Koch Industries bets on tech: ‘Do it or we’ll end up in the Dumpster’

- Share via

It’s not quite what you’d expect from a Koch. Certainly not while speaking before the gray-haired Rotary Club in Wichita, Kan.

But there was Chase Koch, scion of one of America’s mightiest private industrial dynasties — a family revered by the political right, reviled by the left and feared by just about everyone — joking about his knockabout years down in Texas.

It was back in the early 2000s, Chase said, after he graduated with a marketing degree from the proudly anti-Ivy League Texas A&M. (His father, Charles, and uncle, David, studied engineering at MIT, as did his grandfather Fred.) Reluctant to tap the Koch network for a job, he was hunting for work, banging out Led Zeppelin covers with his band and, as he put it, “screwing around in Austin.”

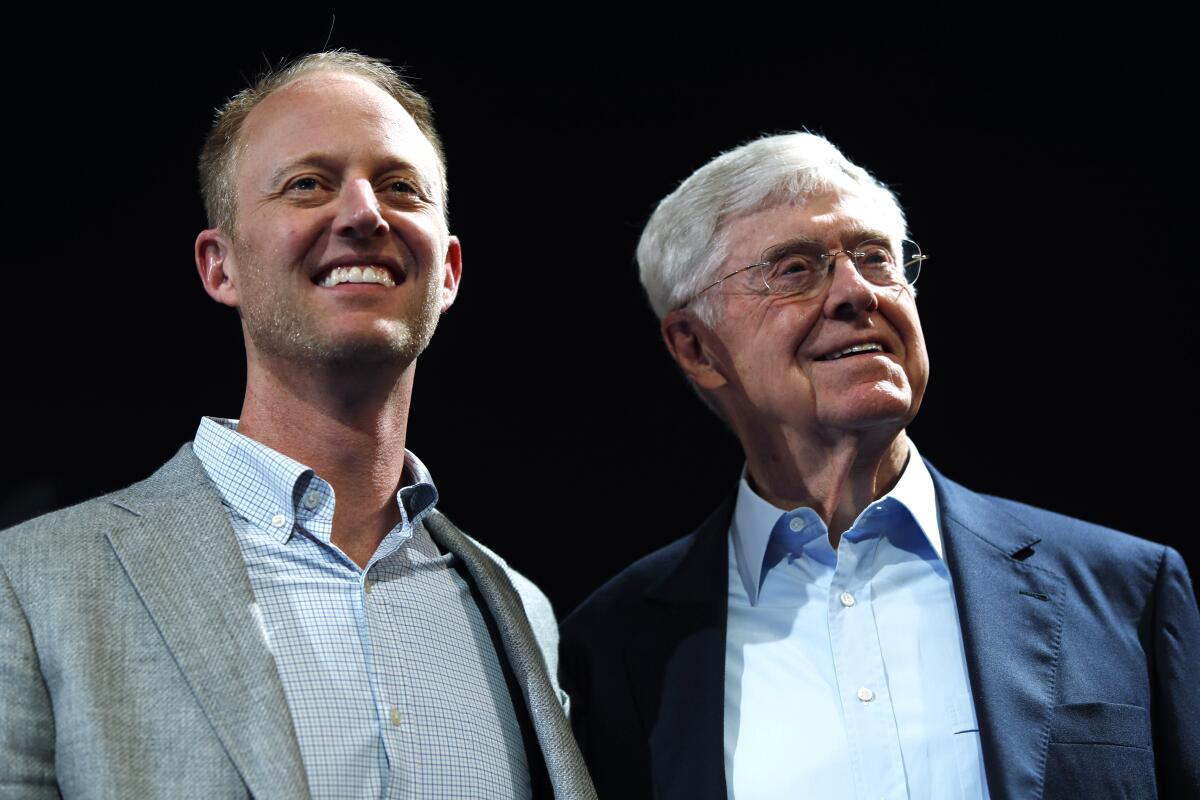

Times change — and, with time, the Kochs do too. Chase, 42, now sits on the board of Koch Industries and is president of Koch Disruptive Technologies, the conglomerate’s venture capital arm. He’s at the sharp edge of efforts to prepare for a knowledge-based future in which cheap computers, data and artificial intelligence might threaten the firm’s dominance.

He’s also positioned to control one of the world’s most powerful closely held companies, and he represents the future of the conservative political network that has put the Kochs among the country’s most influential families.

(David Koch died Friday at age 79. A year ago, he had stepped down from the brothers’ network of business and political activities, with a letter from Charles Koch citing deteriorating health.)

Few people are aware of just how big the Koch empire is or the industries it inhabits. Much as Warren Buffett grew Berkshire Hathaway Inc. from its textile-mill roots, Koch Industries keeps about 90% of its profit and pumps the money back into its businesses or buys new ones. It’s now a sprawling network of subsidiaries reporting back to headquarters in Wichita. They include forestry products (Georgia-Pacific), fertilizer (Koch Ag & Energy Solutions), fabrics (Invista), commodities trading (Koch Supply & Trading) and ranching (Matador Cattle).

The brothers invested well. The $21-million company that Charles joined in 1961 is now worth about $139 billion, a 662,000% return, or roughly 16% annually over almost six decades. Charles and David owned about 84% of the company as of last week. (Elaine Marshall owns most of the rest, having gained control of the stake after the 2006 death of her husband, E. Pierce Marshall.)

Industrial empire

Koch subsidiaries make a wide range of products and investments.

Historically, these investments were in industrial assets — refineries, chemical plants, sawmills.

But over the last few years, they’ve been more futuristic, especially in the venture capital arm led by Chase Koch. The conglomerate has invested billions of dollars in software, network technology, big data, AI, medical technology and 3-D printing.

