them more of a regular thing at all price ranges, said Vanessa Perry, a nonresident fellow at the Urban Institute think tank, who has been studying the letters since members of the California Assn. of Realtors cited the discrimination concerns they raise.

“People feel like they have to go out of their way to convince sellers that they’re the right person to sell a home to,” Perry said. “Since the beginning of the pandemic, we’ve seen markets become hot in places that are unexpected.”

The National Assn. of Realtors formally discourages the writing or accepting of buyer interest letters, noting how they can unfairly influence a sale through discrimination and unconscious bias.

“You want to be fair to everyone,” said Mantill Williams, the trade group’s vice president of public relations. “You want to make sure you’re giving people from all walks of life an opportunity to buy a house.”

Five homebuyers tell us how they chose which neighborhood to commit to in Greater Los Angeles — no small feat.

Oregon last year became the first state in the country to make these letters illegal, although a judge issued a preliminary injunction against the ban March 6. There are no laws in California or other states that block a seller from awarding a home to someone other than the highest bidder, and love letters are an obvious reason they might do so.

And with transactions so competitive, not all real estate agents think the letters are problematic. Realtor Liz Jones said some agents continue to encourage the practice, putting buyers in a tough position if they’d rather leave out the sweet talk.

“I’ve seen agents encouraging their buyers to send in a video,” Jones said. “It’s people trying to be technologically savvy, thinking, ‘Oh, it’s more personable by putting [it] on video.’ I’d say, don’t do that.”

Without any legal guidelines in California, Jones said, she tells her clients to ask the selling agents if they’re accepting letters before submitting one.

“You can try to be compliant and not write a letter, but then everyone else is doing one,” she said. “You don’t want to lose out because you’re not the one writing a letter.”

Perry said she feels love letters can be another tool that keeps underrepresented communities from owning a home. She notes how sellers can often prioritize those who remind them of themselves, either consciously or unconsciously.

Most people don’t buy a home with a 20% down payment. Here’s how you can put down less and get more help with down payment and closing costs.

As Black and brown people continue to own homes at a lower rate than their white counterparts, this can make it more difficult to take that next step, even if they’re financially qualified.

“People talk about things like their pets, their children, their hobbies, their favorite coffee shops in the neighborhood,” Perry said. “These are all signals. Even if they don’t explicitly say their race or other characteristics, these things can be inferred.”

Bryan Greene, vice president of policy advocacy at the National Assn. of Realtors, said he wasn’t aware of any formal fair housing complaints filed based on the contents of these letters. He emphasized that the lack of complaints didn’t mean they weren’t causing discrimination.

“It would be very difficult for a party whose offer was rejected to know that another buyer’s love letter prevailed, and to file a complaint,” he said.

If her clients are intent on writing a letter, Jones advises them not to include photos, as that might open them up to more overt discrimination.

Agent Fran Flanagan said she advises buyers to leave out characteristics such as sexual orientation, race and age.

Uncommon ways to buy a home

“You can say things like ‘we love your house’ that have nothing to do with discrimination,” Flanagan said. “That’s how we guide our buyer clients: Come from your heart, bring a little emotion, but steer clear of things that could cause discrimination.”

Andy Black, who recently purchased a condo in Playa Vista, said he submitted a buyer interest letter because he had common ground with the seller — and because he was submitting an offer lower than the listing price.

After living in Baltimore, he’d moved to Marina del Rey in 2016 before renting a place in Playa Vista with his wife in 2018. After saying in 2021 that it was “now or never,” they decided to start the home-buying process, and saw online that a unit in their building was up for sale.

At $1.4 million, the home was out of their price range, but the two gave it a shot because it had been on the market for five months and the seller was “very motivated.” They submitted a $1.2-million offer, along with a letter highlighting their commonalities — they both worked at nearby Loyola Marymount University — and got a yes.

“When we did a walk-through, we saw they had a map of all the places they’d traveled around the world,” he said. “We had the same map, so we made it really personal. We wanted them to understand that we couldn’t afford their initial price, but that we saw the potential in starting our family there, just like they’d done.”

Lou, who asked to be referred to by only her first name, had been searching for a home for months along with her husband, who served in the Marine Corps.

What does it really take to buy a house in Southern California? A Long Beach couple share their story, from strategic job moves to Realtor regrets.

Despite being approved for a Veterans Affairs loan — intended to help military families purchase their first home — Lou said they were outbid on more than 30 houses, and some sellers and agents seemed hesitant to deal with them because of the VA loan.

Eventually they secured a three-bedroom home in Canoga Park in November 2020, more than a year after they started searching. Despite the many setbacks, it was that same military background that ultimately helped them land the home — a connection made transparent through their love letter.

“We spoke to the seller, and she mentioned how her daughter was in the Army,” Lou said. “She really liked how we were young and planned to set roots here. She said she had higher offers, but she just liked us.”

Step-by-Step Guide

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.