Small-business loan program restarts Monday with fresh hopes and $320 billion

- Share via

The U.S. Small Business Administration will restart a government coronavirus relief loan program for small businesses next week with an additional $320 billion, after the first round of funding was exhausted in just 13 days.

The SBA will resume accepting applications for its Paycheck Protection Program at 10:30 a.m. Eastern time on Monday, the agency and the U.S. Treasury Department said in a joint release.

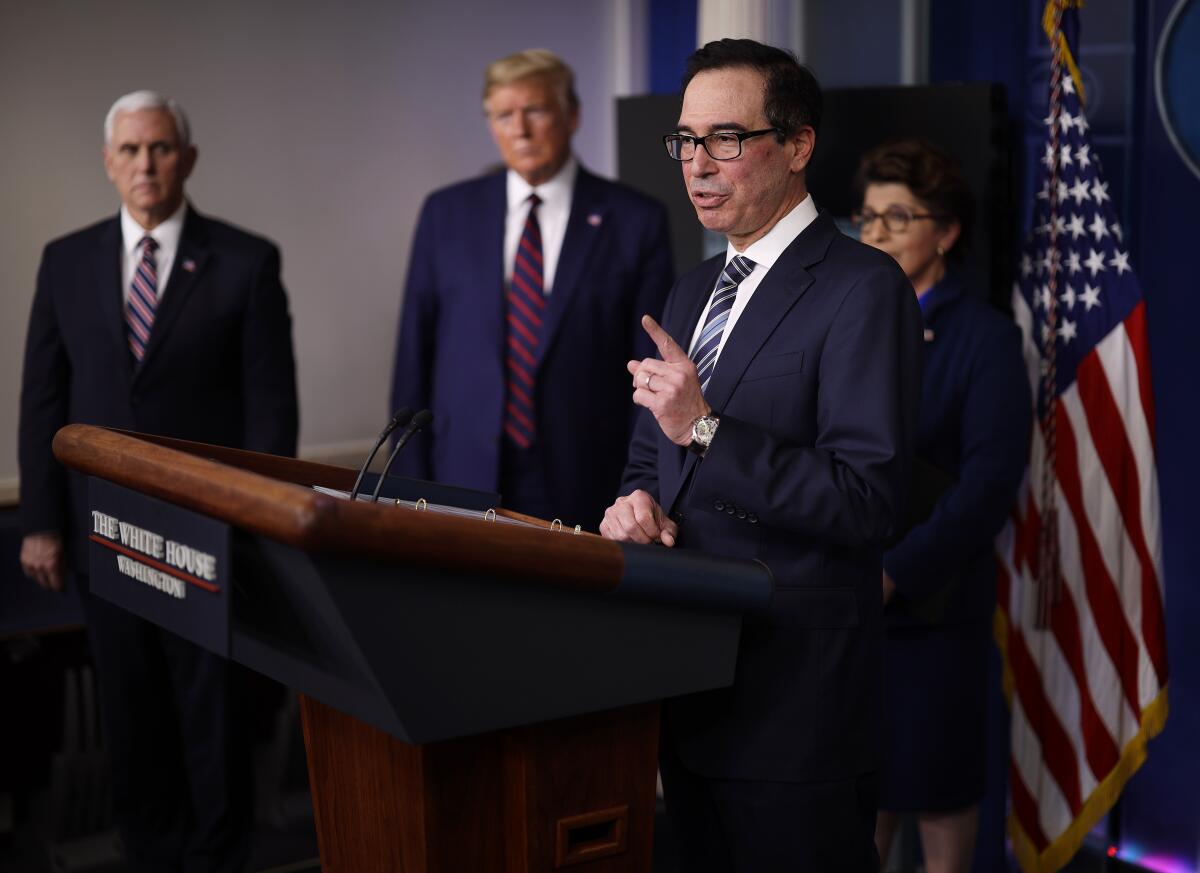

“We encourage all approved lenders to process loan applications previously submitted by eligible borrowers and disburse funds expeditiously,” Treasury Secretary Steven T. Mnuchin and SBA Administrator Jovita Carranza said in the statement.

Independent businesses struggle to survive as federal government fails to deliver payroll protection loans.

Many small-business owners were shut out from financial aid after the program, launched April 3 with an initial $349 billion, was exhausted by April 16. Congress passed a relief bill that President Trump signed Friday with more funding for the program and a separate disaster loan and grant initiative whose funding also expired last week.

Restarting the program Monday morning “will give everybody the rest of today, through the weekend, for the lenders and everyone to get ready,” Sen. Marco Rubio (R-Fla.), chairman of the Senate Committee on Small Business and Entrepreneurship, said in a video posted to Twitter on Friday.

The initial program launch was rocky, after guidance for lenders to process loans wasn’t issued until the night before, some large banks didn’t participate initially or only took applications from customers with existing loan accounts, and the SBA’s processing system was inaccessible at times because of the volume of applications.

There are questions about how smoothly the program will relaunch because some banks continued to take applications after the SBA stopped accepting them, and large banks are ready to flood the SBA with those applications and others that weren’t processed in the first round.

Large public companies and big chains including Shake Shack Inc. and the operator of Ruth’s Chris steakhouses have started returning their loans amid criticism that they were taking loans at the expense of smaller firms. The Trump administration also issued guidance Thursday that it’s unlikely a public company with substantial market value and access to capital markets would qualify for a PPP loan — and that companies have until May 7 to return their loans without penalty.

The SBA and Treasury also clarified Friday that hedge funds and private-equity firms are ineligible to participate in the program, potentially quelling a barrage of outrage over the possibility that well-heeled traders might beat out struggling small businesses for relief aid.

As a result of companies returning their loans, “an additional significant amount of money” will be available to make more PPP loans, Rubio tweeted.

The SBA has said there have been upgrades to its processing system, called E-Tran, and that the system was updated to account for a provision in the new relief bill requiring that smaller lenders disburse at least $60 billion of the funding, another concern for potential delays in processing applications.

Advocates for small businesses are concerned that the funding could be exhausted again after just a few days and that smaller mom-and-pop firms might not be able to get funding — especially those that have not already applied and don’t have applications in line to be submitted when the program restarts.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.