“It’s actually really smart for them to do this,” said Hans Swildens, chief executive of Industry Ventures, which manages more than $3.4 billion of institutional capital. “If you owned a large number of industrial businesses, and you were looking at all the new technologies that were coming out and how they would affect your business, the best thing that you can do is embrace those.”

Jim Hannan, an executive vice president who oversees about half of Koch Industries’ subsidiaries, said tech “has led to a much more common set of issues and opportunities across all our businesses.”

At the same time, big industrials are struggling to grow.

“We are rapidly moving to a digital economy,” said Nick Heymann of William Blair & Co. “Most of the net worth in the last 20 years in this country has been created outside tangible manufacturing businesses.”

For Charles Koch, it was a question of survival. At a 2017 leadership meeting, he pushed his managers to embrace technology and prepare for a knowledge-based future. His message: “Do it or we’ll end up in the Dumpster.”

Falling technology costs are generating new threats to established industries.

There’s “a level of competition that these players did not face,” said Sanjay Aggarwal of Boston-based venture capital fund F-Prime Capital. “Now you can have start-ups out of a garage building an autonomous vehicle. That was just not possible earlier.”

Cheap computing power and data will fundamentally change every industry, said Koch Industries’ chief financial officer, Steve Feilmeier. The firm said it has invested more than $17 billion in technology companies since 2013, with big bets in cloud computing and enterprise data analytics. Investments have included acquisitions as well as strategic stakes.

New Koch

Koch Industries has invested more than $17 billion in tech companies in recent years.

If it’s going to be disrupted by a new technology, Koch wants to be doing the disrupting and “investing in it in a way where we better understand it,” Feilmeier said.

The focus on tech isn’t as big a shift as it appears, said Christopher Leonard, author of “Kochland,” a just-released book about the dynasty.

“If you go back to the 1970s, this company was a knowledge company,” he said. “Yes, they owned oil refineries, but they also filled the basement with IBM computers to study the crude-oil market, the gasoline market, to figure out how to run the refineries at the most optimum level.”

Data analytics have been embedded in the Koch DNA for decades, Leonard said. “I’m not at all surprised that they’re making bigger moves into that space. It builds on their expertise.”

Trying to reposition a huge industrial conglomerate around digital technology doesn’t always have a happy ending.

General Electric Co. “made this big effort and got over its ski tips to make itself the platform for industrial digital analytics, and it got way more expensive more quickly” than former CEO Jeff Immelt anticipated, William Blair’s Heymann said.

Byron Trott, the founder of merchant bank BDT Capital Partners, who has worked with Koch Industries for more than 25 years and advised on several acquisitions, doesn’t see the Kochs’ company running into the same problems. GE faced short-term pressures that come with being publicly traded, he said, while “Koch is doing this because they are really, really good at thinking long term.”

Chase Koch’s group has made some of the more ambitious bets outside Koch Industries’ traditional areas of expertise, such as investing in InSightec Ltd., a manufacturer of ultrasound-based surgical tools that can eliminate the need for incisions. He’s the only member of the family from his generation that works at the company. His sister Elizabeth Koch runs a publishing house, Catapult Books, and David’s children are much younger.

Still, Chase took a somewhat unconventional path.

After graduating from Texas A&M, he spent several years in Austin playing in a band covering Led Zeppelin, Phish and the Grateful Dead, and trying to find his way in the city’s tech start-up scene. Although he previously held summer jobs at Koch, including his first at a cattle ranch at age 15, he spent the years after graduation avoiding his father’s shadow.

“I was too proud to tap into the Koch network,” he told the Wichita Rotarians.

Although he was schooled in his family’s politics from a young age — he recalls Saturdays as a 6-year-old listening to books on tape by Milton Friedman — it’s unclear whether he shares the political philosophy of his father and of his uncle, who ran for vice president as the Libertarian Party nominee in 1980.

“I start with the idea that to learn and grow, you’ve got to be open to other people’s ideas,” Chase Koch told Politico last year. Politics, while important, is “not at all what I’m passionate about.”

That raises questions about what will become of the Koch political network, which gives his father outsize influence in the United States. “There is no comparison for any CEO in corporate America in terms of political influence when compared to Charles Koch,” Leonard said.

The Kochs sponsor candidates, think tanks, advocacy groups and academic groups pushing a conservative, free-market agenda.

Recently, there have been disagreements with the Republican Party under President Trump on issues such as free trade and immigration. Americans for Prosperity, the Kochs’ primary political advocacy group, is shifting focus toward “finding nonpartisan solutions,” according to a June memo, and it’s prepared to support candidates who get things done regardless of party.

In July, the Kochs partnered with liberal investor and philanthropist George Soros to found the Quincy Institute for Responsible Statecraft, a think tank dedicated to promoting peaceful U.S. foreign policy.

Leonard said he isn’t convinced the moves constitute a real change to the Kochs’ political goals.

“It feels like an adaptable reaction to the moment,” he said, “even as Koch keeps its eye on the long-term strategy of doing one thing, which is constraining the reach of the federal government, dismantling the administrative state and pushing back the reach of government as far as possible.”

The political network is “exactly like the corporation,” he said. “It’s run with a long-term view. It has strategic patience.”

When Chase returned to Wichita to rejoin Koch Industries after his years in Austin, he began a rotation of high-level jobs, including stints in mergers and acquisitions, tax structuring, agronomics and trading. It was designed as an MBA-like experience to familiarize him with various parts of the operation.

Koch Industries won’t detail its succession plan beyond saying that one is in place and that roles are filled by those most qualified.

If Chase eventually succeeds his father in running the firm and the political network, he’ll become one of the country’s most influential people.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.