Totally Worth It, Week 1: Make a budget

- Share via

Five years ago, I was sitting exactly where you are now. I was sick of feeling broke between paychecks. I was sick of wondering exactly when and how I’d pay off my debt. I wanted to save up for big things like a house and vacations. Mostly, I wanted to feel like I was in control of my money. I made a New Year’s resolution that that was going to be the year I buckled down and started budgeting.

When I started out, I had no idea what I was doing. I Googled “budget software,” read a few reviews and picked one. I went with YNAB (short for You Need a Budget), but you don’t have to. You can budget with a spreadsheet or with a free app. (I go over a few of your options at the end of this email.)

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.

For a lot of people, money is scary. But it’s worth the stress of digging into your spending and debt. Budgeting changed my life. Now it’s your turn.

All you need to get started is a computer — there’s really too much going on to do this all from your phone — a calculator app, and maybe a pen and paper.

What is budgeting, and why should I bother?

Before we dive in, let’s talk about what budgeting is and is not.

Think of your dollars as your employees. Without a budget, your dollars are just goofing off at their desks all day with nothing to do. They’re going to be at their most productive when you act like their boss and give them assignments.

At its most basic level, budgeting is figuring out the answers to these four questions:

- How much money do I bring in?

- What does my money need to do before I get paid again? (Rent, gas, bills, groceries, debt payments)

- What do I want my money to do before I get paid again? (Going out to eat, clothes, Netflix, local news subscription)

- What do I want and need my money to do someday? (Future needs: emergencies, car repairs, medical stuff. Future wants: vacations, weddings, a PS5)

Once you know how much you have to spend on necessary stuff, such as rent and gas, you’ll know how much you can throw at debt and how much you can spend on fun stuff.

Yes, you can budget and still have fun! Budgeting is not slicing your expenses down to the bare minimum and living like a monk. I was tempted to do that at first. It’s like saying you’re going to lose weight by only drinking green tea and eating plain kale. Crash-dieting your finances is not a sustainable lifestyle change. Your best chance of success is to accept reality, which usually involves spending some money on things that aren’t absolutely necessary but that do make your life better. There are some personal finance experts out there who will tell you that you need to spend as little as possible to “get serious” about debt and savings. I am not one of them.

With this eight-week newsletter course from the Los Angeles Times, assistant editor Jessica Roy will help you get a handle on your money stuff.

So how do I start my budget?

Starting a budget is intimidating. I get it. Here’s a fun fact about me that I never thought I would be publishing in the L.A. Times: I almost failed algebra II in high school. My teacher kindly took me aside and told me I needed to drop the class, because otherwise I would screw up my chances of getting into a good college. I dropped it. I got into UCLA. I picked a major where I didn’t have to take another math class ever again. I’m just not a numbers person — I’m a word person.

But I have great news: Budgeting is not about math. Budgeting is more like resource management. Think of a video game where you know you need to save health potions for the final boss fight. If you look at it that way — I’m not doing advanced formulas; I’m just deciding my priorities and gearing up to defeat my debt — budgeting is not scary. It can even be a tiny little bit fun.

