U.S. initial jobless claims data signal a slowing labor-market rebound

- Share via

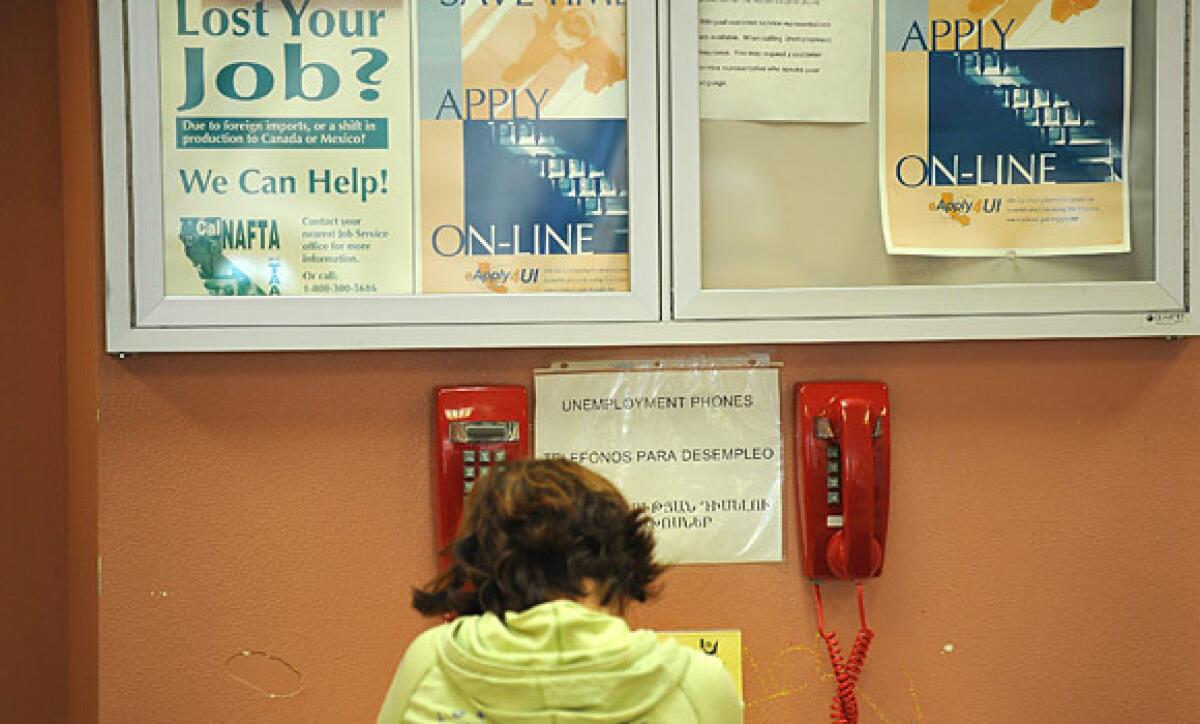

The number of Americans filing for unemployment benefits barely declined last week, signaling that challenges to the economic recovery are multiplying.

Initial jobless claims in regular state programs totaled 1.3 million in the week that ended July 11, down 10,000 from the prior period — the smallest decline since March, Labor Department figures showed Thursday. An additional 17.3 million Americans claimed ongoing unemployment benefits in state programs in the week that ended July 4, indicating economic pain remains widespread.

U.S. stocks fell at the market’s opening Thursday, and 10-year Treasury yields remained lower after the report.

The figures add to signs that the labor market recovery is stalling as coronavirus cases surge and reopenings pause or reverse across the country. Conditions are at risk of worsening with the potential expiration of supplemental federal jobless benefits, along with demand continuing to be depressed in a variety of sectors: American Airlines Group Inc. and United Airlines Holdings Inc., for instance, have indicated they could lay off tens of thousands of employees later this year.

The claims numbers took some of the steam out of a separate report showing retail sales rose in June by more than forecast and reached pre-pandemic levels, underlining the importance of the federal stimulus set to run out this month. Jobless filings exceeded 1 million for a 17th straight week, compared with an average of just above 210,000 before the pandemic.

“The jobless claims data suggests that further gains from here will be much harder to achieve,” said Michael Gapen, chief U.S. economist at Barclays. “The retail sales data tell us something about how households emerged from lockdown between mid-May and the end of June, but the jobless claims data are telling us something about their ability to carry that forward into July and August against a backdrop where it’s unclear whether additional federal benefits payments are forthcoming.”

Without seasonal adjustments, initial claims rose by 108,800, to 1.5 million, the first increase since early April, though the rise followed a shortened holiday week. Of states that have seen recent increases in virus cases, California, Florida and Arizona all saw increases in initial claims on an unadjusted basis.

So far, 22 states have either reversed or paused reopenings, according to Bank of America Corp. economists, with California recently shutting indoor dining statewide along with other actions.

Still, there was other positive news on the economy Thursday. A measure of consumer sentiment rose to the highest level since mid-April, while optimism among home builders jumped to pre-pandemic levels as mortgage rates fell to a record low.

Federal Reserve policymakers have sounded more cautious this week. Philadelphia Fed President Patrick Harker said in an interview Wednesday that his bank is revising its economic outlook in light of the virus surge and he’s a “little skeptical” July’s jobs gain will be as strong as the prior two months’.

In the week that ended July 11, states reported 928,488 initial claims for Pandemic Unemployment Assistance, the federal program that extends unemployment benefits to those not typically eligible, such as the self-employed. That’s down from 1.05 million the prior week.

The total number of unadjusted continuing claims in all programs fell by about 430,000, to 32 million, in the week that ended June 27, though this figure probably reflects an over-count of reported PUA continued claims — in some cases reflecting the number of retroactive weeks claimed rather than individual people.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.