Column: How the $1.9-trillion pandemic relief bill quietly but massively improves Obamacare

- Share via

For years, Democrats have been trying to fix some of the most glaring flaws in the Affordable Care Act: Premium subsidies are too stingy; red states have too little incentive to expand Medicaid.

They’ve been blocked at every turn by Republican obstructions.

But with a couple of provisions quietly inserted into the American Rescue Plan, the $1.9-trillion relief measure due to be voted on Wednesday by the House and promptly signed by President Biden, those goals will be met — a least for the next two years.

With the COVID relief plan poised for final passage, the first significant enhancement of the Affordable Care Act is about to become law.

— Larry Levitt, Kaiser Family Foundation

That’s because the new measure dramatically changes the structure of the ACA’s premium subsidies so they apply to everyone, rather than cutting off households that earn more than 400% of the federal poverty limit ($106,000 for a family of four), as the original ACA did.

Moreover, the subsidies for all those who were eligible under the old rules will be increased.

The relief bill also incentivizes Medicaid expansion through an offer that the 12 holdout red states can’t refuse, unless their political leadership is terminally dense.

The offer doesn’t just pay for the expansion; it provides much more in federal cash than the expansion would cost in any of those states, according to calculations by the Kaiser Family Foundation. Expansion in all those states would add 4 million residents to the ranks of the insured, the foundation estimates.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Although both provisions expire after two years, it’s a fair bet that they become permanent. A general rule of legislating is that it’s very difficult to take away a benefit after it’s put in place.

“With the COVID relief plan poised for final passage,” Larry Levitt, KFF’s executive vice president for policy, observed by tweet, “the first significant enhancement of the Affordable Care Act is about to become law, more than a decade after it was enacted.”

Both goals — improving the subsidies and expanding access to coverage for the lowest-income population — were in the campaign platforms of Hillary Clinton in 2016 and Biden in 2020.

Much of Biden’s healthcare reform platform would remain a work in progress even after passage of the rescue plan. Among the untouched planks are the creation of a public option — a health plan to compete with commercial insurance — and reform of drug price rules to lower prescription costs.

Biden reverses Trump’s widely ridiculed claim that the Affordable Care Act is unconstitutional.

The two-year sunset of the rescue plan’s provisions is a looming obstacle to permanent reform, but that’s a battle to be joined later. Of more immediate concern is a legal case, brought by Texas and other red states seeking to invalidate the ACA as a whole, that is currently under consideration by the Supreme Court.

Most legal experts don’t expect the court to overturn the law in its entirety, but the conservative majority could chip away at it in ways that create considerable mischief. A decision is expected in the spring or early summer.

Let’s take a closer look at the new provisions to see how they’ll improve the lot of Americans in the Obamacare target market.