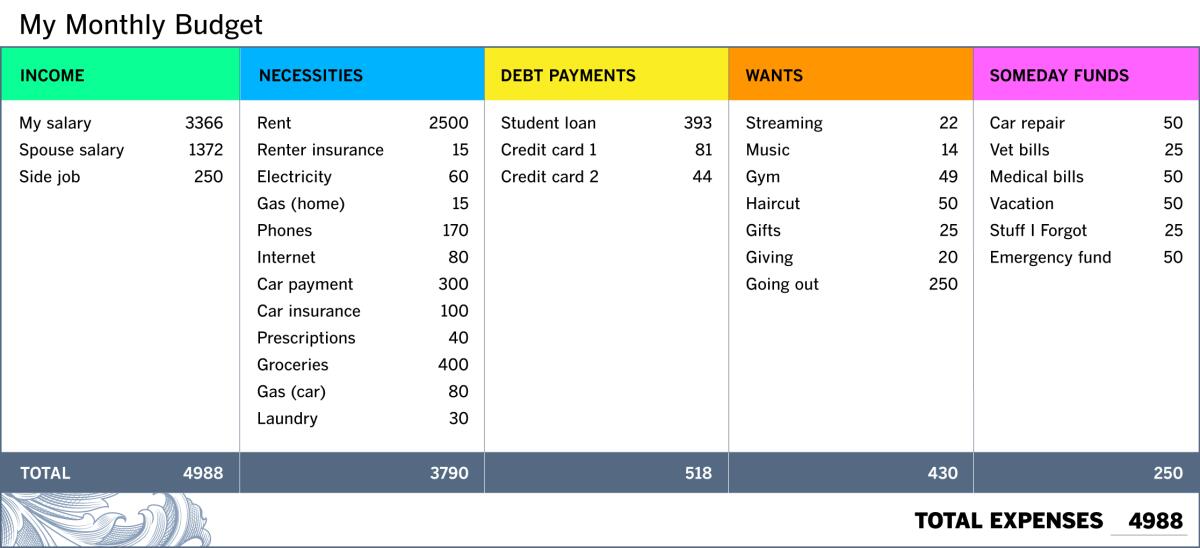

Let’s get a sense of our figures. I have some examples here to give you an idea of what to do. Start a blank spreadsheet, take a deep breath and look at your bank account.

