Empty malls. Closed stores. Will coronavirus forever change how we shop?

- Share via

The prognosis for restaurants and other retailers forced to close by the novel coronavirus outbreak is so grim that many are expected to skip rent payments April 1. Many may never reopen.

The economic pain — especially for laid-off workers — will be unprecedented.

Although analysts predict a rebound by the end of the year, the new retail landscape may look different from the old one, as mandated closures knock out weak malls and merchants. Online shopping is likely to permanently grab an even bigger share of buyers’ money, particularly for groceries because house-bound consumers grew comfortable getting their food picked out by someone else and delivered.

“After the coronavirus effect is over, many of those people who are ordering online right now will continue to do so,” said analyst Robin Trantham of real estate data provider CoStar.

For now, though, the outlook is terrible for businesses closed by the pandemic. Landlords face a wave of missed rent payments from tenants who were ordered by public officials to lock their doors to slow the rate of infection.

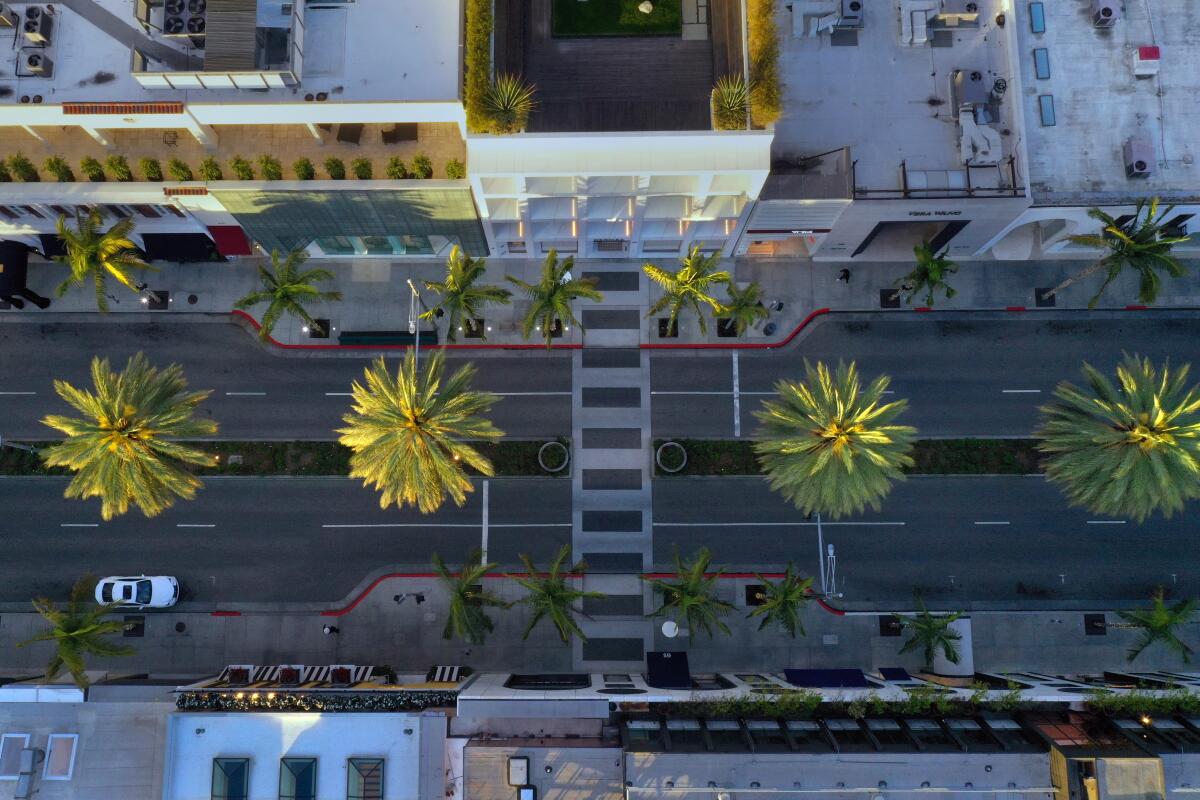

“We are at the mercy of this virus,” said Los Angeles shopkeeper Fraser Ross, who rents two stores on Robertson Boulevard for his chic Kitson brand but doesn’t intend to write rent checks next week for his landlords.

“You leased me an area to make retail sales,” he plans to tell them. “We are not open, so I am not going to pay rent.”

Industry observers expect many tenants such as Ross to invoke provisions in their leases including “force majeure,” contract language that excuses them from meeting their financial obligations because of extraordinary circumstances beyond their control. Current circumstances are decidedly unusual for a majority of stores, restaurants and other businesses such as gyms.

“We’ve never seen on such a large scale, people just staying home,” Trantham said.

Federal coronavirus relief packages so far haven’t addressed commercial rents, Bloomberg reported, but Federal Reserve actions may allow banks to defer mortgage payments, which would give property owners more leeway to delay rent. Disputes between tenants and landlords could soon flood the courts.

The largest commercial landlord in Orange County, Irvine Co., told tenants in an email Sunday that they could delay making rent payments for three months but must eventually pay the money without interest over a 12-month period starting next year.

Many retailers in Irvine and elsewhere want more than a rent delay. They want to skip rent for the time they can’t operate.

