Broadcom commands $37 billion in sale to rival chipmaker Avago Technologies

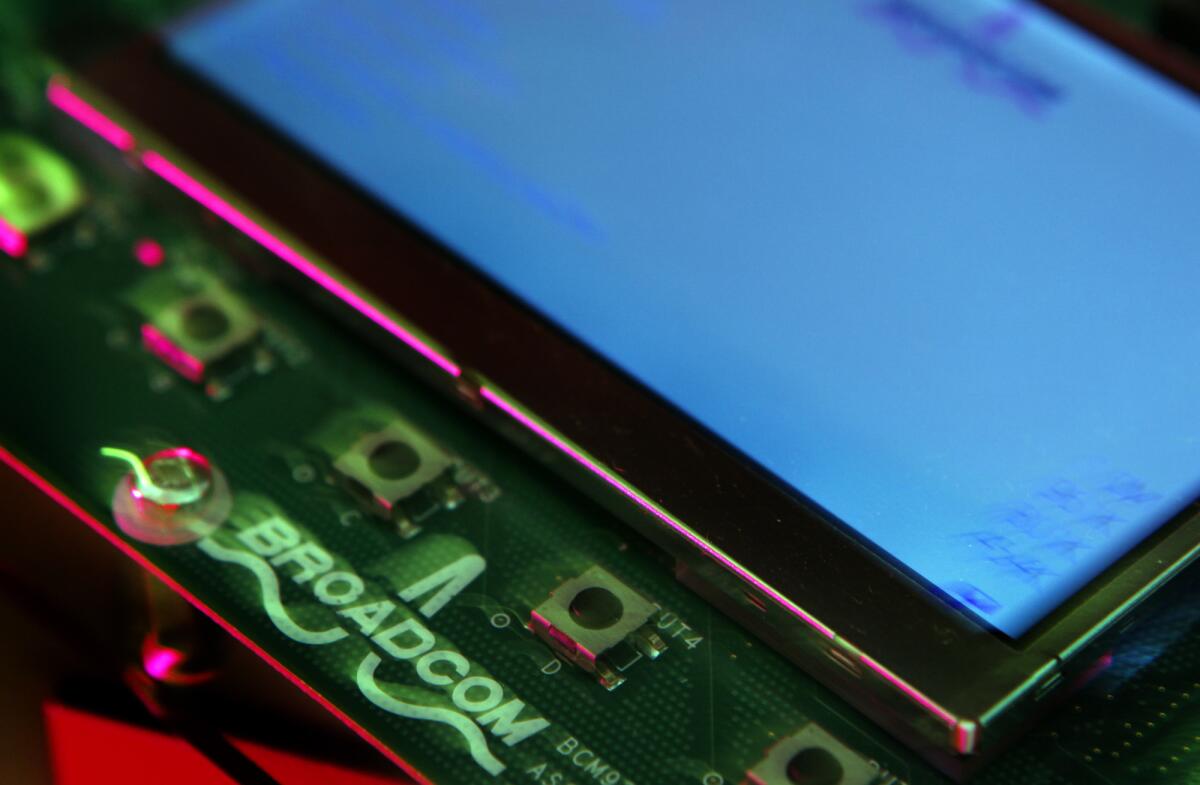

The Broadcom logo is stamped on a circuit board. The Irvine company is being acquired by Avago Technologies.

Irvine semiconductor maker Broadcom Corp. has agreed to be acquired by Avago Technologies Inc. for $37 billion in cash and stock, creating a giant supplier for the technology in a wide array of computing products, including smartphones, tablets, wireless networks and cloud computing.

The blockbuster deal, announced early Thursday, is part of a rapid consolidation in the semiconductor industry. Combined, their market value would reach $77 billion and revenues total $15 billion.

For Broadcom, the deal marks the end of its days as a public company that had been a mainstay of the Orange County technology scene. Founded in 1991 in a Santa Monica condominium by Henry Samueli, a UCLA professor, and Henry T. Nicholas III, a star student, the company now employs more than 10,000, with more than 75% of them engineers.

“When Henry Nicholas and I founded Broadcom, we had a vision of creating the world leader in communications semiconductors,” said Samueli, Broadcom’s chairman and chief technology officer. “Today’s announcement is a continuation of that vision, and we could not think of a better partner for the future than Avago.”

For Avago, the deal is its biggest in its fast rise through acquisitions, which recently included another Orange County firm, networking products maker Emulex Corp. of Costa Mesa.

“Avago has established a strong track record of successfully integrating companies onto its platform,” said Hock Tan, Avago’s chief executive. “Together with Broadcom, we intend to bring the combined company to a level of profitability consistent with Avago’s long-term target model.”