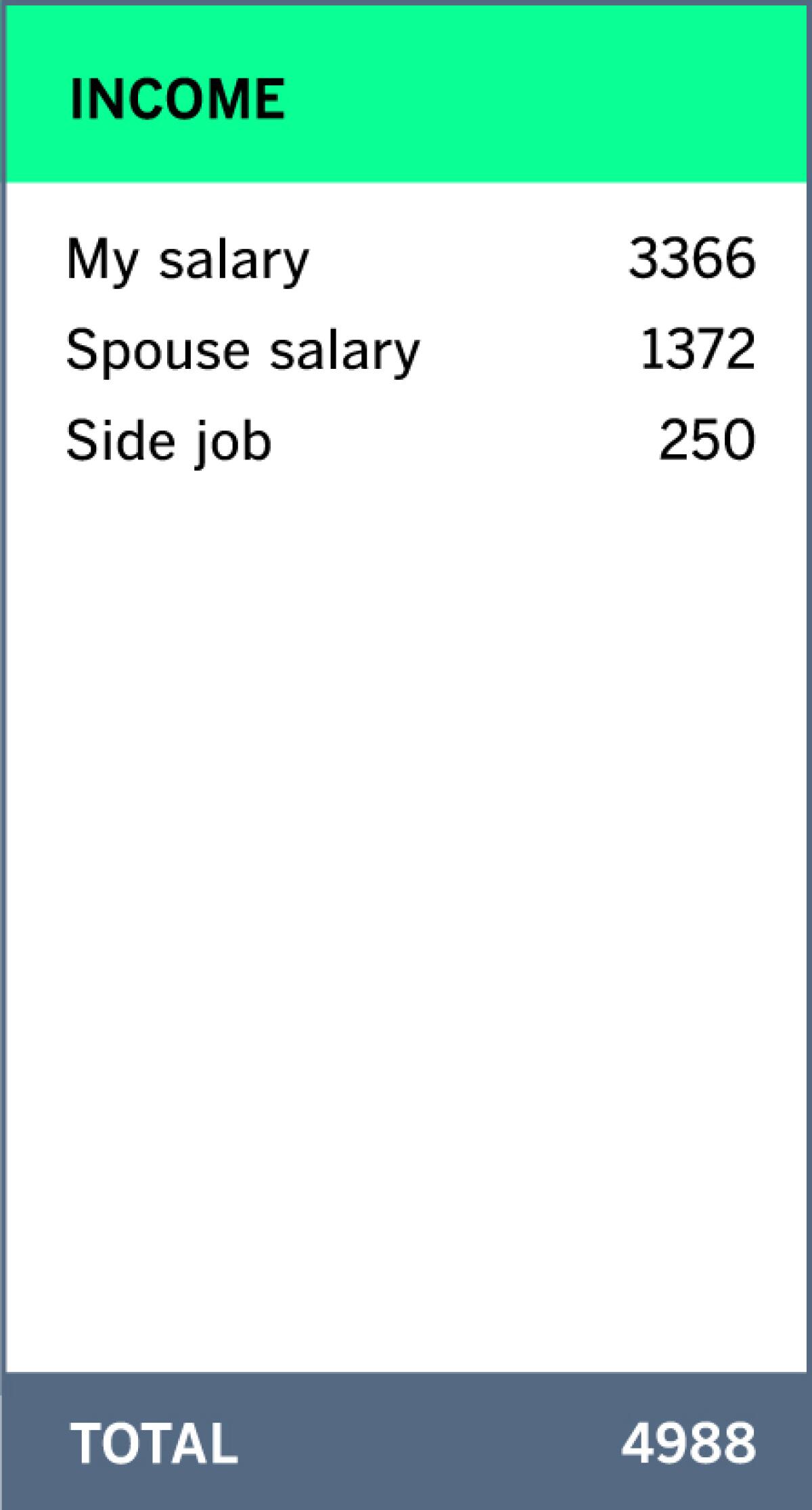

Income. How much do you — and whoever else you’re budgeting for here, such as a spouse or live-in partner or your parents (more tips on navigating that next week) — make per month, after taxes and insurance premiums and whatever else comes out of your paycheck before it hits your account? How often do you get paid? Is every paycheck the same, or does it vary based on how much you worked that month?

Write down your monthly income in the first column.

