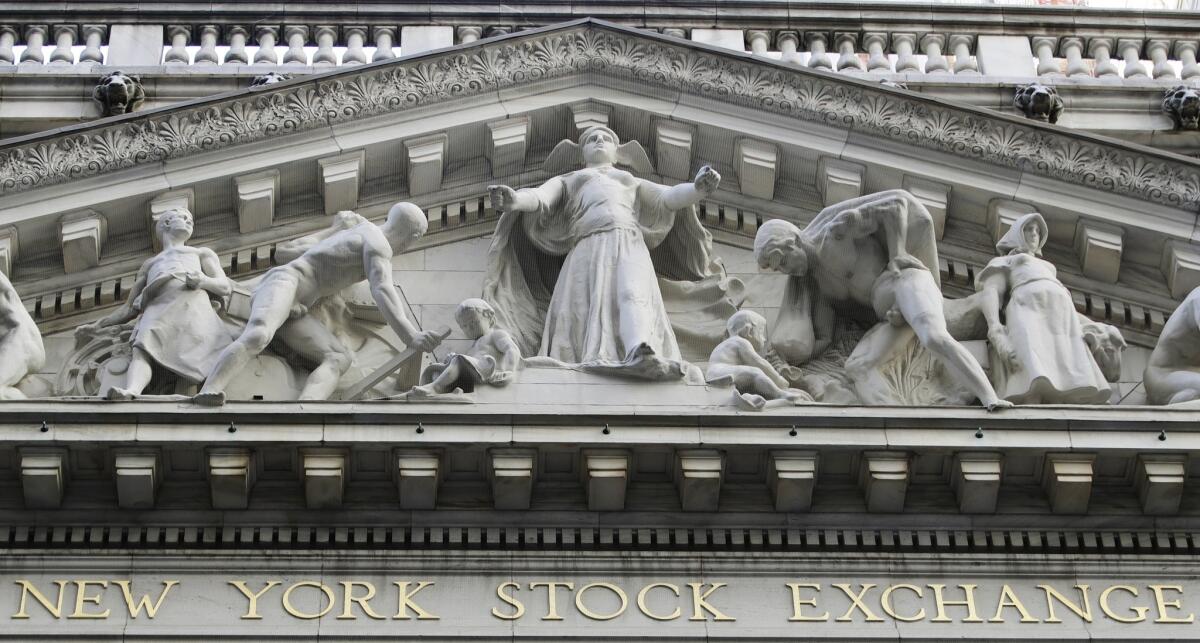

Stocks fall broadly to start the holiday-shortened week

Stocks on Wall Street closed broadly lower Monday, erasing some of the major indexes’ recent gains, though the market remains on track to end the year with its best performance since 2013.

The pullback ended the Standard & Poor’s 500 index’s two-day winning streak. The benchmark index has posted weekly gains for five straight weeks, notching multiple all-time highs along the way. It’s on track to end December with its fourth consecutive monthly gain.

Technology, communication services and healthcare stocks accounted for much of the selling Monday. Retailers and other companies that rely on consumer spending also fell.

Homebuilders fell after a report on pending U.S. home sales in November came in below analysts’ expectations. Real estate firms and utilities fared the best, ending with only tiny losses, as investors shifted assets to high-dividend stocks and other bond proxies.

“There could be a few big institutions out there that are taking some profits,” said Randy Frederick, vice president of trading & derivatives at Charles Schwab. “Big players can have a bigger influence on the market when the volumes are low.”

The S&P 500 slid 18.73 points, or 0.6%, to 3,221.29. The Dow Jones industrial average slid 183.12 points, or 0.6%, to 28,462.14. The Nasdaq composite retreated 60.62 points, or 0.7%, to 8,945.99.

The Russell 2000 index of smaller-company stocks fell 4.88 points, or 0.3%, to 1,664.15.

Bond prices fell. The yield on the 10-year Treasury note rose to 1.89% from 1.87%.

Despite the downbeat start to the holiday-shortened week, the S&P 500 is on pace to finish the year with a gain of 28.5%, which would make be its strongest annual gain since 2013.

A truce in the U.S.-China trade war and positive signs for the economy have helped keep investors in a buying mood. Fears about a possible recession have also faded since the summer after the Federal Reserve cut interest rates three times. The central bank appears set to keep them low for the near future.

Still, as the market prepares to close out a strong year of gains, uncertainty remains over the final details of a “Phase 1” trade deal between Washington and Beijing, which U.S. officials say will be signed in early January. Details of the agreement have not been disclosed, and it’s unclear how much effect it will have if the two sides are unable to resolve their remaining differences.

Hovnanian Enterprises led the slide in homebuilder shares Monday, falling 2.5%. The National Assn. of Realtors said its pending home sales index, which measures the number of purchase contracts signed, rose 1.2% last month to 108.5. Analysts had expected a 1.4% gain, according to FactSet.

Axsome Therapeutics rose 1.8% after the pharmaceutical company reported encouraging results from a trial of its migraine treatment drug.

Lending Tree climbed 3% after analysts at Compass Point upgraded the online loan marketplace operator to “buy.”

Trading is expected to be muted this week as the holiday season continues, with U.S. markets closing on Wednesday for New Year’s Day. Still, a couple of potentially market-moving economic reports are scheduled for release this week.

Investors will get to mull over new data on U.S. consumer confidence and home prices Tuesday and a snapshot of manufacturing Friday. The minutes of the Federal Reserve’s latest interest rate policy meeting are also due out Friday.

Frederick said the manufacturing report is probably the one that investors should pay attention to the most.

Although manufacturing “only represents about 12% of the economy, it tends to be much more of a leading indicator versus the services sector,” he said. “And it’s been one of the things that’s been causing those out there who think we still might be seeing a recession at some point soon to worry.”

Coming off a four-week winning streak, benchmark U.S. crude slipped 4 cents to $61.68 a barrel. Brent crude, the international standard, rose 28 cents to $68.44 a barrel.

In other commodities trading, wholesale gasoline fell 2 cents to $1.73 a gallon. Heating oil slipped a penny to $2.04 a gallon. Natural gas dropped 5 cents, or 2%, to $2.19 per 1,000 cubic feet.

The price of gold inched up 20 cents to $1,514.50 an ounce. Silver rose 6 cents to $17.91 an ounce. Copper was little changed at $2.83 a pound.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.