Visa discloses its stake in mobile-payments company Square

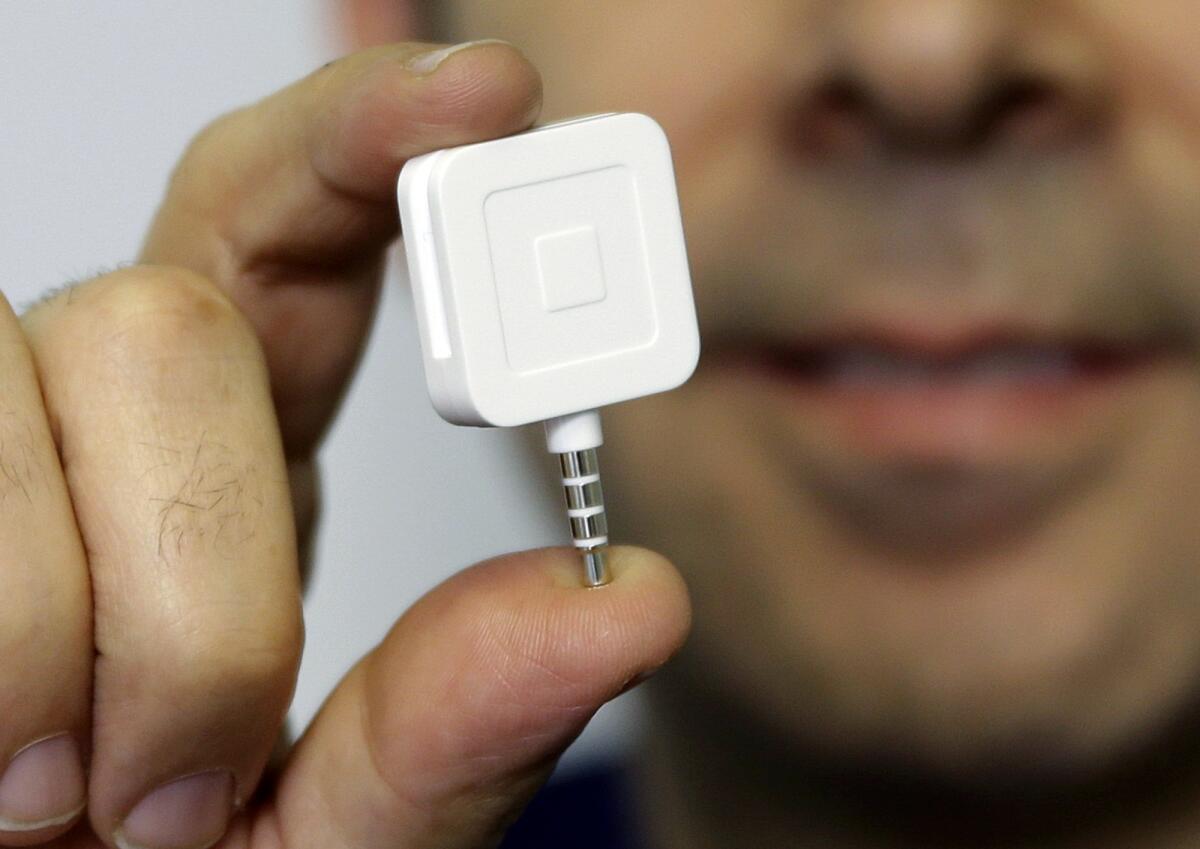

Dr. Greg Werner displays his Square credit card reader at his New York office in 2015. Visa has a major stake in Square, the mobile-payments services company headed by Jack Dorsey.

- Share via

Visa Inc. took a significant stake in mobile-payments company Square Inc. prior to its initial public offering, according to a regulatory filing Thursday with the Securities and Exchange Commission.

The global credit card and financial services firm acquired some 4.19 million Class B shares in 2011 that do not publicly trade. It has the right to convert 3.52 million of them to Class A shares, the filing by Visa said.

------------

FOR THE RECORD

9:01 a.m.: Earlier versions of this article said Visa had taken a new stake in Square Inc., according to a Square regulatory filing. Visa took the stake in 2011 and disclosed it Thursday.

-------------

See more of our top stories on Facebook >>

If it were to do so, Visa would have a 10% stake in the company, smaller only than the 12.4% stake now held by Capital Research and Management Co., the huge mutual fund company based in Los Angeles, according to financial data provider FactSet.

Shares of Square were up 41 cents, or 4.8%, to $9.03 in afternoon trading on Wall Street.

Gil Luria, managing director at Wedbush Securities, said the disclosure could mean that Visa plans to sell its shares.

“Visa is not in the business of owning publicly-traded companies,” he said. “Clearly, they’re not interested in owning Square, either.”

In 2011, Visa wanted a hand in guiding Square’s mobile-payment technology, while the stake lent credibility to the young company, Luria said.

Visa’s initial interest in Square was a matter of “keeping your friends close and keeping your enemies closer,” he added.

The San Francisco-based Square has struggled in the stock market since its November initial public offering at $9 a share. Shares rose 45% on their first day of trading but have since slid back.

Square makes a plastic device that allows mobile phones to accept credit card payments. It generates the vast majority of its revenue from retailers, restaurants and other businesses that pay the company a fee to process payments.

Mobile financial transactions are a fast growing business, but concerns over worldwide economic growth and the valuations of tech companies have cut into stock valuations.

Prior to its IPO, Square reported that its losses rose to $154 million in 2014 on $850 million in revenue. In 2013, its losses totaled $105 million on $552 million in revenue.

Square is headed by Jack Dorsey, who also serves as Twitter Inc.’s chief executive.

For more business news, follow @smasunaga.

ALSO

House flippers turn to crowdfunding platforms for financing

With fewer households behind on bills, consumers better able to absorb economic shocks, Fed says

Feeling lucky? Some Universal Studios visitors will get to test the new Harry Potter attractions

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.