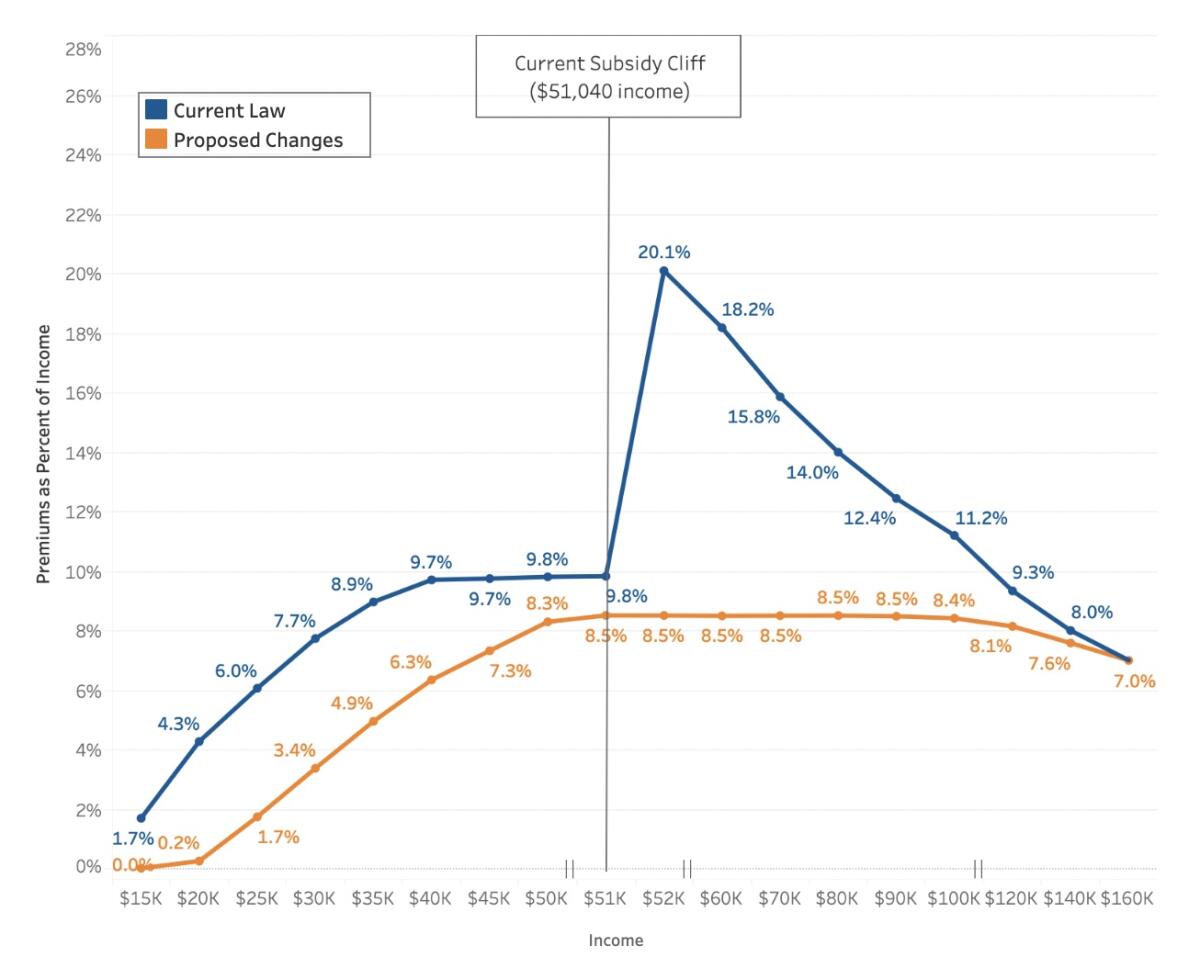

We’ll start with the subsidies. The original ACA subsidies were designed to cap premiums on a sliding scale ranging from 2.07% of income (for those earning 138% of the federal poverty line) to 9.83% of income (for those at 400% of the poverty line).

The subsidies were pegged to premiums for the benchmark silver plan — the second-cheapest silver plan in any given jurisdiction.

For a family of four earning $100,000, then, the benchmark plan wouldn’t cost more than $9,830 per person. For middle-class families, that’s still a daunting figure, since four policies could cost almost $40,000 in premiums alone.

“Many families still struggle to afford health insurance,” Biden’s campaign website observed, quite accurately.

Worse, there was the subsidy cliff. Families earning even a dime over the 400% poverty threshold lost all eligibility for subsidies. A typical 60-year-old customer falling over the brink would see the premium for his or her benchmark silver plan leap from 9.93% of income to more than 20%, KFF calculates.

Under the new measure, no one would have to pay more than 8.5% of income for a benchmark silver plan. Additionally, subsidies would be increased across the board.

Those earning from 100% to 150% of the poverty line ($26,500 to $39,750 for a family of four) would go from a maximum premium of 4.14% to zero premium. Those earning twice the poverty threshold would move from a maximum outlay of 6.52% of income to 2%.

The Congressional Budget Office estimates that for a 64-year-old earning $58,000, or 450% of the poverty line, the subsidy would go from zero under the old law to $7,950 under the new.

CBO estimates that the changes would cost the government $35.2 billion, mostly in fiscal 2021 and 2022, when they will be fully implemented.

Then there’s Medicaid expansion. Mandatory expansion of the state-federal program to add childless adults to the traditional target population of low-income families with children was part of the original Affordable Care Act.

The Supreme Court debated Obamacare’s technicalities, but the healthcare of all Americans hangs in the balance.

The federal government paid 100% of the cost of the expansion from 2014 through 2016, then reduced its share gradually to a permanent level of 90%, where it is today.

The Supreme Court overturned the mandatory feature in 2011, saving the ACA from extinction but giving politicians in red states a way to demonstrate their conservative bona fides. Several have come into the fold since 2011. But 12 states, the largest of which is Texas, are still holding out.

The relief bill gives them an enhanced carrot. States that haven’t yet expanded Medicaid would get an increase in the federal match for their traditional Medicaid programs of five percentage points. (That’s on top of the 6.2-point increase in the match enacted by Congress in its first pandemic rescue bill, passed last March and scheduled to remain in effect through next March.)

Because traditional Medicaid is much bigger than any expansion would be, the offered increase would more than pay for the expansion in every holdout state.

Expansion in every holdout state would cost them a total of $6.8 billion in fiscal 2022-23, KFF calculates. But the five-point bump in the traditional Medicaid federal share would bring them a total of $16.4 billion.

Texas would spend less than $3.2 billion on expansion but gain more than $5 billion from the increased share; Florida would spend $1.26 billion on expansion and collect $3.08 billion in return.

The math looks inescapable. Still, conservative ideology has shown the power to cloud politicians’ minds, especially on healthcare, so it’s not at all clear that free money and the prospect of placing 4 million Americans under the umbrella of health insurance will be enough to sway any of the last 12 states.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.