Full Coverage: Wells Fargo scandal

- 1

Wells Fargo & Co. may not be done shedding assets as it rethinks its business following its sham-accounts scandal.

- 2

Wells Fargo & Co. said Friday its profit edged up in the second quarter as the bank got a boost from rising interest rates and the planned sale of its insurance service business.

- 3

As Wells Fargo & Co. continues to be hit with fallout from its sham-accounts scandal, the bank is facing allegations that it put the screws to customers in yet another way: by slapping them with fees for delays in processing mortgage applications.

- 4

- 5

Wells Fargo & Co. has received preliminary approval for its proposed $142-million class-action settlement to compensate possibly millions of customers who had unauthorized accounts opened in their name.

- 6

- 7

- 8

The federal government’s consumer financial watchdog is defending his handling of the Wells Fargo & Co. unauthorized accounts scandal in the face of Republican charges that the agency failed to catch the problem and has stymied a congressional investigation into how it handled the case.

- 9

Wells Fargo is facing allegations of a new scandal, this time involving its treatment of mortgage borrowers in bankruptcy.

- 10

As part of a class-action settlement, Wells Fargo & Co. will guarantee that customers harmed by the bank’s practice of opening unauthorized accounts will get back any fees they paid and be fully compensated for damage done to their credit scores, according to documents filed early Wednesday.

- 11

Wells Fargo & Co. may have to cough up more than $142 million to settle a bevy of class-action lawsuits in connection with its unauthorized-accounts scandal.

- 12

- 13

The city of Philadelphia has sued Wells Fargo, accusing the bank of discriminating against minority home buyers.

- 14

Wells Fargo & Co. may have opened as many as 3.5 million unauthorized checking, savings and credit card accounts over the last 15 years — far more than originally reported by the bank and federal regulators, according to a new estimate from attorneys representing bank customers.

- 15

The latest allegations of unethical practices at Wells Fargo are so disturbing that even the bank has called them “offensive.”

- 16

Wells Fargo & Co. has agreed to boost its payout in a class-action settlement over unauthorized accounts to $142 million, up from the $110 million it announced just three weeks ago, according to documents filed late Thursday.

- 17

In a long-anticipated report released Monday, Wells Fargo & Co. pinned the blame for its unauthorized-accounts scandal on weak corporate oversight, an overly trustful former CEO and the executive who led its community banking division.

- 18

Wells Fargo & Co. has pledged to reimburse customers harmed when its employees opened unauthorized accounts in their name — but it has been unwilling to allow lawsuits for damages, which are barred by the bank’s standard arbitration clause.

- 19

Wells Fargo & Co. will change how it pays tellers and other bank workers, announcing on Tuesday a long-anticipated overhaul of the incentive-compensation system that was at the root of the bank’s fake-accounts scandal.

- 20

Wells Fargo & Co. customers who learned that bank employees opened accounts without their consent later discovered another problem when they tried to sue to recover lost fees and for other damages.

- 21

The chairman of the California Senate’s banking committee blasted Wells Fargo on Monday for failing to answer questions about the bank’s accounts scandal and for not sending Chief Executive Tim Sloan or another representative to a committee hearing.

- 22

A federal regulator has tightened restrictions on Wells Fargo & Co., requiring it to get approval to replace or hire new executives and make other changes, in the latest fallout over the San Francisco bank’s fake-accounts scandal.

- 23

Three Democratic senators are questioning Wells Fargo & Co. about regulatory filings for employees fired for creating unauthorized accounts, saying the forms gave the bank “ample information about the scope of fraudulent sales practices.”

- 24

Wells Fargo & Co. confirmed Thursday that the U.S.

- 25

Two U.S. senators are pressing Wells Fargo & Co. about how much new Chief Executive Timothy Sloan knew about the unauthorized-accounts scandal that led to his appointment.

- 26

The California Department of Justice is investigating Wells Fargo & Co. on allegations of criminal identity theft over its creation of millions of unauthorized accounts, according to a search warrant sent to the bank’s San Francisco headquarters this month.

- 27

Advocates of greater accountability for executives in the banking sector cheered this week when Wells Fargo Chairman and Chief Executive John Stumpf lost both his jobs.

- 28

Wells Fargo & Co.’s new chief executive vowed Friday to take “the necessary actions to restore our customers’ trust” as the scandal-plagued banking giant posted a 3% drop in third-quarter earnings.

- 29

A red stagecoach, pulled by a team of six galloping horses and driven by a ruddy-faced man in a tan stetson, rumbles across a field of dry grass at the foot of a mountain range, all under a clear blue sky.

- 30

Scandal-plagued Wells Fargo & Co. opted to choose a longtime insider, Timothy Sloan, to replace John Stumpf after the embattled chief executive abruptly quit on Wednesday.

- 31

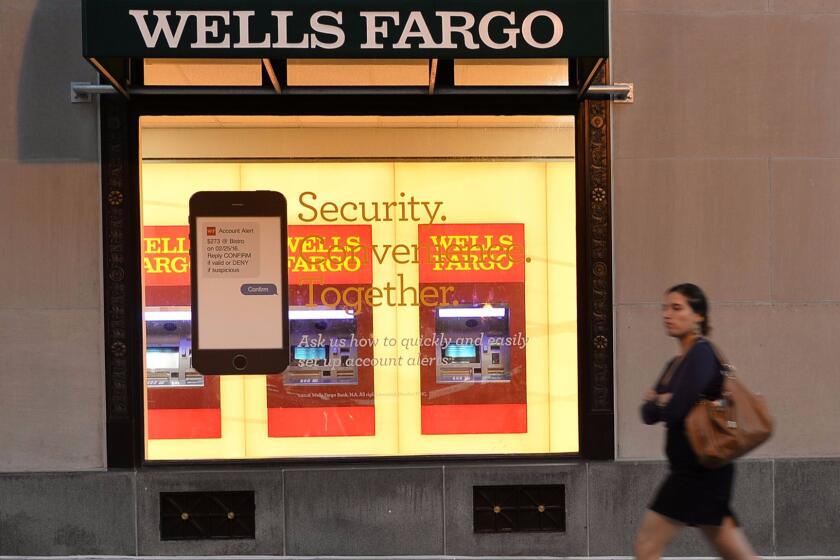

Wells Fargo & Co. has launched a campaign to regain customers’ trust after revelations that, in order to meet aggressive sales quotas, bank employees created as many as 2 million accounts in customers’ names without their knowledge or consent.