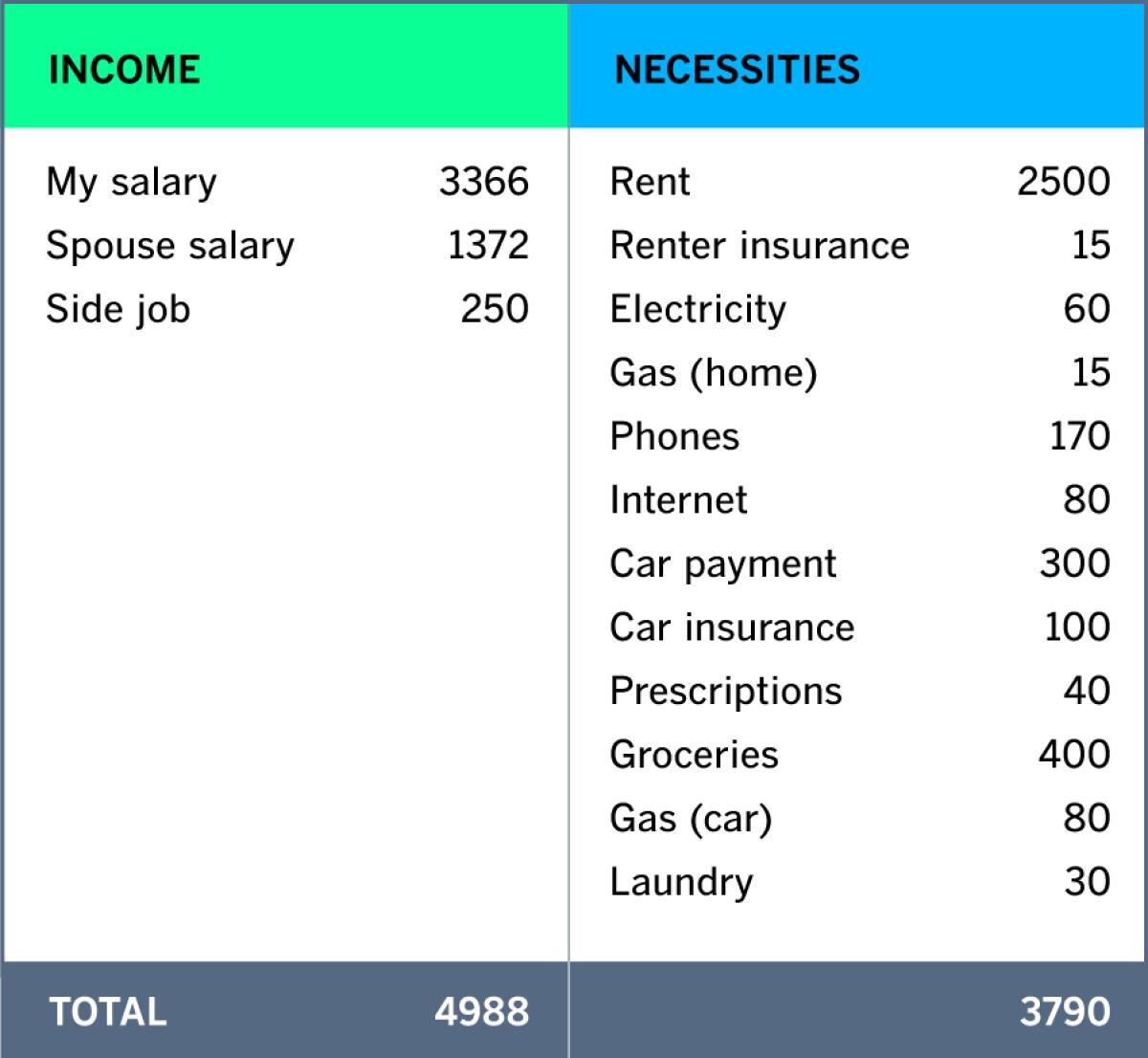

Spending: necessities. I think of this category as the expenses I can’t possibly cut from my budget. That includes:

- Housing costs (rent, mortgage, HOA, insurance)

- Utility bills (electricity, gas for heat and cooking, water)

- Phone and internet

- Transportation costs (your car payment and insurance, gas for the car, parking, Metro card)

- Groceries

- Recurring medical expenses (prescriptions, copays)

- Child and pet expenses

- Tuition

Some of these amounts will be fixed (the same every month). Your rent and your phone bill probably don’t change much. Some things, such as electricity and groceries, might vary based on the time of year — think summer AC bills or your shopping trip the weekend before you host Thanksgiving. For those variable categories, I would say to look at your last three or four months of bank statements, figure out the average, and budget that. (“But I’m going to be really disciplined and spend less from now on!” I hear you. We will talk about that! Keep reading!)

In the second column, write down the total of these monthly fixed costs.

