Why âFrozenâ and âStar Warsâ matter so much to toy makers this Black Friday

As this summer wound down, Hasbro Inc. was feverishly ramping up for the winter holidays.

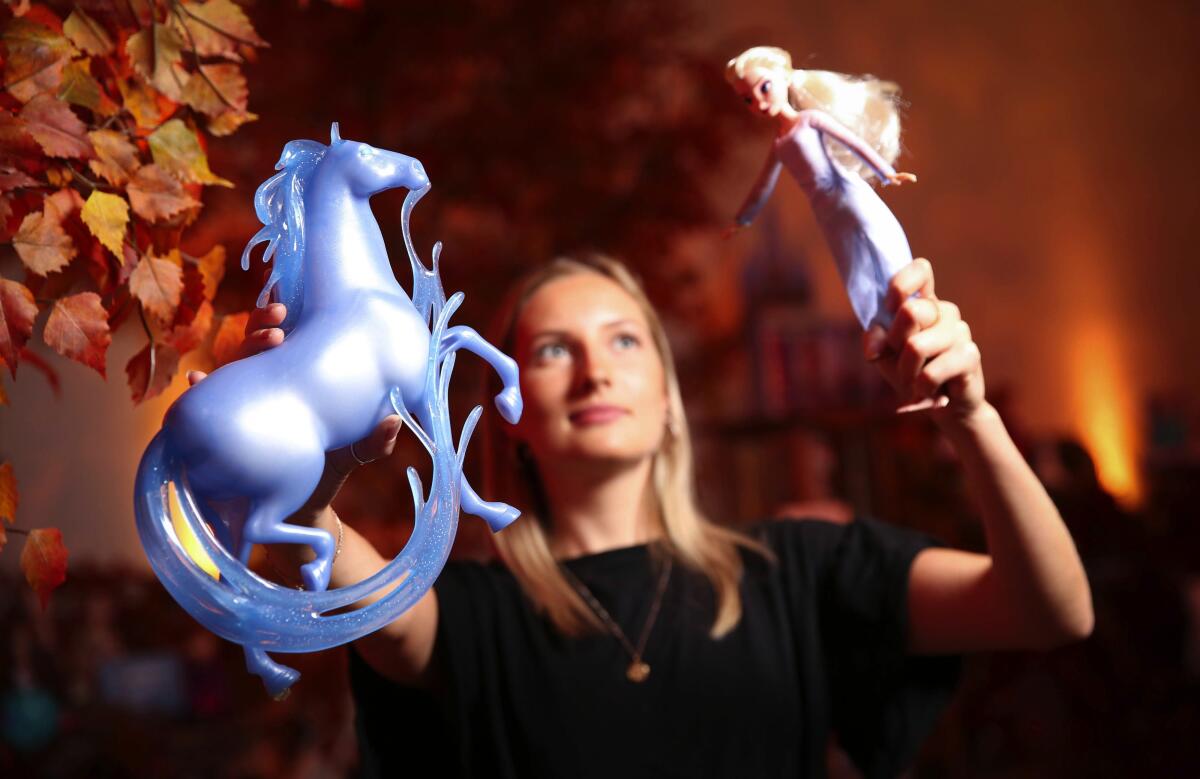

The toy maker added air-freight services and shifted its warehousing operations to get toys based on two new Walt Disney Co. movies, âFrozen 2â and âStar Wars: The Rise of Skywalker,â to retailers in time for the holiday shopping season.

The toy launches were âcritically important,â and the company hustled to âensure shelves were stockedâ ahead of the opening of âFrozen 2â in theaters last Friday and the âStar Warsâ opening Dec. 20, Hasbro Chief Executive Brian Goldner told analysts last month.

Hasbroâs effort illustrates the central role movies and TV shows play in shaping which dolls, action figures and other toys hit the shelves. But licensing of othersâ intellectual property, or IP, is now spreading beyond films and TV to include toys tied to video games, home video streaming, music, YouTube and other platforms that are increasingly part of kidsâ free time in the digital age.

âWeâll continue to see a proliferation of licensing in the toy industry based on the content kids are watching,â said Juli Lennett, vice president for toys at the research firm NPD Group. âThere are so many different places where kids can go nowâ for entertainment.

Conversely, the toy makers also are licensing their popular in-house toys to film studios and other entertainment platforms to bolster sales and otherwise generate more revenue.

Mattel Inc. has a live-action Barbie film in the works. There have been Lego movies. Hasbro is paying $4 billion for the studio Entertainment One, and Hasbro teamed with Paramount Pictures a year ago on the movie âBumblebee,â based on the Transformers character. Spin Master, the Canadian company that makes Hatchimals and âPaw Patrolâ toys, has produced six TV series around its brands in the last decade, including âPaw Patrolâ on Nickelodeon.

Mattel Chief Executive Ynon Kreiz repeatedly has talked about transforming the El Segundo firm into an âIP-drivenâ toy company whose strategy includes licensing Barbie, Hot Wheels and its other popular brands to others while also licensing outside IPs.

Case in point: Kreiz has said its toys based on âJurassic Worldâ from Universal Pictures âexceeded all expectations in 2018.â Mattel also has licensing deals with Sanrioâs Hello Kitty and Disneyâs Pixar Studios, including the âToy Storyâ and âCarsâ franchises, among others.

âThey realize that building these IPs brings immediate brand recognition, builds licensing revenue and is essential to help a toy company grow,â said Jim Silver, chief executive of TTPM, a toy review and research website.