“We’re not sending any checks, period,” said Andy Nguyen, co-owner of the Afters Ice Cream chain and a tenant of Irvine Co. “We are the ones who are on the front line right now. Taking the hit is not fair.”

Nguyen is a partner in about 50 restaurants, including Ground House Burger, Portside Fish Co. and Dough & Arrow cookies. Some are closed, while others are selling takeout and delivery fare.

The stores had more than 600 employees combined, but more than 200 have been let go. Nguyen has dozens of landlords and said Irvine Co. is the only one that offered a rent assistance program to tenants.

“Some landlords have told us no, they have their own bills to pay,” he said. “Others haven’t responded to anyone.”

Nguyen predicted that some of his restaurants will reopen. Others won’t have enough financial reserves to make it through the disaster.

“We’re going to hang on as long as we can,” he said. “It’s tough.”

Another Irvine Co. tenant, upscale Mexican restaurant Red O, is selling groceries, margaritas and even toilet paper at curbside to stay in business. The landlord’s rent payment delay “will give us the breathing room we need to stay on our feet,” spokesman Robbie Dye said.

Rick Caruso, one of Southern California’s biggest independent shopping center owners, said he is still figuring out how to best help his tenants, the majority of whom have been closed for several days.

“We frankly don’t know what we are going to do yet, but of course we are going to support them,” Caruso said in a phone call from his Palisades Village center in Pacific Palisades.

The issue is complicated because, he said, financial concessions should best come from multiple parties, including tenants’ insurance companies and the government.

“It’s a partnership and the risk needs to be shared,” he said. “We certainly are going to do our part.”

Caruso said he is keeping all of his company’s more than 1,000 employees on the payroll during the shutdown. He also opted to keep his outdoor malls — including the Grove in Los Angeles and the Americana at Brand in Glendale — open to strolling visitors, even though most stores are closed and restaurants are selling food to-go only.

“The lights are bright and the music is on,” Caruso said. “We hope people find a little bit of joy in a complicated time. We are happy we can do it.”

Forced isolation has made the pandemic in some ways more distressing than other catastrophic events in the past, he said, when people could connect with other suffering people over food and drink.

“As a community, we have gone through a number of crises together — the earthquake, 9/11,” Caruso said. “The difference now is we don’t have places to come together and feel a sense of warmth and safety. That is one of the things that is hitting me the most personally. I think there is going to be a real eagerness to get back to that.”

Formerly quarantined Chinese citizens have resumed gathering in public, much to the interest of analysts and American business leaders, including Starbucks Chief Executive Kevin Johnson. He told CNBC recently that the company’s China business is “on the mend” and that it would have 95% of its stores in the country operating by the end of the month, including outlets in hard-hit Hubei province.

“What’s happening on the ground in China is reason for objective optimism in the face of the storm,” said Spencer Levy, chairman of Americas research for real estate company CBRE.

More than 80% of Chinese shopping centers are open and hotel occupancy is on the rise, Levy said. Demand for big-ticket items such as homes and cars is lagging, but “long queues are lining up to luxury stores and restaurants because of pent-up demand.”

He expects a similar pattern will happen in the U.S., but not until many retail businesses go through dark times that are hitting their employees hardest.

“Distress starts at the bottom of the chain and works its way up in missed payments,” Levy said. “We need to be here now for the most vulnerable people.”

National real estate trade organizations including the International Council of Shopping Centers and the Mortgage Bankers Assn. “are working to ensure that the most vulnerable, including the tenants, employees and other parties, are protected immediately and then given the tools to get back on their feet shortly thereafter,” Levy said.

He predicted that the the U.S. economy will have “a rough row to hoe” for the next six to eight weeks but would rebound strongly before the end of the year, perhaps even late in the third quarter.

It may be several years before the economy returns to “normal normal,” he said, “but it will bounce back faster than a lot of people think.”

But will the retail landscape look different then, after the panic is over? Are empty malls going to stay that way as shoppers grown accustomed to keeping their distance from one another decide to keep buying what they need online?

It’s too early to know, Levy said, but he doesn’t expect a radical shift.

“I will not accept at all that people will stop going to restaurants or gyms or other places” people congregate, he said. “That is not going to happen.”

The big shutdown may well, however, accelerate a years-long decline for traditional shopping centers that included record store closures in 2018 and more losses last year. Closures in January and February suggested a new record might come in 2020, according to CoStar.

“Retail was already in a state of flux, and coronavirus is only going to compound those effects,” Trantham said.

“Malls are definitely going to be the most impacted,” he said, because more than 70% of most mall space is occupied by traditional retail such as apparel stores and department stores. “Those are most impacted by e-commerce.”

The vast majority of restaurants will eventually reopen, he said.

The ongoing slow demise of conventional malls that are basically a collection of stores “could clearly be accelerated” by the shutdown, said George Belch, professor of marketing at San Diego State. Malls that have invested heavily in “experiential” features, such as restaurants and activities that give people things to do besides shop, are positioned to survive, he said.

Caruso said people in Southern California will be eager to get back to enjoying themselves when the pandemic has passed.

“The human spirit is built not only to survive but thrive,” he said. “The minute there is a signal you can get back to normal life, it will be a celebration.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.