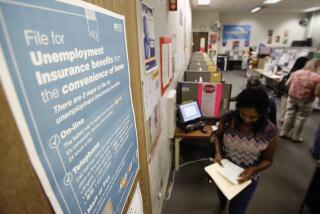

California coronavirus unemployment surges as payrolls shrink for first time since 2010

- Share via

California’s unemployment rate shot up in March as a statewide coronavirus shutdown took effect and overall payrolls shrank for the first time in a decade, state officials reported Friday.

The March report showed a jobless rate of 5.3%, up from 3.9% in February, the largest jump in more than four decades of state data collection. But the rate is based on a survey that ended March 12, so it doesn’t reflect the positions axed by thousands of employers in the second half of the month.

Through the first half of the month, the state lost 99,500 jobs. That ends a record 120-month streak of gains since the Great Recession.

Both the U.S. jobless rate, which was 4.4% in March, and California’s rate have skyrocketed in recent weeks, according to economists who predict the state’s unemployment rate this year could climb to more than 16% and perhaps as high as 20%.

“California employment is in free fall and no bottom is yet in sight,” said Sung Won Sohn, a Loyola Marymount University economist. “Economic activities won’t recover sharply even when the lockdown ends.”

The grim news came the day after federal officials reported that 660,966 Californians had filed jobless claims in the week that ended April 11. Over four weeks, 2.7 million claims were processed statewide, amounting to 1 of every 7 workers in the state’s 19.3-million-person labor force.

California’s unemployment rate will register double digits through 2021 and may be as high as 8.5% two years from now, UCLA economists predict.

Nationwide, some 22 million people have sought unemployment benefits in the last month, the largest number on record. In the Great Recession, employment declined by 8.6 million workers between November 2007 and December 2009.

The number of California jobs lost in March was the fourth-largest on record, driven by declines in six of 11 industry sectors. The leisure and hospitality sector shrank the most — losing 67,200 positions — largely because of closures of hotels, restaurants, food services and bars.

“This is just the tip of the iceberg of what we are likely to see when the April California employment report is released,” said Scott Anderson, chief economist of the Bank of the West in San Francisco. “No sector of the economy will be spared before the job losses will be over.”

The state’s “other services” sector, which covers a mixture of businesses such as auto repair and dry cleaning, lost 15,500 positions. The construction sector shrank by 11,600.

The professional and business services sector, which includes some technology jobs, dropped by 8,600 positions. The manufacturing sector lost 5,300. The trade, transportation and utilities sector shrank by 4,600.

Retail trade was flat over the month. Amazon, Walmart and many grocery stores have hired thousands of workers in recent weeks as shoppers order goods online and crowd into markets to stock up on food. Those jobs are offset by furloughs at Macy’s, Kohl’s and other large department stores as well as thousands of smaller clothing stores and other nonessential-goods outlets.

Coronavirus unemployment hits a broad swath of industries across California.

The government sector posted the largest job gain of the month: 5,200 positions, mostly caused by a rise in local government employment. Federal government also grew, boosted by the hiring of U.S. census takers.

The financial activities sector grew by 4,000 jobs, and the information sector, which includes some software jobs, gained 2,600. Payrolls in the education and health services sector grew by 1,200. Mining and logging gained 300 positions.

California employers with more than 75 workers must report plant closures and mass layoffs to the California Employment Development Department under the Worker Adjustment and Retraining Notification, or WARN, law. In the past, the agency issued two monthly reports, but so many companies have been laying off workers that the list is now updated daily.

The numbers reveal a rapid acceleration. In February, just 64 companies reported layoffs, totaling 7,164 workers. In March, 354 companies reported staff cuts, totaling 52,959. And in the first half of April, 1,377 employers reported shedding a combined 154,269 workers.