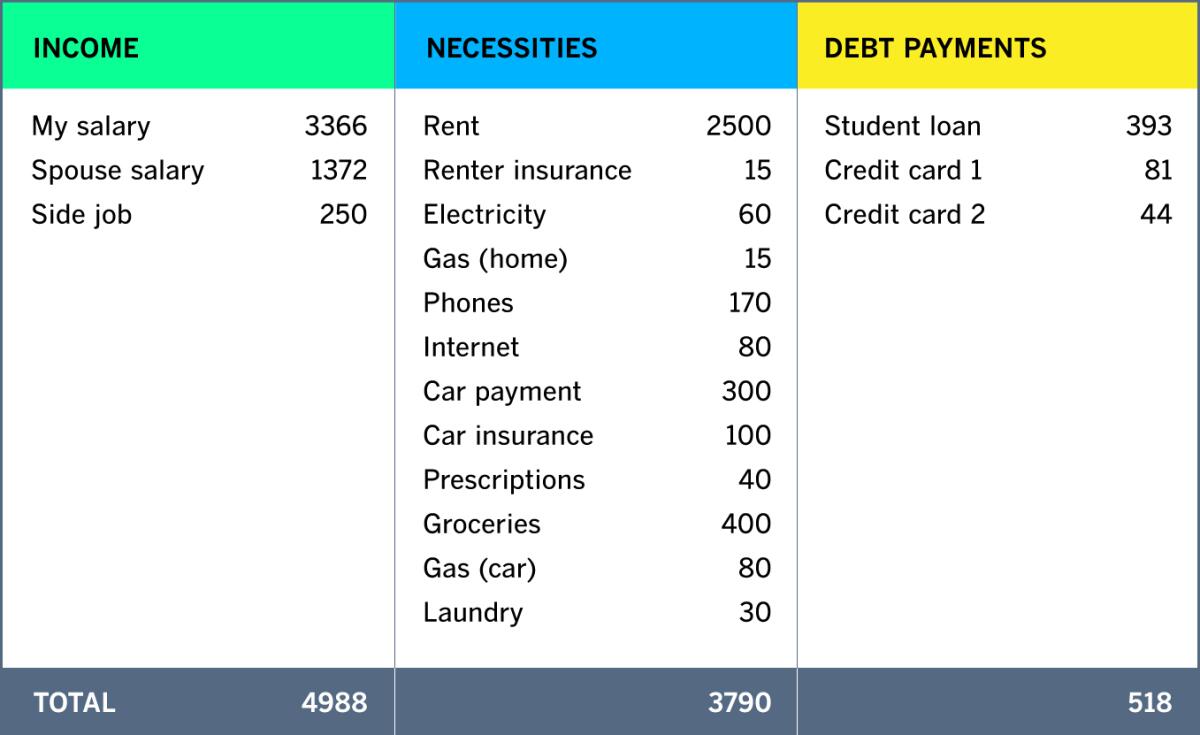

Now add in your minimum debt payments. Ultimately, we want to throw more than the minimum at our debt, but for now, focus on how much of the monthly budget must be allocated to get the minimums paid. Credit cards, student loans, car loans, medical debt, back taxes, personal loans. No, it is not fun or relaxing to have to look at all of these at once. More deep breaths. Doing this hard part is the first step to not being stressed about it anymore.

In your third column, put down the total of your minimum debt payments. (You’ll notice I put the car payment down as a necessity instead of a debt payment. In my mind, I needed the car, so it was a necessity. If you’d rather categorize it as a debt payment, you can. Your budget — and brain! — will be different from mine.)

