Virgin Galactic has had no flights or profits, but investors love it nonetheless

- Share via

Virgin Galactic Holdings Inc. is a very sparse enterprise when it comes to the usual benchmarks — things like sales, profits or customers.

What Richard Branson’s space transport company does have, however, are hedge funds and other investors who are convinced it will establish a new space-tourism industry and fly people across continents at hypersonic speeds.

That unfettered enthusiasm was responsible for driving up Virgin Galactic’s stock by almost 200% so far this year, conjuring comparisons to Tesla Inc.’s meteoric rise. Virgin more than doubled over an eight-day winning streak. That took its market value to almost $8 billion from $2.4 billion in early January.

“This is all momentum-driven,” analyst Alex King of Cestrian Capital Research said. “It’s not real yet. It will become real, but it’s not real yet.”

The first sign of trouble was the ever-extended launch date.

That cautionary point was driven home Tuesday when Virgin Galactic reported a $72.8-million loss for the fourth quarter, up sharply from a $45.7-million loss in the year-earlier quarter. The company’s share price dropped as much as 6% in after-hours trading on the news.

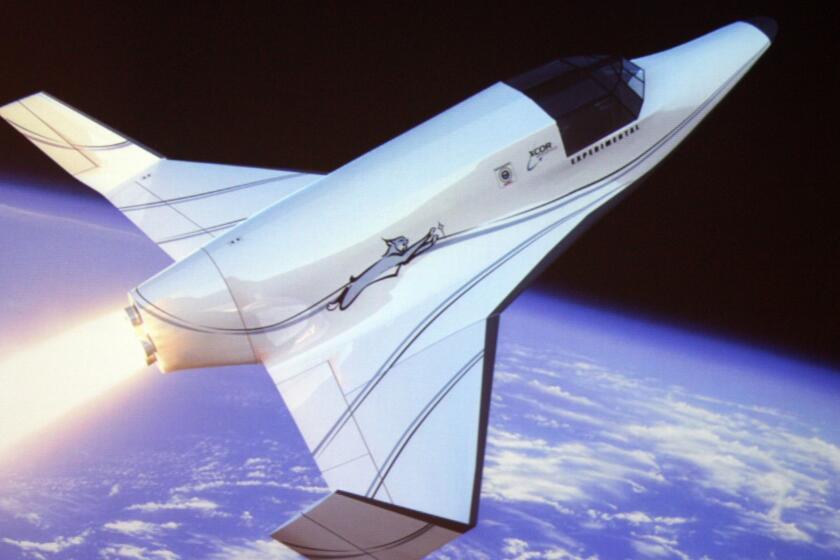

At some point, Virgin Galactic could indeed become a very profitable company with near-daily spaceflights, high margins, a deep and affluent customer base and an early-mover advantage in the nascent field of crossing the Atlantic and Pacific in an hour or two via suborbital travel at hypersonic speeds.

Or, it could be out of business in, say, a year.

“This stock is the essence of speculation,” King said. “It doesn’t trade on numbers and we don’t think it will trade on numbers for a long time.”

Meanwhile, Virgin Galactic is preparing to resume ticket sales for future space flights, in an effort to assure investors that affluent customers will pile in as the company edges toward commercial service. Virgin Galactic will begin taking $1,000 refundable deposits Wednesday, which will put those customers first in line for booking reservations.

Tourist flights are expected to begin later this year, Virgin Galactic has said, with Branson expected to be among those on the first commercial flight. It didn’t specify Tuesday when it will resume selling seats or what price it would charge.

Accepting deposits again underscores Virgin Galactic’s effort to make space tourism a reality after years of rising expectations. The company has a group of 600 people from five dozen nations, dubbed Founders, who purchased tickets as long as 16 years ago for as much as $250,000 each. Virgin Galactic suspended ticket sales in December 2018.

The next round of reservations is expected to cost more than the previous tranche, based on demand, company officials have said. Those sums are largely refundable until a flight date is assigned.

Virgin Galactic has collected expressions of interest from nearly 8,000 people through its website, Virgin’s commercial director, Stephen Attenborough, said in an interview this week. That’s more than double the figure it reported late last year after becoming a publicly traded company.

“Management has guided to a very attractive financial outlook a few years from now, but there are also a lot of thematic reasons to own it and I think that’s been the driver lately,” said Darryl Genovesi, an analyst with Vertical Research Partners, who has a “buy” rating on the stock.

The stock has attracted the attention of hedge funds, with three of them now holding more than 7% of the company’s outstanding shares, led by Suvretta Capital Management at 3.4%.

The stock surge has proved a huge financial win for Boeing Co., which invested $20 million in October ahead of the IPO for a minority stake. The money, invested through Boeing’s HorizonX Ventures unit, is aimed at furthering research into hypersonic travel, a key area of interest for the aerospace giant.

Virgin Galactic is also benefiting from the dearth of “pure-play space stocks that trade on regular markets,” King, who owns Virgin Galactic shares personally, wrote earlier this month.

Bears have continued to ratchet up their bet to record highs. Roughly a third of shares available for trading are currently sold short, according to data compiled by S3 Partners. That indicates that skeptics think Branson’s company won’t reach its ambitious goals.

Those goals include increasing its spacecraft fleet to as many as five, expanding internationally to places like Italy, and then tackling the various technical, commercial and regulatory hurdles of point-to-point long-haul travel.

Virgin Galactic has the lead in the potential suborbital business of taking tourists on a brief joyride into space, said Steve Jorgenson, a general partner at Starbridge Venture Capital and a former hedge fund equities manager. But it lags in areas that can produce far bigger revenue.

“Everything else, from hypersonic point-to-point transportation to delivery of astronauts and cargo to destinations in Earth orbit and beyond, are highly speculative,” he said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.