Hasbro, Mattel and others also keep designing new toys they hope will catch fire, including some that merge physical toys with the digital world. Mattel, for instance, this year rolled out Hot Wheels ID, which enables kids to use an app to track how their Hot Wheels cars perform, along with a new line of gender-inclusive dolls called Creatable World.

MGA Entertainment Inc. in Chatsworth, the privately held creator of the popular L.O.L. Surprise! dolls, takes a different route, preferring to create its own toys while eschewing making toys based on movies and other outside IPs.

But MGA aggressively promotes its toys on digital media to attract kids and their parents. L.O.L. Surprise! has a YouTube channel with 1.2 million subscribers, and fans can watch L.O.L. Surprise! on Amazon Primeâs streaming service. There also are teasers on YouTube for a new MGA toy doll, Na Na Na Surprise, due for release Dec. 1.

âWe understand how to create a teaser campaign to create that fandomâ for a toy, said Hailey Wu Sullivan, MGAâs chief marketing officer.

All of the toy makersâ various strategies are playing out in the face of two overarching trends.

First, although toy makers and some analysts reject the oft-repeated notion that kids are ditching toys for tablets, smartphones and streaming video at ever-younger ages, they do agree that those technologies heavily influence what toys will be popular and how those toys are marketed.

âKids are now so influenced by entertainmentâ they consume not just in theaters and on TV, but on a variety of platforms such as streaming, video games, YouTube and elsewhere on the internet, Silver said. âAll these IPs on different platforms greatly affect purchasesâ of toys, he said.

For instance, two popular toy lines are based on video games: Jazwaresâ âFortniteâ and Legoâs âMinecraft.â

Second, U.S. toy sales overall have been relatively flat for years, ranging from $20 billion to $22 billion, according to NPD. That puts pressure on the toy makers to have hit products â including products based on movies and other outside IPs, or by licensing their own IPs to outsiders â to take market share from competitors because the total market isnât growing much.

Yet the industryâs consistent sales also point up that although technology has changed how kids spend their leisure hours, it hasnât severely disrupted overall demand for non-electronic toys. Barbie remains a $1-billion business. Monopoly and Uno games are having strong years. L.O.L. Surprise! dolls have been one of the top-selling toys since their debut three years ago.

Sales of conventional toys such as dolls and action figures also reflect some parents pushing back against their kidsâ growing use of tablets and smartphones.

âWeâve seen it in our research; parents are very conflicted with children and technology,â Lennett said. âThey have greater concerns about technology than before, including the solitary nature of technology,â and theyâre seeking toys that are âimportant to the social, emotional and physical development of kids,â she said.

L.O.L. Surprise! exemplifies both sides of the changes swirling around the industry. The toys feature several layers to unwrap â with each layer having its own surprise â and finally thereâs a small, wide-eyed plastic doll at the center.

Yet this physical doll âwas born on the internetâ because âwe were watching what kids were watching, and they loved unboxing,â that is, watching videos of kids taking toys out of their packaging, Sullivan said. âWe delivered what they wanted without them asking explicitly what they wanted.â

Toys based outside of IPs â movies, TV and other content sources, or what the companies call their âpartner brandsâ â amount to less than 25% of the total sales at Hasbro and Mattel. But those toys still accounted for $1.7 billion in combined sales for the two companies last year, and thus they remain key to their growth.

In the case of movies, the toys get a sales bump not only when the movies are released in theaters, but also when the films enter the home video and streaming markets. âFrozen 2â and the new âStar Warsâ movie are expected to reach those markets next spring. In the case of âFrozen 2,â that will benefit not only Hasbro, but also other toy makers such as Lego and Jakks Pacific Inc. in Santa Monica that also are licensees.

Thatâs when kids will âbe binge-watchingâ those movies and other favorite programs, and then âthey get connected to the content and the characters theyâre watching,â Lennett said. âThe next step is theyâll buy a toy of one of these licensed characters.â

Deborah Thomas, Hasbroâs chief financial officer, told the analysts last month that when itâs making toys tied to âmovie releases coming so late in the year, we tend to see the benefit of that continuing into the next year.â

The toy makers need the benefits because theyâre grappling with a variety of problems.

Mattel, for example, has suffered from falling sales at its Fisher-Price and American Doll brands while also operating with heavy debt and operating costs.

Hasbro posted disappointing third-quarter results on Oct. 22 â and its stock plunged 17% that day â in part because the U.S. tariffs on Chinese imports disrupted retailersâ orders and Hasbroâs supply chain in the period.

Lego also has struggled. Excluding currency fluctuations, its sales fell 7% in 2017 but rebounded 7% last year, and the company has been trying to integrate its lineup of familiar block toys with more technology. Lego also heavily relies on its outside IP, with toys based on Disney characters, Harry Potter, Batman, Spider-Man and others.

But one problem largely is behind all those problems: the demise of Toys R Us, which liquidated last year after filing for bankruptcy. Its failure was a huge disruption for toy makers as they scrambled to place their goods with other retailers and was one reason why U.S. retail sales of toys slipped 2% last year to $21.6 billion, according to NPD.

Sales fell another 5.5% in the first nine months of this year, NPD said. But itâs the fourth quarter, with the holidays, that is critical for the toy industry, and NPD said it expected an unspecified fourth-quarter gain that would enable overall 2019 sales to show an increase, even though there are six fewer shopping days between Thanksgiving and Christmas this year compared with 2018.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.