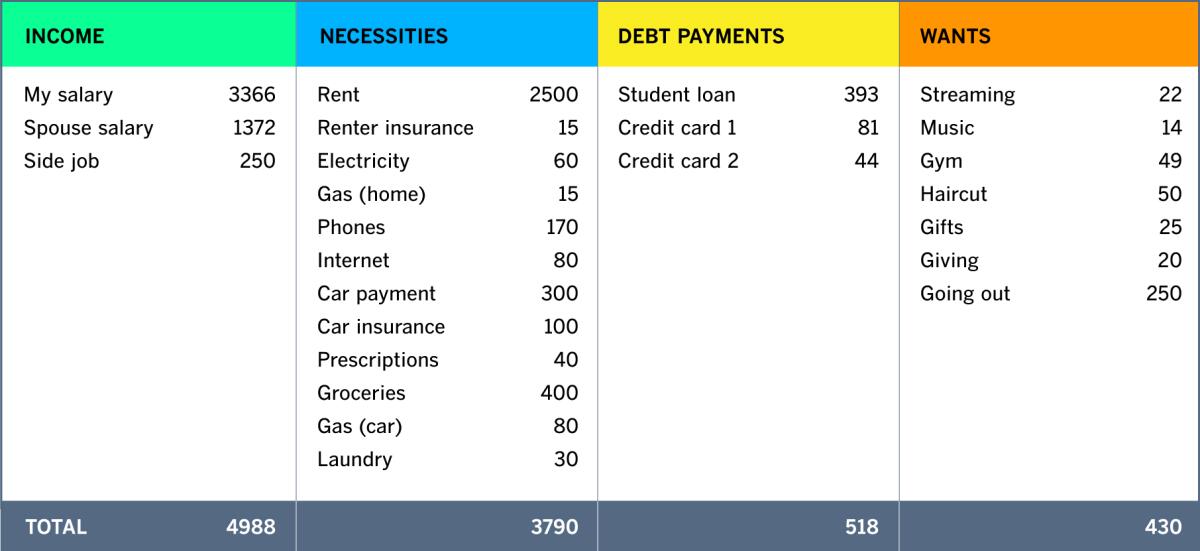

Next up is what you want your money to do before you get paid again. I define this as anything I could hypothetically cut from my budget if I really needed to. Start with recurring fixed expenses: TV and music streaming services, a gym membership. Then add the variables: things like takeout, going out to eat, gifts, haircuts, charitable giving, furniture.

Add up these recurring expenses that you could cut if you had to and put them in the fourth column.

Then comes the stuff you need your money to do someday. You will want line items in your budget for things such as an emergency fund, car repairs, home maintenance, vet bills. You probably also have something big and fun in mind, like a vacation, a wedding, a down payment on a house, or money to go to grad school.

A lot of people also like to have a cushion. If you want to, say, always have $500 “left over” in your checking account, make a $500 “cushion” category. I don’t do “cushion,” but I do have “stuff I forgot to budget for,” where I categorize the inevitable things that don’t really fit into any of my other line items (stamps, an ATM fee, a Halloween costume).

Enter lines for all of those, even if you’re not sure yet how much to set aside for them.

Look at your total income, and then add up your total expenses. Are these numbers the same? Great. Is income higher? Even better! More to assign! Is income lower? That’s … pretty normal. We’ll work on it. Keep reading.

How do I know how much to budget?

The fixed expenses are the easy ones. You can’t exactly tell your landlord that you’re cutting back on rent this month. Allocate those dollars in your budget first.

For the variable categories, well, there’s no right or wrong amount. I can’t tell you how much you “should” spend on groceries, or Postmates, or on anything else. A general guideline to shoot for is “50/30/20” — aim to spend about 50% of your income on needs, 30% on wants, 20% on savings and debt payments.

Beyond that, budgeting is really about deciding on your priorities. If you Google “average amount to spend on groceries,” you will find people who spend $2,000 a month and buy only organic cruelty-free produce and cook five-course meals daily at home, and people who spend $75 a month and eat rice and beans twice a day and grow all their own vegetables.

The right amount for YOU to spend on groceries is the amount you spend on groceries.

The best thing you can do is look at what you spent in previous months and budget roughly that amount for this month. Right now, we are trying to accept what our expenses are. We’ll talk about strategies for cutting them later.

The only way to budget “wrong” is if you don’t budget for what you actually spend. You aren’t setting yourself up for success if you decide today is the day you become an entirely different person. If you regularly spend $400 a month on groceries, it’s not very realistic to set a goal that you’ll spend only $75 this month. If you know you always spend more on groceries than you need to and your fridge is full of rotting produce and your pantry is packed with stale snacks, OK, maybe you can shoot for $300 this month. But if you keep budgeting $300 and then spending $400, you are not budgeting correctly, because your budget isn’t reflecting your reality.

Similarly, if you really value catching up with your friends at brunch on the weekend, you’re not going to stick to a budget that allocates zero dollars for going out to eat.

For the long-term categories, like car repairs or vet bills, start small today. Putting $10 toward future car repairs still puts you ahead of everyone saving zero. Once you get the hang of budgeting, it’ll be easier to assess how much you can assign to these categories. Saving up for emergencies and big stuff is another topic we’ll cover in a future newsletter.

Budgeting is something you learn by doing. Part of that is accepting that you’ll mess up and have to move money around. I screwed up a million times. That’s not failing. That’s learning. You have to start somewhere, so if you’re just kind of guessing for some of this stuff, that’s fine. You and I have eight weeks together during which we’ll review and refine all of this. Today is just the start.

So which budgeting software should I use?