- 32

Wells Fargo Chairman and Chief Executive John Stumpf fulfilled the prediction of a growing volume of tea leaves Wednesday by announcing his immediate resignation from the bank company.

- 33

John Stumpf resigned Wednesday as chairman and chief executive of Wells Fargo & Co., bowing to mounting criticism from lawmakers and others who said he should lose his job over revelations that bank employees created as many as 2 million accounts without customer authorization.

- 34

More than a month after regulators announced a sweeping settlement against Wells Fargo & Co. over its creation of unauthorized customer accounts, lawmakers went after the bank again Tuesday and called for reforms that could rein in abusive practices by banks.

- 35

For Estela Slikker, life as a personal banker at a Chase branch in the East San Francisco Bay city of Martinez wasn’t easy.

- 36

Already the subject of federal investigations and congressional inquiries, Wells Fargo & Co. is now facing criticism from a growing number of state and local officials who want more answers from bank executives or hope to enact sanctions of their own.

- 37

- 38

Less than a week after California suspended doing some business with Wells Fargo & Co. over its fake-accounts scandal, Illinois is following suit.

- 39

Lawmakers on Thursday intensified their calls for a wide-ranging probe into Wells Fargo & Co. — and into the practices of other banks — as political fallout from the San Francisco institution’s creation of unauthorized accounts continues to grow.

- 40

After Wells Fargo & Co.

- 41

Founded during the gold rush as a place that could be trusted with your money, Wells Fargo & Co. has deep California roots and remains one of the state’s largest and oldest institutions.

- 42

Outraged lawmakers pressed Federal Reserve Chairwoman Janet L.

- 43

Wells Fargo & Co.

- 44

- 45

The Labor Department has launched a “top-to-bottom review” of how Wells Fargo & Co. treated employees as it pushed the aggressive sales quotas that led to the bank’s fake-accounts scandal.

- 46

Wells Fargo may have gone out if its way to take senior citizens to the cleaners when the bank’s workers fraudulently opened as many as 2 million accounts without customers’ permission.

- 47

As beleaguered banking giant Wells Fargo & Co. deals with inquiries from federal prosecutors and scrutiny from lawmakers, it’s facing a growing number of civil lawsuits brought by customers and former employees.

- 48

In the category of adding insult to injury — or perhaps piling one injury on top of another — Wells Fargo is an expert.

- 49

Outraged senators castigated Wells Fargo & Co.

- 50

The unwanted accounts created by Wells Fargo & Co. employees trying to hit aggressive sale goals have already forced the bank to provide some 100,000 customers with refunds averaging $25 for fees and other expenses.

- 51

Pressure mounted on Wells Fargo & Co.

- 52

Did Wells Fargo violate overtime laws? Elizabeth Warren among 8 senators seeking Labor investigation

A group of senators on Thursday requested a federal investigation into whether Wells Fargo & Co. violated labor laws after allegations the bank failed to pay overtime to tellers and other employees who worked late nights and weekends to meet aggressive sales quotas.

- 53

- 54

Wells Fargo Chairman and CEO John G. Stumpf, who has been described as “the Mr.

- 55

The trouble at Wells Fargo & Co. started small, with a few employees at branches opening bogus accounts as they tried to meet aggressive sales goals and keep their jobs.

- 56

The outrageous scandal at Wells Fargo & Co., for which federal and local regulators hammered the bank for $185 million in fines and penalties earlier this month, speaks volumes about the decline of morality in corporate America.

- 57

When the Senate Banking Committee grills Wells Fargo & Co.’s chairman Tuesday about the banking giant’s sales scandal, look for the word “clawback” to come up more than once.

- 58

The House Financial Services Committee has launched an investigation into improper sales tactics at Wells Fargo & Co., and plans to call the bank’s chief executive to testify at a hearing this month.

- 59

- 60

Wells Fargo & Co. said Tuesday that it would eliminate all sales goals for credit cards, checking accounts and other retail banking products as the financial giant tries to repair its image following a $185-million settlement over aggressive sales tactics.

- 61

The Justice Department is investigating Wells Fargo & Co.’s improper sales tactics, according to a person familiar with the probe.

- 62

The $185 million that Wells Fargo agreed to pay Thursday to settle government allegations over its overbearing sales practices is one big figure.

- 63

Despite a blockbuster settlement announced Thursday, Wells Fargo isn’t done fighting allegations that its aggressive sales culture pushed employees to create accounts that customers never authorized.

- 64

Calling it “outrageous” and “a major breach of trust,” local and federal regulators hammered Wells Fargo & Co. for a pervasive culture of aggressive sales goals that pushed thousands of workers to open as many as 2 million accounts that bank customers never wanted.

- 65

Employees say intense sales demands at Wells Fargo branches create a dilemma for many: cheat or risk being fired. Bank officials say they make ethical conduct a priority.