Samueli and Nicholas, who resigned in 2003 as chief executive, together hold 47.1% of Broadcom’s voting stock.

The two founders have signed “support statements” to vote for the deal, according to the companies’ joint statement. Both boards as well as a special committee of Broadcom’s independent directors have approved the sale. The deal is expected to close early next year after shareholders of both companies vote on it.

Samueli will stay on as chief technology officer of the combined company. Nicholas will serve in a strategic advisory role, reporting to Tan.

A spokesman for the companies declined to comment on a future role for Scott McGregor, Broadcom’s president and chief executive.

The deal is part of a wave of consolidation in the semiconductor industry as revenue growth has slowed and companies have sought to expand market share to allay huge capital costs involved in building systems and manufacturing processes to produce millions of chips and other small items.

Analyst said the deal was largely driven by financial, as opposed to strategic, considerations. The companies share few product lines and Avago has a history of using acquisitions to cut costs, especially in the acquired company.

“It’s all about financial engineering,” said Gary Mobley, an analyst with research firm Benchmark Co.

Analysts said the big winners in the deal are Broadcom shareholders, who receive a premium price over what already has been a fast-rising stock.

Other winners will be Broadcom’s long roster of A-list customers — Amazon.com Inc., Apple Inc., DirecTV, Google Inc. and Samsung Electronics Co., among them — that will benefit from potentially lower prices as the new company achieves efficiencies.

The downside will probably be borne by Broadcom employees, analysts said, as the new owners are likely to cut administrative, research and development and other costs and sell business lines.

“The net losers are the Broadcom employees because of the job losses,” said Betsy Van Hees, an analyst with Wedbush Securities Inc.

The companies projected cost savings of $750 million over the next 18 months. Van Hees said she expects the figure to go higher, given Avago’s track record of cutting jobs in the wake of past deals.

“That’s an exceptionally conservative number, she said.

A spokesman for the two companies declined to comment on possible job cuts.

Meantime, Broadcom will continue with construction at its Irvine headquarters, according to a person familiar with the company’s plans.

Some analysts had figured that Broadcom could be in play, but the idea of Avago taking it over caught them off-guard.

“We are surprised because Broadcom would be a very big fish for Avago,” said analyst Brian Colello at investment research firm Morningstar Inc. “Avago is at the forefront of trying to get bigger and break into new markets and [is] willing to pay for it.”

On Wednesday, Broadcom shares soared $10.09, or 21.5%, to $57.15 in anticipation of one of the largest deals in the latest consolidation of the chip industry.

Shares gave back $2.16, or almost 4%, falling to $55 in early trading Thursday. Even after Thursday morning’s pullback, Broadcom shares are up more than 75% on the year, according to FactSet Research Systems Inc.

Avago’s stock fell $2.11, a little more than 1%, to $139.28, in early trading Thursday. It had advanced $10.19, or 7.8% Wednesday, to $141.49.

Broadcom is a major provider of chips for complex systems such as electronic switching gear, Wi-Fi, automotive systems and broadband connections. Last year, it posted net earnings of $652 million on revenue of $8.4 billion.

Analysts recently have been positive about the company’s growth prospects. Earlier this month, a Goldman Sachs Group Inc. analyst recommended buying its shares, citing its potential to increase its presence in the smartphone business as well as a potentially longer-term bonanza supplying mobile technology for cars.

Amid Broadcom’s rise, company founders Samueli and Nicholas weathered a federal prosecution in a stock-options backdating case in 2008.

Prosecutors had alleged that Samueli, Nicholas and two other executives hatched an elaborate scheme to secretly increase the value of employee stock options without disclosing the expense in regulatory filings as required. But a federal judge dismissed the charges in late 2009.

Samueli, also an owner of the Anaheim Ducks, resigned as Broadcom chairman in 2008 but returned to the post in 2009.

One of Broadcom’s directors is Eddy Hartenstein, non-executive chairman of Tribune Publishing Co., owner of the Los Angeles Times.

The deal to buy Broadcom is the latest in a series of aggressive acquisitions by Avago, based in Singapore with executive offices in San Jose. This month, it bought networking products maker Emulex Corp. of Costa Mesa for about $606 million. In 2014, it paid $6.6 billion in an all-cash deal for LSI Corp., a chipmaker based Allentown, Penn.

Avago formerly was part of Agilent Technologies, which itself had been part of Hewlett-Packard Co. until Avago was spun off in 2005.

Twitter: @deanstarkman

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.