Thousands were laid off at hotels, restaurants and entertainment venues, but pain has been felt across a wide variety of businesses. Among the largest layoffs were 3,029 at Pacific Dental Services, an Irvine-based chain; 2,250 at San Diego’s Sea World; 1,671 at YMCA of Metropolitan Los Angeles; 1,331 at LAZ Parking in Los Angeles; 1,900 at Hawaiian Gardens Casino and 893 at San Diego-based Core Power Yoga.

A hotel housekeeper, victim of a coronavirus layoff, struggles to support her three kids. ‘I just want to keep my little family together,’ she says.

And the WARN report is far from complete. Not only does it not include layoffs at smaller companies, it also counts only workers who were employed for at least six of the 12 months before the layoffs. And last month, Gov. Gavin Newsom suspended the law’s provision that employers give workers and the agency 60 days’ notice, so many companies have yet to file reports.

In Los Angeles County, the jobless rate jumped to 6.3% in March from 4.3% in February. Payrolls in the county, which total about 4.6 million jobs, shed 35,200.

In Orange County, unemployment grew to 3.6% from 2.8%. The county, with about 1.67 million workers, lost 13,200 jobs.

In the Inland Empire, spanning Riverside and San Bernardino counties, unemployment rose to 5.1% from 4%. The region, with some 1.54 million workers, lost 5,500 positions.

Unemployment claims will jump at the end of April when California begins accepting applications from hundreds of thousands of self-employed workers and independent contractors, noted Lynn Reaser, an economist at Point Loma Nazarene University in San Diego. With the growth of gig economy companies such as Uber, Lyft and Instacart, that pool of workers has expanded rapidly in recent years.

Until now, gig workers have not been eligible for jobless benefits because the companies they work for do not pay state unemployment taxes. But they’re explicitly included in the federal Coronavirus Aid, Relief, and Economic Security Act, known as CARES, which offers jobless workers up to $600 a week.

Here’s how to file for unemployment benefits if you’ve lost work because of the coronavirus outbreak. Read this explainer for eligibility requirements and how the program works.

Economists offer varying assessments as to how long a coronavirus-induced recession might last.

Anderson, at the Bank of the West, predicted, “We will be entering a multiyear process of recovery for the California economy, even in the best-case scenario where business shutdowns end and economic activity returns in the second half of this year.”

Reaser was somewhat more optimistic.

“The steepness and suddenness of the decline is probably unparalleled in U.S. history,” she said. “However, the downturn is likely to be much shorter than the Depression of the 1930s, which spanned four years, and even the Great Recession, which lasted 18 months. The economy is not in a downward spiral with no relief in prospect.”

And Sohn suggested California’s eventual recovery might be faster than the overall nation’s “because technology has been the workhorse of the state’s recent economic expansion. During this pandemic, remote communication, online shopping, social media and digital streaming have limited the decline in the state’s employment.”

But, he cautioned, “boosting production is easier than persuading consumers to visit restaurants and theaters. Employees are eager to return to work after weeks of lockdown, but the psychological shock to the people and the economy should not be underestimated.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

![INGLEWOOD, CA - APRIL 10: Jacob De Wilde [sic], Local 33, left, and Lesli Lytle, right, Local 44, of International Alliance of Theatrical Stage Employees, loads a car with food at a food distribution organized to celebrate Good Friday, in collaboration with the Los Angeles County Federation of Labor, the Forum, the City of Inglewood, Labor Community Services and the Los Angeles Regional Food Bank, and other organizations host a food distribution for more than 5,000 families, or 20,000 individuals, impacted by the COVID-19 crisis.Inglewood, CA. (Irfan Khan / Los Angeles Times)](https://ca-times.brightspotcdn.com/dims4/default/b3cbe75/2147483647/strip/true/crop/2400x1600+0+0/resize/840x560!/quality/75/?url=https%3A%2F%2Fcalifornia-times-brightspot.s3.amazonaws.com%2F79%2F57%2Fb4fd719c4c9181aacec4e6508684%2Fla-photos-1staff-522870-me-0410-unions-food-distribution-009.IK.jpg)