I saved this part for last because really, this is up to you. I would recommend you look at a few, read some reviews online (here are the recommendations from Wirecutter, NerdWallet, U.S. News & World Report and the Balance) and decide what seems appealing. You can always change your mind and try something else if it’s not working.

Figuring out your income and expenses — what we’ve done today — is just the beginning of budgeting, not the whole thing. The real magic happens when you start to track your expenses and check your budget before you spend money. The only thing you really need to assess when choosing budgeting software is whatever makes it easiest for you to do that.

Let’s review some of your options.

Spreadsheets. Examples: Excel, Google Sheets

Pro: Free! Con: It can be a lot of work, particularly if you are not spreadsheet-inclined. You have to add all the transactions to the sheet yourself and program the formulas if you want to automate the math.

If you feel confident about doing this all from a spreadsheet, Godspeed. Personally, I like using a spreadsheet as my starting point, just to have everything written down for reference. But I do not want to be in charge of remembering to input every grocery bill and parking meter fee as well as programming a formula to subtract it all from my balance total. I knew I wouldn’t stick with a budget if I had to do so much work.

Excel and Sheets both have add-ons (Money for Excel and Aspire for Google Sheets) that make them more robust and usable for budgeting purposes, but these may have other drawbacks (cost, lack of support).

Free software and apps. Examples: Mint, EveryDollar, PocketGuard, Personal Capital

Pros: Free, with lots of the same features as the paid ones. Cons: Not all the features of the paid ones. And you may “pay” in other ways.

The free apps can be a great way to get started. And if they work for you, great. But nothing “free” is ever really free, and a lot of them have ads or will try to sell you on their sponsors’ particular bank accounts, credit cards or services. Or they’ll constantly hit you up to upgrade to a paid version. I didn’t want to deal with any of that.

Also, some of the free apps function more as “expense tracking” than “budgeting” — you can see where your money went, but it’s harder to say, “Here’s how much I want to spend” and then figure out how much you have left by the time the last weekend of the month rolls around.

Paid software and apps. Examples: You Need a Budget (YNAB), Simplifi by Quicken, Mvelopes

Pros: Lots of features, including tracking your spending and doing all the math for you. Offers personalized help if you need it. Usually has extra resources and tools. Con: Costs money.

Like I said, I use You Need a Budget (YNAB). I like YNAB’s philosophy — a lot of it is echoed in these newsletters — and I like the extras it offers, such as live support and loan tracking.

Some people chafe at the idea of spending money to save money. For others, like me, paying for something helps make it feel like you’re putting a little skin in the game.

What about “rounding” apps?

There are some apps out there that “round up” your purchases and put the “extra” (e.g., you spent $2.91 on a coffee; it takes the remaining nine cents) into savings or an investment account. I don’t love these. Passively saving is not budgeting. If you want to save or invest your money, hell yeah, I want that for you. But I want you to make the choice and figure out how to make it happen instead of kinda-sorta-accidentally seeing how much you maybe end up with.

Good job!

OK. Whew. This was a lot. If you get started on this and need to come back to it, that’s cool. It’s a lot to get through in one go. I know this stuff can be really stressful. Almost everyone has hang-ups with money. I’m proud of you for getting this far.

Making a budget is just the first step. Next week, we’ll get into the nuts and bolts of maintaining your budget and adjusting it as things come up, plus tips for budgeting with a partner or family. Now give yourself a big pat on the back: You’re budgeting!

See you soon.

— Jessica

P.S.

This newsletter is free. But making it is not. Totally Worth It won’t have any sales pitches for specific financial products — i.e., I’ll never tell you that you need to buy this specific software or open an account with this specific bank. (The advertisers associated with this newsletter had no say over the content.) My only sales pitch is this one: If you aren’t already, please consider subscribing to the Los Angeles Times. For a budget-friendly $1, you can try it out for a limited time.

If you have questions, please email [email protected]. And to ensure you get this newsletter, please add this email address to your contacts or address book. Thanks.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.