How to figure out if your student loan qualifies for coronavirus relief

- Share via

Dear Liz: I’m confused about what help is being offered to people with student loans. At first I heard interest was waived but payments had to be made. Then supposedly the stimulus package made payments optional. Is there something I have to do to get relief or is it automatic?

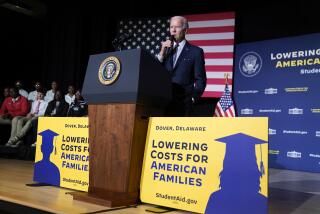

Answer: If your student loans are held by the federal government, relief should be automatic. You won’t have to make a payment until after Sept. 30, and interest will be waived during that time. In addition, federal collection efforts on defaulted student loans have been paused.

These provisions of the Coronavirus Aid, Relief and Economic Security Act apply to federal student loans made through the direct loan program, including undergraduate, graduate and parent loans. You can log on to studentaid.gov to see if your loan qualifies.

If you have Perkins loans or Federal Family Education loans that don’t qualify, you can consolidate those loans into a direct consolidation loan, which would qualify. The provisions also don’t apply to private student loans, although your lender may offer other hardship options.

Giving away your relief funds

Dear Liz: My wife and I are retired. We are comfortable financially, with a generous pension, maximum Social Security benefits due to start in a few months, and three years’ worth of ready cash in the bank. We don’t anticipate touching our investments until mandatory distributions from our IRAs kick in. Now we’re apparently going to get $2,400 tax-free as part of the coronavirus stimulus package. We don’t need the money, nor do we particularly want it. We’d welcome your thoughts on how we can give it away to generate the greatest good, on the individual and societal levels. Where is the “multiplier” effect the greatest?

Answer: Thank you for thinking of others. Donating money to a food bank is always a good choice. These charities often have deals with food suppliers that allow them to create far more meals using donated money than they would be able to produce with donated food. Cash also allows food banks to offer perishables. In some cases, food banks work directly with farmers to supply fruits and vegetables that are too imperfect to sell, which reduces food waste.

One option is to give through Feeding America, which represents a network of 200 food banks nationwide that feed more than 40 million people. Meals on Wheels is another option that helps 5,000 community-based programs.

There are many other ways, of course, to help people hard hit by the coronavirus pandemic. Before you give to a charity, check it out at one of the watchdog organizations such as Charity Navigator or CharityWatch. You’ll want to make sure the bulk of your money supports the cause, rather than fundraising efforts or overhead.

You also can use the checks to directly help people or businesses in need. Buying gift cards from local restaurants and small businesses offers a potential two-for-one benefit: You can give the cards to people who need the assistance while you help keep the businesses afloat. Or you can subscribe to newspapers and public radio stations that are working hard to bring you accurate and timely information about staying safe in the pandemic.

Volatile markets and retirement

Dear Liz: With the tumult in the stock market, I’ve been thinking of a strategy which may be safe but not prudent. I have about $315,000 in a trust account which pays me about $9,000 a year in dividends. I’m 81. If I sell all the stocks in my trust account, I could draw the same $9,000 for over 10 years, not counting about 2% growth on the $315,000. What are your thoughts?

Answer: Many people have discovered they’re not as risk tolerant as they thought they were. The volatile stock market has unnerved even seasoned retirement investors. Most, however, should continue investing because they won’t need the money for decades, and even retirees typically need the kinds of returns that only stocks can deliver long term.

There’s no reason to take more risk than necessary, however. If all you need from your trust account is $9,000 a year, you’d be unlikely to run out even if your money is sitting in cash. But you may need more than $9,000 in the future — to adjust for inflation, for example, or to cover long-term care costs.

One option to consider is a single-premium immediate annuity. In exchange for a lump sum, you’d get a guaranteed stream of monthly checks for the rest of your life. At your age, you could get $9,000 a year by investing about $100,000 in such an annuity. Because your payments would be guaranteed by the annuity, you might be more comfortable leaving at least some of the rest of your account in stocks for potential growth.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.